North Carolina Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in North Carolina.

- Brandon Canonica

- Updated March 20, 2024

North Carolina is one of the top ten states by population. This means there are many people on the road at any given time. According to the Federal Highway Administration, NC reached a total of roughly 7.6 million licensed drivers in 2020. You’ll find many of them in the large Charlotte metro area, as well as Raleigh, the state’s capital city.

Just like nearly every other state, North Carolina requires motorists to buy car insurance. On this page, you’ll find the minimum requirements for the state, important laws you should think about, and the best companies. We’ll also give you a good idea of how much, on average, people in the Tar Heel State pay for their premiums.

Table of contents

North Carolina Average Auto Insurance Rates

Looking at average car insurance rates in your state can be a good strategy when you’re shopping for a new policy. This is because it can tell you how much you should pay, relative to what others in your state pay for auto coverage. However, remember that you can end up paying more or less than the mean. Certain details about you can affect your rates, like your:

- Driving experience

- Marital status

- Driving record

- Claims history

- Zip code

Luckily, North Carolinians pay less for coverage than the rest of the country, on average. The table below shows rates in North Carolina compared to the national mean:

| Coverage | North Carolina Average | US Average |

|---|---|---|

| Liability | $392.06 | $650.35 |

| Collision | $344.07 | $381.43 |

| Comprehensive | $138.40 | $171.87 |

| Full Coverage | $741.70 | $1,070.47 |

| Price Per Month | $61.81 | $89.20 |

So, why are North Carolina premiums lower than the nation’s average? It’s likely because the state is largely rural, except for some major urban centers, such as Charlotte. In general, people pay less for coverage in rural areas than in big cities or metropolitan areas. This is because there are often fewer cars all in one place, leading to fewer accidents and fewer claims.

The North Carolina Office of State Budget and Management (OSBM) revealed that, while the state has become increasingly urban in the last few decades, much of the state is still rural. They provide data from 2019 showing that more than 80% of the people in the state lived in rural unincorporated areas. This can help keep premiums down throughout the state, even if there are some densely populated cities.

Premiums Are Increasing Across the State

Despite enjoying low premium costs, North Carolina residents will see their rates going up in 2022. An article by WFMY News 2 out of Greensboro reports that the Insurance Commissioner allowed an average rate increase of 7.9% to take effect in June 2022.

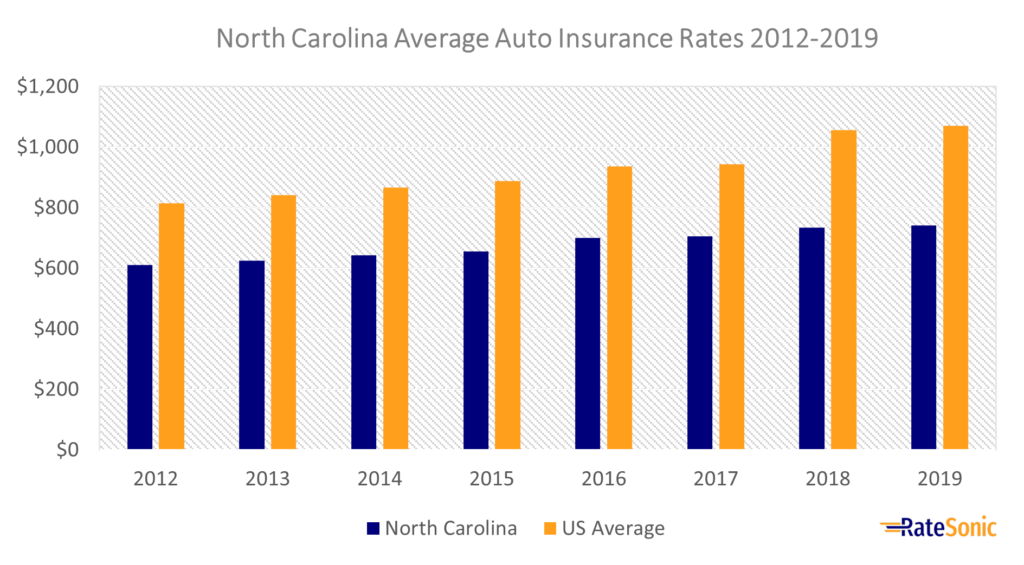

Average Full Coverage Rates

The following graph shows the change in average North Carolina full coverage costs from 2012 to 2019. Rates rose from $611 in 2012 to $741 in 2019. This was an increase of $130 or 21%. The gradual rise in premiums could be due to inflation across the country. It’s not uncommon for insurers to raise prices every couple of years to meet the markets.

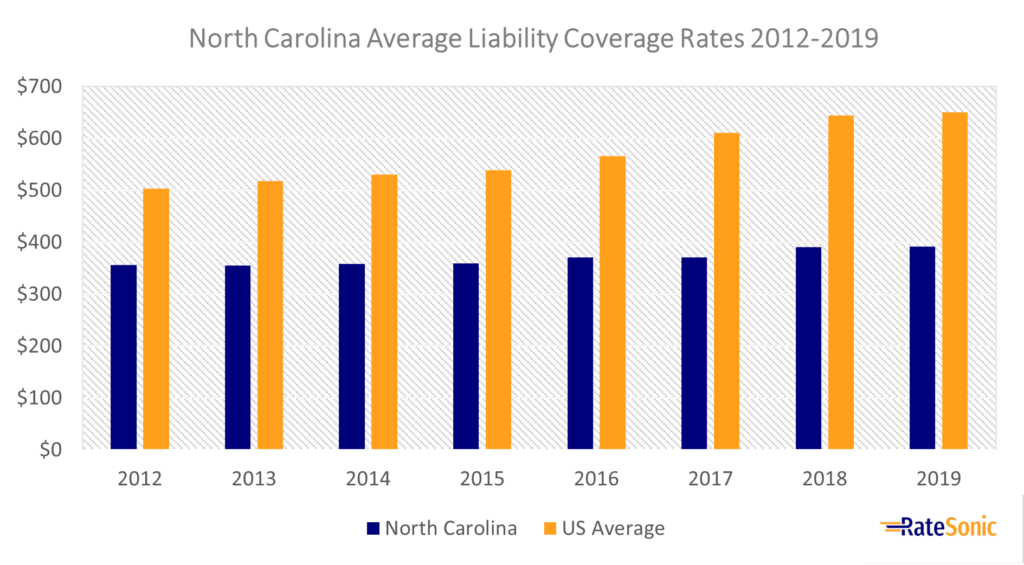

Average Liability Rates

The graph below shows the change in average North Carolina liability insurance costs from 2012 to 2019. Rates rose from $356 in 2012 to $392 in 2019. This was an increase of $36 or 10%. Over the eight years, the cost of this coverage has remained below the US mean.

One reason liability costs less here is because of the slightly lower-than-average standard of living. This means that people here make less than those in other states. Poorer areas often have lower costs in general. That’s because people can’t afford to pay more. It also means auto repair and medical treatment costs less.

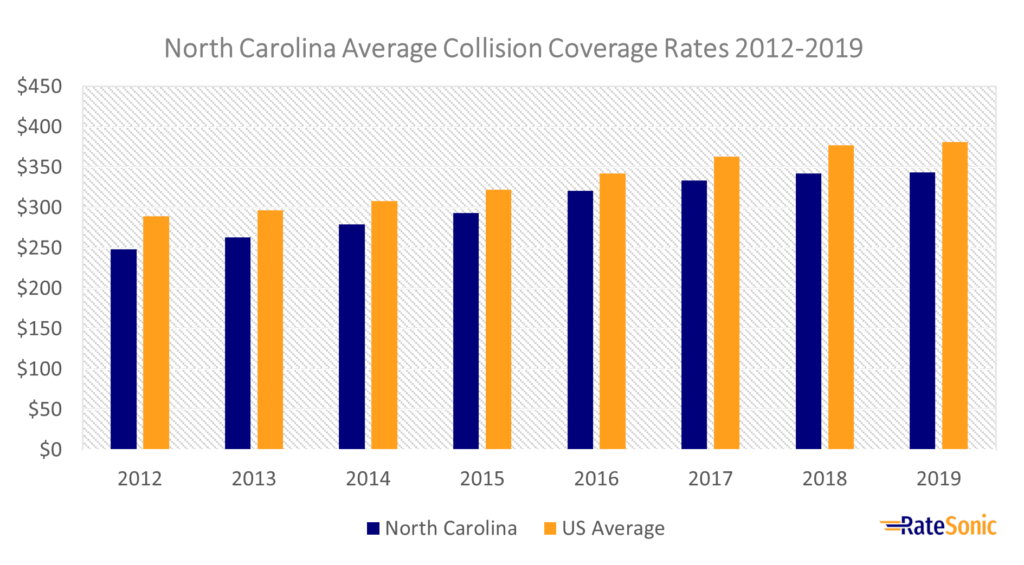

Average Collision Rates

The next graph shows the average North Carolina collision insurance costs from 2012 to 2019. Prices rose from $248 in 2012 to $344 in 2019. This was an increase of $96 or 38%. Even so, insurers charged consumers here slightly less for this coverage than in other states.

It’s noteworthy that, in a study done by CarMD in 2019, it ranked seventh for car repair costs. More expensive claims can cause insurers to raise collision rates. A high incidence of vehicle crashes in places you drive will also push prices higher.

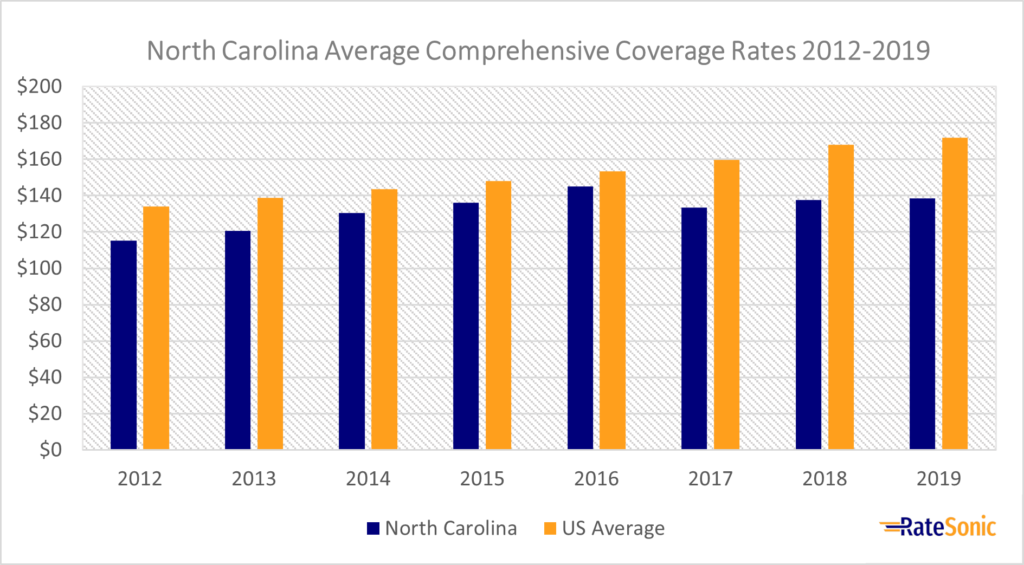

Average Comprehensive Rates

The chart below shows the average North Carolina comprehensive insurance rates from 2012 to 2019. Prices rose from $115 in 2012 to $138 in 2019. This was an increase of $23 or 20%. Once again, the cost of this coverage is well below the national mean, peaking in 2016 at nearly $150. Pricing pressures eased starting in 2017 before increasing slightly in 2018 before before resuming their decline in 2019.

North Carolina Minimum Auto Insurance Requirements

Most states have minimum requirements for auto insurance. North Carolina is no different and requires it’s own specific coverages and policy limits:

Liability Insurance

State law mandates liability insurance limits no less than:

- $30,000 of bodily injury liability (BIL) per person

- $60,000 of bodily injury liability (BIL) for two or more people

- $25,000 of property damage liability (PDL) per accident

You will sometimes see liability requirements written in shorthand form on your policy or government websites as “30/60/25.”

These are just the most basic limits required by state law. However, just having the minimum may not be enough to cover every accident or situation. Some car wrecks can result in expensive injury or property damage. Unexpected events like natural disasters or theft can also cause damage to your vehicle.

For this reason, it’s smart to buy as much car insurance as you can afford. Higher limits or extra coverage, like collision or comprehensive, could help you avoid paying for expensive repairs out of pocket.

Uninsured Motorist (UM) and Underinsured Motorist (UIM)

North Carolina also requires drivers to buy uninsured motorist (UM) and underinsured motorist (UIM) coverage. This protects you if you’re in a car accident with someone who either has no insurance or doesn’t have enough. According to the III, about 7.4% of NC drivers drive uninsured.

Below are the minimum UM/UIM requirements:

- $30,000 of bodily injury liability (BIL) per person and $60,000 per accident

- $25,000 of property damage liability (PDL)

Valid Proof of Insurance

You must carry proof of auto coverage to drive. You must also send any documents showing valid proof to the NCDMV. The following are ways you can prove that you have coverage:

- An insurance policy or ID card showing the issue date and effective date of the policy

- A certificate of insurance (FS-1) that shows your vehicle’s make, model, year, and VIN

- DL-23 form

Exceptions to the Minimum Coverage Requirement

There may be some cases where you don’t want to buy a policy from a standard insurer. In these situations, you’d need to prove to the state that you have enough money to cover the costs of an accident if one occurs. This is often known as proving financial responsibility (FR).

You can prove financial responsibility in North Carolina by showing the state that you have at least $85,000 to spare for an emergency. This can come in the form of:

- Surety bonds

- Security deposits

- Real estate bonds

- Self-insurance (you must own 26 or more vehicles to do this)

Penalties for Driving Without Insurancee

It’s illegal to drive without car insurance. If you’re caught doing it, you’ll face expensive fines, and you could have a hard time buying auto coverage in the future. You also risk losing your driver’s license.

State law requires you to be covered by a current, valid policy that meets state requirements. You must surrender your license plate if you wish to cancel your coverage and not renew with another company.

If you go a period without a policy, but still plan to drive, you’ll have a lapse in coverage. The NCDMV requires that providers inform them if they cancel your policy. The DMV will also notify you, and you’ll have ten days to respond. You must pay the following fines if you don’t respond:

- $50 if it’s your first insurance lapse

- $100 if it’s your second lapse

Insurers will raise your rates if you go a period without coverage. This is because it makes you look like a risky driver.

Best Car Insurance Companies in North Carolina

Before buying coverage, it’s smart to take a look at the best companies in your state. But what makes up the top companies? Normally, these are the insurers that give you great value for your hard-earned money. They provide:

- Excellent customer service

- An easy claims process

- A wide range of discounts you can qualify for

- Great rates

One smart way to find the right company is by comparing insurers side by side. For example, you can compare quotes between well-known providers. This could help you find a good deal and, potentially, the best value. You can also look at things like market share, customer satisfaction, and customer benefits. Our article on the best insurance providers in the country ranks each one based on these factors.

Top Companies by Market Share

As mentioned, it’s good to look at each insurer’s market share. While this may not necessarily tell you how good a company is overall, it can tell you which one people prefer working with. Chances are, if an insurance provider has a lot of happy customers, it’s because they’re doing something right.

Below is a list from 2020 of the top ten car insurance companies by market share in North Carolina:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm | $954,761,068 | 14.3% |

| 2 | North Carolina Farm Bureau | $666,481,539 | 10.0% |

| 3 | GEICO | $585,948,467 | 8.8% |

| 4 | Allstate | $353,557,382 | 5.3% |

| 5 | National General | $325,256,646 | 4.9% |

| 6 | Progressive | $310,281,011 | 4.6% |

| 7 | Nationwide | $211,411,738 | 3.2% |

| 8 | Erie | $202,268,851 | 3.0% |

| 9 | USAA | $192,313,230 | 2.9% |

| 10 | Liberty Mutual | $139,416,277 | 2.1% |

Top Companies by J.D. Power Rating

Another great way to find the top companies in your area is with J.D. Power’s customer satisfaction ratings. Every year, J.D. Power releases a list of the best auto insurance companies in specific regions. Checking it out can show you what other people think about different providers.

Below were the top providers in the Southeast in 2021 by J.D. Power ranking (note: USAA didn’t fit the criteria of the study and isn’t on this list):

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | Farm Bureau – Tennessee | 883 |

| 2 | Erie | 874 |

| 3 | Kentucky Farm Bureau | 866 |

| 4 | State Farm | 859 |

| 5 | Auto-Owners | 849 |

| 6 | GEICO | 843 |

| 7 | Allstate | 838 |

| 8 | Alfa | 837 |

| 9 | North Carolina Farm Bureau | 836 |

| 10 | Liberty Mutual | 831 |

| 11 | Nationwide | 831 |

| 12 | Travelers | 831 |

| 13 | Progressive | 828 |

| 14 | Safeco | 820 |

| 15 | Farmers | 818 |

| 16 | National General | 803 |

Best Companies Based in North Carolina

There are several insurers based locally in North Carolina. Working with a state-based company could be good for those who want to support local businesses. You may also get unique benefits that you can’t find with the more mainstream insurers.

Here are the state’s top carriers (in no order):

- North Carolina Farm Bureau

- National General

- Discovery

- The Members Insurance Company

North Carolina Auto Insurance Laws

North Carolina, like other states, has unique laws and requirements. Below are some of the most important car insurance laws to pay attention to:

No-Fault or Fault?

No-fault states require you to buy coverage that protects you regardless of fault in a car accident. This type of coverage is typically personal injury protection (PIP). PIP covers injury and medical costs for you and your passengers after a crash.

North Carolina is not a no-fault insurance state. Rather, it’s a fault state. This means that you’re responsible for covering the costs of other drivers or passengers if you cause an incident.

Though the state doesn’t require PIP, it might still be a good idea to add it to your policy if you can afford it. Accidents happen, and it’s nice to know you have coverage for costly medical bills in all cases.

Totaled Cars

Your car is declared a total loss if it’s taken so much damage, that the cost to repair it would cost more than it’s worth. In many states, your car’s repairs must cost at least some percentage of its actual cash value (ACV) before insurers can declare it a total loss.

In North Carolina, your provider can total your car if its repairs match or exceed 75% of its ACV. If this happens, your insurer should give you a payout equal to your car’s value before the accident occurred.

Salvage and Rebuilt Titles

A salvage title car is a vehicle that an insurer has deemed a total loss. You might also hear them called branded titles. This is because salvaged vehicles must carry a brand showing the reason it was totaled.

Salvage motor vehicles are illegal to drive on public roads and highways in North Carolina. And, because of their damage, most car insurance companies also won’t insure vehicles with salvage titles. This essentially renders a salvage useless unless you want to use it for parts or sell it. To take your salvage car out on the roads again, you must repair and “rebuild” it so it’s safe to drive. Once you do that, you can get it a rebuilt title.

How to Get a Rebuilt Salvage Title

Below are the steps to convert your salvage title to a rebuilt title:

- Repair your vehicle completely

- Send your driver’s license to the NCDMV

- Be ready to provide receipts for every part you used to repair your car

- Undergo a thorough safety inspection for a fee of $13.60

- Undergo a routine emissions inspection for a fee of $30.00

- Fill out a title application form (MVR-1) and send it to the NCDMV

- Fill out an odometer disclosure statement (MVR-180) and send it to the NCDMV (not applicable if your car is more than ten years old)

Insuring Cars with Rebuilt Titles

Once you’ve repaired a salvage car and obtained a rebuilt title, it must be insured. Luckily, you should have no difficulty finding a company willing to cover rebuilds. Most major providers accept rebuilt cars, but won’t offer full coverage options like collision or comprehensive. You often can only get the state’s minimum required liability insurance. But that’s enough since that’s what you need to legally drive your rebuilt car.

Insurance for rebuilt title cars is more expensive than it is for clean titles. This is because rebuilds used to carry a salvage brand. And these are normally more risky or costly to repair. Each provider varies, however. So, it’s a good idea to double-check with your insurer on what coverages are available for rebuilt titles, and at what cost.

Full Windshield Replacement

Some states, such as Florida, require insurers to replace your windshield without a deductible by offering full glass coverage. North Carolina doesn’t have any such laws. Instead, your comprehensive coverage will step in to repair windshield damage. In this case, you’ll have to pay a deductible of a varying amount depending on your carrier and how high you set it.

Filing Claims

You’ll likely need to file a claim with your insurer after an accident. Most auto insurance providers make filing a claim easy on customers. You can usually do it over the phone and many allow you to file online.

How Long Does It Take to Settle a Claim?

Once you file a claim, you can expect an adjuster to figure out who or what was at fault in the accident. They’ll also assess the damages to your car. Then, by law, your carrier has 30 days to tell you whether they’ll accept or deny your claim.

Your insurer must send you payment within ten business days if they accept your claim. If they don’t approve your claim, they must clearly explain why per state law or the specifics of your policy.

Credit History

Providers use many factors when they’re deciding your premiums. This can include things like the type of car you drive or your driving experience. Another common rate factor that companies look at is your credit score. They believe that this can reveal something about your reliability as a customer or overall risk as a driver.

Some states, like California, have banned the practice of using your credit history to determine how much you pay for insurance. North Carolina, however, allows insurers to use your credit or FICO score to raise or lower your rates. Companies may also use it to cancel or deny you coverage if they give you written notice, but it can’t be the only reason for doing so.

Policy Cancellation and Non-Renewal

Your auto insurance company can cancel or not renew your policy for various reasons. Insurers must send you written notice of cancellation of at least:

- 15 days if cancellation is for failure to pay your rates

- 60 days if cancellation is for any other valid reason

- 10 days for any coverage other than liability, medical payments (MedPay), and UM/UIM

Insurers must also give you at least 60 days of written notice if they wish to non-renew your policy for liability, MedPay, and UM/UIM coverages. With any other coverage, they only need to give you notice ten days before your policy period ends.

Keep in mind that if you don’t pay your rates, it’s still possible to keep your policy. You’ll need to contact your insurer and request a reinstatement. This requires you to pay your rates as soon as you can. If you don’t, you’ll have a coverage lapse, making it extremely difficult to acquire coverage in the future.

Safe Driver Discounts Not Approved

Many of the most well-known car insurance companies offer discounts and programs aimed at safe drivers. These often allow you to use an app or telematics device to track your driving habits such as braking, speed, and more. Then, you’ll receive a discount if you can drive safely consistently.

However, some states don’t approve of every company’s program. For instance, not all of the major insurers’ programs are eligible in this state. A 2022 article from the Asheville Citizen-Times reports that programs such as Progressive’s Snapshot and Liberty Mutual’s Right Track aren’t approved in North Carolina.

Drunk Driving Laws

Driving under the influence of drugs and alcohol is always a bad idea. It can put yourself and others in harm and can land you in some serious legal trouble. A driving while impaired (DWI) conviction will lead to expensive fines and jail time. You can get a DWI if you get caught driving with a blood alcohol content (BAC) of 0.08.

A DWI will also make it extremely difficult to buy insurance. With the new label of a high-risk driver, your current insurer is likely to cancel or not renew your policy. Other companies may also deny you coverage. Because of this, you typically must find a non-standard provider or enroll in a state-assigned risk pool. Note that policies from non-standard companies or state programs are normally much more expensive.

Drunk Driving Penalties

There are five levels of penalties for a DWI conviction in the State of North Carolina, with level I being the most severe. Below is a breakdown of the penalties for getting a DWI conviction:

Level V:

- Fine of $200

- 24 hours in jail, with a maximum sentence of 60 days

- If a judge suspends the sentence, the offender must spend 24 hours in jail, do a total of 24 hours of community service, or not drive any vehicle for 30 days

Level IV:

- Fine of $500

- 48 hours in jail, with a maximum sentence of 120 days

- If a judge suspends the sentence, the offender must spend 48 hours in jail, do a total of 48 hours of community service, or not drive any vehicle for 60 days

Level III:

- Fine of $1,000

- 72 hours in jail, with a maximum sentence of six months

- If a judge suspends the sentence, the offender must spend 72 hours in jail, do a total of 72 hours of community service, or not drive any vehicle for 90 days

Level II:

- Fine of $2,000

- Seven days in jail, with a maximum sentence of one year

Level I:

- Fine of $4,000

- 30 days in jail, with a maximum sentence of two years

- If a judge suspends the sentence, the offender must spend 24 hours in jail, do a total of 24 hours of community service, or not drive any vehicle for 30 days

According to the state Department of Public Safety, your driver’s license will be suspended for one year after your first DWI offense. After that, you’ll lose your license for four years if you get a second DWI violation within three years of your first one.

Do I Need an SR-22 After a DWI?

The state doesn’t require drivers to maintain an SR-22 after a DWI. An SR-22 is a form often required by certain states after a DUI/DWI traffic violation. It certifies that you meet your state’s coverage requirments.

Driver’s License Points System

North Carolina uses a driver’s license points system to keep track of moving violations. Each violation gives you a certain number of points on your driving record. If you get too many, you could have your license suspended.

You’ll lose your license if you collect 12 points on your record within three years. You’ll face another suspension if you rack up eight points in the three years after you get your license back. Your first license suspension will be for a length of 60 days, your second will be for six months, and any further ones will be for one year.

Safe Driver Incentive Plan

North Carolina’s Safe Driver Incentive Plan (SDIP) offers an insurance-related incentive for safe drivers. If you maintain a safe driving record, you avoid a severe rate increase imposed by the state. For each driving violation, you’ll receive a rate increase by a certain percentage and points against you. Here are a few examples of common violations and corresponding consequences:

- At-fault accident resulting in $2,300 in damage or less – 40% increase, one SDIP point

- Following too closely and illegal passing – 55% increase, two SDIP points

- Reckless driving and property damage hit-and-runs – 90% increase, four SDIP points

- Driving during a license suspension – 200%, eight SDIP points

- DUIs – 340% increase, 12 SDIP points

Most Popular Cars

These were the Old North State’s most-sold cars in 2021. The most popular cars in the state are the most sought after by customers and, at times, thieves. Your insurer could raise your rates if you own one of these vehicles.

- Ford F-Series

- Chevrolet Silverado

- Honda CR-V

- Ram 1500/2500/3500

- Toyota RAV4

Most Stolen Cars

The type of car you drive is one of many factors that companies look at when they decide your rates. Owning one of the most stolen cars in the state could make you look at risk to file claims for vandalism or theft. Because of this, you could see a bump in your rates. These were the most stolen vehicles in 2021:

- 1997 Honda Accord

- 2006 Ford Pick-Up (Full Size)

- 2020 Chevrolet Pick-Up (Full Size)

- 1998 Honda Civic

- 2019 Toyota Camry

- 2020/2015 Nissan Altima

- 2020 Toyota Corolla

- 2019 Jeep Cherokee/Grand Cherokee

- 2019 Nissan Sentra

- 2020 Chevrolet Malibu