Missouri Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Missouri.

- Sean Canonica

- Updated March 20, 2024

Missouri is the 18th-largest state in the country by population. It’s home to major cities such as Kansas City, St. Louis, and Springfield. The state is famous for its amazing barbecue, agriculture, and, of course, the Missouri River.

According to the Federal Highway Administration, there are about 4.25 million drivers on Missouri roadways. The state requires all drivers to have coverage if they want to get behind the wheel. This page will help you learn how car insurance works in The Show Me State, including rates, laws, best companies, and more.

Table of contents

Missouri Average Auto Insurance Rates

Where you live is a big factor in how much your premium costs. It’s always a good idea to look at your state’s average auto rates if you’re shopping around. This will help you know if you’re paying too much or getting a discount. The table below shows the average cost of auto insurance in Missouri. You can also see how rates stack up against the rest of the nation.

| Coverage | Missouri Average | US Average |

|---|---|---|

| Liability | $527.59 | $650.35 |

| Collision | $318.44 | $381.44 |

| Comprehensive | $223.94 | $171.87 |

| Full Coverage | $929.91 | $1,070.47 |

| Price Per Month | $77.49 | $89.20 |

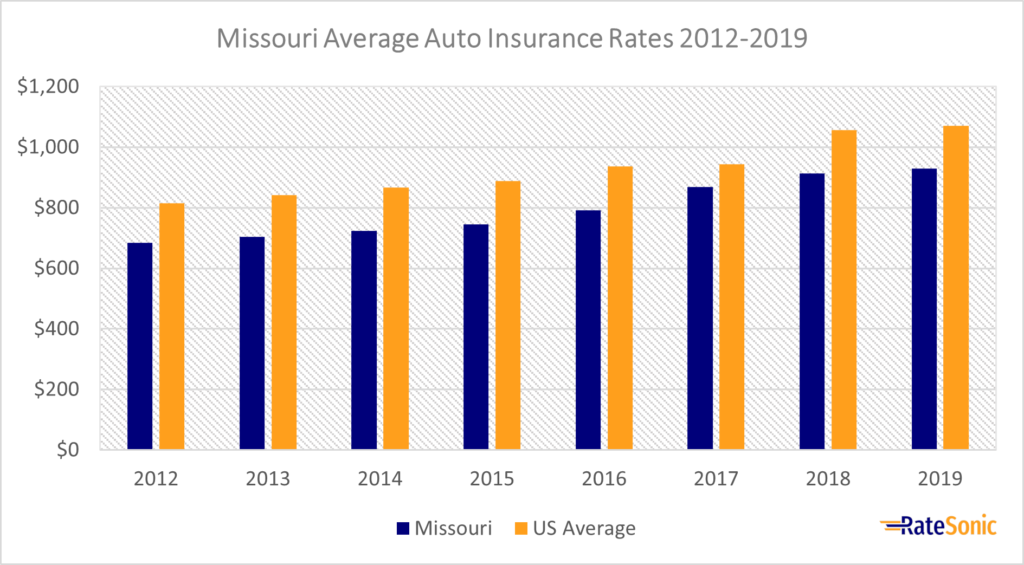

Average Full Coverage Rates

In the graph below, you can see the change in the average price of full coverage in Missouri from 2012 to 2019. In 2012, it cost $638 for the highest amount of protection, but by 2019 the same premium was $929. This was an increase of $291, or 45%. Despite this, drivers here pay less for car insurance than most Americans.

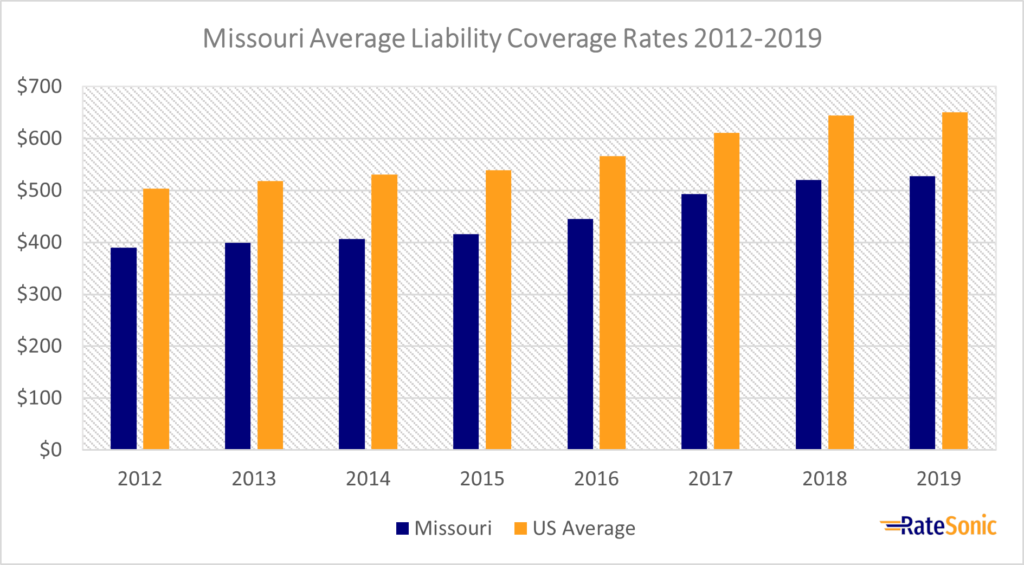

Average Liability Rates

This next graph shows the average cost of liability insurance in Missouri from 2012 to 2019. This coverage is much cheaper here than the rest of the US. However, rates still saw an increase through the seven years, rising nearly $400 in 2012 to over $500 in 2019.

The rate increase may be due to the number of crashes per year. In 2019, there were 157,038 crashes in the state. This is up from 142,966 crashes in 2012.

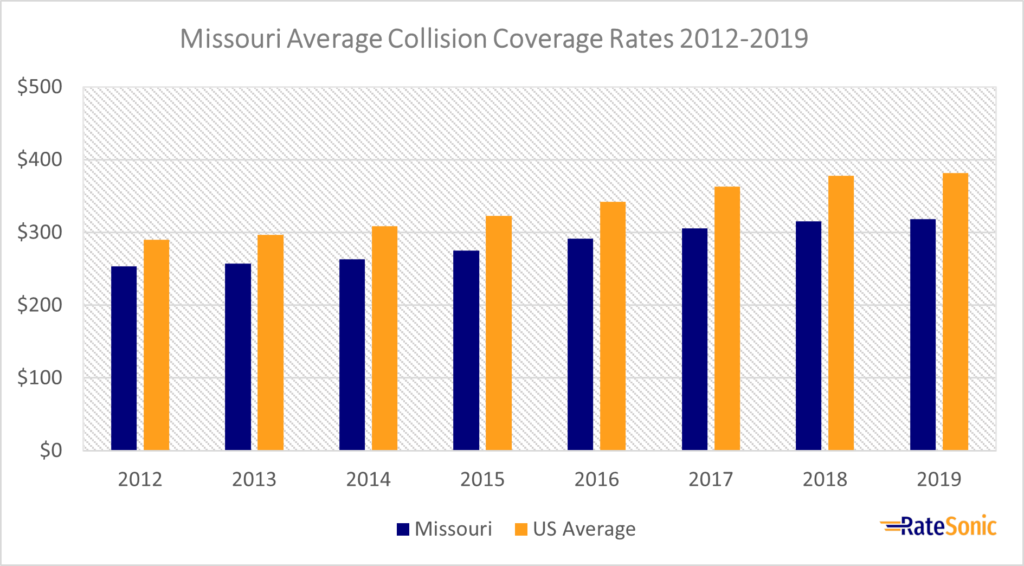

Average Collision Rates

The graph below displays Missouri’s collision insurance rates from 2012 to 2019. Despite staying under the US mean, prices increased steadily, rising from around $250 in 2012 to over $300 in 2019.

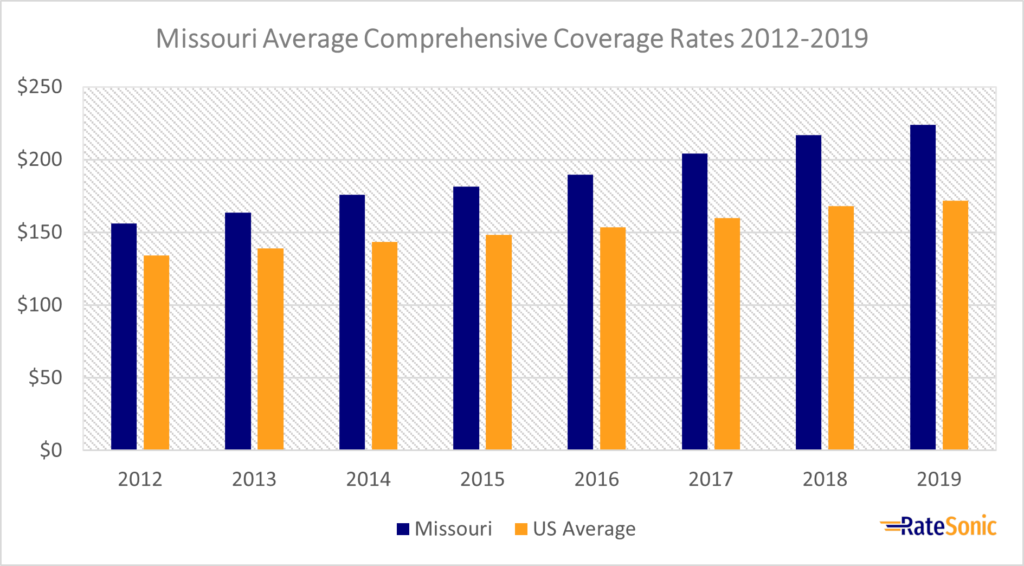

Average Comprehensive Rates

Unfortunately, comprehensive insurance in Missouri costs much more than the US average. Prices Making matters worse, rates for this coverage increased from 2012 to 2019, going from over $150 to about $225.

Comprehensive coverage most likely costs so much in Missouri because of the state’s exposure to risk from natural disasters. Tornadoes, floods, winter weather, and earthquakes are all possibilities in the Show Me State. These can result in more claims, raising auto insurance premiums for everyone in the area.

Why Do Rates Keep Increasing?

Although Missouri’s insurance rates are below the national average, they’ve been steadily increasing each year. Why is this the case? There are a few reasons behind it. Inflation can contribute to rate increases. As the cost of auto repairs and medical bills go up, claims become more expensive. This results in higher rates. More accidents and claims in the area may also contribute to higher rates. This is especially if you live in an urban area.

With premiums rising each year, it’s important to get the best deal. It’s a smart idea to compare quotes from multiple companies to find the cheapest rates for the same coverage. Discounts are also a great way to lower your premium.

Minimum Auto Insurance Requirements

Every state requires auto insurance or proof of financial responsibility to drive. However, states don’t always have the same requirements. Below are Missouri’s minimum coverage requirements:

Liability Coverage

The only type of insurance Missouri requires is liability insurance. This pays for any damages or injuries you cause to other parties in a car accident. To meet state coverage requirements, you need at least:

- $25,000 of bodily injury liability (BIL) for one person

- $50,000 of BIL for two or more persons

- $25,000 of property damage liability (PDL) for any one accident

You may also see minimum liability requirements in shorthand form: “25/50/25.” Each number represents the amount, in thousands, you must carry on your policy.

Missouri’s minimum requirements are all you need to drive. However, they may not be enough to cover the expenses in the event of an accident. You should consider buying as much coverage as you can to avoid paying out of pocket. The auto insurance industry typically recommends bodily injury limits of $100,000 per person and $300,000 per accident.

Valid Proof of Coverage

Drivers must carry proof of financial responsibility (FR) in their car at all times. For most people, this will be an insurance identification card. Below is a list of all three types of valid proof of financial responsibility:

Self-Insurance

Instead of buying a policy, Missouri state law allows you to self-insure your vehicles. This is where you prove, in some other way, that you’ll pay for damages you cause in a car accident. There are three ways to achieve this:

Surety Bond

To use a surety bond as valid proof of FR, you need to complete Form 2308, Financial Responsibility Surety Bond. The bond you submit needs to show an amount of at least $75,000 to be valid. You must also complete a Power of Attorney form to go along with the bond.

Real Estate Bond

You may also use a real estate bond as proof of FR. To do this, you’ll need two or more property owners in the state (including yourself). You and the other property owner must complete Form 1585, Justification of Sureties. The properties should, in total, be worth at least $150,000 with no liens or encumbrances against them.

The property owners will also need to complete a Proof of Financial Responsibility Bond form (Form 1721). A county or city Circuit Court Judge must then approve each form.

Deposit of Cash or Negotiable Securities

Depositing cash, stocks, bonds, or other negotiable securities is also an option for self-insurance. No matter the type, it should amount to at least $75,000 to be valid. You must complete three forms to do so:

- Agreement to Pay Judgments (Form 5317)

- Affidavit for Assignment of Securities (Form 4201)

- Affidavit of no Unsatisfied Judgments (Form 4202)

Penalties for Driving Without Insurance

It’s illegal to drive without coverage. Doing so will result in various penalties, including fines and license suspensions. Below are the penalties if you’re caught driving without auto insurance:

- Four points on your driving record

- Order of supervision to ensure you have proper coverage

- Possible license suspension

- License reinstatement fees

Best Car Insurance Companies in Missouri

With so many insurers to choose from, it can be hard to know which one is best. To find the best company, it’s important to look at how good a company is overall. The best and most popular insurance providers offer great value for your money. The following are characteristics of great providers:

- Competitive rates

- Excellent customer service

- Lots of discount opportunities

- Customer loyalty benefits

- User-friendly websites

Top Companies by Market Share

One way to find the best insurers is to look at who owns the most market share in your state. These insurance companies are the biggest and most popular. The biggest isn’t always the best for you, but it’s a good place to start. Below are the top ten Missouri auto insurers by market share:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm | $917,788,981 | 20.69% |

| 2 | Progressive | $617,082,009 | 13.91% |

| 3 | American Family | $470,270,949 | 10.60% |

| 4 | GEICO | $361,653,549 | 8.15% |

| 5 | Liberty Mutual | $286,825,765 | 6.47% |

| 6 | Shelter | $242,834,791 | 5.48% |

| 7 | Allstate | $227,378,280 | 5.13% |

| 8 | Farmers | $225,509,918 | 5.08% |

| 9 | USAA | $195,739,568 | 4.41% |

| 10 | Auto Club | $160,674,340 | 3.62% |

Top Companies by J.D. Power Rating

Another way to find the best insurer is by paying attention to a company’s J.D. Power rating. J.D. Power ranks car insurance companies in each state or region based on customer satisfaction. These are the companies with the highest J.D. Power rating in the Central region (including Missouri):

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | Shelter | 866 |

| 2 | American Family | 848 |

| 3 | GEICO | 847 |

| 4 | State Farm | 843 |

| 5 | Liberty Mutual | 840 |

| 6 | AAA | 838 |

| 7 | Travelers | 832 |

| 8 | Farmers | 828 |

| 9 | Auto-Owners | 821 |

| 10 | Progressive | 820 |

Best Companies Based in Missouri

Your favorite auto insurance provider may call Missouri its home. Local insurers tend to offer special benefits to state residents. It’s also a good way to support local businesses. Here are the companies calling the Show Me State home:

- Shelter

- Missouri Farm Bureau

- Traders

- Cameron Mutual

Missouri Insurance Laws

No-Fault or Fault?

A no-fault insurance state requires drivers to carry personal injury protection (PIP) or medical payments coverage (MedPay). Both help pay the medical bills for you and your passengers following an accident, no matter who caused it. Missouri, on the other hand, is a fault or tort state. Here, the at-fault driver is responsible for all of the expenses in an accident.

Totaled Cars

Your car will become a total loss if repair costs after an accident exceed more than its actual cash value (ACV). In many states, the damages must reach a certain percentage of the car’s value for it to be totaled. In Missouri, insurance companies declare vehicles a total loss when damages reach 80% of fair market value.

Salvage and Rebuilt Titles

Once your car is declared a total loss, it may receive a salvage title if its year is newer than 2011. A Vehicle with a salvage title is illegal to drive. For this reason, insurance companies won’t cover it. The only way to legally drive a salvaged car again on Missouri roadways is to restore it to a safe condition and obtain a rebuilt title.

How to Get a Rebuilt Title

To get a rebuilt title, your car will already need a salvage title. Then, you’ll need to mail the following to the Missouri Motor Vehicle Bureau:

- A salvage title certificate in your name

- Bill of sale for the car

- Completed Application for Missouri Title and License (DOR-108)

- Vehicle examination certificate (DOR-551)

- Notarized bills of sale in your name for all major parts

- Copy of the front and back of the certificate of title for any cars you received major parts for

- Any invoices, bills of sale, receipts for parts you used to rebuild the car

- State and local taxes on the purchase price of the vehicle and parts used for restoration

- $8.50 title fee and $6.00 processing fee

Insuring Cars with Rebuilt Titles

You can insure cars with rebuilt titles in Missouri. Most companies should offer you a policy. However, you may only be able to get liability insurance. Few, if any, providers offer full coverage on rebuilt titles. This is because insurers understand that rebuilt cars were once totaled, so they may carry a higher safety risk. Rates are also likely to be high for this reason.

Full Windshield Replacement

Some states require insurers to replace your windshield without a deductible if it has damage. Missouri doesn’t have any law about this. This means that you’ll need to pay a deductible for any comprehensive claims involving your windshield.

Another option is to add full glass coverage to your policy. For an extra cost added to your premiums, your insurer will replace your windshield deductible-free. Full glass insurance may be a smart choice in Missouri, where tornadoes and other severe weather are the norms.

Filing Claims

If you get into a car accident, chances are you’re going to end up filing a claim. You must file a claim as soon as possible so that you can get repairs or medical help promptly. Missouri’s Department of Insurance recommends that drivers file claims with their provider unless they’re not at fault. If this is the case, you should file a claim with the other driver’s insurer.

What to Expect After Filing a Claim

After you file, you should expect your insurer to handle the claim fairly and promptly. The Unfair Claims Settlement Practices Act (UCSPA) requires that claims are investigated within 30 days. After that, providers must send any claim forms within ten days. Then, insurance companies must accept or deny the claim within 15 days. After the investigation concludes, you should receive a settlement.

SR-22 Forms

An SR-22 form is a document certifying that you carry an insurance policy that meets Missouri’s minimum coverage requirement. You may have to file an SR-22 form if your license is revoked or suspended. When you lose your license, you’ll need to keep an SR-22 form on file with the state for up to two years.

Credit History

Insurance companies will often use your credit score as a way to determine how much to charge you for coverage. However, many states, such as California, don’t allow this practice. Missouri doesn’t have any law preventing insurers from using your credit history. If your credit rating is poor, you could see high auto rates.

Policy Cancellation

An insurer cannot cancel your policy if it’s been in effect for 60 days or more unless it has at least one of the following reasons:

- Non-payment of premium

- License suspension

Missouri state law mandates that insurers send you a written explanation for why your policy is canceled, non-renewed, or denied. Also note that state law prevents insurance companies and agents from asking you about any past policy cancellations, non-renewals, or denials.

Depending on your insurer and situation, policy reinstatement is possible. Contact your provider ASAP if you receive a cancellation notice. Any delay can lead to a lapse in coverage which makes any reinstatement process considerably more difficult.

Drunk Driving Laws

In Missouri, you’ll receive a DUI if your blood alcohol content (BAC) is .08 or higher (.04 for minors). Two different laws dictate DUI convictions:

- Criminal law. This is regarding the ticket you’re issued. You’ll receive points on your record and may lose your driving privilege.

- Administrative law. If your BAC is over the legal limit or you refuse to test, you’ll receive an automatic license suspension. This will happen even if the court throws out the ticket.

Penalties for a DUI are typically severe. After each conviction, penalties will get worse. Here’s what’ll happen if you’re convicted for a DUI:

First Offense

If this is your first DUI offense, you’ll receive a 90-day license suspension. However, you may be eligible for Restricted Driving Privilege (RDP). On RDP, you’ll need to file an SR-22 form and drive with an ignition interlock device (IID). You have the option of either:

- 90-day RDP with IID

- 30-day license suspension, then a 60-day RDP

Multiple Offenses

After a second DUI offense, you’ll receive a one-year license suspension. If this is your second offense in five years, you may lose your license for up to five years. After three or more convictions, you will lose your license for ten years.

Getting a DUI won’t just result in legal trouble. You can also expect your car rates to go way up. Insurance companies may even label you as a high-risk driver, making it hard for you to get coverage.

Driver’s License Points System

Missouri uses a driver’s license points system to keep track of violations on your record. After you have eight or more points on your record in 18 months, you’ll lose your license for anywhere from 30 to 90 days. This will depend on how many suspensions you’ve already had. Every year that you drive without new points, your total will go down.

Insurance companies periodically access the state’s points database to find out if you’ve accumulated any violations. If any are discovered, you could see higher rates. Once your premium is boosted like this, you’ll need to wait until points expire from your record and your provider scans your record again.

Most Popular Cars

Every state has a different collection of the most popular cars. Here were the most sold cars in 2021:

- Ford F-Series

- Chevrolet Silverado

- Ram 1500/2500/3500

- GMC Sierra

- Honda CR-V

Most Stolen Cars

Insurers pay close attention to which cars thieves target most in each state. If you own a car that makes the most stolen list, your rates could end up being higher. These were the most stolen vehicles in 2021:

- 2006 Ford Pick-Up (Full Size)

- 2005 Chevrolet Pick-Up (Full Size)

- 2001 Dodge Pick-Up (Full Size)

- 2020 Nissan Altima

- 2020 Chevrolet Malibu

- 2014 Ford Fusion

- 2020 Jeep Cherokee/Grand Cherokee

- 1997 Honda Accord

- 2020 Toyota Camry

- 2008 Chevrolet Impala