Oregon Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Oregon.

- Brandon Canonica

- Updated March 20, 2024

Oregon is home to an incredible variety of beautiful landscapes and diverse cities. It’s also home to Portland, the state’s largest city and the center of a growing metro area. According to the DMV, there are presently about 4.1 million registered vehicles in the state. Even so, Oregonians consistently pay lower auto insurance rates than the national average.

Everyone who gets behind the wheel in Oregon must have an insurance policy. On this page, we’ll give you key insights about insuring cars in the Beaver State. This includes a breakdown of average rates, required coverages, and important laws. We’ll also go over how to find the best companies in the state.

Table of contents

Oregon Average Auto Insurance Rates

It’s a smart choice to examine Oregon’s average rates when you’re shopping for a new policy. This can help you see how much others in your state pay for insurance. Doing so can also give you a good idea about how much you should end up paying for coverage.

So, how much does Oregon car insurance cost? We’ve put together a table that shows the average rates in Oregon versus the rest of the US. This includes average premium costs for all the most common coverages.

| Coverage | Oregon Average | US Average |

|---|---|---|

| Liability | $684.81 | $650.35 |

| Collision | $281.69 | $381.43 |

| Comprehensive | $109.76 | $171.87 |

| Full Coverage | $990 | $1,070.47 |

| Price Per Month | $82.50 | $89.20 |

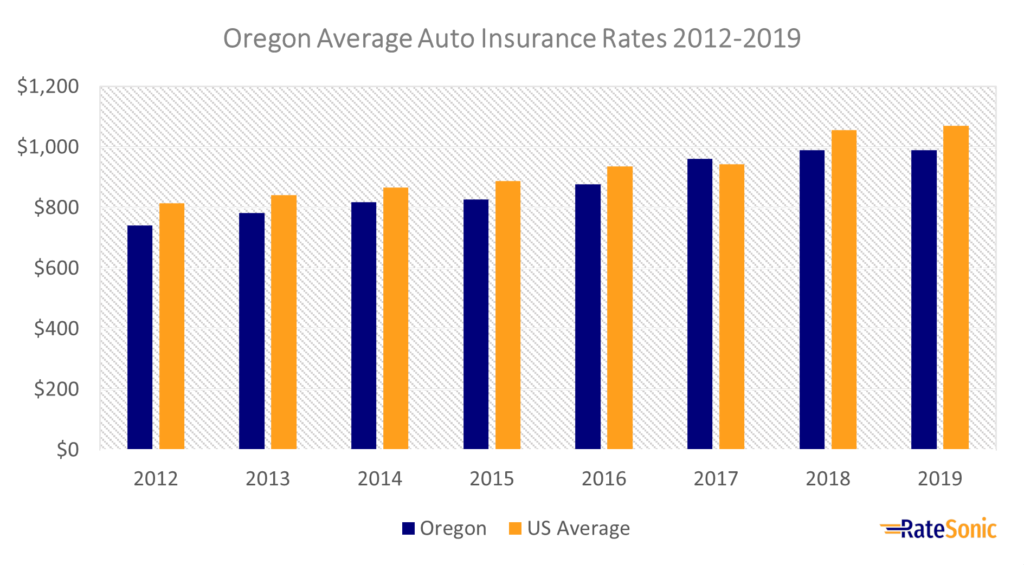

Average Full Coverage Rates

The graph below shows the change in average Oregon car insurance rates from 2012 to 2019. Rates here increased from $741 in 2012 to $990 for full coverage in 2019. This was an increase of $249, or 33%. For the most part, however, Oregonians pays less for full coverage on average than the rest of the nation.

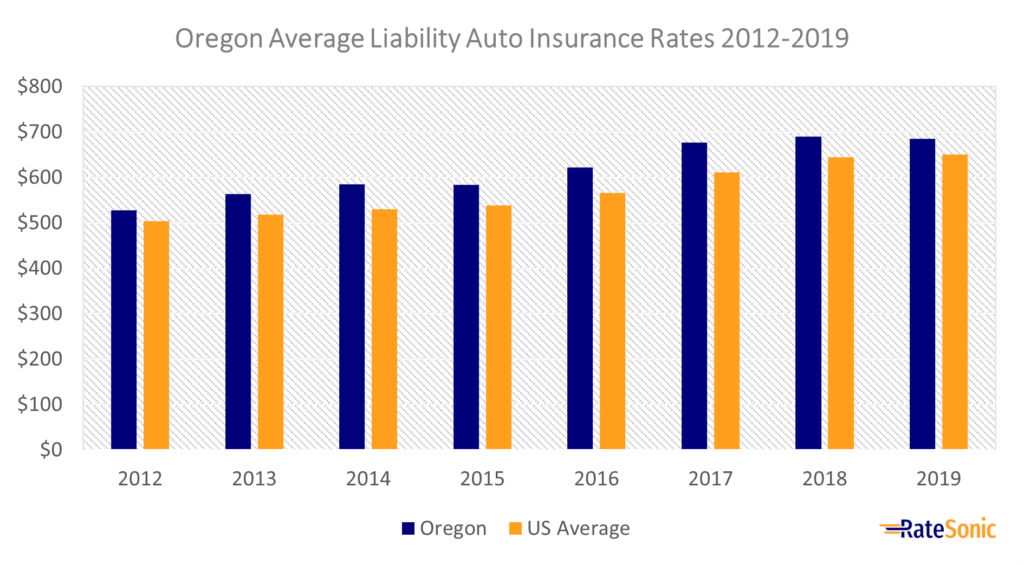

Average Liability Rates

The following graph displays the average liability car insurance rates in Oregon from 2012 to 2019. For the entire eight years, this state has seen higher rates than the national average. Average liability coverage rates have been climbing each year since 2012 and reached a peak in 2018 at nearly $700, about 35% higher than they were in 2012 at $181.

One reason for higher liability rates could be high medical care costs. Per the Oregon Health Authority, residents pay more, on average, for health care than the rest of the country. Data from the Oregon Department of Transportation (ODOT) shows that there were about 50,000 motor vehicle crashes in 2019, of which 456 were fatal. Higher medical costs for injury-related accidents and fatalities may lead to increased claims and higher coverage costs for motorists.

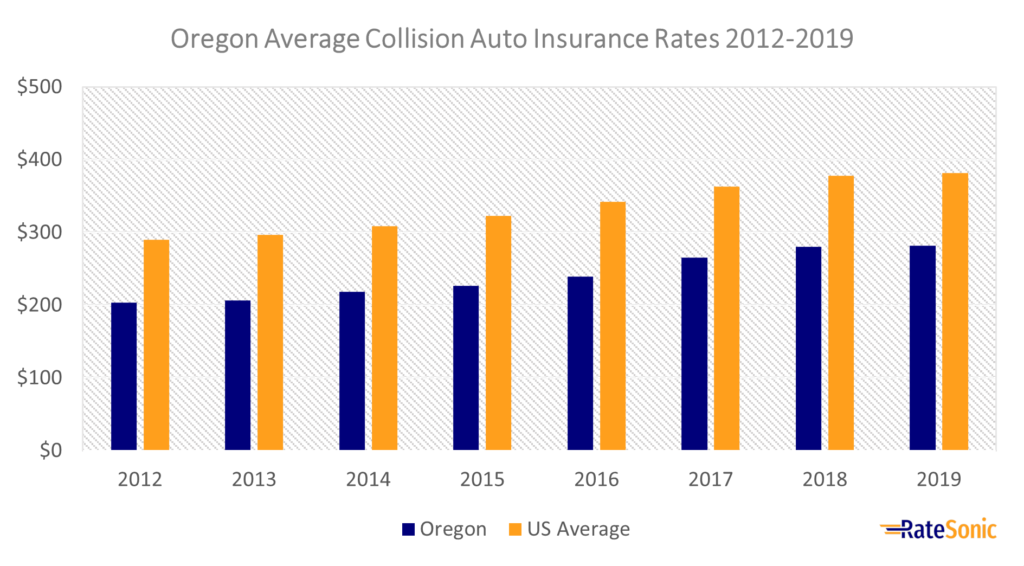

Average Collision Rates

The graph below shows the average collision insurance rates in Oregon from 2012 to 2019. Collision coverage increased from $203 to $281 a year between 2012 and 2019. This was an increase of $78 or 38%. However, Oregonians have paid less than the US average for collision coverage over the period. This could have something to do with more people using public transit, especially in the Portland metro area. You’ll often see locals taking buses, light rails, streetcars, or even riding bikes to get around. This can help with congestion and lower the total number of collision claims.

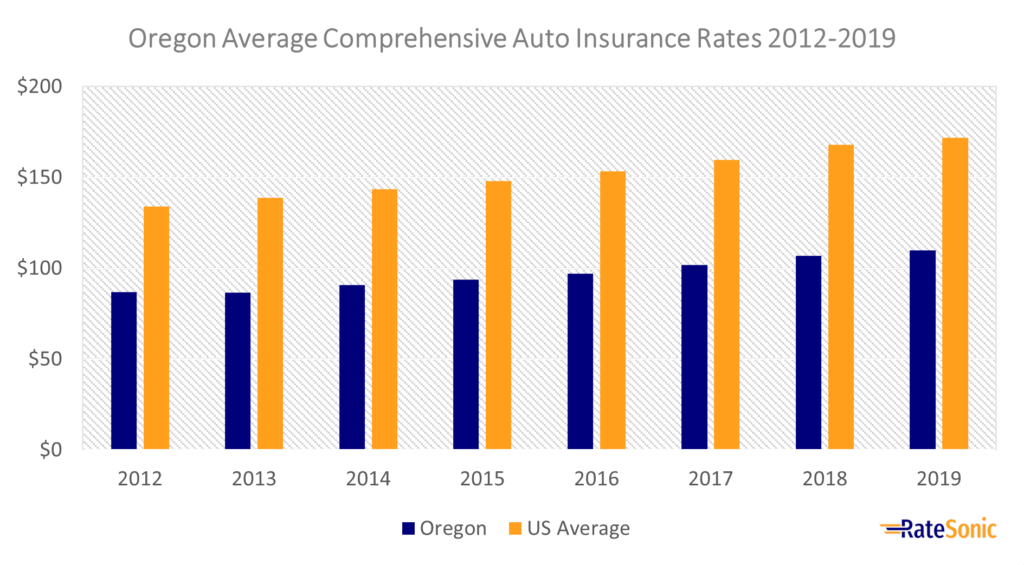

Average Comprehensive Rates

The next graph illustrates the average comprehensive insurance rates in Oregon from 2012 to 2019. Comprehensive coverage increased from $86 to $109 a month between 2012 and 2019. This was an increase of $23 per year or 26%. Like collision coverage, Oregonians pay lower rates for comprehensive coverage than the average for the rest of the country.

Why Do Rates Keep Rising

You’re not alone if you’ve recently seen your rates go up. There are many reasons why this could be the case. One of the main causes is inflation across the country, which is hitting a 40-year high. Inflation results in higher repair costs, causing everything involving your car to become more expensive. This is why insurance prices are rapidly increasing in every state, including Oregon.

With premiums increasing, it’s a good idea to compare quotes from top insurers. This will help you find the cheapest rates.

Oregon Minimum Auto Insurance Requirements

The State of Oregon requires a minimum amount of car insurance to legally drive. Here are the required types of coverage, as well as the basic coverage limits:

Liability Coverage

Oregon requires minimum liability limits of at least:

- $25,000 of bodily injury liability (BIL) per person

- $50,000 of bodily injury liability (BIL) per crash for injury to others

- $20,000 of property damage liability (PDL) per crash

You’ll sometimes see minimum liability requirements written in shorthand form on your policy: “25/50/20.”

Be aware that this is just the bare minimum requirement for liability coverage. Purchasing it will allow you to drive, but it might not be enough coverage for every incident. A good rule of thumb is to buy as much coverage as you can afford. You never know when an accident will happen and you’ll need that extra coverage.

The auto insurance industry generally recommends bodily injury limits of $100,000 per person and $300,000 per accident.

Personal Injury Protection (PIP)

In addition to liability, the state requires $25,000 of personal injury protection (PIP) per person. PIP provides extra medical coverage regardless of who caused an accident. This means that if you or a passenger gets injured following a car accident, PIP will step in to cover any medical or rehab costs.

Uninsured Motorist (UM) and Underinsured Motorist (UIM)

Oregon also requires uninsured motorist (UM) and underinsured motorist (UIM) coverage to help with costs when you’re in a crash with someone who either doesn’t have enough insurance or none at all. The minimum limits for UM/UIM coverage are:

- $25,000 of bodily injury liability (BIL) per person

- $50,000 of bodily injury liability (BIL) per crash for injury to others

You must show your policy numbers when you renew your vehicle registration. You can’t register a vehicle without carrying coverage within mandated limits.

Valid Proof of Insurance

It’s important to have proof of coverage in your car whenever you drive. Oregon state law may also refer to this as proof of financial responsibility.

You can prove financial responsibility with an insurance ID card or digitally on an electronic device. The law only requires an effective date and expiration date for a policy to be valid. You can get an ID card through your insurer.

While not required, it’s also a good idea if your proof of coverage includes your vehicle’s:

- VIN

- Make

- Model

Self-Insurance

You can self-insure your cars in Oregon, but it’s not an easy process and isn’t for everyone. For instance, you’ll have to put up quite a lot of money to prove you’re able to cover damages from an accident. You also need to have more than 25 vehicles registered in your name.

To self-insure, you must apply for a self-insurance certificate from ODOT. You’ll also need to display that you meet the state financial responsibility requirements. For more information, be sure to check out the specific qualifications on the ODOT website.

Penalties for Driving Without Insurance

Driving without coverage in Oregon is a Class B traffic violation. You could experience lofty fines, car impoundment, or even lose your license if you get pulled over and can’t prove that you have insurance.

You’ll face the following penalties if you’re convicted of driving uninsured:

- A fine between $130 and $1,000

- Loss of driver’s license

- Towing and impoundment

- Maintain an SR-22 for three years

- $75 reinstatement fee

After a conviction, you won’t be able to drive again until you show that you comply with the financial responsibility law. If you’re involved in an accident without insurance, you’ll lose your license for as much as a year.

Best Car Insurance Companies in Oregon

It’s not always easy to find the best insurance company. After all, there are many providers Oregonians can choose from. Also, it may not seem straightforward to know what could make one provider better than another. Typically, the best companies are the ones that give you the best value. This includes:

- Top-notch customer service

- Easy ways to file claims

- Special benefits and discounts

- Competitive rates

In the end, it’s best to compare companies side by side before you buy a policy. One way you can do this is by comparing quotes among well-known national and local Oregon-based car insurance carriers. This can help guide you toward the best deal. You can also research specific aspects of providers, such as market share, customer reviews, and available discounts. For an in-depth review of each company’s quality, be sure to visit our article on the best auto insurers in the country.

Top Companies by Market Share

One way to find the best car insurance companies is by looking at how much market share each provider has. The companies with the largest chunk of the market have more customers and are normally more established all over the country or in a certain region.

Below is a list from 2020 of the top ten insurers in Oregon by market share:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm | $549,017 | 18.11% |

| 2 | Progressive | $290,124 | 9.57% |

| 3 | GEICO | $275,229 | 9.08% |

| 4 | Farmers | $220,810 | 7.29% |

| 5 | Safeco | $184,424 | 6.08% |

| 6 | Allstate | $173,061 | 5.71% |

| 7 | COUNTRY | $80,950 | 2.67% |

| 8 | USAA | $68,443 | 2.26% |

| 9 | Liberty Mutual | $55,923 | 1.85% |

| 10 | Travelers | $53,186 | 1.75% |

Top Providers by J.D. Power Rating

It’s also helpful to look at what other people think when you’re trying to find the best auto insurers. Checking out J.D. Power’s customer satisfaction ratings is a great way to do that. Every year, J.D. Power releases a list of the top companies by customer satisfaction.

Below were the top companies in the Pacific Northwest in 2022 by J.D. Power rating:

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | The Hartford | 842 |

| 2 | State Farm | 839 |

| 3 | GEICO | 832 |

| 4 | PEMCO | 823 |

| 5 | Progressive | 819 |

| 6 | Safeco | 816 |

| 7 | Allstate | 811 |

| 8 | Farmers | 802 |

Oregon Auto Insurance Laws

Car insurance laws aren’t always the same from state to state. It’s not uncommon for each state to have unique processes and requirements. Oregon, of course, is no exception. The following are some of the most important laws you should pay attention to:

No-Fault or Fault?

No-fault states require you to buy coverage, such as personal injury protection (PIP), that takes care of medical or injury costs after a car accident, regardless of fault. Oregon is not a no-fault state. Note that state law still requires PIP, despite not being an official no-fault state.

Oregon is an at-fault state. This means that you’re responsible for covering any damages or injuries resulting from an accident you cause. You can often do this by buying enough liability coverage.

Totaled Cars

Your car becomes a total loss if it’s been damaged to the point where its repairs would cost more than its actual cash value (ACV). Oregon requires carriers to declare your vehicle a total loss once the cost to repair or replace it reaches 80% of its value.

After your insurer deems your vehicle a total loss, you should get a payout that’s equal to your its estimated market value before the accident. Insurance companies often arrive at these numbers by analyzing other cars on the market of the same year, make, and model.

Salvage and Reconstructed Titles

A car receives a salvage title once it’s totaled by an insurance company. In Oregon, a salvage title will often contain the owner’s name and the reason it’s a salvage.

Cars with salvage titles are illegal to drive in the State of Oregon, and are often nearly impossible to insure. This is because they’re damaged to the point where they’re not road-worthy. To drive a salvaged vehicle again, you must rebuild it and make it safe to drive again. Then, you can apply for a reconstructed title.

How to get a Reconstructed Title

Per ODOT, to get a reconstructed (also known as rebuilt) title, you must send the below to your local DMV:

- An application for title and registration (Form 735-226)

- An assembled, reconstructed, or replica certification (Form 735-6511)

- An original odometer disclosure (only necessary for vehicles under 20 years old or cars made in 2011 or later)

- Your original salvage title

- Original releases or bills of sale for major parts you used

- Original lien releases from security interest holders or lessors

- A VIN inspection

- Payment of the title fee

Insuring Cars with Reconstructed Titles

While it’s not always easy to insure a rebuilt or reconstructed car, you can still get coverage for one in Oregon. However, you may not be able to get the same kind of coverage or even the same prices, that you’d get with a clean title.

Most providers will take full coverage options such as collision and comprehensive coverage off the table when you own a reconstructed title. But, at the very least, you’ll still be able to get the state minimum liability requirement. You’ll also pay more to insure a vehicle with a reconstructed title because they’re considered less safe.

Though you’ll likely end up paying more to insure vehicles with reconstructed titles, you can still try to find the best deal. For instance, you can compare quotes between well-known companies and find one that offers the best rates for rebuilt cars.

Full Windshield Replacement

Some states, such as Florida, have laws that require providers to replace your windshield without a deductible. Oregon, however, has no laws that require insurers to do so. Instead, your comprehensive coverage will step in to cover damages to your windshield. In this case, you’ll need to pay your deductible.

Some insurers may offer an additional option called full glass coverage. If you have it, they’ll replace your windshield without a deductible. But consider that adding extra coverages to your policy can increase your rates.

Filing Claims

If you get into an accident or take damage to your car, then chances are you’ll need to file a claim with your provider. This is usually a straightforward process, especially if you gathered as much info as you could about the incident. You typically file over the phone, and many insurers even let you do it online.

It’s critical to file a claim as soon as possible. This will ensure that you remember everything about the accident and can get your car the proper repairs.

When you file a claim in Oregon, you can expect an adjuster to assess the damage to your vehicle. They’ll also do their best to decide who or what was at fault in the accident. If your insurer accepts your claim, you should receive coverage to pay for your car’s repairs.

Credit History

Auto insurance companies employ a wide range of factors to determine your rates. These are often certain facts about you, such as the type of car you drive, your claims history, or even your marital status. Another common rate factor that insurers use is your credit history. They look at your credit score to decide your rates because they believe it can show how reliable you are as a customer.

A handful of states don’t permit providers to use your credit history. Oregon doesn’t let providers deny you coverage because of your credit or FICO score. But it does allow companies to determine your rates using your credit report. They can also only use certain info on your credit report. We recommend talking to an agent to see which parts of your credit insurers can use.

Policy Cancellation

Insurers can cancel or not renew your policy for many reasons. Common examples of reasons for non-renewal include:

- A driving record with lots of tickets and violations

- Lots of recent claims

- A severe at-fault accident or violation, such as reckless driving or a DUI

In Oregon, insurers must give you at least ten days of notice before they cancel your policy*. Per the Division of Financial Regulation, companies also must give you 30 days of written notice if they want to cancel or not renew your policy for a reason that doesn’t include failure to pay on time. The DFR also notes that your company must say why they’re canceling your coverage in the notice they give you.

According to state law, these are grounds for an insurer to cancel your policy:

- Not paying your rates

- Fraud or false information provided on your policy

- Driving with a revoked or suspended license

*This doesn’t apply if your policy hasn’t been in effect for 60 days.

If your auto insurer cancels your policy because you didn’t pay your rates, you can still reinstate it. All you need to do is contact your provider immediately. If you avoided a coverage lapse, you should be able to reinstate your policy as it was before.

DUII Laws

It’s illegal to drive while under the influence of drugs and/or alcohol in Oregon. The state refers to this as driving under the influence of intoxicants (DUII). By law, you’re intoxicated if you get behind the wheel with a blood alcohol content (BAC) of 0.08 or are under the influence of liquor or other controlled substances.

You can expect to see serious consequences that include jail time, fines, and license suspension if you get a DUII. Your car insurance will also take a massive hit. For example, your carrier might cancel or not renew your policy. Providers will also consider you a risky driver, which can make it hard to find anyone willing to insure you. If you do find a company that covers drivers with DUIs, it’s almost a certainty that you’ll pay more for coverage.

Below are the penalties for getting a DUII:

First offense:

- $1,000 in fines, $2,000 if BAC was 0.15 or more

- Two days to one year in jail

- Ignition interlock device (IID) for one year

- License suspension for one year

Second offense:

- $1,500 in fines, $2,000 if BAC was 0.15 or more

- Two days to one year in jail

- IID for two years

- License suspension for three years

Third offense:

- $2,000 in fines, $125,000 if convicted of a class C felony

- Three months to five years in jail

- IID for two to five years

- Permanent license suspension

SR-22

You must maintain an SR-22 for three years after a DUII conviction in Oregon. An SR-22 is a certificate proving you have the minimum required liability coverage by the state.

Typically, you get an SR-22 through your insurance carrier. They can help you make sure it’s correct and then send it off to the state DMV. Keep in mind that not every insurer offers SR-22s for customers. It may be a good idea to do some research on this when finding a new company after a DUII.

Driver’s License Points

Oregon doesn’t have a driver’s license points system. Instead, the state keeps track of your moving violations. If you get too many, you could lose your license.

The State suspends your driver’s license if you get three moving violations in 18 months. You can also lose your license immediately if you commit a severe offense like a DUII or aggravated driving.

Most Popular Cars

Each state has a list of the most popular or sought-after vehicles by consumers. The following were Oregon’s most-sold cars in 2021:

- Toyota RAV4

- RAM 1500/2500/3500

- Toyota Tacoma

- Ford F-Series

- Honda CR-V

Most Stolen Cars

Just as each state has its most popular vehicles, it also has its most stolen. These are the ones most coveted by criminals. Some vehicle’s are coveted more than others. That’s one reason your make and model is a rate factor. Be aware that if you own one of these cars, it could cost more to insure.

These were Oregon’s most stolen cars in 2021:

- 2000 Honda Civic

- 1997 Honda Accord

- 1999 Ford Pick-Up (Full Size)

- 1998 Subaru Legacy

- 1998 Honda CR-V

- 2000 Chevrolet Pick-Up (Full Size)

- 1998 Toyota Camry

- 1999 Toyota Corolla

- 1999 Subaru Impreza

- 1993 Jeep Cherokee/Grand Cherokee