At any point, a random disaster or event could damage your vehicle. This could cost you thousands of dollars. Comprehensive insurance coverage is one of the best ways to ensure that you don’t have to pay out of pocket in the event of an incident that’s not in your control.

This article will cover the basics of the comprehensive insurance, including:

- A full definition of comprehensive insurance

- How it works

- What it does and doesn’t cover

- Collision vs. comprehensive

- Deductibles and limits

- When it’s necessary

- How much it costs

How Comprehensive Insurance Works

Comprehensive is one of the primary types of auto insurance. It’s a key part of what many in the industry call full coverage. This protects you from natural accidents or damages that don’t involve a collision.

There are no states that require comprehensive on auto policies. It’s completely optional. The only time it may be required is when you borrow money to finance a car. Typically, a lender will require the three coverages that fully protect a vehicle to protect their investment until the loan is paid off.

What It Covers

When you buy comprehensive, you’ll have coverage for many types of damages. It covers anything that doesn’t involve a collision with another car or object. Here are some examples of what it covers:

- Vandalism

- Civil disturbances and riots

- Theft

- Fire

- Hitting an animal

- Falling objects

- Natural disasters (e.g., hurricanes, tornadoes, earthquakes, hailstorms, etc.)

Most incidents that comprehensive insurance covers are out of the driver’s control. At times, many refer to these incidents as an “act of God,” meaning that what’s causing damage is out of your control. For example, if your car is sitting in the driveway and a tree falls on it, your comprehensive coverage will pay for the damages.

What It Doesn’t Cover

There are many different causes of damage that comprehensive covers. But it doesn’t protect you from every risk drivers face. Here’s what it doesn’t cover:

- Damage to your vehicle involving a collision with another car or object, including hit-and-runs.

- Any damage you cause while driving (liability coverage)

- Medical costs of any kind

Keep in mind that this coverage won’t cover any medical costs to you or your passengers. Even if a natural disaster causes them. You’d have to get personal injury protection (PIP) or medical payments coverage (MedPay) if you need coverage for medical bills.

Collision vs. Comprehensive

Comprehensive insurance and collision are very similar. Both aim to cover the costs of a vehicle’s damages. And each one is part of “full coverage.” But there are still some major differences. The following is a breakdown of how each type of coverage is different:

Comprehensive

- Covers your car’s damages in the event of a natural accident or disaster

- Doesn’t cover any medical costs

- Covers when an animal hits your car (Only if the animal runs into it)

- Covers theft or vandalism

In short, comprehensive insurance handles the damage costs of a vehicle from incidents that you can’t control.

Collision

- Covers damages to a car due to hitting an object such as a pothole

- Covers roll-over accidents

- Covers accidents involving one or more other cars

- Covers collisions with other objects like trees or rocks

The types of accidents may seem similar, but the accidents that collision insurance covers are incidents where the driver is in control. Collision covers accidents that involve hitting other objects. It can even cover your car if it’s sitting in a parking lot and another vehicle hits it.

Is Comprehensive Necessary?

By legal standards, comprehensive is optional to you. No state requires it. An exception is if you are financing or leasing your vehicle. Many lenders may require that you buy full coverage to protect their asset. Even though it’s optional in most cases, there are many reasons for you to buy it.

It’s more important for some people to buy comprehensive coverage than others. Below are a few items to consider:

It Depends on Your Risk

Deciding not to purchase comprehensive coverage is a risk you may not want to take. For example, people living in rural areas are more likely to hit animals on the road. Living in a big city can also pose a risk. Vandalism and theft are more likely to occur in areas with a larger population.

Another risk is living in areas where natural disasters are common. For instance, you may need to buy comprehensive if you live in a state that’s prone to hurricanes or tornadoes. This way you’ll be able to sleep at night knowing you have protection from natural disasters.

Considering the risk factors for potential damage to your car is an important part of determining if you need this coverage. It’s hard to know when disaster will strike. Comprehensive can help you be ready for those life-changing disasters.

You Financed Your Car

Comprehensive insurance may be mandatory when you’re taking a loan. The amount of coverage that you need to buy is up to your moneylender. In many cases, your lender will require that you buy full coverage. They do this to protect their financial interest in your vehicle.

You Drive a Luxury Vehicle

Your car’s value is important to consider if you’re thinking about getting comprehensive coverage. If you happen to drive an old beater, there may not be a reason to purchase it. This is because the cost of the coverage may exceed the value of the vehicle itself. On the other hand, if you drive a much newer model that’s worth far more than an old one, it may be wise to protect your assets and the vehicle by buying this coverage.

Not Having This Coverage Increases Risk

While no state requires comprehensive, it may be smart to buy it if possible due to the risks of not having it. Without this coverage, you’ll need to pay for any damages that occur to your vehicle. Remember that these only include damages that don’t involve other vehicles, as well as events that the driver can’t control.

As with any type of insurance, comprehensive protects your finances. A major disaster could wipe out your savings. Buying coverage will help you make sure that you never have to pay out of pocket.

Comprehensive Deductibles and Limits

If you buy any amount of comprehensive coverage, you must choose a deductible. A deductible is the amount of money that you pay the insurance company each time you file a claim. Comprehensive has a separate deductible from collision or liability, even if it’s part of full coverage.

If it’s financially viable, having a higher deductible could help you save more money on your rates. Per the Insurance Information Institute (III), setting your deductible at $1,000 could discount your premiums by as much as 40%.

Comprehensive also has a coverage limit, which is the total amount that your insurer will pay to cover a claim. Normally, the limit for comprehensive is equal to the actual cash value (ACV) of your car.

How Much Comprehensive Costs

Comprehensive insurance can be a bit more expensive than basic liability coverage. The III says that the average yearly cost is about $134 a year. If you’re looking at buying comprehensive coverage, there are some factors to look into that could affect the price you’ll end up paying.

Insurers consider many factors when they calculate your rates. They’re usually small details about you that indicate your risk for filing claims. The higher your risk is, the higher your rates will be. Here’s a list of common factors that could greatly impact your insurance rates:

- Where you live

- Marital status

- Past driving record

- Annual mileage

- Car value

Keeping these rate factors in mind will help you decide how much comprehensive will cost you. These aren’t the only factors that companies use when pricing insurance. But they are some of the most common ones to consider.

Finding the cheapest comprehensive coverage can seem like a tough task. However, knowing the key rate factors and how much each company charges are a big part of finding the best price.

Rates will likely vary between different companies. You don’t have to settle for the first insurer you see. It’s a smart practice to compare quotes from each provider. That way, you can find the best deal for you.

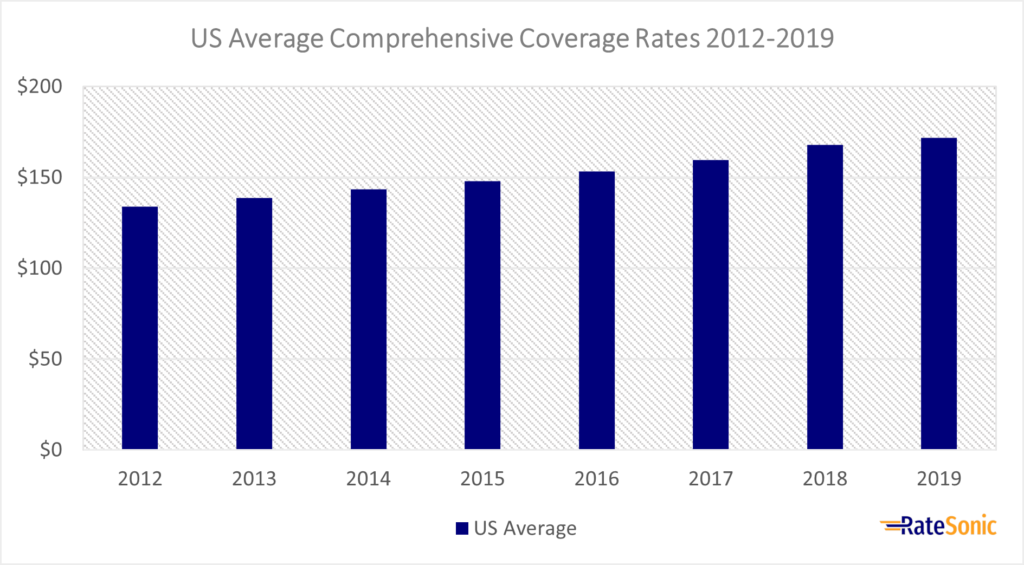

US Average Comprehensive Rates

This table illustrates average national comprehensive rates from 2012 to 2019. This is the most recent period we have available cost data from the III.

| Year | US Average |

|---|---|

| 2012 | $134.04 |

| 2013 | $138.82 |

| 2014 | $143.45 |

| 2015 | $148.04 |

| 2016 | $153.32 |

| 2017 | $159.72 |

| 2018 | $167.91 |

| 2019 | $171.87 |

Below is a visual representation of the above data:

Average Comprehensive Rates By State

Comprehensive coverage rates vary based on where you live, and tend to be higher in states that experience more natural disasters or severe weather events. Your rates could also go up, on average, if your state experiences lots of car-related crime.

To help you find out how much you could pay for comprehensive in your area, we’ve organized the table below. It provides comprehensive coverage rate data in all 50 states and the District of Columbia in 2019. Average costs come from the III, and were originally from the National Association of Insurance Commissioners (NAIC). The national average we compared each state to was $171.87 in 2019.

| State | Average Cost | US AVG Difference |

|---|---|---|

| Alabama | $180.11 | +4.5% |

| Alaska | $155.11 | -10.8% |

| Arizona | $208.38 | +17.5% |

| Arkansas | $240.54 | +28.5% |

| California | $96.53 | -79.1% |

| Colorado | $298.01 | +42.3% |

| Connecticut | $134.01 | -28.2% |

| District of Columbia | $221.94 | +22.5% |

| Delaware | $136.31 | -26.1% |

| Florida | $153.00 | -12.3% |

| Georgia | $180.37 | +4.7% |

| Hawaii | $106.29 | -61.7% |

| Idaho | $142.89 | -20.3% |

| Illinois | $144.65 | -18.8% |

| Indiana | $138.86 | -23.8% |

| Iowa | $221.72 | +22.5% |

| Kansas | $286.48 | +40% |

| Kentucky | $168.11 | -2.2% |

| Louisiana | $252.34 | +31.9% |

| Maine | $115.26 | -49.1% |

| Maryland | $168.01 | -2.3% |

| Massachusetts | $149.86 | -14.7% |

| Michigan | $162.01 | -6.1% |

| Minnesota | $214.55 | +19.9% |

| Mississippi | $238.95 | +28.1% |

| Missouri | $223.94 | +23.2% |

| Montana | $313.27 | +45.1% |

| Nebraska | $269.19 | +36.1% |

| Nevada | $119.19 | -44.2% |

| New Hampshire | $120.48 | -42.6% |

| New Jersey | $129.97 | -32.2% |

| New Mexico | $222.43 | +22.7% |

| New York | $172.85 | +0.6% |

| North Carolina | $138.40 | -24.2% |

| North Dakota | $264.98 | +35.1% |

| Ohio | $131.37 | -30.8% |

| Oklahoma | $270.19 | +36.4% |

| Oregon | $109.76 | -56.6% |

| Pennsylvania | $171.18 | -0.4% |

| Rhode Island | $141.03 | -21.9% |

| South Carolina | $211.29 | +18.6% |

| South Dakota | $347.61 | +50.5% |

| Tennessee | $168.07 | -2.2% |

| Texas | $285.56 | +39.8% |

| Utah | $127.15 | -23.7% |

| Vermont | $148.88 | -15.4% |

| Virginia | $149.42 | -15% |

| Washington | $121.13 | -41.9% |

| West Virginia | $225.50 | +23.8% |

| Wisconsin | $168.52 | -1.99% |

| Wyoming | $335.04 | +48.7% |

Frequently Asked Questions

Is comprehensive worth the money?

The answer to this depends in large part on your tolerance of risk. Comprehensive insurance pays for all unknown events that can damage your car except for crash damage, which collision coverage pays to fix. The unknown is the key word here, and it encompasses just about everything that can damage a vehicle. In our modern world, a list of risks is far too long to begin here. But a few examples are theft, vandalism, falling trees, natural disasters of every kind, fire, and hitting an animal.

Comprehensive insurance on your policy can relieve stress and is a good value, as it isn’t expensive in most states. Hail alley residents pay more, but let’s face it, it’s more expensive there because it’s crucial to carry comprehensive on your policy for this very reason.

Adding comprehensive is a personal decision. Only you can say whether it’s worth it. But there’s no question that it’s great to have when you need it.

Do comprehensive claims raise your rates?

It may come as a surprise, but yes rates may go up after filing a comprehensive insurance claim. After filing a claim for fire, theft, vandalism, or hitting an animal, your provider might consider you a higher risk for filing a similar one in the future. If you don’t file more claims, the incident will eventually disappear from your record, and your rates should go down.

Providers understand that drivers have little to no control over the risks that lead to comprehensive claims and raise rates less than they would for an at-fault accident. It may not be reassuring, but this is ammunition for the argument that you pay for minor damages out-of-pocket.

Will I need to buy rental coverage if I already have car insurance?

The short answer is that you might have to. If you already have comprehensive or collision, it could carry over to your rental car. Be sure to check with your insurer.

Does comprehensive cover any medical bills?

No. Comprehensive only covers damages to your vehicle up to the limit you choose. The limit will typically be equal to the actual cash value of your vehicle or the amount of money it’s worth on the market.

If a car hits my vehicle in a parking lot, does comprehensive insurance cover it?

If the other driver leaves their policy info, their liability coverage pays for it. Otherwise, unless you have collision coverage, you’ll likely need to pay for it out of pocket. If a parking lot is where you regularly park your car, it can affect how much you pay for auto insurance.

And, say your car is struck there once, then your insurer isn’t going to consider it a safe spot to park. It’s not unheard of for a single vehicle to get hit more than once parked in the same lot. Multiple claims for the same thing in the same place won’t do you any favors at policy renewal time.