Texas Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Texas.

- Brandon Canonica

- Updated March 20, 2024

Texas is the second-largest state based on both population and land area. It also boasts one of the largest highway networks in the nation. As of 2019, there were roughly 23.7 million Texans licensed as drivers. You’ll find many of these drivers in major cities and transportation hubs such as Houston, Dallas, and Austin.

As is the case with any state, Texas has laws and minimum coverage requirements. This page will break down auto insurance in the Lone Star State. This includes coverage costs, important policies and rules, and an overview of the best national and in-state auto insurers.

Table of contents

Texas Average Auto Insurance Rates

It’s smart to look at average car insurance rates if you’re looking to buy a new policy or switch providers. It’s a good way to see what others pay for coverage. Then, you can put it up against what you pay and decide if you’re getting the best deal.

The following table displays average Texas auto insurance premiums, by coverage type, versus the average for the rest of the country:

| Coverage | Texas Average | US Average |

|---|---|---|

| Liability | $650.17 | $650.35 |

| Collision | $434.46 | $381.43 |

| Comprehensive | $285.56 | $171.87 |

| Full Coverage | $1,143.85 | $1,070.47 |

| Price Per Month | $96.32 | $89.20 |

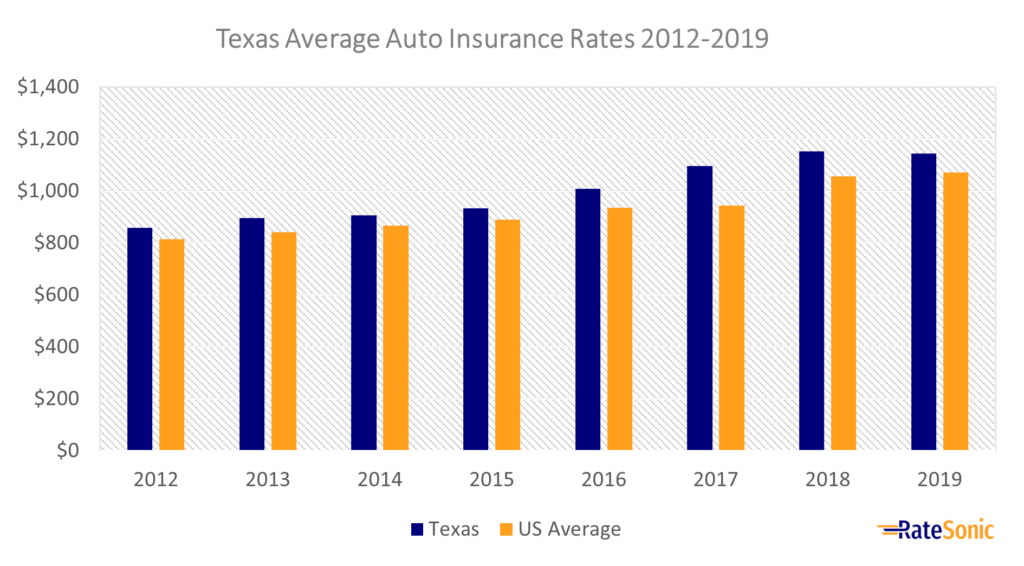

Average Full Coverage Rates

The graph below shows the change in average Texas car insurance rates from 2012 to 2019. Full coverage prices rose from $858 in 2012 to $1,143 in 2019. This was an increase of $285, or 33%.

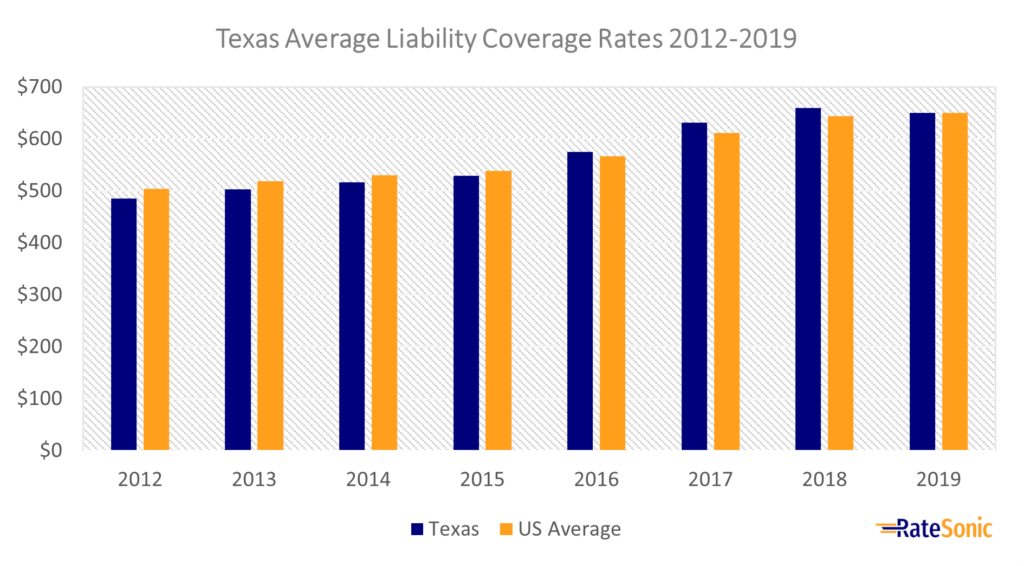

Average Liability Rates

The following graph shows the average liability insurance rates in Texas from 2012 to 2019. Around 2016, liability costs here climbed over the national average and have only begun to drop in 2019 to about $650. This year-to-year increase could be the result of:

- More claims getting filed each year

- More drivers on the road

- Inflation

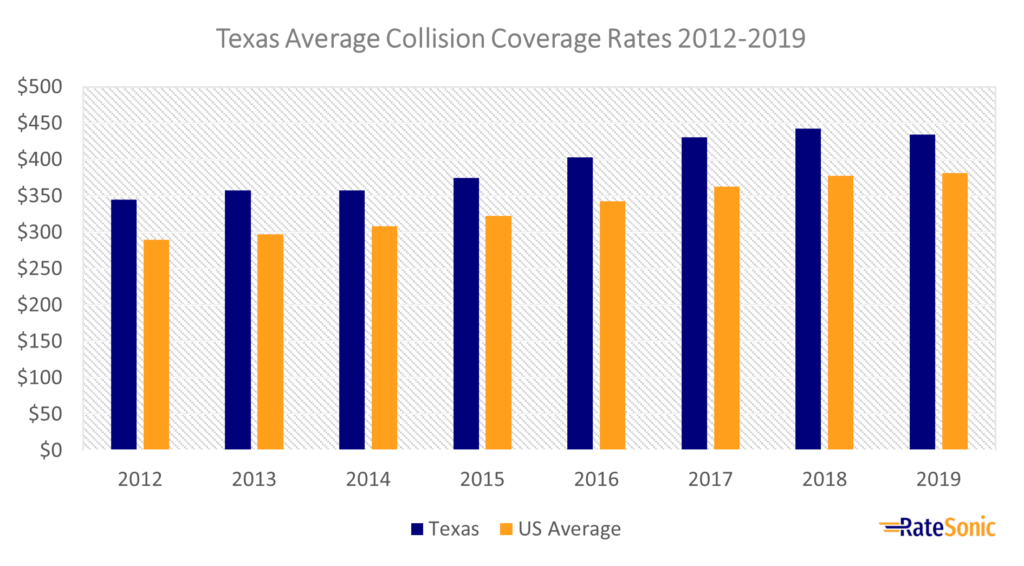

Average Collision Rates

Below is another graph that displays the average collision insurance rates in Texas from 2012 to 2019. Collision prices rose from nearly $350 in 2012 to a peak of just under $450 in 2018. This is an increase of roughly $100. Over the entire span, collision costs have been higher than the US average. This could be due to the higher number of drivers in the state compared to the rest of the country.

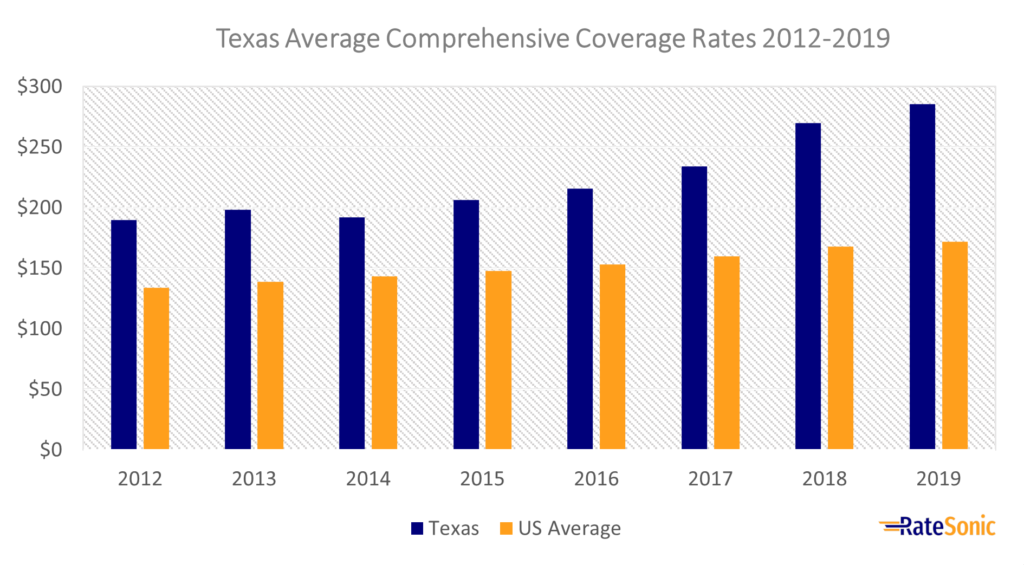

Average Comprehensive Rates

The next graph depicts the change in average Texas comprehensive insurance rates from 2012 to 2019. Over the eight years, Texans have seen much higher comprehensive prices than the rest of the country. Rates have been increasing each year, with a high of about $280 in 2019 compared to the US average of roughly $175 in the same year. The nearly $100 difference is likely due to recent natural disasters, such as hurricanes, that helped drive costs higher.

Texas Minimum Auto Insurance Requirements

Like most other states, Texas has unique minimum coverage requirements. Residents must make sure their insurance policy meets the coverage limits imposed by the state before they can legally hit the road. Policies in the Lone Star State must include the following:

Liability Coverage

Texas requires minimum liability coverage limits of at least:

- $30,000 of bodily injury liability (BIL) per person

- $60,000 of bodily injury liability (BIL) per accident

- $25,000 of property damage liability (PDL) per accident

You may see minimum insurance requirements written in shorthand form: “30/60/25.” It’s not uncommon to see the shorthand form from insurers or on state websites.

If you meet the state’s minimum requirements, you’ll have basic coverage. However, the auto insurance industry typically recommends bodily injury limits of $100,000 per person and $300,000 per accident.

Uninsured Motorist/Underinsured Motorist (UM/UIM)

Uninsured and underinsured motorist (UM and UIM) coverage protects you if you get into an accident with another driver who either has no auto coverage or doesn’t have enough. Texas law requires that your insurance company offer both coverages when selling you a policy. You have the option of refusing this coverage in writing.

Before refusing UM/UIM, be aware that as many as 20% of Texans drive without coverage, per the Department of Motor Vehicles.

Personal Injury Protection

Personal injury protection (PIP) takes care of any medical expenses that you or your passengers have after an accident. It also covers costs such as lost wages, rehab bills, and funeral costs in the aftermath of a vehicle wreck. Texas includes PIP by default in every policy. If you don’t want it, you’ll have to notify your insurer in writing.

You have the option of purchasing comprehensive, collision, medical payments, and other types of auto insurance coverage. But the state requires none of them for you to comply with the law.

Valid Proof of Insurance

Drivers must always keep proof of coverage with them. After an accident, drivers must provide proof to law enforcement or other parties involved in the incident. Your proof of motor vehicle liability insurance must include:

- The name of your provider

- Policy number

- Policy effective period

- Name and address of each insured driver

- Policy limits or a statement that the policy meets the required minimum amounts of liability

- Make and model of each insured vehicle

Texas recently passed a law allowing digital formats as proof of insurance on portable electronic devices. Also, note that the state requires proof of coverage for each vehicle owned before issuing a driver’s license.

Valid Proof of Financial Responsibility

There may be some situations where you might not want standard auto insurance. But how does this work if the state requires drivers to buy a minimum amount of coverage? Does Texas allow drivers to self-insure? Well, you’d have to prove to the state that you can handle paying for any damages that occur in an accident.

State law allows drivers options for satisfying the state’s financial responsibility requirement without paying a premium. To do this, you must submit proof of financial responsibility (FR) to the state. This usually comes in the form of surety bonds or a deposit you make with the state:

Surety Bonds

Texas drivers can file a bond with the state that proves FR. You can do this in the same amounts and under the same circumstances required for a vehicle motor insurance policy.

Deposit

You can also deposit $55,000 in cash or securities with the state comptroller. Another option is to deposit $55,000 in cash or a cashier’s check with the county judge.

What Is TexasSure?

TexasSure is a state program intended to lower the number of uninsured motorists on state roadways. It does this by checking vehicle registrations against auto insurer databases. If the system detects a lack of coverage on a vehicle, the owner must provide proof of coverage.

That’s why drivers must ensure their vehicle identification number (VIN) is correct on their policies and car registration. If the VINs don’t match for some reason, the system will treat that as non-compliance.

Penalties for Driving Without Insurance

You’ll face severe consequences if the police can’t confirm your auto insurance is in place. Under Texas state law, failure to maintain motor vehicle liability coverage is a misdemeanor punishable by:

First Offense

- A fine of at least $175 and no more than $350

- Loss of driver’s license until you show valid proof of coverage

If you can’t afford the fines for not having coverage, the state can reduce fines below $175 for first-time offenders.

Second and Subsequent Offenses

- A fine of at least $350, but no more than $1000

- Loss of driver’s license

- Vehicle registration canceled

- The car impounded for 180 days

- 2-year SR-22 requirement

Driving without coverage is a serious offense and, after second or subsequent violations, you’ll lose your car, registration, and driver’s license until you file an SR-22 form with the state. This form proves that you have the mandatory level of coverage. You must maintain an SR-22 for two years after your second or subsequent conviction.

It’s important to note that the state might drop all your charges if you can prove that you had an active auto insurance policy at the time of the citation.

Best Car Insurance Companies in Texas

When it comes to car insurance, it’s critical to find a great company that’ll best suit your needs. The best companies typically feature excellent customer service, easy tools for filing claims, opportunities for discounts, and, of course, great rates.

One of the nation’s top insurers may fit your needs. Our article on the best insurers in the country ranks each of them by overall quality.

Top Companies by Market Share

A good way to narrow down the best car insurance companies in Texas is by looking at the top ten in terms of direct premiums written. The following is a list from 2020 of the top ten auto insurers by market share:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | Progressive | $3,414,822,585 | 15.13% |

| 2 | State Farm | $3,023,473,039 | 13.4% |

| 3 | GEICO | $2,356,606,871 | 10.44% |

| 4 | Allstate | $2,016,461,039 | 8.94% |

| 5 | Farmers | $1,334,643,508 | 5.91% |

| 6 | Liberty Mutual | $1,024,120,449 | 4.54% |

| 7 | USAA | $640,829,776 | 2.84% |

| 8 | Consumers County Mutual | $489,483,130 | 2.17% |

| 9 | Garrison Property and Casualty | $365,709,805 | 1.62% |

| 10 | Home State County Mutual | $364,627,382 | 1.62% |

Top Companies by J.D. Power Rating

Another effective method of finding the best auto insurers in any given state is by looking at each insurance company’s J.D. Power ranking. Each year, J.D. Power ranks the top insurers by looking at their customer satisfaction rating.

The table below lists J.D. Power’s top insurers in Texas from its 2021 auto insurance study (note: USAA didn’t fit the criteria of the study and isn’t on this list):

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | Texas Farm Bureau | 850 |

| 2 | Liberty Mutual | 847 |

| 3 | Progressive | 843 |

| 4 | State Farm | 838 |

| 5 | Allstate | 836 |

| 6 | GEICO | 832 |

| 7 | Farmers | 826 |

| 8 | Auto Club of Southern California | 810 |

Texas Auto Insurance Laws

No-Fault or Fault

Texas is a fault state rather than a no-fault state when it comes to auto insurance. This means that if you cause an accident, you must pay for any damages or injuries that occur. That’s a good incentive to pick up as much coverage as you can. As was mentioned earlier, PIP appears on policies by default, and it’ll be up to you whether you want to keep it or decline it in writing.

Totaled Cars

Vehicles become a total loss if they get into an accident and the repair costs exceed the car’s actual cash value (ACV). Your insurer can declare your car a total loss with less damage. But when damages reach 100% of the adjusted cost of repair, your car must receive a salvage title.

If your car gets totaled, your insurer will give you a payout equal to it’s value at the time of the accident. When this happens to a new car, owners sometimes owe more than its value. Gap coverage exists to cover this difference.

Salvage and Rebuilt Titles

A salvage title car refers to a vehicle that an insurance company has declared a total loss. Since they’re so badly damaged, salvages are undrivable and aren’t legal to drive on public roads. Vehicles with these titles must carry a brand indicating the reason for salvage.

You also typically can’t insure cars with salvage titles. Carriers don’t like to provide coverage for a car that’s taken so much damage that the state deems it unworthy to drive.

The only way to legally drive a salvage car again is to take the proper steps to make it a rebuilt title. A rebuilt title car is a salvage that’s been restored to a drivable state.

How to Get a Rebuilt Salvage Title

To change a salvage motor vehicle into a rebuilt title, you must go through a few steps:

- Repair the car to as drivable condition

- Complete a vehicle inspection with your county

- Apply for a rebuilt title

You must also pay a fee to apply for a rebuilt title.

To file for a prior salvage or rebuilt title, you must submit the following to your county tax office, per the DMV:

- A filled-out title/registration application (Form 130-U)

- A filled-out rebuilt title statement form that lists the repairs you made (Form VTR-61)

- A copy of your valid driver’s license

- Proof of auto insurance

- Proof of vehicle inspection

Insuring Cars with Rebuilt Vehicle Titles

Once your salvage is repaired and inspected, can you insure a rebuilt vehicle title? Don’t worry. Many of the state’s largest insurance companies offer coverage for rebuilds. However, you may be limited to a liability-only policy, with full-coverage off the table.

The reason is that a rebuilt vehicle car was declared a total loss after an accident. And, even though a certified mechanic repaired it, the vehicle can pose some risk in the eyes of insurers, even though it’s safe to drive.

Insuring a rebuilt vehicle also usually costs more than coverage for a clean title. For lower rates, it may be a good idea to compare quotes between providers. Some insurers may just charge less than others and could offer better discount opportunities.

Filing a Claim

You’ll probably need to file a claim with your insurer if you get into a car crash. This is especially the case if your car took a lot of damage or if you got injured. It’s a good idea to file a claim as soon as possible after an accident. If you wait too long, you may not remember all the details or may not even get help from your insurer.

What to Expect After Filing a Claim

Texas requires insurers to notify you that they got your claim within 15 days. After that, you can expect an adjuster to assess the damage to your vehicle.

Once your provider considers the damage your car has taken and the information you gave them about the accident, they must notify you within 15 days whether they’ll accept or deny your claim (if they say no, it must be in writing). If your company accepts your claim, they must send you money within five business days.

Credit History

Car insurance companies look at many details and factors when they decide on your premium. One of these factors is your credit history. Providers use your credit or FICO score because it might reveal your dependability or risk potential as both a customer and a driver. If you have bad credit, they may increase your rates just in case you end up filing lots of claims and costing them money.

Some states, such as Hawaii, don’t allow insurers to use your credit score as a rate factor. Texas allows the use of your credit history to determine how much you pay. Companies can also cite your credit score as a reason to cancel your policy or deny you one.

Policy Cancellation

Your insurer can cancel your policy within 60 days for any reason unless the reason goes against any current law. If your provider wants to cancel your policy, they must give you at least ten days’ notice.

Remember that your insurer will refund you for the rest of your policy in the case of cancellation. That’s the case if you cancel your policy or if your insurer does.

After cancellation, a policy reinstatement is still possible. This is usually only if you missed a payment. To reinstate your policy, call your insurer to explain what happened. Then, you’ll be able to pay your rates and avoid a lapse.

Drunk Driving Laws

Driving while under the influence of drugs and alcohol is a severe offense. You can get a DUI conviction if you’re caught driving with a blood alcohol content (BAC) of 0.08 or if you’ve used any drugs before operating a vehicle. If you get a DUI, you’ll pay a hefty fine, spend at least three days in jail, and will temporarily lose your driver’s license.

Your insurance provider will also likely label you as a high-risk driver and significantly increase your rates. In some cases, your insurer could even cancel your policy or decide not to renew it. It could be hard to find coverage as a high-risk driver. Many people must turn to non-standard insurers or state run programs.

Below are the penalties for a DUI conviction:

First offense:

- Up to $2,000 in fines

- Up to six months in jail. Three days are mandatory.

- Ten-day impoundment of your car

- License suspension for up to one year

Second offense:

- Up to $4,000 in fines

- A month to a year in jail

- Ten-day impoundment of your car

- License suspension for up to two years

Third offense:

- A $10,000 fine

- Two to ten years in prison

- Ten-day impoundment of your car

- License suspension for up to two years

SR-22 Forms

You’ll need an SR-22 certificate if you get a DUI/DWI conviction. An SR-22 is a form that certifies that you have the minimum amount of liability coverage required by the state. You can often get an SR-22 form through your provider. They can also help you file the form with your state. Be aware, however, that not every insurer will offer an SR-22.

The Texas Department of Public Safety (DPS) says you must have an SR-22 for two years after your previous conviction, with no further lapses. A lapse in coverage happens when you go any period without coverage.

Driver’s License Points System

Texas doesn’t use driver’s license points to assess traffic violations and convictions. Even so, the DPS records moving violations and convictions. They also keep track of the accidents you cause. You may not get any specific points on your record, but the DMV may consider these incidents when you renew your license.

Insurance carriers also keep track of violations and accidents on driving records. If they see tickets or accidents on your record, your rates rise. This is because your driving record is one of the main factors that auto insurers use to decide how much to charge you

Most Popular Cars

Every state has a varying set of the most popular cars. These cars are the ones that have sold the most, and that many people want to buy. But they can also be the most stolen because of their popularity. In 2012, these were the most popular cars in Texas:

- Ford F-Series

- Chevrolet Silverado

- Ram 1500/2500/3500

- GMC Sierra

- Toyota RAV4

Most Stolen Cars

The type of car you drive is one of the many factors that providers look at when they pick your rates. Your insurer might think that you’re more likely to file a claim if you drive a car with a high chance of being stolen. Here were the top ten most stolen cars in Texas in 2020, according to the National Insurance Crime Bureau (NICB):

- 2018 Chevrolet Pick-Up (Full Size)

- 2006 Ford Pick-Up (Full Size)

- 2018 GMC Pick-Up (Full Size)

- 2005 Dodge Pick-Up (Full Size)

- 2004 Chevrolet Tahoe

- 2002 Honda Accord

- 2015 Nissan Altima

- 2008 Toyota Camry

- 2019 Ram Pick-Up (Full Size)

- 2000 Honda Civic