Car accidents are expensive. Even minor damage can cost you thousands of dollars to repair. They’re also very common. The National Highway Traffic Safety Administration (NHTSA) reported 6.7 million auto crashes in 2019. That’s why collision insurance coverage is so important.

Understanding how collision insurance works and how it differs from other coverages could save you thousands of dollars. In this article, we help you have a better understanding of this essential car insurance coverage, including:

- What it is

- What it does and doesn’t cover

- Pros and cons of getting it

- How much it costs

- Coverage for rental cars

- Frequently asked questions

Collision Insurance Basics

Collision coverage pays for repairs, minus your deductible, when there’s damage to your car. The damage can result from hitting another vehicle or object like a sign, tree, or pothole. It also helps pay to replace your vehicle if your insurer declares it a total loss.

Collision is one component of what many refer to as “full coverage.” To be fully covered, however, you also need comprehensive and liability insurance on your policy.

What It Covers

Collision coverage covers many types of accidents. But it’s important to remember that it only covers incidents that are within your control as a driver. This includes:

- Head-on collisions

- Rear-end collisions

- Side-impact collisions

- Hit-and-run incidents

- Accidents involving only your vehicle such as rollovers

- Collisions with objects like trees, light poles, or fences

- Any damage caused by potholes

Unlike liability coverage, it doesn’t matter whose fault the accident is. Even if you’re at fault, collision insurance will pick up the costs.

What It Doesn’t Cover

While it takes care of a lot, collision doesn’t cover everything. There are several ways your vehicle can take damage or become a total loss. Most of these incidents are out of your control. Here are some situations where you can’t rely on this coverage:

- Vandalism to your car

- Theft of your vehicle

- Acts of nature such as falling trees or light poles, hail, tornadoes, or earthquakes

- Collisions with deer, elk, or other animals

- Any damage to another vehicle

- Any injuries of other drivers or people in your vehicle

- Any injuries that you sustain from an incident

- Items stolen from inside your car

Comprehensive insurance is a different type of coverage. It covers damage to your vehicle in incidents out of your control. Comprehensive covers most of the incidents listed above. Some states require it before you can get collision coverage.

It’s also important to note that auto insurance doesn’t cover items stolen from your car. To protect your personal property, you’ll need either homeowners or renters coverage.

Is Collision Required?

No states require collision coverage. However, some car dealers and lenders may ask you to have it if you finance your vehicle or get a loan. If you own your vehicle outright, you’ll only need to buy what your state requires.

Not having this coverage could be pricey in the long run. You’d have to pay all the repair costs out of pocket if you get into a car accident without it. This is the case even if you’re not at fault and there are extra costs.

You can sue the at-fault driver for varying amounts, depending on your state’s laws. For example, Michigan allows you to sue for up to $1,000. Check your state’s insurance website for more information.

Though not required, collision coverage can have many benefits. Below are some of its pros and cons:

Pros:

- Peace of mind

- Save money from costly repairs

- Get coverage for a totaled vehicle

Cons:

- Requires you to set a limit, which could affect your rates

- You must pay a deductible to claim benefits

- Premiums could increase after the use of benefits

Collision Coverage Deductible/Limit

Like many types of insurance, collision coverage has a deductible. This is the total amount you’ll pay out of pocket before your provider pays your claim.

For example, let’s say you have a deductible of $1,000. If you get into an accident where the repairs total $4,000, you’d have to pay the $1,000. After you’ve paid your deductible amount, your policy will pay the remaining $3,000.

In addition to a deductible, collision insurance has a limit. Coverage limits are the greatest amount your insurer will pay for a claim.

The limit for your collision coverage is usually the same as your car’s actual cash value (ACV). The ACV is the cost to repair a damaged vehicle or replace it minus the depreciation. The ACV is also known as the fair market value of your vehicle.

Collision Coverage for Rental Cars

When renting a car, your company might mention a collision damage waiver (CDW) or loss damage waiver (LDW). These are common protection plans offered by rental companies. They provide some coverage for collisions. But these plans aren’t the same as collision auto insurance.

A CDW wipes away all costs for a damaged rental car. Keep in mind that these protection plans are normally optional when renting. Often, you won’t need the CDW if you have collision coverage. But if you get into an accident and you don’t have collision or didn’t opt-in, you’ll end up paying for all the repairs yourself.

How Much It costs

Auto insurance rates aren’t a concrete value. There are several factors that leading companies use to decide prices. Some common factors include:

These are only a few of the factors that providers analyze before setting your rate. According to the Insurance Information Institute (III), the average cost of collision coverage is nearly $290 per year. Even so, prices vary quite a bit from one carrier to the next.

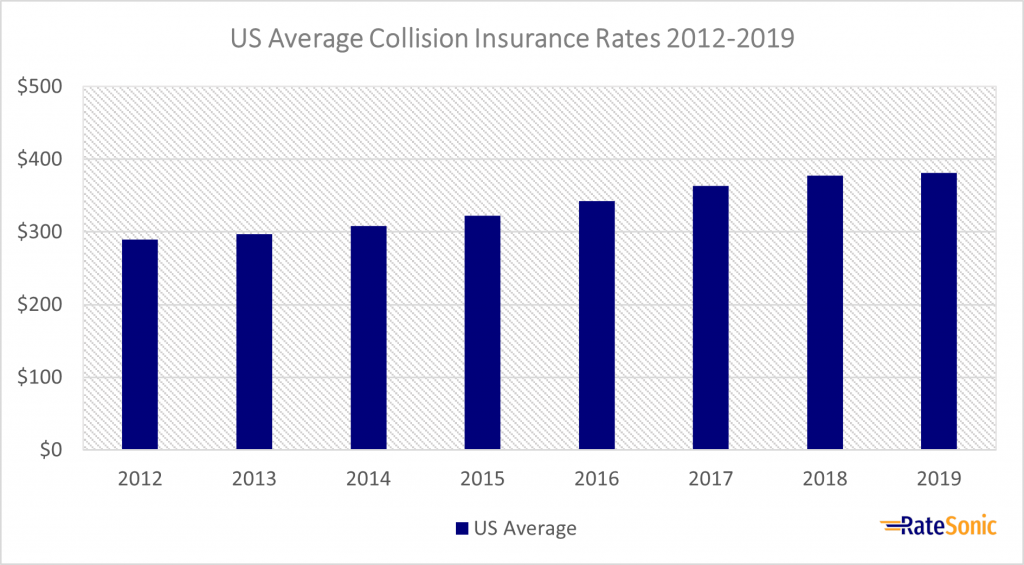

US Average Collision Rates

The following table shows national average collision coverage rates from 2012 to 2019. This is the most recent year we have actual auto insurance pricing data from the III.

| Year | US Average |

|---|---|

| 2012 | $289.66 |

| 2013 | $296.99 |

| 2014 | $308.32 |

| 2015 | $322.61 |

| 2016 | $342.40 |

| 2017 | $363.08 |

| 2018 | $377.62 |

| 2019 | $381.43 |

Below is a visual representation of the above data:

Average Collision Rates by State

People often pay different amounts for coverage depending on where they live. Several factors could cause this, such as population density (more drivers means more accidents), inflation, and the average cost to repair a vehicle.

To help provide clarity on how much you can expect to pay for collision coverage in your state, we’ve put together the table below. It contains collision rate data for all 50 states and the District of Columbia. The average cost was supplied to the III by the National Association of Insurance Commissioners (NAIC) and reflects collision rates in 2019. The national mean we compared each state to was $381.43 in 2019.

| State | Average Cost | US AVG Difference |

|---|---|---|

| Alabama | $390.19 | +2.2% |

| Alaska | $401.87 | +5.1% |

| Arizona | $327.86 | -16.3% |

| Arkansas | $372.65 | -2.3% |

| California | $495.18 | +22.9% |

| Colorado | $332.26 | -14.8% |

| Connecticut | $412.78 | +7.6% |

| District of Columbia | $539.48 | +29.3% |

| Delaware | $354.76 | -7.5% |

| Florida | $355.69 | -7.2% |

| Georgia | $420.60 | +9.3% |

| Hawaii | $370.53 | -2.9% |

| Idaho | $270.36 | -41.1% |

| Illinois | $351.27 | -8.6% |

| Indiana | $288.97 | -32% |

| Iowa | $250.96 | -52% |

| Kansas | $285.92 | -33.4% |

| Kentucky | $307.91 | -23.9% |

| Louisiana | $485.01 | +21.4% |

| Maine | $297.60 | -28.1% |

| Maryland | $430.21 | +11.3% |

| Massachusetts | $447.05 | +14.7% |

| Michigan | $478.54 | +20.3% |

| Minnesota | $274.20 | -39.1% |

| Mississippi | $364.63 | -4.6% |

| Missouri | $318.44 | -18.8% |

| Montana | $286.02 | -33.3% |

| Nebraska | $272.97 | -39.7% |

| Nevada | $374.59 | -1.8% |

| New Hampshire | $334.15 | -14.1% |

| New Jersey | $422.29 | +9.7% |

| New Mexico | $315.88 | -20.7% |

| New York | $469.82 | +18.8% |

| North Carolina | $344.07 | -10.8% |

| North Dakota | $284.09 | -34.3% |

| Ohio | $305.55 | -24.8% |

| Oklahoma | $338.87 | -12.5% |

| Oregon | $281.69 | -35.4% |

| Pennsylvania | $383.01 | +0.4% |

| Rhode Island | $491.19 | +22.3% |

| South Carolina | $317.95 | -20% |

| South Dakota | $248.09 | -53.7% |

| Tennessee | $353.43 | -7.9% |

| Texas | $434.46 | +12.2% |

| Utah | $308.40 | -23.7% |

| Vermont | $333.38 | -14.4% |

| Virginia | $323.76 | -17.8% |

| Washington | $325.38 | -17.2% |

| West Virginia | $352.97 | -8.1% |

| Wisconsin | $250.73 | -52.1% |

| Wyoming | $292.37 | -30.5% |

Frequently Asked Questions

What happens if I have an accident with no collision coverage?

Without collision coverage, you’re required to pay all repair costs out of pocket. If the other driver is at fault and has liability insurance, they’ll pay for the damages up to their limits. Then, you’d have to cover the rest on your own.

Is collision coverage required?

In general, it’s optional. But if you’ve financed your car, your lender will require you to maintain collision insurance on your policy until the car’s paid off.

Is comprehensive the same as collision?

No. Comprehensive covers many events collision doesn’t. Collision coverage handles crashes that are under your control. Think of crashes with other vehicles or buildings or trees. Comprehensive covers incidents that aren’t under your control. For example, if a tree falls on your car, comprehensive would pay for repairs. Comprehensive steps in when your vehicle suffers damage wherever it’s parked. One way to think of comprehensive insurance is “other than collision” coverage.

Will collision pay my claim even if the accident was my fault?

If you have collision coverage, fault doesn’t matter. Your insurance company will pay for all repairs up to your policy limits and minus your deductible.

How much does collision coverage cost?

The price of collision coverage varies. It depends on lots of factors, including:

- Age

- Geography

- Gender

- Driving experience

Auto insurers consider all of these and more when determining premiums. And most people get collision and comprehensive together. This usually doubles your total premium, but your car will have outstanding coverage in the event of a wide assortment of incidents that damage vehicles.

Who needs collision coverage?

People with outstanding loans for sure. Also, anyone that feels uncomfortable with risk. Many people sleep better at night knowing they can get their car repaired after an accident. Anyone likely to get into an accident should also consider this type of coverage. Whether you know you’re a bad driver or have unsafe drivers in your neighborhood, collision adds a lot of security.