Indiana Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Indiana.

- Brandon Canonica

- Updated March 20, 2024

With the motto, “The Crossroads of America,” Indiana is a diverse state with tons to offer. Most know it for professional sports teams such as the Colts and Pacers, as well as the popular annual Indy 500 car race. It’s also well-known for landmarks such as Hoosier Hill and the Angel Mounds archaeological site.

The Hoosier State is one of the top 20 largest states in the US by population. In 2020, it had approximately 4.5 million registered drivers. In this guide, we’ll explain everything you need to know about car insurance in Indiana, so you’re ready to hit the road. This includes key laws and requirements, average rates, the best companies, and more.

Table of contents

Indiana Average Auto Insurance Rates

It’s smart to look at average rates in your state when you’re shopping for coverage. This can give you a good perspective on whether you’re paying too much or already getting a good price.

Be aware that many factors, including your ZIP code, age, and driving history, can impact your premiums. So, depending on your situation, your rates could be more or less than the state average.

The following table shows average car insurance rates in Indiana against the average for the rest of the country:

| Coverage | Indiana Average | US Average |

|---|---|---|

| Liability | $444.98 | $650.35 |

| Collision | $288.97 | $381.43 |

| Comprehensive | $138.86 | $171.87 |

| Full Coverage | $777.05 | $1,070.47 |

| Price Per Month | $64.75 | $89.20 |

Average Full Coverage Rates

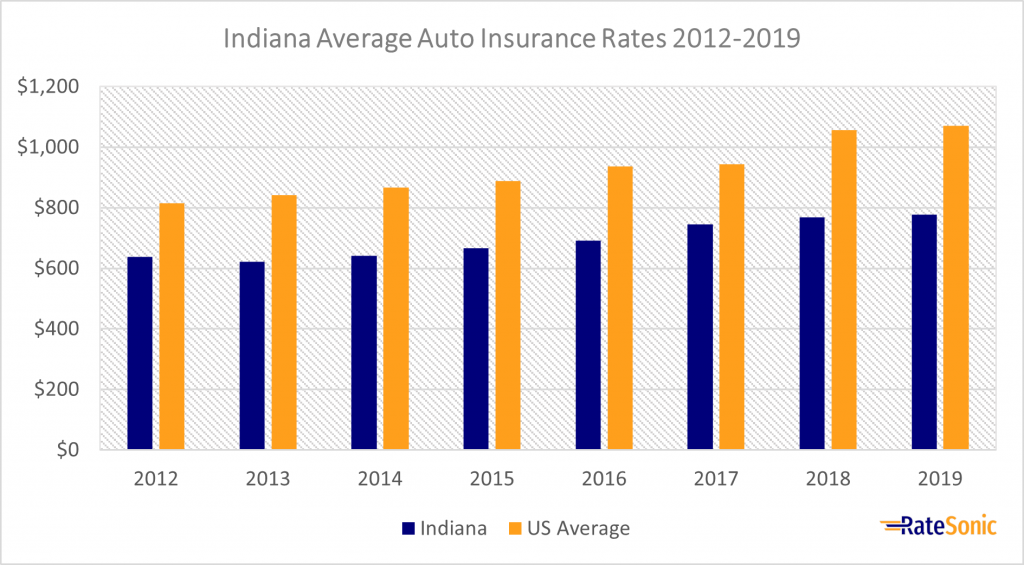

The graph below shows the change in average Indiana full coverage insurance costs from 2012 to 2019. Rates rose from $637 in 2012 to $777 in 2019. This was an increase of $140, or nearly 22%.

Full coverage rates in Indiana were far less than the national average over the entire eight years. Despite inflation and increases due to other factors, the state’s average prices have stayed relatively consistent, never exceeding $800.

Average Liability Rates

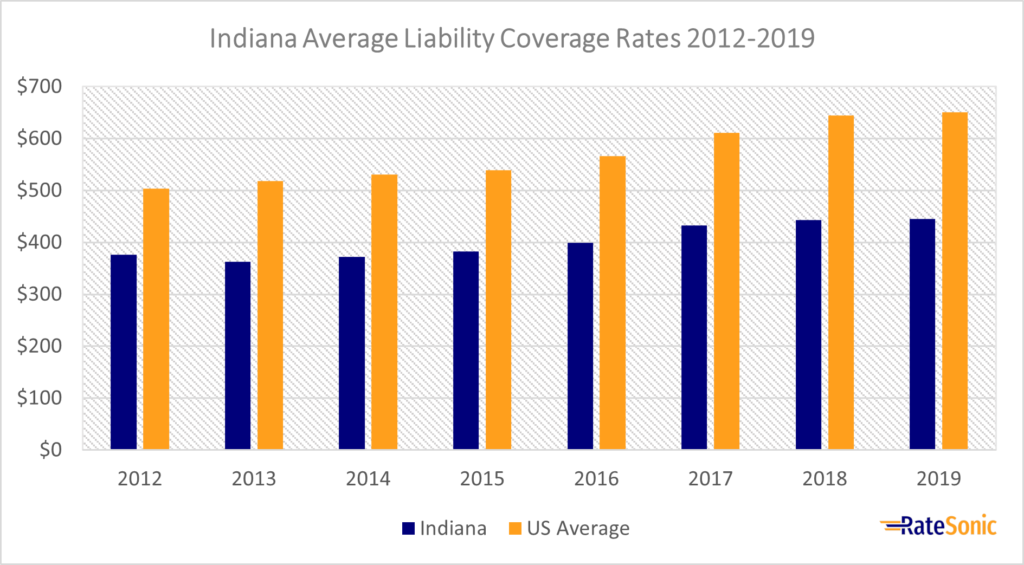

Below is a graph displaying average liability insurance costs in Indiana from 2012 to 2019. Rates went from just below $380 in 2012 to around $450 in 2019. Drivers here paid less for liability, on average, than the rest of the country. Indianans enjoy this coverage at $200 below the mean.

Average Collision Rates

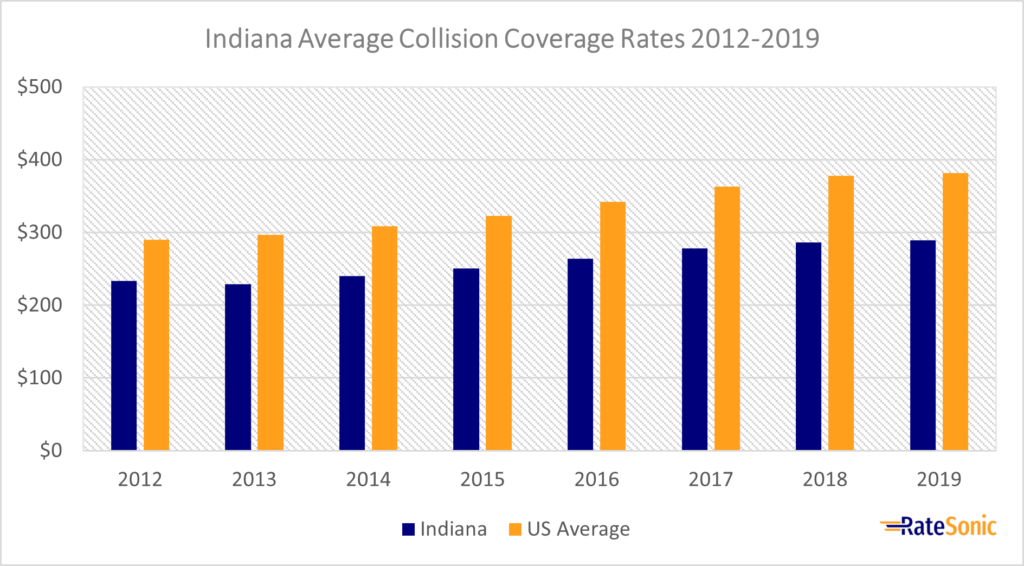

The chart below shows average collision insurance costs in Indiana from 2012 to 2019. On average, Hoosiers paid less than the rest of the country for this coverage over the eight-year span. Since 2012, costs increased about $60, but remain consistently below the national mean.

Average Comprehensive Rates

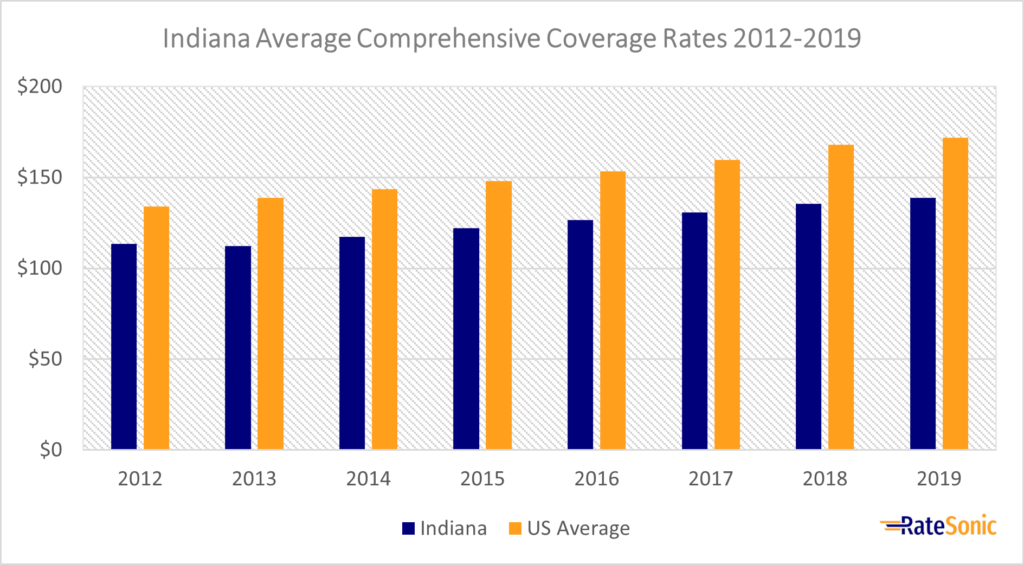

The next graph shows average comprehensive insurance rates in Indiana from 2012 to 2019. As is the case with the other types of coverage, comprehensive is also less expensive here than in most states. Prices barely budged, starting at $120 in 2012 but only increasing to $140 in 2019.

It’s noteworthy that prices for comprehensive coverage in Indiana are closer to the mean than collision or liability. One reason could be the state’s risk for national disasters, including earthquakes, tornadoes, flooding, and severe winter weather.

Why are Indiana premiums lower than the US average?

The answer is likely because much of Indiana is rural. In short, this leads to fewer total drivers and cars on the road, generally meaning there are fewer accidents.

In 2020, for instance, the state saw a total of 175,816 collisions, as per the IU Public Policy Institute’s Crash Fact Book from the year. While that number may seem high, the bulk of those accidents (28,701) occurred in Marion County, which houses Indianapolis. Crash totals aren’t nearly as high for any other county because of their rural status, with the average only reaching 1,911.

Though Marion County inflates the state’s crash numbers, the lesser numbers from across the rest of the state help most Hoosiers pay lower-than-average auto insurance premiums.

Minimum Auto Insurance Requirements

Every Indiana auto insurance policy must meet a minimum requirement threshold. Below are the required types of coverage in the state, as well as how much of each you must have:

Liability Coverage

State law mandates minimum liability limits of at least:

- $25,000 of bodily injury liability (BIL) per person

- $50,000 of bodily injury liability (BIL) for two or more people

- $25,000 of property damage liability (PDL) per accident

The above requirements are often written in the following shorthand form: “25/50/25.”

Keep in mind that while getting your state’s minimum required coverage is what you need to get on the road, it doesn’t give you nearly enough protection against all incidents. Accident costs can add up quickly. Therefore, many in the auto insurance industry recommend bodily injury limits of $100,000 per person and $300,000 per accident. However, be sure to only buy as much as you can afford.

Uninsured and Underinsured Motorist Coverage

You’ll automatically have uninsured (UM) and underinsured motorist (UIM) coverage when you get a new policy. However, the state gives you the option to reject them in writing if you don’t want them on your policy. Below are the minimum limits for UM and UIM coverage:

- UM: $25,000 of bodily injury liability (BIL) per person

- UM: $50,000 of bodily injury liability (BIL) per accident

- UIM: $50,000 of bodily injury liability (BIL) per person

- UIM: $50,000 of bodily injury liability (BIL) per accident

Valid Proof of Coverage

You must carry proof of an existing auto policy whenever you register a vehicle or drive. This is typically an insurance ID card that you get from your insurer. State law allows you to use either a physical copy or a digital version.

Indiana also requires drivers to file a certificate of compliance (COC) after filing an accident report or a traffic violation. This proves to the state that you have the minimum required financial responsibility requirements. According to the Bureau of Motor Vehicles (BMV), you’ll receive a letter in the mail telling you if you need to file a COC. After this, you’ll have 90 days to work with your provider to file it with the state.

Alternatives to Standard Coverage

Some states allow motorists to self-insure their cars by making a significant deposit as proof of financial responsibility, as well as applying for a certificate. In Indiana, however, this isn’t an option for most people. The state only allows companies to apply for self-insurance as an alternative to buying coverage for each vehicle from an outside provider.

Penalties for Driving Without Coverage

It’s illegal to drive uninsured on Indiana roads, and if caught, you’ll face a license suspension and a requirement to file an SR-22 form for an extended period. An SR-22 proves to your state that you have the minimum required coverage.

Here are the penalties for driving without coverage:

First Offense

- 90-day driver’s license suspension, with a $250 reinstatement fee

- 180-day SR-22 requirement

Second Offense

- One-year driver’s license suspension, with a $500 reinstatement fee

- Three-year SR-22 requirement

Third and Subsequent Offenses

- One-year driver’s license suspension, with a $1,000 reinstatement fee

- Five-year SR-22 requirement

Best Car Insurance Companies in Indiana

Everyone wants to find the best insurer when they’re shopping for a new policy. The top companies are often the ones that provide the most value, usually with more than one of these attributes:

- Great rates

- Above-average customer service

- Solid claims processes

- Plenty of discounts or bundling opportunities

It’s easier to find the leading companies when you can compare them side-by-side. To get started, we recommend reading our article on the best US auto insurance companies. It ranks the top three insurers, as well as breaks down the best ones by categories. Another way to find the right provider for you is by researching specific details such as market share and customer satisfaction ratings.

Top Companies by Market Share

As mentioned, looking at an insurance company’s market share is a smart way to see how strong or big it is. While it doesn’t necessarily indicate an insurer’s overall quality, it’s typically a good thing if a carrier owns a significant market share in a certain area. Customer behavior can reveal a lot about how well a business performs.

Below is a list from 2021 of the top Indiana car insurance companies by market share:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm | $848,540 | 20.42% |

| 2 | Progressive | $605,503 | 14.57% |

| 3 | Allstate | $398,290 | 9.59% |

| 4 | GEICO | $309,063 | 7.44% |

| 5 | Indiana Farm Bureau | $294,275 | 7.08% |

| 6 | Liberty Mutual | $228,136 | 5.49% |

| 7 | Erie | $172,037 | 4.14% |

| 8 | American Family | $167,748 | 4.04% |

| 9 | Auto-Owners | $125,120 | 3.01% |

| 10 | USAA | $122,192 | 2.94% |

Top Companies by J.D. Power Rating

Another good way to find out which insurance companies people love the most is by looking at customer service ratings. J.D. Power releases an annual study on the top insurers in each state/region by customer satisfaction score. In the study, Indiana falls within the North Central region, which also includes states such as Illinois, Michigan, and Ohio.

Below were the top insurers in the North Central region in 2022 by J.D. Power rating:

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | Erie | 876 |

| 2 | COUNTRY Financial | 868 |

| 3 | State Farm | 848 |

| 4 | Allstate | 847 |

| 5 | GEICO | 847 |

| 6 | The Hanover | 843 |

| 7 | American Family | 838 |

| 8 | Auto-Owners | 834 |

| 9 | Safeco | 834 |

| 10 | Grange | 832 |

| 11 | Farmers | 827 |

| 12 | Progressive | 827 |

| 13 | Travelers | 818 |

| 14 | Automobile Club Group (AAA) | 810 |

| 15 | Nationwide | 809 |

| 16 | Liberty Mutual | 807 |

Indiana Auto Insurance Laws

No-Fault or Fault?

No-fault states require drivers to have auto insurance coverage that takes care of injury-related expenses for them and their passengers after an accident, regardless of who caused the accident. In most cases, this is personal injury protection (PIP).

However, Indiana is not a no-fault insurance state. Instead, it’s an at-fault state. That is, each driver is responsible for covering the costs of any accidents they cause. Luckily, liability coverage would kick in, up to your limits, if an accident occurs.

Totaled Cars

In basic terms, a totaled vehicle is one that’s been damaged to the extent that it would cost more to repair than it’s worth. In Indiana, your vehicle becomes a total loss once the cost to fix it exceeds 70% of its value.

If you get into a wreck and your car gets totaled, you’ll usually receive a payout from your auto insurer. Most often, the amount is equal to your vehicle’s actual cash value (ACV) at the time of the incident.

Salvage and Rebuilt Titles

Vehicles receive a salvage title once they’ve been declared a total loss. Because of their severe damage, it’s illegal to drive a salvage title car. Most insurers also don’t cover salvages since they’re undrivable and can’t go out on public roads.

How to Get a Rebuilt Title

To drive a rebuilt salvage motor vehicle on Indiana roads, you’d need to repair it to a drivable condition and then apply for a rebranded title. However, consider that this can take quite a bit of both hands-on work and money. It’s only worth it if it’s special or you enjoy working on cars.

Per the BMV, you must apply for a “salvage restoration title” before you can officially get a rebuilt title. This includes filling out some forms and paying some fees, and then a little bit of waiting to see if the state approves. Here’s what you need to submit:

- Completed salvage motor vehicle restoration checklist

- Filled out Application for Certificate of Title for a Vehicle (State Form 205)

- Certificate of salvage title

- If you’re transferring ownership, you must fill out an odometer statement on your salvage certificate or an Odometer Disclosure Statement (State Form 43230)

- Filled out Affidavit of Restoration for a Salvage Motor Vehicle (State Form 44606)

- Receipts or bills of sale (or proof of ownership) for parts you used to rebuild the vehicle. The BMV notes that you must fill out a General Affidavit (State Form 37964) and include the car’s year, make, and VIN if you used parts you already had on hand

- Proof of address (e.g., driver’s license or valid state ID)

- Filled out Collection of Payment Information (State Form 56163).

- The general fee for filing is $15 (you could also pay a $25 speed title fee if you’d like it faster). Note that other fees could apply in specific cases

Once you’ve finished filling out all the forms and making the required payments, you can send them together in the mail to the BMV. Make sure you include all the above documents. You must send the packet to “Indiana Bureau of Motor Vehicles, Central Office Processing, 100 North Senate Avenue, Room N411, Indianapolis, IN 46204.”

Insuring Cars with Rebuilt Titles

You should be able to get insurance coverage for a rebuilt title car in Indiana. However, many providers may not fully cover them. This is because, while the vehicle has undergone repairs and is safe to drive, it still carries a bit of risk due to it formerly being totaled. At the very least, you’ll be able to have a liability-only policy.

Keep in mind that insuring a car with a rebuilt title is typically much more expensive than it is for those with clean titles. Even if you’ll pay a higher rate in general, comparing quotes between several companies to find the best deal is still a good idea.

Full Windshield Replacement

There are a few states that require insurers to offer full glass coverage that provides windshield repairs without a deductible. Indiana isn’t one of those states, though. If something damages your windshield, comprehensive insurance coverage will take care of it. You’ll need to pay your deductible, and then your provider will handle the remaining costs.

Filing Claims

In most cases, you’ll need to file a claim with your provider after you get into a car accident. Most insurers make it a straightforward process and allow you to do it either over the phone, online, or on a mobile app.

How Long Does It Take to Settle a Claim?

Insurance carriers must settle claims “reasonably promptly.” That is, your insurer must work with you and settle your claim with you in an amount of time that both you and they consider to be reasonable. Even though Indiana doesn’t provide a specific number of days providers have to handle claims, unlike other states, most companies settle claims within about 30 days.

SR-22 Forms

You must file an SR-22 form following a severe traffic violation, such as an OWI or driving without insurance. The form acts as proof to the BMV that you have a minimum amount of coverage required by the State of Indiana. Your insurer should be able to help you file the form with the state.

Credit History

Auto insurers use several different facts about you to calculate your monthly premium. A very common one is your credit or FICO score. They use this because it reveals how reliable of a customer you are. The less ideal your credit is, the more your risk of a price hike goes up.

Some states ban or place restrictions on the use of consumers’ credit history in the ratemaking process. However, the law allows Indiana insurance companies to use it to decide your rates. The state even lists it among other things, such as age and where you live, as important rate factors companies might use.

Price Optimization

Price optimization is a controversial way auto insurance companies decide how much to charge customers. It’s essentially where they figure out the highest rate increase you’ll take before you say enough is enough and find a better price somewhere else. It involves the use of data mining and an in-depth look at consumer behavior.

Indiana is one of 20 states that ban the use of price optimization to set auto premiums. In a bulletin posted in 2015, the Indiana Department of Insurance (IDOI) asserts that the practice violates state law and can lead to “unfairly discriminatory rates.”

Policy Cancellations

The State of Indiana has rules in place governing auto insurance cancellation or non-renewal. As per the IDOI, your carrier can cancel your policy for almost any reason within the first 60 days. But after this period, insurers can only cancel a policy for several, well-defined reasons such as missing premium payments or losing your driver’s license. The state requires that they provide the reason for cancellation.

When your policy period expires, your insurer can cancel or decline to renew your policy. However, they must provide you with 20 days of notice.

Below are some of the most common reasons why an insurer might cancel or non-renew your policy:

- Policy fraud or misrepresentation (e.g., lying about where you live, how old you are, or your credit score)

- Failure to pay your rates on time

- You or a driver on your policy got a violation for drunk or reckless driving

- You’ve had your driving privileges suspended

- You’ve been driving your car for business reasons (e.g., driving for Uber or Lyft) without telling your provider

You might be able to reinstate your policy after a non-renewal if you’ve forgotten to pay your bill. If this happens, your best course of action is to call your insurance company and see if it’ll let you pay your premium. This will help you avoid lapsing on your coverage, which can drastically affect your rates in the future.

Drunk Driving Laws

Getting in a car and driving while under the influence is against the law. It’s also extremely dangerous. In all cases, you risk putting both yourself and others in danger. Under Indiana state law, you can get an operating while intoxicated (OWI) conviction when you have a blood alcohol content (BAC) greater than or equal to 0.08.

One OWI will negatively affect your car insurance coverage in several ways. After a conviction, your provider may drop your policy or choose not to renew it. An impaired driving violation on your record will also give you a high-risk driver status, making other companies wary of covering you. This may force you to have to work with a non-standard company or enroll in the Indiana Auto Insurance Plan (AIP), which helps high-risk drivers find coverage.

Operating While Intoxicated (OWI) Penalties

First Offense

- Up to one year in jail

- Fines up to $5,000

- License suspension for up to two years or varying probationary period, which includes a substance abuse education course

Second Offense

- At least five days and up to three years in jail

- Possible community service requirement

- Fines up to $10,000

- License suspension of at least six months and up to two years

Third Offense

- At least ten days and up to three years in jail

- Possible community service requirement

- Fines up to $10,000

- License suspension of at least one year and up to ten years

- Possible habitual traffic violator label

- Possible charge for being a habitual substance offender, which carries a prison sentence of one to eight years depending on the situation

According to the Indiana Criminal Justice Institute, for each OWI offense, you could face additional requirements, such as visiting a victim impact panel and being tested for drugs and alcohol. Upon conviction, you may also need to pay various costs and legal fees of around $300 or more.

Driver’s License Points System

Indiana uses a driver’s license points system to keep track of traffic violations. In other words, you’ll receive points on your driving record if the police pull you over and write a ticket. Your insurance company will be able to see the points you accrue and may raise your rates if you get too many.

Each violation comes with a varying number of points. While there are too many violations to list here, here are some ones we hand-picked to give you an idea of how the state’s point system works:

- 1 to 15 mph over the speed limit – 2 points

- Failure to obey stop or yield signs – 4 points

- Failure to yield to an emergency vehicle – 6 points

- Reckless driving – 6 points (8 with property damage and 10 with bodily injury)

- OWI – 8 points

If you get a certain number of points on your record over two years, you’ll receive either a warning notice or a varying license suspension. These are the penalties for each amount of points over 24 months:

| Number of Points in Two Years | Length of Suspension |

|---|---|

| 14 to 18 | N/A, warning notice from BMV |

| 20 | 1 month |

| 22 | 2 months |

| 24 | 3 months |

| 26 | 4 months |

| 28 | 5 months |

| 30 | 6 months |

| 32 | 7 months |

| 34 | 8 months |

| 36 | 9 months |

| 38 | 10 months |

| 40 | 11 months |

| 42 | 12 months |

Most Popular Cars

Every state has a unique list of the most popular cars. People gravitate towards certain cars for several reasons, such as being a good fit for the state’s roads or having better safety features.

Here were the Hoosier State’s most-sold cars in 2022:

- Chevrolet Silverado

- Ford F-Series

- Ram 1500/2500/3500

- Chevrolet Equinox

- Honda CR-V

Most Stolen Cars

Auto insurers often consider car make and model when they set rates. Owning a vehicle more likely to fall victim to thieves could cause you to pay more for coverage each month.

These were Indiana’s most stolen vehicles in 2021:

- 2004 Ford Pick-Up (Full Size)

- 2004 Chevrolet Pick-Up (Full Size)

- 2008 Chevrolet Impala

- 2009 Chevrolet Impala

- 2001 Dodge Pick-Up (Full Size)

- 2004 Honda Accord

- 2016/2013 Ford Fusion

- 2020 Toyota Camry

- 2020 Nissan Altima

- 2020/2000 Jeep Cherokee/Grand Cherokee