Washington Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Washington.

- Brandon Canonica

- Updated March 20, 2024

Most people know Washington for its dense evergreen forests, impressive mountain ranges, and diverse wildlife. It’s also home to Seattle, one of the most populous cities on the West Coast of the US. The state is the 13th-largest state in the country by population with an estimated 7.7 million residents in 2022.

In 2021, there were about 5.8 million licensed drivers in the Evergreen State, according to the Federal Highway Administration. By law, every driver in this state must have coverage. This page will explain how auto insurance works in the State of Washington. We’ll examine relevant laws and policies, how much you can expect to pay for coverage, top companies, and more.

Table of contents

Washington Average Auto Insurance Rates

It’s always a good idea to look at your state’s average car insurance rates before you get a policy. This is because it allows you to see what other people pay for auto coverage. You can then compare it to what you’re paying. But keep in mind that many factors affect your final premium. This includes things like:

- Car make and model

- Driving record

- Zip code

- Gender

- Claims history

Just how much does it cost to insure a car in Washington? The table below displays average Evergreen State rates, by coverage type, versus the average for the rest of the country:

| Coverage | Washington Average | US Average |

|---|---|---|

| Liability | $705.11 | $650.35 |

| Collision | $325.38 | $381.43 |

| Comprehensive | $121.13 | $171.87 |

| Full Coverage | $1,066.84 | $1,070.47 |

| Price Per Month | $88.90 | $89.20 |

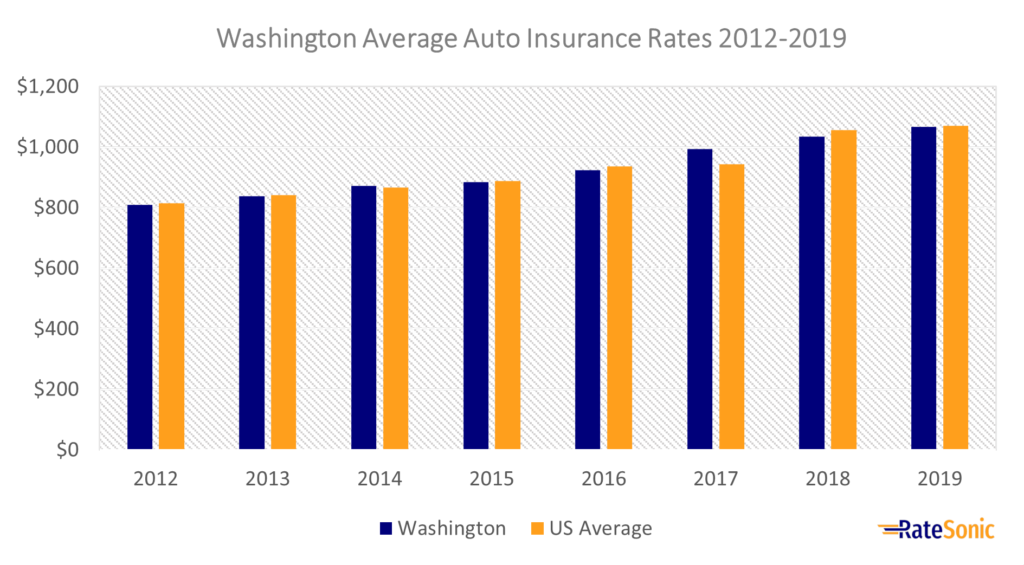

Average Full Coverage Rates

The graph below shows the change in price for average full coverage insurance in Washington state from 2012 to 2019. Rates here rose from $809 in 2012 to $1,066 in 2019. This was an increase of $257, or 31%.

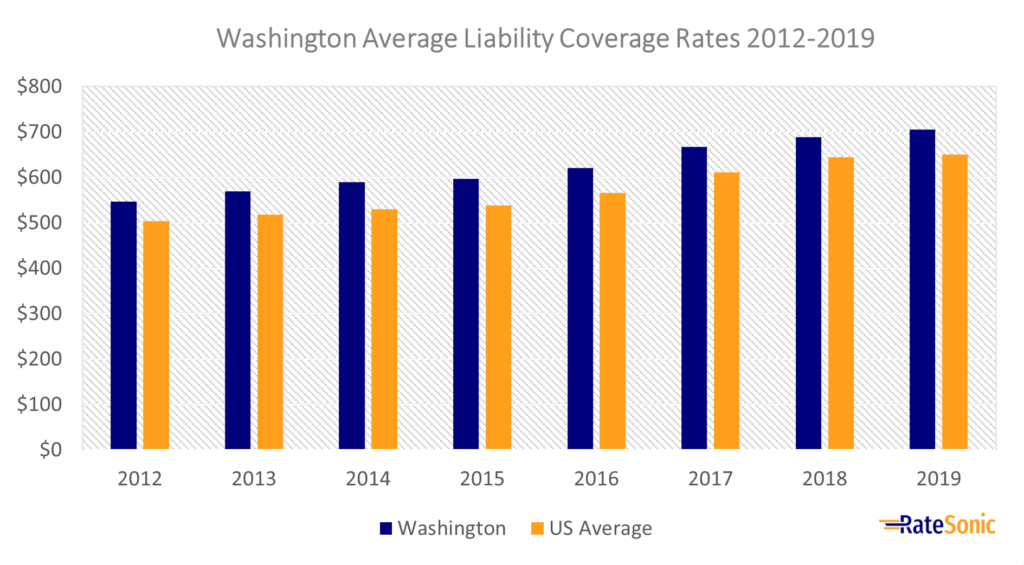

Average Liability Rates

The following chart displays the average liability insurance rates in Washington from 2012 to 2019. Prices for this coverage have been higher than the national average for the whole eight years. They reached their highest point in 2019 at around $700. This is almost a $150 increase from the average cost of $550 in 2012.

Higher liability rates than the national average could be due to any of these factors:

- The state’s increasing population, especially in major cities

- Natural market shifts

- More claims are filed each year

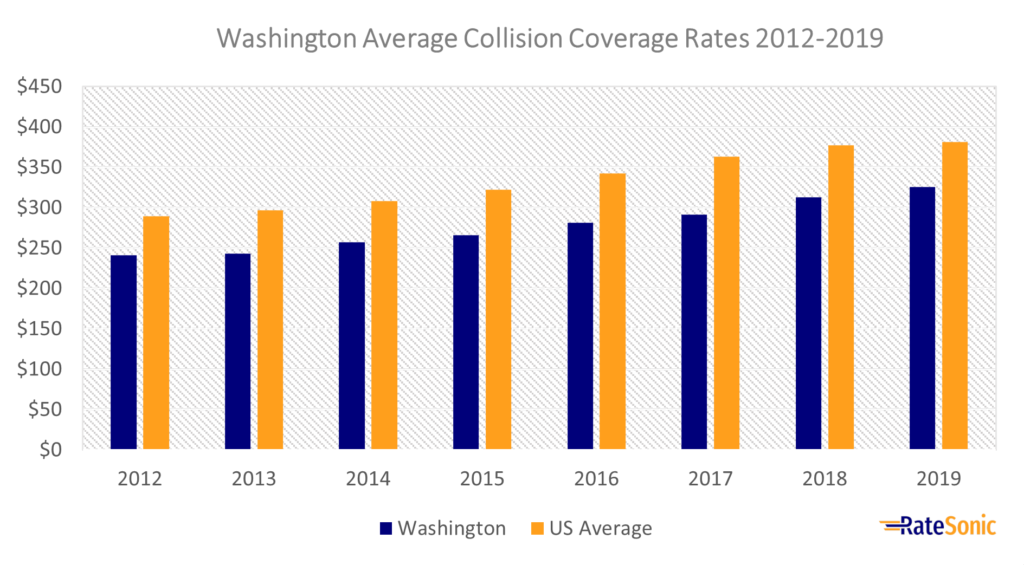

Average Collision Rates

The next graph illustrates average collision insurance rates in Washington state from 2012 to 2019. During the period, state residents paid less for collision coverage than the US average. However, prices have still either gone up or stayed relatively the same year to year. A likely cause for this could be inflation.

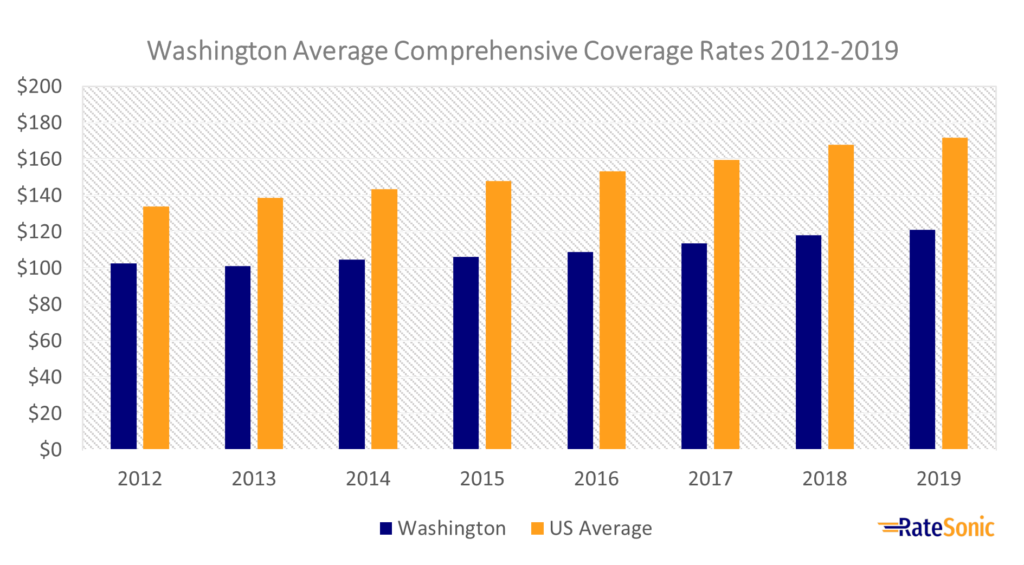

Average Comprehensive Rates

Below is a graph that shows the average Washington comprehensive insurance rates from 2012 to 2019. While rates for comprehensive have increased almost every year, the prices have remained either at or below $120. This is well under the national average, which eclipsed $160 in 2019. There are many possible reasons for this. For instance, Washingtonians may file less comprehensive claims because they experience fewer natural disasters than, say, Florida or California.

Why Do Auto Insurance Rates Keep Increasing?

Does your car insurance premium seem more expensive than last year? There could be several reasons you’re seeing a jump in your auto rates. Insurers cite reasons such as increased health care costs, rising driving and accident rates, and inflation. Inflation, in particular, is behind many rate increases both in Washington and across the nation.

According to a report by The Seattle Times, Washington traffic deaths saw a 21.4% increase in 2022, despite a nationwide dip. This may result in higher rates for everyone in the state. As claims in the region go up, so too will everyone’s costs.

Though rates seemingly go up each year, there are steps you can take to lower your premium. It’s smart to compare quotes from the best companies. That’s the best way to keep your rates low.

Washington Minimum Auto Insurance Requirements

Like all other states (except New Hampshire and Virginia), Washington requires drivers to have a minimum amount of car insurance. You must meet the bare minimum requirements for coverage before you can get behind the wheel.

Below are the basic coverage requirements in the Evergreen State:

Liability Insurance

Washington requires minimum liability insurance coverage limits of at least:

- $25,000 of bodily injury liability (BIL) for the injury of one person in a one-car accident

- $50,000 of bodily injury liability (BIL) for the injury of more than one person in a one-car accident

- $10,000 of property damage liability (PDL) for one accident

It’s common to see state minimum requirements written in a shorthand form, such as “25/50/10.” You may see it on your policy or at other times you deal with your auto insurer.

You’ll satisfy state law if you purchase the minimum required coverage. But be aware that this is just the smallest amount of insurance the state wants you to have. You may not have full protection if an especially costly accident happened. If you can afford it, consider adding more coverage, such as collision and comprehensive, to your policy.

Washington State law doesn’t require drivers to have either uninsured or underinsured motorist (UM/UIM) coverage. Also, be aware that roughly 20% of drivers in the state don’t have coverage. Because of this, UM/UIM is a good idea.

Valid Proof of Insurance

Washington drivers must show proof of coverage cards to the authorities when asked. This can be a physical or digital card that your insurer should provide for you. ID cards must include the following:

- Name of your insurer

- Your policy number

- The effective date of your policy

- The expiration date of your policy

- A description of the year, make, or model of the insured vehicles, and the name of the driver. You can use the word “fleet” for more than five vehicles owned by the same person or business.

Valid Proof of Financial Responsibility

Washington state allows drivers to prove financial responsibility as an alternative to buying standard auto insurance. With this method, you must prove that you have enough money to cover any damages that occur in a car accident.

You can prove financial responsibility (FR) by depositing sixty thousand dollars in your bank. Another valid way you can prove FR is by owning approved securities that equal sixty thousand dollars. To satisfy the state’s proof of financial responsibility requirement, you must get a certificate of deposit or liability bond from the Department of Licensing (DOL).

If you’re a driver using a certificate of deposit as proof of financial responsibility, your ID card must contain:

- Your certificate number

- Your name, or the driver’s name covered by the certificate

If you use a liability bond as proof of financial responsibility, your ID card must have:

- The name of the company that gave you the bond

- The bond number

- Your name, or the driver’s name covered by the bond

Self-Insurance

In Washington, owners of 26 or more vehicles can self-insure. Then, you must either submit a cash or security deposit to prove your financial responsibility (see above).

Penalties for Driving Without Insurance

Driving without coverage is a severe traffic violation in the State of Washington. You could face a $550 fine if you’re pulled over and don’t show proof of auto insurance to law enforcement.

Things could get even worse if you get into an accident without coverage. The DOL warns that you could lose your license if you’re at fault in a car accident and can’t provide proof of coverage. This is typically the case if you can’t cover the costs of damages or injuries caused by the accident.

It’s also important to note that driving without coverage will make it harder to buy a policy in the future. Insurers might label you a high-risk driver and increase your rates if they discover that you’ve had a lapse in coverage. A lapse is when you go through a period without any coverage.

Best Car Insurance Companies in Washington

It’s important to find the best auto insurance company when you’re buying coverage in Washington State. This is usually an insurer that offers the best value at a reasonable price. The best providers share common features like:

- Friendly and attentive customer service

- Quick and easy process for filing claims

- A range of discounts

- Competitive rates

Top Companies by Market Share

A smart place to begin when searching for the best insurance companies is by looking at the top ten carriers by market share. This allows you to see which companies other people generally work with, as well as how big each insurer is.

Below is a list from 2021 of Washington state’s top ten auto insurers by market share:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm | $293,711 | 13.78% |

| 2 | Progressive | $169,649 | 7.96% |

| 3 | First National | $156,228 | 7.33% |

| 4 | Allstate | $139,738 | 6.55% |

| 5 | GEICO | $112,088 | 5.26% |

| 6 | PEMCO | $109,670 | 5.14% |

| 7 | USAA | $69,588 | 3.26% |

| 8 | Farmers | $51,308 | 2.41% |

| 9 | Safeco | $33,909 | 1.59% |

| 10 | American Family | $32,634 | 1.53% |

Top Insurers by J.D. Power Rating

Another good way to find the best auto insurer in your Washington is by looking at the top companies by J.D. Power rating. J.D. Power comes out with a new list of the top insurance companies in each region every year. They rank each carrier by customer satisfaction.

The following table lists J.D. Power’s listing of the Pacific Northwest’s best providers of auto insurance in 2022 (note: USAA didn’t fit the studies criteria and isn’t on this list):

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | The Hartford | 842 |

| 2 | State Farm | 839 |

| 3 | GEICO | 832 |

| 4 | PEMCO | 823 |

| 5 | Progressive | 819 |

| 6 | Safeco | 816 |

| 7 | Allstate | 811 |

| 8 | Farmers | 802 |

Best Companies Based in Washington

There are insurers headquartered in Washington state that you may want to do business with for several reasons. For instance, locally based businesses often offer unique benefits and better rates than many providers. Popular insurance carriers based in The Evergreen State are PEMCO, Safeco, and the Mutual of Enumclaw.

Washington Auto Insurance Laws

Auto insurance laws and regulations are not federally regulated and vary from state to state. This includes everything from required types of coverage to if it’s required at all. Below are some specific Washington state laws:

No-Fault or Fault?

No-fault states require you to buy insurance that pays for injuries, medical bills, and other related costs after a car wreck. This type of coverage is typically personal injury protection (PIP), which works regardless of fault in an accident.

Washington is not a no-fault state. But it is an at-fault state. This means you’re responsible for covering the damages and injury costs of other drivers when you cause an accident.

Even so, you have the option of adding PIP to your policy. By law, insurers must offer you PIP when you get a policy. If you don’t want it, you must tell your provider in writing.

Totaled Cars

A vehicle is totaled when it’s damaged to the point where its repair costs exceed its actual cash value (ACV). The State of Washington requires insurance providers to use the total loss formula (TLF) before they declare a car as totaled. With the TLF, your vehicle becomes a total loss when its damages and salvage value cost more than its ACV.

Once your car has been declared a total loss, your insurer must give you a payout equal to its ACV, or how much it was worth at the time of the accident. But, according to the Office of the Insurance Commissioner, your carrier must do the following if you can’t agree on the ACV:

- Replace your vehicle with one of similar value

- Give you a settlement equal to the ACV of a “comparable” car

Salvage and Rebuilt Titles

A car has a salvage title if an insurance company declares it a total loss. State law restricts driving a one on any public roads or highways. A salvage title vehicle must get rebuilt and repaired properly before it can get back on the road.

Most companies in Washington State won’t cover salvage cars. This is in large part because these cars are illegal and unsafe to drive.

How to Get a Rebuilt Salvage Title

You have some options if you own a salvage car. For instance, you can sell it. It’s common for people or auto shops to buy salvaged titles for spare parts, or to restore them later. You can also take the necessary steps to get it a rebuilt title to drive it again. To get a rebuilt title in Washington state, you must:

- Get your car the repairs it needs

- Undergo a thorough vehicle inspection (your vehicle must be in a complete state)

- Own a vehicle 5 years old or newer, and it was 6-20 years old or had a market value of $7,930 before getting totaled

Insuring Cars with Rebuilt Titles

Once repaired, the final step before taking your restored car on the road is acquiring auto coverage. Luckily, most Washington state providers cover rebuilt titles. However, your options could be limited, depending on how each company evaluates rebuilt salvage vehicles. For example, many insurers won’t offer full coverage for rebuilt titles.

You should be able to get liability coverage for your rebuilt car from most companies, though. This is because you need it to drive. Note that insurance for a rebuilt vehicle is much more expensive than a clean title. This is because a rebuild used to be a total loss, making it look riskier to providers.

Filing Claims

You’ll likely need to file a claim if you get into a car accident that causes injury or property damage. It’s important to file a claim with your insurance provider as soon as possible. If you wait too long to talk to them after an accident, you might not remember everything about the accident, or you risk your policy not covering your car’s damages. Be sure to check with your provider on its policies for filing a claim.

What to Expect After Filing a Claim

Filing a claim can be a confusing process. This is especially true if you haven’t done it before. You may not know how long it will take to hear back from your insurer, or how it works for them to reimburse you. However, Washington law sets some standards for insurance companies to follow when customers file a claim. Here are some things you can expect:

- Your insurer must get back to you within ten business days

- You should get a specific explanation of how you’ll receive coverage

- Your insurer must be available and quick to respond to any of your questions

- Your provider must reimburse you promptly

Credit History

Your credit score is a common rate factor used to determine your premium. Providers believe that credit ratings indicate risk. People with bad credit file more claims. So, if your credit isn’t great, you could end up paying more for coverage.

Many states prohibit the use of credit scores when deciding your rates, though. The State of Washington passed a law in 2021 that bans insurance companies from using your credit or FICO score as a rate factor. This law will stay in effect until three years after the government declares the COVID-19 pandemic over.

Policy Cancellation

Washington state has regulations that providers must follow if they want to cancel a customer’s policy. By law, your provider must give you 20 days of written notice before canceling your policy. Your auto insurer can cancel your policy for any reason within 60 days of signing your policy. After 60 days, however, they can’t cancel your policy, unless you:

- Don’t pay your rates on time

- Have had your driver’s license suspended or revoked

- Have committed fraud or another crime related to the information on your policy

If you don’t pay your rates, you’ll lose your policy unless you take immediate action. You’ll need to call your insurer and ask for a reinstatement. Most carriers have a grace period for you to pay. Paying within the grace period will ensure you avoid a coverage lapse and allow you to continue your policy as normal.

Drunk Driving Laws

It’s illegal to drive while under the influence of drugs and alcohol. You can get a DUI conviction in Washington if you’re caught driving with a blood alcohol content (BAC) of 0.08. You’ll also get a violation if you’ve been taking drugs (prescription or recreational) before operating a vehicle.

Penalties

You’ll lose your driver’s license following a DUI conviction. The state of Washington will suspend your license for three months to two years, depending on the severity of your violation. However, you may be able to avoid a suspension if you request a hearing within seven days, in which the examiner decides in your favor.

You’ll also face a lengthy license suspension after a DUI conviction. The DOL will suspend your license for three months to four years. They’ll decide the length of suspension based on the severity of the DUI, as well as past traffic violations on your driving record.

SR-22

Washington requires an SR-22 form following a DUI conviction. An SR-22 is a form that proves that you meet the state minimum liability requirements. You must maintain an SR-22 for three years after a DUI.

To get an SR-22 form, you must first find a company that’s willing to cover drivers with a DUI. They can then sign the form for you and help you file it with the WA-DOL. But keep in mind that not every insurer will offer an SR-22.

Driver’s License Violations

Unlike some states, Washington doesn’t have a driver’s license points system. Instead, it keeps track of tickets on your record for a certain period. Too many tickets in a short time result in a suspended license.

You’ll get a driver’s license suspension for 60 days after six violations in one year or seven violations in three years. After you lose your license, you’ll have to go through a one-year probation period. Some violations result in the instant suspension of your driver’s license, including:

- Reckless driving

- Hit-and-runs

- DUI

- Driving without coverage

Most Popular Cars

Popular cars often vary by state. The top models are often the ones that are most sold or sought after by consumers. These were the Evegreen state’s most-sold vehicles in 2022:

- Toyota RAV4

- Tesla Model Y

- Subaru Crosstrek

- Honda CR-V

- Toyota Tacoma

Most Stolen Cars

Insurers focus on the most stolen cars in each state. They do this because it reflects some level of risk of theft or damage, which could cost them more money. That means your premium may increase if you own one of the vehicles on this list.

These were Washington state’s most stolen cars in 2021, per the National Insurance Crime Bureau (NICB):

- 1998 Honda Civic

- 1997 Honda Accord

- 1999 Ford Pick-Up (Full Size)

- 1999 Honda CR-V

- 1999 Chevrolet Pick-Up (Full Size)

- 1998 Subaru Legacy

- 1991 Toyota Camry

- 1999 Toyota Corolla

- 1995 Acura Integra

- 2000 Subaru Impreza