Wisconsin Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Wisconsin.

- Sean Canonica

- Updated March 20, 2024

Wisconsin is the 20th most populous state in the country. It’s known for its massive dairy production, famous beer, and bordering the Great Lakes. The state also houses large urban areas, such as Milwaukee and Green Bay.

Per the Federal Highway Administration (FHA), there are about 4.31 million drivers on the road in the Badger State. Like most states, you must have coverage to get behind the wheel in the Badger State. This guide will help you learn about Wisconsin car insurance, including detailed info on rates, requirements, and laws.

Table of contents

Average Wisconsin Car Insurance Rates

Your place of residence or where you live plays a major role in your monthly premium. Because of this, it’s important to look at your state’s average auto rates from time to time. This should help you know if you’re overpaying or getting a great deal with your current provider. The table below shows Wisconsin’s average auto insurance rates, as well as how the state measures up with the rest of the country.

| Coverage | Wisconsin Average | US Average |

|---|---|---|

| Liability | $421.21 | $650.35 |

| Collision | $250.73 | $381.43 |

| Comprehensive | $168.52 | $171.87 |

| Full Coverage | $767.42 | $1,070.47 |

| Price Per Month | $63.95 | $89.20 |

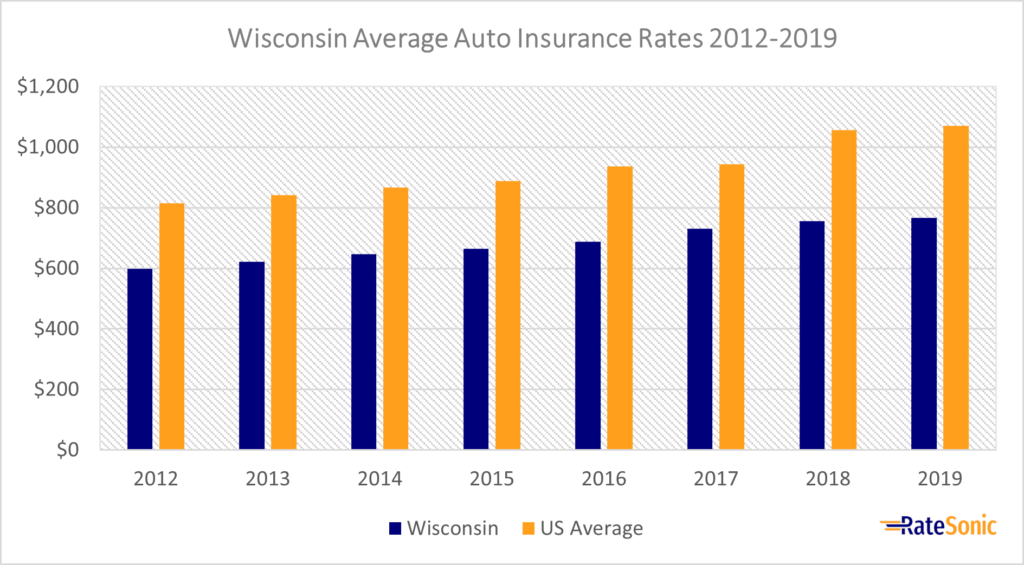

Average Full Coverage Rates

The graph below displays the difference in average full coverage premiums in Wisconsin from 2012 to 2019. Prices increased from $598 in 2012 to $767 in 2019. This was an increase of $169, or 28%. However, despite the increase, Wisconsinites pay well below the national average for car insurance.

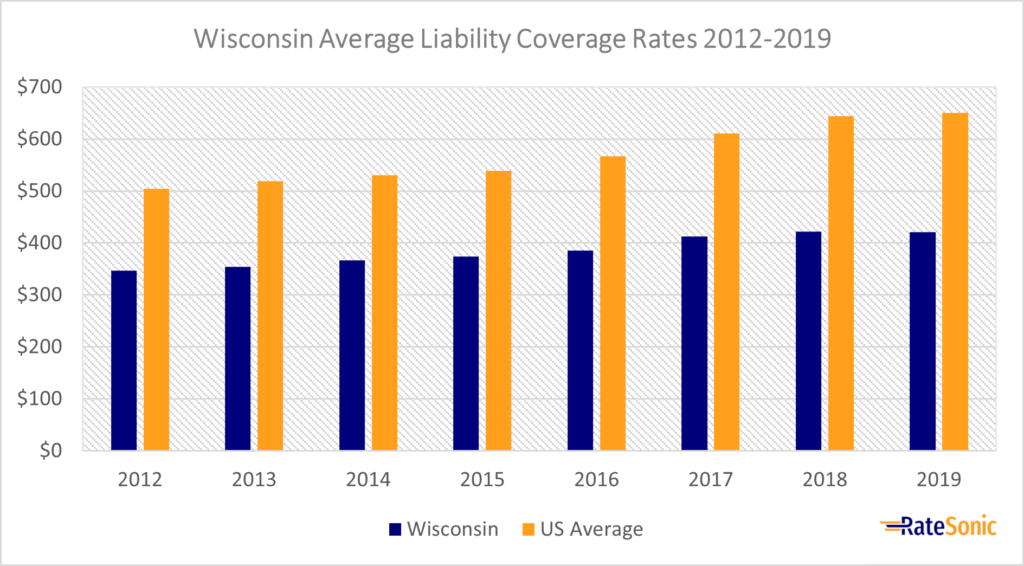

Average Liability Rates

Below is a graph showing Wisconsin’s average liability insurance rates from 2012 to 2019. During this time, rates only went up from around $350 to $421 annually. This is much cheaper than the national average for liability coverage, which sits at around $650.

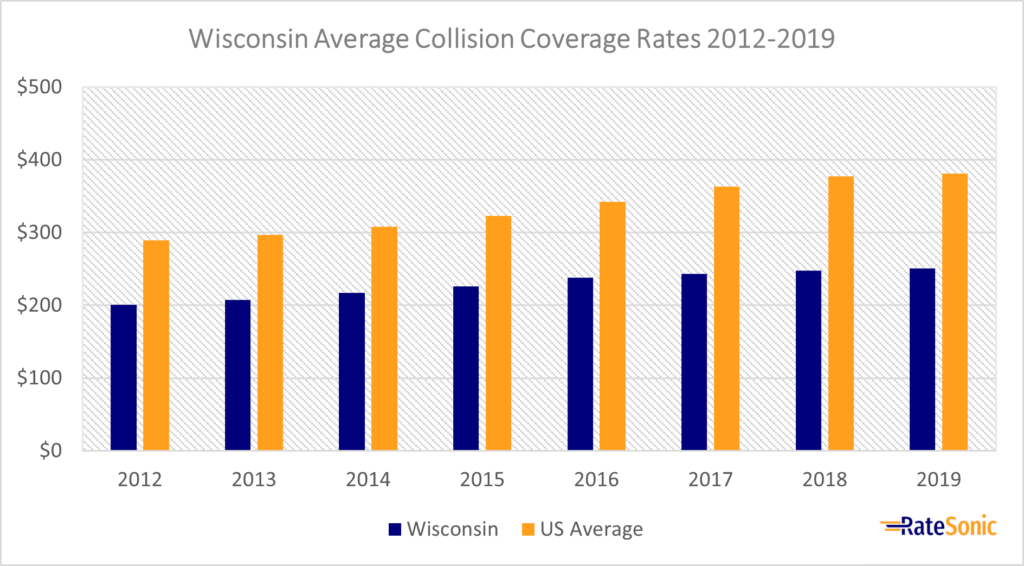

Average Collision Rates

Wisconsin’s collision insurance rates have also remained much lower than the US average from 2012 to 2019. Despite this, costs for this coverage increased from around $200 in 2012 to $250 in 2019.

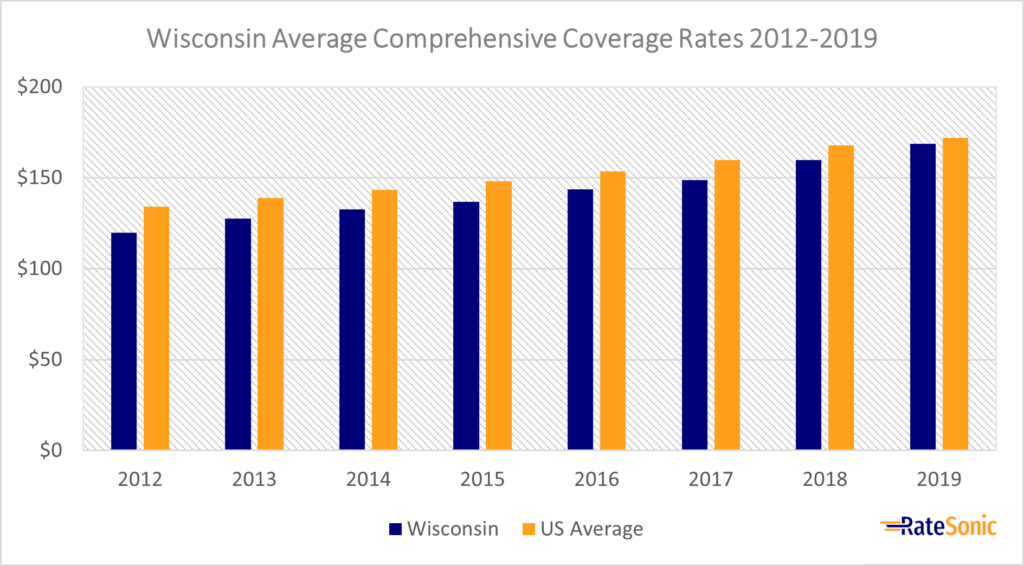

Average Comprehensive Rates

From 2012 to 2019, Wisconsin’s average comprehensive insurance rates have gone up, getting very close to the national average. Premiums rose from about $120 in 2012 to $168 in 2019. Comprehensive costs may be higher than other coverages because of the risk natural disasters pose in the region. The state faces many disasters, such as floods, tornadoes, and harsh winters. All of this can damage vehicles and result in more claims for insurers to deal with.

Why Do Rates Keep Increasing?

As you can see from the graphs above, auto insurance rates in Wisconsin are on the increase as the years go by. There are a few reasons why this is the case. First, inflation is on the rise. As the cost of car repairs and medical bills increase, so will your auto rates. This is because it becomes more expensive for providers to handle claims. You can also expect higher prices because of more accidents in the area. If claims increase near you, then your premium is sure to go up.

To combat the rise in your coverage costs, it’s always a good idea to shop around and make sure you’re getting the best deal. From time to time, it’s wise to compare quotes from several carriers to find the cheapest rates.

Wisconsin Minimum Auto Insurance Requirements

Like most states, Wisconsin requires car insurance to drive. The following are the types of coverage and how much of each you must have on your policy:

Liability Insurance

Before you can register a vehicle, you must maintain minimum liability insurance coverage limits of at least:

- $25,000 of bodily injury liability (BIL) for the injury or death of one person

- $50,000 of BIL for the injury or death of more than one person

- $10,000 of property damage liability (PDL) for each accident

Often, you’ll see the above minimum car insurance requirements in shorthand form: “25/50/10.” Each number indicates the amount, in thousands of dollars, you must have on your policy to drive.

Uninsured Motorist Coverage

Wisconsin also requires uninsured motorist (UM) coverage. The state only mandates UM bodily injury insurance. UM property damage coverage is optional. The required limits for UM are:

- $25,000 of BIL for the injury or death of one person in a car accident

- $50,000 of BIL for the injury or death of more than one person in a car accident

Underinsured motorist (UIM) is an optional coverage you may want to consider. But it’s not a requirement in the Badger State.

Keep in mind Wisconsin’s minimum coverage may satisfy the law, but it’s likely not enough to cover a severe car accident. The general recommendation in the insurance industry is to buy as much coverage as you can afford. It’s ultimately up to you to decide how comfortable you are with risk.

Valid Proof of Insurance

Wisconsin requires drivers to provide proof of coverage at any traffic stop or accident. State law specifies no format for proof, but an ID card issued by your carrier will work in most instances. We recommend that your proof of insurance includes the following facts:

- Name of your insurer

- Name of insured

- The effective date of coverage

- Description of the vehicle, including year, trade name, and vehicle identification number (VIN)

State law doesn’t mention electronic proof of auto coverage. To be safe, keep a hard copy of your proof in your vehicle.

Penalties for Driving Without Insurance

It’s illegal to drive without coverage in Wisconsin. This includes getting behind the wheel without any proof that you have car insurance. Here are the penalties you’ll receive for driving without a policy

- Failing to produce valid proof at a traffic stop or accident – $10

- Driving without insurance – up to $500

- Using a fraudulent proof – up to $5,000

Self-Insurance

If you own 25 or more vehicles, you’re able to self-insure them. You must fill out and submit Form MV3069 to the Wisconsin Department of Transportation (WisDOT). If the state deems that you meet the requirements, you’ll receive a one-year certificate for self-insurance.

Best Car Insurance Companies in Wisconsin

Finding the best company is important when you’re shopping for coverage. The best car insurance companies offer the most value for your money. Often, an excellent provider will have these characteristics:

- Great rates

- Superior customer satisfaction

- Streamlined claims processes

- An abundance amount of discounts

- Plenty of coverage options

By comparing each insurer head-to-head, you’ll be able to distinguish what separates one from the others. In our article on the best national car insurance companies, we rank the top providers based on the above attributes. This is a great starting point to find the right one for your needs.

Top Companies by Market Share

One way to find the best car insurance companies in Wisconsin is by looking at market share data. This can help you see which providers are the biggest and most popular in the region. The largest insurers aren’t always the best, but this is a good place to start.

Below are the auto insurance companies with the most market share in Wisconsin:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | Progressive | $724,009 | 21.38% |

| 2 | American Family | $587,607 | 17.35% |

| 3 | State Farm | $469,105 | 13.85% |

| 4 | GEICO | $175,757 | 5.22% |

| 5 | Allstate | $159,518 | 4.71% |

| 6 | Erie | $125,382 | 3.70% |

| 7 | West Bend Mutual | $102,277 | 3.02% |

| 8 | Acuity Mutual | $100,518 | 2.97% |

| 9 | USAA | $94,204 | 2.78% |

| 10 | Farmers | $94,804 | 2.78% |

Top Companies by J.D. Power Rating

Excellent customer satisfaction is a key trait of any good insurance company. Each year, J.D. Power releases a study displaying each company’s customer satisfaction score, either regionally or nationally. The table below displays the top companies by J.D. Power rating in the North Central region of the US (including Wisconsin):

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | Erie | 876 |

| 2 | COUNTRY Financial | 868 |

| 3 | State Farm | 848 |

| 4 | Allstate | 847 |

| 5 | GEICO | 847 |

| 6 | The Hanover | 843 |

| 7 | American Family | 838 |

| 9 | Auto-Owners | 834 |

| 10 | Safeco | 834 |

| 11 | Grange | 832 |

| 12 | Farmers | 827 |

| 13 | Progressive | 827 |

| 14 | Travelers | 818 |

| 15 | Automobile Club Group (AAA) | 810 |

| 16 | Nationwide | 809 |

| 17 | Liberty Mutual | 807 |

Wisconsin Auto Insurance Laws

No-Fault or Fault?

Wisconsin is a fault, or tort, insurance state. This means that any driver who’s at fault for a car accident is financially responsible for any resulting damages and injuries. However, keep in mind that state law allows you to add personal injury protection (PIP) to your policy for additional coverage. To reject it, you must do so in writing.

Totaled Cars

If you get into an accident, your car is totaled if the cost of damages is more than the actual cash value (ACV). However, each state has a varying threshold for when a vehicle becomes a total loss. In Wisconsin, a vehicle is totaled if the damages reach 70% of its value.

Once an insurer labels your car as a total loss, you’ll receive a cash payout. This is in the amount of your vehicle’s ACV.

Salvage and Rebuilt Titles

Once a car becomes a total loss, it’ll receive a salvage title from the DOT. Salvage title cars are illegal to drive because they’re unsafe and typically have severe damage. For this reason, providers won’t insure a salvage title vehicle.

How to Get a Rebuilt Salvage Title

To legally drive a salvage car in Wisconsin, you must restore it to a roadworthy condition and obtain a rebuilt salvage title. This can be both time-consuming and expensive. Before getting started, you should first consider whether it’s worth it to keep the car.

You must complete several steps to obtain a rebuilt salvage title. First, you’ll need to repair the car. Then, you’ll need to apply for a new title rebuilt title brand, pass an inspection by a certified state salvage inspector, and pay fees to WisDOT. Here’s what you’ll need to submit:

- Current salvage title for the vehicle

- Form MV1 – Title/License Plate Application

- Form MV2673 – Major Parts Statement

- Four images displaying the salvage vehicle before repairs

- Check for $329.50 (vehicle registration, rebuilt salvage title, and inspection fees)

Insuring Cars with Rebuilt Salvage Titles

You can get insurance coverage for your rebuilt salvage cars in Wisconsin. However, some providers may limit you to a liability-only policy because of the vehicle’s accident history.

Getting coverage for a vehicle with a rebuilt salvage title may prove more expensive as well. It’s a good idea to compare quotes between various companies to find the best rate.

Full Windshield Replacement

Some states, such as Florida, require insurers to repair your windshield without a deductible. Wisconsin, on the other hand, doesn’t mandate carriers to do this. This means that you must pay a comprehensive deductible for any windshield damage your car sustains.

Providers may also allow you to add full glass coverage to your policy. This lets you repair your windshield without a deductible, but you’ll need to pay extra on your premium.

Filing Claims

After you get into an accident, you’ll probably need to file a claim with your insurance provider. It’s important to file as soon as you can to avoid any complications. Luckily, most insurers make the process easy. In most cases, you can file online, on your provider’s mobile app, or over the phone.

How long does it take to settle a claim?

Wisconsin auto insurers have 30 days to settle a claim, per §628.46. This is a relatively prompt time compared to most other states.

SR-22 Forms

An SR-22 form certifies to the state that you have the minimum amount of insurance (financial responsibility). In most cases, you’ll only need to file one for specific reasons, such as reinstating a suspended license. Wisconsin requires you to file an SR-22 form in the following instances:

- Reinstating your driver’s license after a suspension

- Reinstating your driver’s license after a suspension due to damage judgment or uninsured motorists law

- Obtaining an occupational license after a suspension

- Under 18 drivers without a sponsor or parent

To file an SR-22 form, you must either contact your insurance carrier or do so yourself. You must file on the state’s website or by visiting the nearest DMV. Here’s what you’ll need to include on the form:

- Insured’s name

- Your policy number

- Policy and SR-22 form dates

- Name of your insurer

- Date and signature

- Either the owner’s or operator’s policy boxes marked or the “all owned and non-owned” indicated

- Wisconsin listed as the state you’re submitting in

Credit History

Several states, such as California and Hawaii, ban insurance companies from using your credit score to determine your premium. Many view the use of credit scores as a rate factor to be an unfair indicator of risk.

Wisconsin doesn’t have any rules against carriers using your credit history to calculate your auto rates. Therefore, if you have a poor credit rating, you could end up paying more for coverage. Insurers may also turn you away for the same reason.

Price Optimization

Price optimization is a practice where insurance companies gradually raise your prices to see how much you can tolerate before switching. 20 states ban this because they view it as unreasonable and unfair. However, Wisconsin allows providers to use price optimization. So, if you’ve experienced any recent rate increases despite a clean record, this could be why.

Policy Cancellation

During the first 60 days of your policy, Wisconsin insurers can cancel for any reason. But after that period, it may only drop your insurance policy for the following reasons:

- Non-payment of premium

- Misrepresentation or fraud to obtain your policy

- Fraudulent claims

- A significant change in circumstances regarding the insured

By law, your provider must mail you a written cancellation notice if any of the above occurs. Then, you’ll have 10 days before the cancellation becomes final.

Drunk Driving Laws

Driving under the influence of drugs and alcohol is against the law. It also puts you and others in your path in danger. In Wisconsin, you’ll receive an operating while intoxicated (OWI) conviction if you drive:

- With a blood alcohol content (BAC) of 0.08 or higher

- With an intoxicant, restricted controlled substance, or any other drug in your system

Even just one OWI on your record can spell tons of legal and financial trouble. You could spend time in jail, be forced to complete rehab, or even install an ignition interlock device (IID) in your car. After all that, you’ll still face plenty of fines, legal fees, and a sharp rise in your rates or even insurance policy cancellation.

Operating While Intoxicated (OWI) Penalties

Wisconsin, like most states, has a tiered system for its OWI penalties. After each offense, the penalties get more severe. Here’s what’ll happen after each OWI offense:

First Offense

- $150 to $300 in fines

- $435 OWI surcharge

- Six- to nine-month license revocation

- If BAC is more than 0.15:

- Ignition interlock device

- 24/7 sobriety program for one year

Second Offense

If this is your second offense, but only one in the last 10 years and it results in no bodily harm or death, you’ll receive:

- $150 to $300 in fines

- $435 OWI surcharge

- Six- to nine-month license revocation

- Ignition interlock device

- 24/7 sobriety program for one year

For a second offense in the last 10 years or one that results in bodily harm or death, you’ll receive:

- $350 to $1,100 in fines

- $435 OWI surcharge

- Five days to six months of jail

- 12- to 18-month license revocation, plus sentence length

- Ignition interlock device

- 24/7 sobriety program for one year to 18 months, plus sentence length

Third Offense

- $600 to $2,000 in fines

- $435 OWI surcharge

- 45 days to one year of jail

- Two- to three-year license revocation, plus sentence length

- Ignition interlock device

- 24/7 sobriety program for one to three years, plus sentence length

Driver’s License Points System

Wisconsin is one of many states to have a driver’s license points system. For each moving violation, you’ll receive points against your record. Racking up enough points will result in a driver’s license suspension of varying lengths. Below is a table that displays how license suspensions work in the Badger State:

| Number of Points in One Year | Length of Suspension |

|---|---|

| Less than 12 | N/A |

| 12 | 2 months |

| 17-22 | 4 months |

| 23-30 | 6 months |

| 30+ | 1 year |

For anyone with a probationary license, learner’s permit, or no license, you’ll receive a six-month suspension for 12-30 points. Over 30 points results in a year suspension.

Most Popular Cars

Insurers keep track of the most popular cars each year. Thieves may target these vehicles more often, resulting in higher rates for anybody that drives one of these cars.

These were the Badger State’s most-sold cars in 2022:

- Chevrolet Silverado

- Ford F-Series

- RAM 1500/2500/3500

- Chevrolet Equinox

- Toyota RAV-4

Most Stolen Cars

These were the most stolen cars in 2021. If you own one of these vehicles or are thinking of purchasing one in the future, be aware that they could cost more to insure.

- 2000 Honda Civic

- 1997 Honda Accord

- 2000 Honda CR-V

- 2007 Chevrolet Impala

- 2017 Jeep Cherokee/Grand Cherokee

- 2016 Chevrolet Malibu

- 2011 Hyundai Sonata

- 2020 Chevrolet Pick-Up (Full Size)

- 2003/2002 Dodge Caravan

- 2017 Toyota Camry