Colorado Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Colorado.

- Brandon Canonica

- Updated March 20, 2024

Colorado is widely known for incredible sights such as the Rocky Mountains and the Eastern Plains. Denver, the state capital and the 19th-most populous city in the nation, features several well-known museums and breweries. It’s also home to sports teams such as the Colorado Rockies and the Denver Broncos.

According to the Federal Highway Administration (FHA), there were about 4.4 million registered motorists in the Centennial State in 2021. State law requires every driver to have auto coverage before they can get on the road. In this guide, we’ll go over critical information about car insurance in Colorado. This includes minimum requirements, important laws, and the best companies.

Table of contents

Colorado Average Auto Insurance Rates

Looking at the average rates in your state is a great way to see if you’re overpaying for car insurance. It enables you to see how much, in general, others pay versus yourself. Of course, many factors could make you pay more or less than other residents in your state for coverage. This often includes details like your age, driving history, ZIP code, and more.

How much is car insurance in Colorado? The following table displays the average rates for each main type of coverage here compared to the rest of the country:

| Coverage | Colorado Average | US Average |

|---|---|---|

| Liability | $704.82 | $660.35 |

| Collision | $332.26 | $381.43 |

| Comprehensive | $298.01 | $171.87 |

| Full Coverage | $1,174.87 | $1,070.47 |

| Price Per Month | $97.90 | $89.20 |

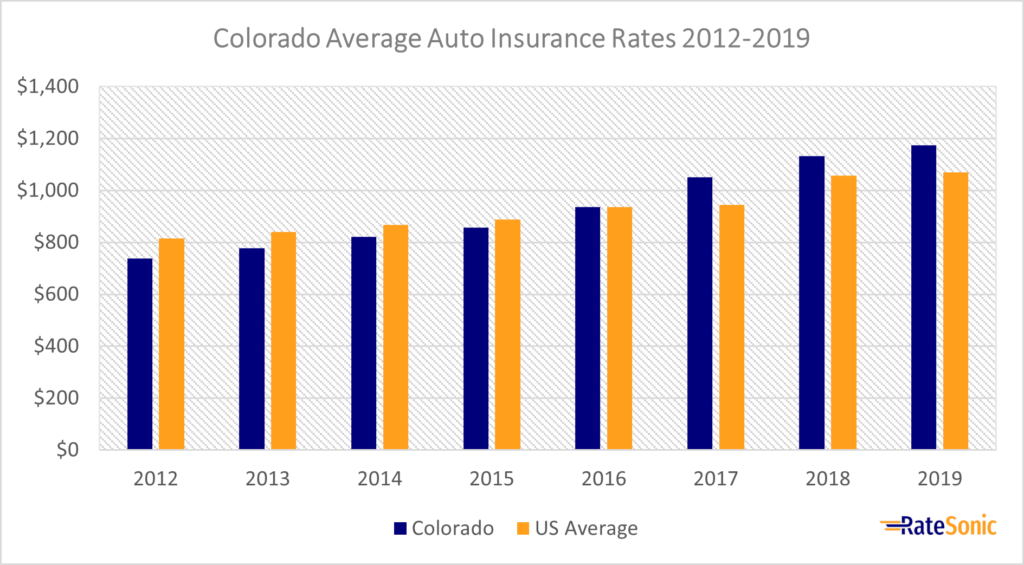

Average Full Coverage Rates

The graph below shows the change in average rates for full coverage insurance in Colorado from 2012 to 2019. Premiums increased $437 from $737 in 2012 to $1,174 in 2019.

Colorado’s full coverage prices stayed below the national average until about 2016. From 2017 to 2019, though, Coloradans have consistently paid more than the rest of the nation for auto insurance. One likely cause for this could be inflation, as well as the ever-growing number of motorists in the Denver metropolitan area.

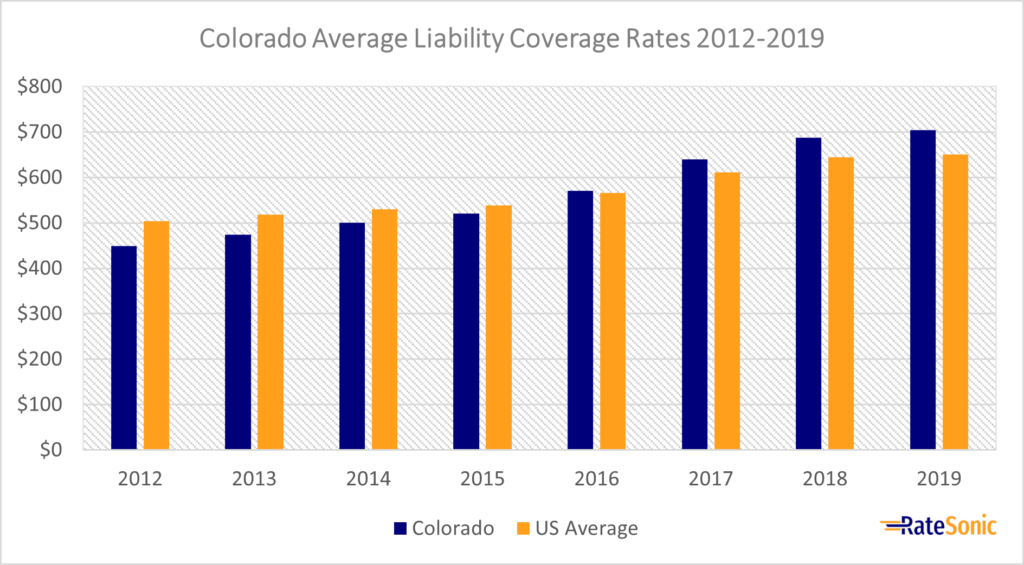

Average Liability Rates

The following graph displays average liability insurance rates in Colorado from 2012 to 2019. During the eight years, rates went up from about $450 in 2012 to around $700 in 2019. This was an increase of $250, or about 55.5%.

Like the graph above, Coloradans started out paying less than the rest of the nation for liability coverage. But around 2016, they ended up paying more, with the difference increasing each year. As of 2019, drivers in the state paid about $50 above average for liability.

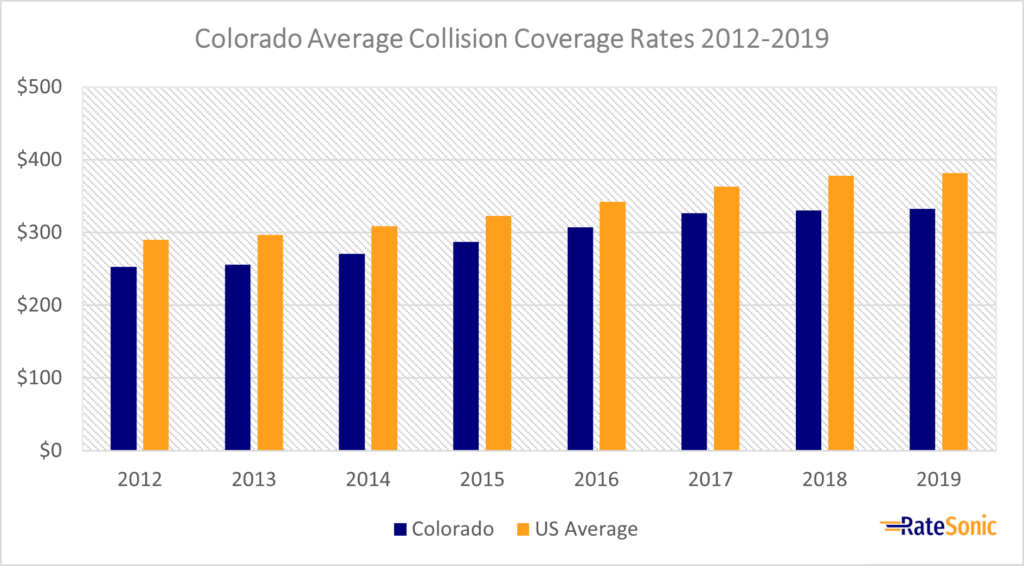

Average Collision Rates

The next graph shows average Colorado collision insurance rates from 2012 to 2019. Breaking the pattern from the previous two charts, drivers in the state have paid less than average rates for collision auto coverage over the eight years. Despite this, rates have still gone up by about $82 since 2012.

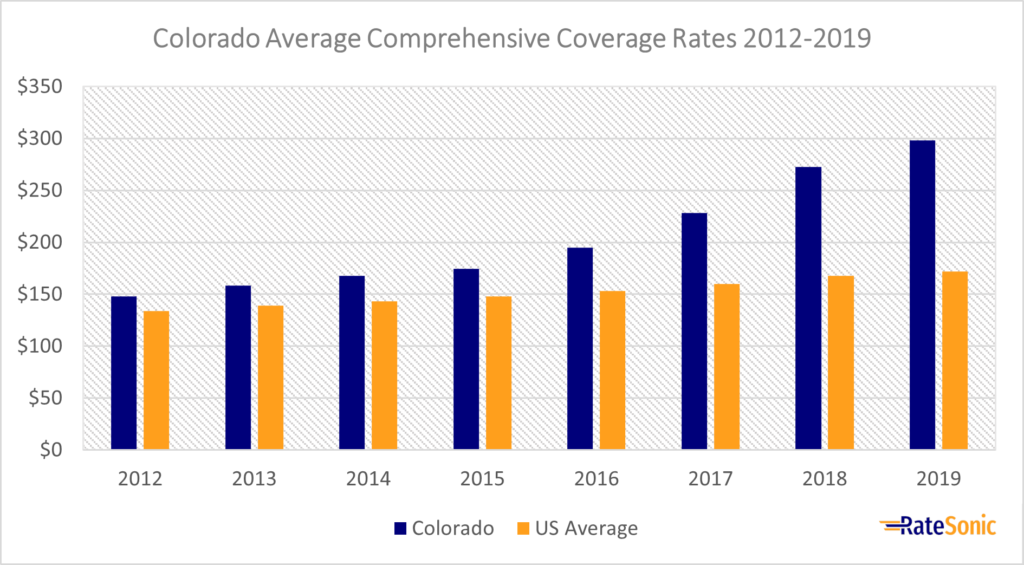

Average Comprehensive Rates

The final graph shows average comprehensive insurance rates in Colorado from 2012 to 2019. Motorists in the state paid significantly more for this coverage than the rest of the country. In 2019, for instance, Coloradans paid an average of $298.01 for comprehensive, about $126.14 more than the national average of $171.87.

There could be several reasons for such a drastic difference in rates. However, the most likely is the state’s risk for costly national disasters such as tornadoes, floods, and wildfires. These disasters can cause lots of property damage, which often leads insurers to increase rates to offset the risk.

Colorado’s high vehicle-related crime rate could be another factor. A 2023 news article from Denver7 reports that the state experiences the most car thefts in the nation and that 2019 and 2021 saw increases in car theft of 104% and 21% respectively. As crime continues to rise, insurance providers will charge people more for coverage.

Why Are Colorado Rates Increasing?

All four of the graphs above share a common theme—auto insurance rates are going up each year, both in Colorado and around the country. There could, of course, be several reasons for this. However, as we touched on earlier, inflation is probably the most common culprit for premium increases over time. As costs for medical care and vehicle repairs rise, your rates are almost sure to follow the same pattern. Insurers raise prices to keep up with the changing economy.

Increases in the number of claims where you live can also make premiums go up. This applies especially to areas with more drivers on the road such as major cities or highly developed suburban areas. According to CDOT, Colorado saw a total of 92,612 car accidents in 2022. Most of these, however, occurred in the more populous counties. Since car insurance companies set prices largely based on risk, you’ll likely pay more for coverage each month if you live in a place that experiences more crashes per year.

For reference, here are the five counties that had the most car accidents in 2022:

- Denver County – 14,887

- El Paso County – 10,186

- Adams County – 10,065

- Arapahoe County – 8,308

- Jefferson County – 8,080

Colorado Minimum Auto Insurance Requirements

Auto insurance or some form of financial responsibility is a universal driving requirement across America. Each state sets its own rules and dictates how many types of coverage a driver must carry as well as how much of each.

Below, we list each type of auto insurance coverage required to legally operate a motor vehicle on Colorado roadways including their minimum limits:

Liability Insurance

Colorado requires liability coverage limits of at least:

- $25,000 of bodily injury liability (BIL) per person

- $50,000 of bodily injury liability (BIL) for the injury or death of more than one person

- $15,000 of property damage liability (PDL) per accident

It’s not unusual to see the above requirements written the shorthand form: “25/50/20.”

The above may allow you to get on the road in the state, but it may not be enough to cover most incidents. Once you exceed your limits, you’ll have to pay out of pocket to take care of the remaining costs. This is why it’s generally best to buy as much car insurance as you can afford. That way, you’ll have the best chance of not having to dip into your personal assets after an accident.

Uninsured and Underinsured Motorist

Uninsured or underinsured motorist coverage (UM/UIM) is not required. However, if you don’t want it on your policy, you must decline it in writing. Otherwise, you’ll automatically have it.

Even though the state makes UM and UIM optional, having both is still a good idea. Per the III, Colorado ranks 13th in the nation for uninsured drivers, with about 16.3% of people not carrying the required liability.

Valid Proof of Insurance

You need proof of an existing policy before you register a vehicle. The state’s Department of Motor Vehicles (DMV) cites the following as acceptable forms of proof of insurance:

- A card or printout from your provider (usually containing your name and address, insurer, policy effective date and number, etc.)

- Electronic forms of proof (e.g., a mobile app or digital version of your insurance card)

- A current copy of your policy

- Letters from your provider

- Facsimile, or exact copy, of your proof

The most common of the above is probably the card/printout or electronically accessed proof of insurance. Most companies allow you to access your policy information on their apps or let you print it out on their websites.

Self-Insurance

Self-insurance is a way that people (often those with plenty of funds) can avoid buying auto coverage from a traditional provider. To receive a certificate showing that you self-insure, you must own more than 25 vehicles.

Normally, you must have lots of money on-hand to self-insure. This is because the state wants to know that you can handle covering the costs of an accident. Car repairs and property damage, however, can exceed multiple thousands of dollars. For this reason, along with the small likelihood of someone having 20 cars, self-insurance isn’t an option for most people.

Penalties for Driving Without Insurance

It’s illegal to drive uninsured in Colorado and can land you in serious trouble. Here are the penalties you can expect if you’re caught on the road without insurance:

First Offense

- A fine of at least $500

- License suspension until you buy coverage

- Four points on your record

Second Offense

- A fine of at least $1,000

- Four-month license suspension

- Four points on your record

Third and Subsequent Offenses

- A fine of at least $1,000

- Eight-month license suspension

- Four points on your record

Best Car Insurance Companies in Colorado

It’s essential to find a high-quality company when you’re shopping for auto insurance. But what makes an insurer great? We believe it’s often a combination of the following characteristics:

- Top-notch customer service

- Easy claims process

- Strong selection of coverage

- Plenty of discounts

It’s helpful to compare insurers alongside each other, using the above as a guide, to find the one that’ll best suit your needs. For a complete breakdown of which we think are the best and why, check out our article on the best car insurance providers in the nation.

Best Providers by Market Share

One way to accelerate your search for the right insurer is by looking at the top companies by market share in the state. While not always the best, the ones that own most of the market have more resources and a lot of customers they serve. Since others like them, it might not hurt to check any one of them out.

The following is a list from 2021 of the top ten Colorado auto insurance companies by market share:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm | $953,918 | 17.02% |

| 2 | Progressive | $436,456 | 7.79% |

| 3 | GEICO | $410,097 | 7.32% |

| 4 | Allstate | $351,975 | 6.28% |

| 5 | Safeco | $324,991 | 5.8% |

| 6 | Farmers | $241,375 | 4.31% |

| 7 | USAA | $225,392 | 4.02% |

| 8 | American Family | $224,232 | 4.0% |

| 9 | Travelers | $171,386 | 3.06% |

| 10 | Liberty Mutual | $92,848 | 1.66% |

Top Companies by J.D. Power Rating

Customer service ratings are another important metric to use when you’re researching the best companies in your state. Luckily, J.D. Power releases an annual list of the top insurers in specific regions and states, basing scores on customer satisfaction. This is a great way to gauge which providers are the best for you.

Below were the top companies in the Southwest region (which includes Arizona, Colorado, Nevada, and more) in 2022 by J.D. Power rating:

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | State Farm | 848 |

| 2 | The Hartford | 834 |

| 3 | American Family | 833 |

| 4 | GEICO | 827 |

| 5 | Allstate | 824 |

| 6 | Farmers | 819 |

| 7 | Safeco | 819 |

| 8 | Liberty Mutual | 815 |

| 9 | Progressive | 800 |

| 10 | CSAA Group (AAA) | 798 |

Colorado Auto Insurance Laws

No-Fault or Fault?

State law doesn’t require motorists to have personal injury protection (PIP) on their policy. Therefore, it’s not a no-fault insurance state. Colorado is, rather, an at-fault state. This means that you’re responsible for paying the costs of an accident if you’re at fault.

Totaled Cars

A total loss is a car that has been damaged to the point where it’s no longer financially feasible to repair. In the State of Colorado, insurers will consider your car a total loss if it reaches 100% of its value. Normally, if your vehicle gets totaled, you can expect to receive a payout from your provider matching your car’s actual cash value (ACV) immediately before the accident.

Salvage and Rebuilt Titles

Once a vehicle is a total loss, it receives a salvage title brand. Cars with this status are illegal to drive on public roads and, therefore, are impossible to insure.

You usually have three options if you own a salvage car: sell it, repair it and get a rebuilt title, or use it for spare parts. Colorado allows you to get a rebuilt title once you go through a specific process and get the proper documentation together before you can get your vehicle re-branded as a rebuild.

Rebuilt Title Process

Here’s what you need to do to get a rebuilt title:

- Have your car repaired to a fully drivable condition (keep all bills of sale or receipts for parts used in case you’re asked to present them)

- Sign your name on the front of your salvage title and certify that it’s roadworthy

- Apply for a Certificate of Title at your local county motor office

- Fill out a Salvage Statement of Facts (Form DR 2424)

- The bottom part must be filled out by the individual who completes your vehicle’s inspection

- Stamp the words “REBUILT FROM SALVAGE” into your vehicle. Form DR 2415 (step four) provides more on how you should go about this, as well as where you should stamp the letters

- Go through a Certified VIN Inspection and receive a completed DR 2704 form from a P.O.S.T. certified inspector

- Includes a $50 inspection fee, only payable by cash or check

Insuring Cars with Rebuilt Titles

You can get insurance coverage for a rebuilt title car in Colorado. But some providers may only offer you liability, taking other options such as collision or comprehensive off the table. This is because rebuilds were once a total loss and, therefore, carry much more risk than cars with clean titles.

Monthly rates also tend to be much more expensive for rebuilt vehicles. Because of this, it’s a good idea to compare quotes between insurers to ensure you’re getting the best deal, even if you’re still paying a little more than average.

Full Windshield Replacement

Some states require insurance companies to repair or replace your windshield without a deductible. Colorado doesn’t require any insurer to do this, however. To repair your windows after an accident, you’ll need comprehensive coverage. This will include a deductible that you’ll have to pay after you file a claim.

Keep in mind that Colorado is one of three “hail alley” states (also including Nebraska and Wyoming) that experience the most hailstorms per year. In some cases, hail can cause serious damage to your windshield. If you keep your car outside often, it’s probably a smart idea to have comprehensive on your policy.

Filing Claims

Filing a claim is almost a certainty in most cases after a car accident. You’ll want to do this as soon as possible. If you wait to tell your insurer about an accident, you’ll likely forget important details or may not get the coverage you need.

Most auto insurers have easy claims processes, often allowing you to file online, on a mobile app, or over the phone.

What to Expect When Filing a Claim

When you report a claim to your auto insurance carrier, you’ll typically end up working with an adjuster, who will assess the damages to your vehicle. Then, you’ll hear back on whether your provider will accept or deny your claim. If they accept it, you’ll receive a prompt payment so you can fix your car.

After filing, you should expect your insurer to settle your claim in a reasonable amount of time. This can vary, but, according to Progressive, most providers make it a point to settle claims within about 30 days.

SR-22 Forms

You must file an SR-22 form with the state when your license gets suspended following a severe traffic violation, such as a DUI or reckless driving. In short, the form shows the DMV that you carry the minimum required liability insurance. In most cases, you can work with your insurer to ensure that you file the form correctly. You can also upload the form directly to the DMV website.

Credit History

It’s not uncommon for insurance companies to use your credit score to determine your rates. People who have bad credit will pay more, while those with good credit pay less. Providers use this as one of many factors to decide how reliable or risky of a customer you are and, ultimately, to set your premium.

Unlike in some other states, such as California and Hawaii, Colorado allows carriers to use your credit rating to decide how much to charge you per month. However, no company can cancel your policy or deny you coverage due to a bad credit history, as per the Rocky Mountain Insurance Information Association (RMIIA).

Price Optimization

Price optimization is a rate-setting method that insurers use to decide how much of a price increase you’d tolerate before you hunt for a different company. It typically includes in-depth research on consumer behavior and data, as well as the use of advanced algorithms.

Colorado prohibits insurers from using price optimization. The state Division of Insurance posted a bulletin in 2015 noting that the practice uses details “unrelated to underwriting” and violates the law.

Policy Cancellations

The State of Colorado sets certain rules for auto insurance companies on how they can go about policy cancellations, non-renewals, and denials. Under state law, providers must give you at least 30 days of advance notice in writing before they choose not to renew your policy. Insurers can cancel your policy for any one of these reasons, provided they give you written notice:

- Failure to pay your premium

- Fraud or misrepresentation on your policy

- Having a severe violation, such as drunk or reckless driving

- You or another driver on your policy has had their license suspended

- You’ve driven your car for commercial or business reasons

If you’ve failed to pay your rates on time and are facing cancellation or non-renewal, you can attempt to reinstate your policy. Be sure to call your carrier and see if it’ll let you pay your bill. If you lose your policy, you risk a lapse in coverage, which often leads to increased rates long into the future.

Drunk Driving Laws

Driving intoxicated is always a bad idea. It significantly affects your judgment behind the wheel and drastically heightens your chance of harming both yourself and others. In Colorado, there are two types of impaired driving convictions:

- Driving under the influence (DUI). Your blood alcohol content (BAC) is 0.08 or more, “substantially” affecting your ability to operate a vehicle.

- Driving while ability impaired (DWAI). Your BAC is between 0.05 and 0.08.

DUI and DWAI convictions carry severe penalties and costs. These include legal fees, fines, and losing your license. They’re also certain to affect your car insurance, both in how much pay and who’ll cover you. Getting convicted for intoxicated driving is grounds for an insurer to cancel or non-renew your policy. You’ll also become a high-risk driver, making it tough to find a company willing to cover you without offering exorbitant prices. To get coverage, you may need to work with a non-standard company or enter the state’s assigned risk pool.

Driving While Ability Impaired (DWAI) Penalties

First Offense:

- Between two and 180 days in jail

- $200 to $500 fine

- 24 to 48 hours of community service

- Eight points on your record

Second Offense:

- Between ten days and one year in jail

- $600 to $1,500 fine

- 48 to 120 hours of community service

- Eight points on your record

- 12-month license suspension

Third Offense:

- Between 60 days and one year in jail

- $600 to $1,500 fine

- 48 to 120 hours of community service

- Eight points on your record

- 24-month license suspension (five years if it’s the third offense within seven years)

Driving Under the Influence (DUI) Penalties

First Offense:

- Five days to one year in jail

- $600 to $1,000 fine

- 48 to 96 hours of community service

- 12 points on your record

- Nine-month license suspension

Second Offense:

- Five days to one year in jail

- $600 to $1,000 fine

- 48 to 120 hours of community service

- 12 points on your record

- 12-month license suspension

Third Offense:

- Five days to one year in jail

- $600 to $1,000 fine

- 48 to 120 hours of community service

- 12 points on your record

- 24-month license suspension (five years if it’s the third offense within seven years)

Driver’s License Points System

Colorado uses a driver’s license points system to track violations on your record. Once you get a ticket, you’ll receive points. If you get too many in a certain period, you could lose your license.

Here are the license suspension thresholds for drivers of certain ages:

- Drivers aged 17 and younger: six or more points within one year or 7 or more at any point

- Drivers aged 18 to 21: nine or more points within one year, 12 or more within two years, or 14 or more at any point

- Drivers aged 21 and older: 12 or more within one year or 18 or more within two years

Most Popular Cars

The most popular cars in any given state often reflect the environment or the driving culture in the region. Colorado drivers seem to favor all-terrain vehicles such as trucks or SUVs. These were the most-sold cars in 2022:

- Ford F-Series

- Toyota RAV4

- Ram 1500/2500/3500

- Subaru Crosstrek

- Toyota Tacoma

Most Stolen Cars

Just as each state has a list of the most popular cars, there’s also an infamous list of the most stolen vehicles. Unfortunately, if you own one of these, you could end up paying a higher premium. Here were the vehicles most targeted by thieves in Colorado in 2021, according to the National Insurance Crime Bureau (NICB):

- 2006 Ford Pick-Up (Full Size)

- 2005 Chevrolet Pick-Up (Full Size)

- 1998 Honda Civic

- 1997 Honda Accord

- 2001 Dodge Pick-Up (Full Size)

- 2005 GMC Pick-Up (Full Size)

- 2000 Jeep Cherokee/Grand Cherokee

- 2017/2016 Hyundai Sonata

- 2000 Honda CR-V

- 2015 Kia Optima