Virginia Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Virginia.

- Sean Canonica

- Updated March 20, 2024

Virginia, famous for its rich American history, is the 12th-largest state in the country. There are approximately 5.9 million licensed drivers in the state. Many of these drivers are in large city centers, like Virginia Beach, Chesapeake, and Norfolk.

Auto coverage is a pre-requisite for anyone wanting to drive unless you can pay for the expenses of an accident yourself. This article will help you understand how car insurance works in Virginia. This includes rates, requirements, the best companies, laws, and other key info.

Table of contents

Virginia Average Auto Insurance Rates

Taking a look at your state’s average auto insurance rates is a smart practice. This research can give you an idea of whether or not you’re paying too much (or just enough) for coverage. You can also find out how much you can expect to pay each month if you’re a first-time buyer in the area. Keep in mind that everyone pays a different amount for their policy. Your rates are based on several factors, including:

- Gender

- Age

- Driving history

- Marital status

- Car make and model

In the table below, you can see Virginia’s average rates for car insurance. Residents here pay less on average than the rest of the country. The cost per month for a policy that includes liability, collision, and comprehensive is $17.44 less than the US average.

| Coverage | Virginia Average | US Average |

|---|---|---|

| Liability | $491.51 | $650.35 |

| Collision | $323.76 | $381.43 |

| Comprehensive | $149.42 | $171.87 |

| Full Coverage | $861.18 | $1,070.47 |

| Price Per Month | $71.76 | $89.20 |

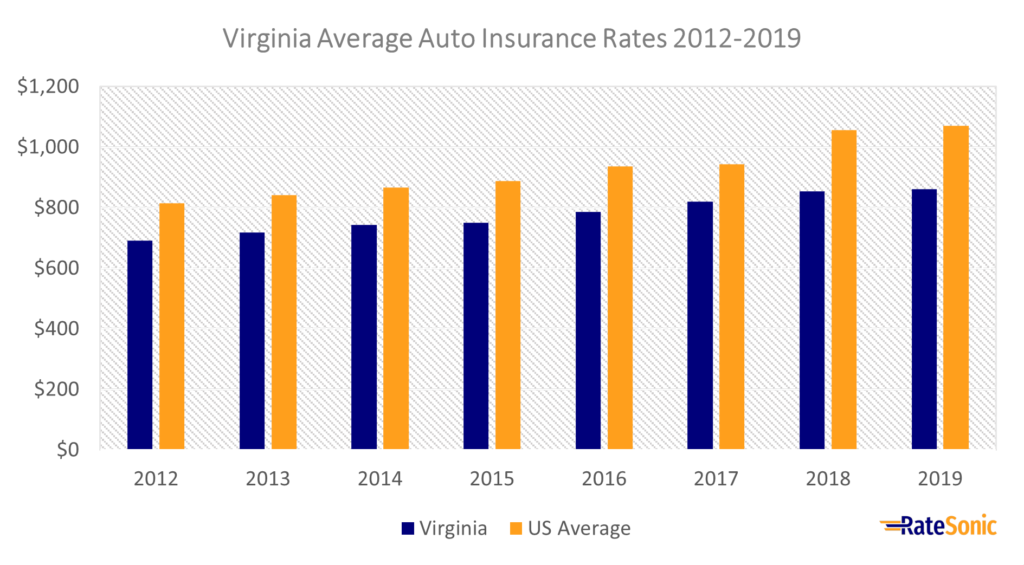

Average Full Coverage Rates

The graph below shows the average price for full-coverage in Virginia from 2012 to 2019. Premiums rose from $691 in 2012 to $861 in 2019. This was an increase of $170, or 24%.

Despite recent increases, premiums in the Old Dominion State have remained below the US average. The gap between what Virginians pay for coverage vs. the rest of the country has only gotten wider over time. One reason for this could be that Virginia ranks 30th for the standard of living. With a lower cost of living overall in the state, rates are also likely to drop.

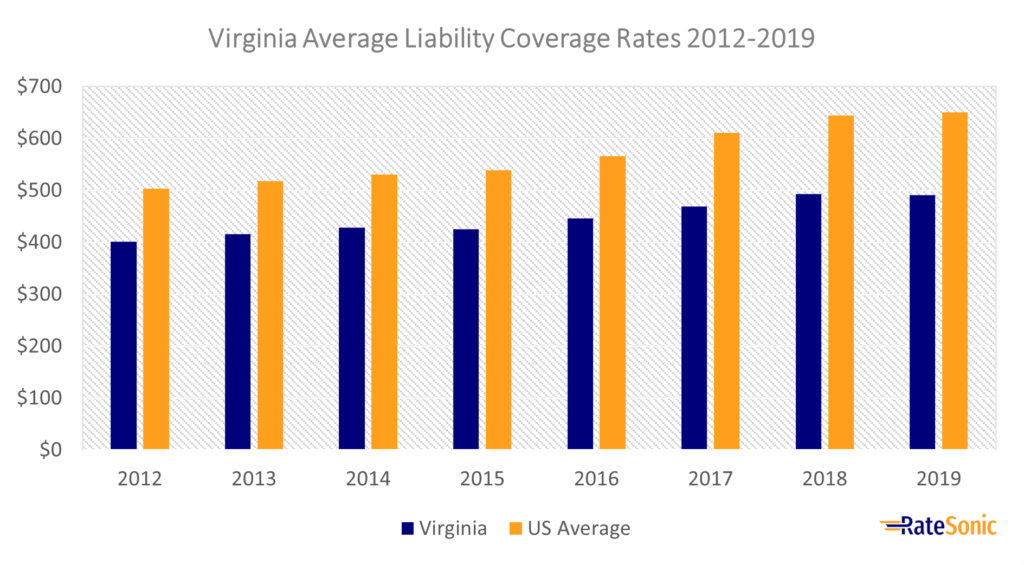

Average Liability Rates

Below are Virginia’s average auto liability insurance rates from 2012 to 2019. During this period, liability coverage costs rose from $401 in 2012 to $491 in 2019. This was a 22% increase.

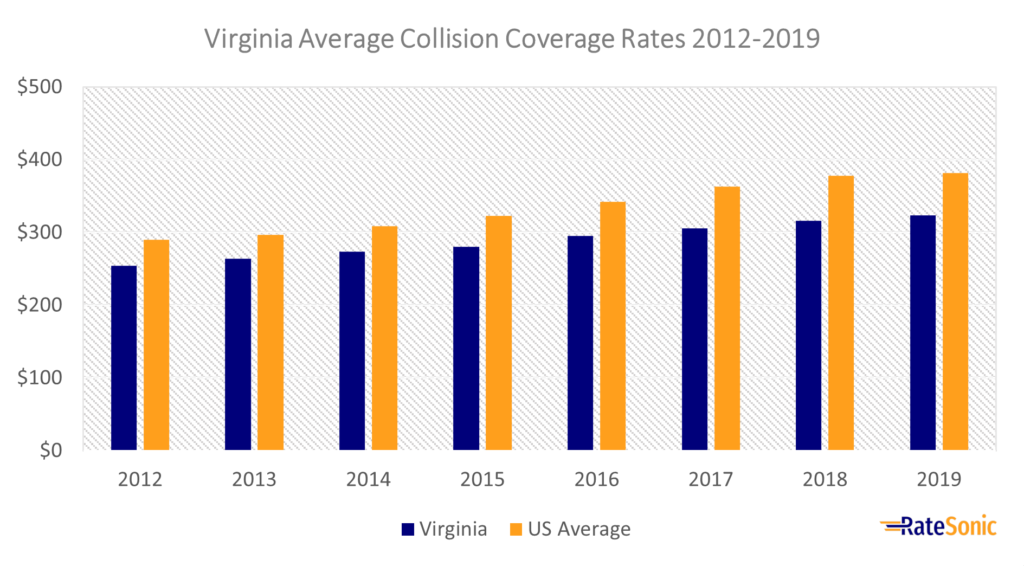

Average Collision Rates

Below is a graph showing the change in Virginia’s average collision insurance costs from 2012 to 2019. Rates increased 27% during this period, going from $254 in 2012 to $323 in 2019. Like the other coverages, liability premiums in the state are well below the US mean.

While collision rates here are lower than other states, they’re still higher than the other coverage types on auto policies. The reason could be, at least in part, that it costs so much to fix cars here after an accident. According to a study by CarMD, Virginia ranks fifth for vehicle repair costs. This would likely result in more expensive collision prices for everyone in the state.

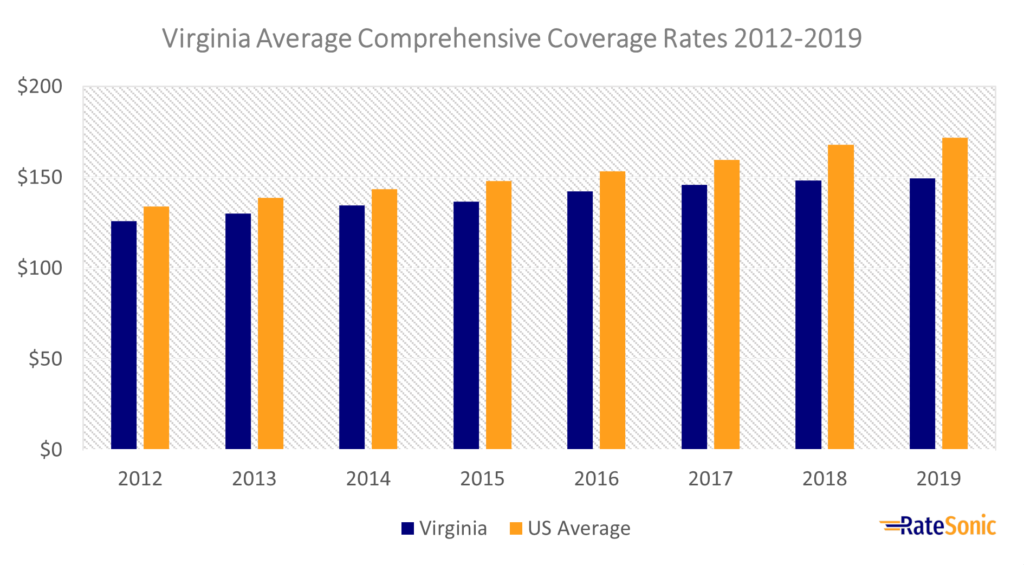

Average Comprehensive Rates

The graph below shows the trend in Virginia’s average comprehensive insurance rates from 2012 to 2019. Costs rose $24 during this time, going from around $125 in 2012 to about $149 in 2019.

Rates in Virginia are likely to keep rising for a couple of reasons. In 2021, the state passed a bill raising the minimum coverage requirement. This will, naturally, cause rates to be higher for everybody in the state. Inflation is also factoring into auto insurance price increases. As the cost of car repairs increases, so too will everyone’s rates.

Minimum Auto Insurance Requirements

In most states, you must have car insurance policy in place to drive. But in Virginia, you don’t need any if you’re capable of covering the costs of an accident yourself or if you pay an uninsured motor vehicle fee. All other drivers must have a policy.

Below is a breakdown of coverage requirements:

Liability Insurance

Virginia only requires liability auto coverage to drive. This type of insurance protects you from having to pay out of pocket for injuries or damages you cause in an accident. To drive, you’ll need the following minimum liability limits:

- $30,000 of bodily injury liability (BIL) for the injury or death of one person in a one-car accident

- $60,000 of BIL for the injury or death of more than one person in a one-car accident

- $20,000 of property damage liability PDL for one accident

You may also see insurers and the state write minimum requirements in a shorthand form: “30/60/20.” This lists the amount of coverage, in thousands, you need.

Be aware that the state-mandated minimum limits may not be enough. Accidents can cost thousands of dollars and often go way over your limits. It’s best to buy as much coverage as possible. The auto insurance industry recommends bodily injury limits of $100,000 per person and $300,000 per accident.

Uninsured and Underinsured Motorist (UM and UIM)

Providers must include uninsured motorist coverage (UM) on policies. Consumers have the option of rejecting it in writing. UM limits must not exceed your insurance policy’s liability limits.

State law doesn’t require drivers to carry underinsured motorist (UIM) on their policies. It also doesn’t require any other type of insurance including collision, comprehensive, personal injury protection (PIP), or medical payments.

Valid Proof of Insurance

Virginia drivers aren’t required to keep valid proof of an existing policy with them. But this doesn’t mean the DMV has no way of keeping track of your account status. The state has partnered with the insurance industry to randomly verify coverage. If the DMV can’t find a policy covering your vehicle, you must provide them with information regarding your policy or you may face a penalty.

Self-Insurance

You may only self-insure if you own over 21 vehicles. If this is the case, you’ll need to apply by filling out Form FR-302. Otherwise, you can avoid buying a policy if you have enough money to handle the costs after an accident. All you’ll need to do is pay an uninsured motor vehicle fee.

Uninsured Motor Vehicle Fee

The DMV allows drivers to pay a $500 uninsured motor vehicle (UMV) fee to drive their car for 12 months without car insurance. This is at your own risk. The $500 doesn’t provide any form of financial protection. If you get into an accident, you must meet your financial obligations out-of-pocket.

Penalties for Driving Without Insurance

It’s illegal to drive without an insurance policy meeting the minimum requirements. The only exception is if you’ve paid the UMV to allow for a year without coverage. Failing to comply with the Virginia minimum requirement law will bring harsh penalties, including:

- $500 Uninsured Motor Vehicle fee

- Temporarily deactivate your license plates

- Or permanently lose the license plates

Drivers without coverage that haven’t paid the UMV fee will have their driver’s license and vehicle registration suspended. To reinstate driving privileges, you must pay a $600 noncompliance fee, file an SR-22 with the DMV for three years and pay a reinstatement fee.

Best Car Insurance Companies in Virginia

You’ll have plenty of options if you’re shopping for a new policy. But how do you know which one is the best for you? The best companies are those that put the customer first. To find the best insurer, you’ll want to take a look at the overall quality of each company. The best carriers have the following features:

- Excellent customer service

- Competitive rates at a great value

- Plenty of benefits, such as customer loyalty programs and discounts

If you’re considering one of the major insurers in the nation, we’ve already done the research for you. Be sure to check out our article on the best companies for car insurance for an in-depth breakdown and rankings.

Top Companies by Market Share

Looking at which companies own the most market share is a good place to start when looking for the best insurer. These carriers are the most popular in the state. They also likely have the most resources, such as large, accessible agent networks. Here were Virginia’s top property casualty companies by market share in 2020:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm | $807,637,166 | 5.45% |

| 2 | USAA | $694,067,052 | 4.69% |

| 3 | Erie | $543,759,027 | 3.67% |

| 4 | Allstate | $379,529,064 | 2.56% |

| 5 | GEICO | $375,080,176 | 2.53% |

| 6 | Progressive | $349,762,908 | 2.36% |

| 7 | Nationwide | $203,951,734 | 1.38% |

| 8 | Continental | $148,655,032 | 1.0% |

| 9 | Cincinnati Insurance | $139,921,258 | 0.94% |

| 10 | Virginia Farm | $138,866,572 | 0.94% |

J.D. Power Rating

It’s also a good idea to look at the companies with the highest customer satisfaction in Virginia. These are carriers that tend to treat their customers the best. J.D. Power ranks insurance providers in each state or region based on a customer satisfaction score. Below are J.D. Power’s top insurers in the Mid-Atlantic region (including Virginia):

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | NJM | 867 |

| 2 | Erie | 856 |

| 3 | State Farm | 851 |

| 4 | Travelers | 836 |

| 5 | GEICO | 835 |

| 6 | Progressive | 834 |

| 7 | Liberty Mutual | 833 |

| 8 | Allstate | 830 |

| 9 | The Hartford | 829 |

| 10 | Plymouth Rock Assurance | 827 |

| 11 | Nationwide | 823 |

| 12 | CSAA | 806 |

| 13 | MetLife | 806 |

| 14 | Farmers | 794 |

Best Companies Based in Virginia

Some of the best companies for you may be based in your home state. Local insurers commonly have unique benefits for people who live in the area. Below are well-known providers based in Virginia (in no particular order):

- Rockingham

- Elephant

- Virginia Insurance Group

- Central Virginia Insurance

Virginia Auto Insurance Laws

No-Fault or Fault?

In a no-fault state, you must buy insurance that covers your injuries no matter who caused the accident, such as personal injury protection (PIP). Virginia isn’t a no-fault state. It’s a fault state, where the at-fault driver assumes full responsibility for damages they cause. The only coverage required is liability.

Totaled Cars

Your car will typically become a total loss if the cost of repairs is more than the actual cash value (ACV). Even so, many states use different criteria for when an insurer can declare to be a total loss. Some states use the total loss formula (TLF), where a car is totaled if the damages and the salvage value outweigh the ACV. However, in Virginia, cars become a total loss if the damages reach 75% of their ACV.

Salvage and Rebuilt Titles

After an insurance company declares your vehicle as a total loss, it’ll get a salvage title. Because they are illegal to drive, a salvaged car is difficult to insure. You must restore it to a safe and drivable condition. Then, you’ll need to apply for a rebuilt title with the DMV to legally drive the car.

How to Get a Rebuilt Salvage Title

Getting a rebuilt title in any state usually takes several steps. You must follow a specific process. First, your car will need to pass a rebuilt vehicle examination. To schedule one, you’ll need to mail the following to the Department of Motor Vehicles Vehicle Branding Work Center at P.O. Box 27412, Richmond, Virginia 23269-0001:

- Original salvage title

- A completed Form LES 022A – Request for Examination of Rebuilt Salvage Vehicle

- A $125 exam fee

- A $15 substitute title fee

When you go to the examination, you’ll need to bring these papers with you:

- A copy of Form LES 022A

- Receipts for all original car parts

- Photos of the car in its original salvage condition (pre-repairs)

- Proof that your car passed a state inspection

- A list of all old parts along with their VIN

After you pass the examination, the DMV will tell the Vehicle Branding Work Center to mail you a new certificate of title. This process may take up to 48 hours. Once you receive your rebuilt salvage vehicle title, you may legally drive the car.

Insuring Cars with Rebuilt Salvage Vehicle Titles

Don’t worry about finding a company willing to insure a rebuilt salvage title. Most insurance providers operating in Virginia should be willing to cover one. However, you may only be able to buy a liability-only policy. This means full coverage won’t be an option.

You should also expect to pay higher rates for cars with rebuilt titles. This is because insurers consider rebuilds less safe. After all, they were totaled. That doesn’t mean you can’t get a good deal. If you think your rebuilt car’s coverage costs too much, try comparing rates from several companies.

Full Windshield Replacement

In some states, insurers must repair your windshield damage without charging you a deductible. Virginia doesn’t have such a law. This means that if you file a comprehensive claim for your windshield, you’ll need to pay a deductible.

Some insurers may also offer full glass coverage as a policy add-on. For a few extra bucks a month, you won’t need to pay a deductible if you file a windshield claim. This may be a good option if you think your car is at risk for lots of windshield damage. Otherwise, it could just cost you more in the long run because it adds an extra cost to your bill each month.

SR-22 Forms

You may need to file an SR-22 form if you commit a serious driving violation. SR-22 forms certify that you’re carrying the minimum amount of liability on your policy. Normally, you have to file one if you have a severe penalty, such as a DUI or hit-and-run. Below are the types of violations that require you to file an SR-22 form:

- Driving without coverage or failing to provide valid proof

- Uninsured motor vehicle suspension

- Any unsatisfied judgments

- Insurance fraud

- Driver’s license suspension due to:

- Perjury

- Manslaughter (voluntary or involuntary)

- Any felonies involving a motor vehicle

- Hit and run

- Driving without a license or allowing someone without one to do so

A court may also require you to file an FR-44 form. These are like SR-22s but come with even higher coverage requirements. FR-44 forms require you to have twice the amount of liability insurance. Here’s when you’ll need to file an FR-44:

- DUI conviction

- Driving with a suspended license

- Causing injury while under the influence of drugs or alcohol

Filing Claims

After an accident, you’ll likely need to file a claim. State laws make this a straightforward process. Insurance companies must follow rules set by state laws when handling claims. These rules include deadlines for how long insurers have to settle your claim.

How long do insurers have to settle a claim?

There isn’t a set date for how long insurers have to settle your claim. However, providers must accept or deny your claim within 10 working days. If the company only pays part of your claim or rejects it entirely, they must tell you why in writing.

How long do you have to file a claim?

You should notify your carrier as soon as possible if you get into a car accident. Virginia doesn’t have strict requirements for how long you have. But your insurer may have a deadline for filing. It’s best not to wait too long to file.

Credit History

Several states, such as California, don’t allow insurance companies to use your credit history as a factor in determining your rates. Virginia, however, allows this practice. This means that having a low credit score could mean expensive premiums. Providers may also use your credit score to decide whether or not to offer you a policy.

Policy Cancellation

Car insurance companies may only cancel your policy for certain reasons. These include:

- Driving with a suspended driver’s license

- Missing premium payments

- Moving to another state

When you miss a payment, you might still be able to reinstate your policy. Call your insurer as soon as you can to explain your situation. You may receive an extension to pay your rates. Once you pay, you should be able to continue your coverage without a lapse.

Drunk Driving Laws

Getting behind the wheel while under the influence is a terrible decision. It’s hazardous to yourself and everyone around you. Not to mention, it carries a ton of legal trouble with it. In Virginia, a DUI is where your blood alcohol content is 0.08 or higher (0.02 for a minor). The penalties for a DUI are severe and only get worse with each offense. Below are the penalties for a DUI:

First offense:

- At least $250 in fines

- Driver’s license suspension of up to one year

Second offense:

- At least $500 in fines

- Driver’s license suspension of up to three years

- Jail time of up to one year (minimum of 10 days if within ten years, 20 days if within five years)

Third offense:

- At least $1,000 in fines

- Indefinite driver’s license suspension

- Class 6 felony

- Minimum of six months in jail if the offense was within five years of another

DUI Impact on Auto Coverage

A DUI conviction won’t just result in legal trouble. Your provider will raise your rates significantly. Insurers may also label you a high-risk driver. This makes it hard to get coverage and may force you to turn to a non-standard policy instead.

Driver’s License Points System

Virginia uses a driver’s license points system to keep track of your moving violations. But, unlike other states, certain points are for rewarding consistent years of safe driving. You’ll receive demerit points for any moving violations. Racking up enough points may result in a driver’s license suspension, although the DMV doesn’t say how much will cause this.

Virginia groups violations and assigns them points according to their severity. Below are the three traffic violation severity categories, the points given for each, and a few examples of citations for each:

- Six points – DUI, reckless driving, or speeding 20 mph or more over the posted speed limit

- Four points – excessive speeding, unsafe passing, failure to stop

- Three points – speeding 1-9 mph over the posted speed limit, making an improper U-turn, learner’s permit violations

After each year with no moving violations or suspensions, you’ll receive one safe point. You can only have five safe points on your record at one time. Safe points help to offset the effect of moving violations on your record. They can help prevent license suspensions.

Most Popular Cars

Below were the most sold cars in 2021. These cars were the most popular in the state. Virginia car insurers pay close attention to this list because these cars may also be a target for thieves.

- Honda CR-V

- Ford F-Series

- Toyota RAV4

- Chevrolet Silverado

- Ram 1500/2500/3500

Most Stolen Cars

These were the most stolen vehicles in 2021. Insurers also watch this list closely because thieves regularly target these cars. Owning one of these could result in a bump in your comprehensive rates.

- 2014 Honda Accord

- 2006 Ford Pick-Up (Full Size)

- 2020 Toyota Camry

- 2013 Honda Civic

- 2020 Nissan Altima

- 2020/2016 Toyota Corolla

- 2020/2015 Chevrolet Pick-Up (Full Size)

- 2013 Hyundai Elantra

- 2019 Jeep Cherokee/Grand Cherokee

- 2013 Hyundai Sonata