Tennessee Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Tennessee.

- Sean Canonica

- Updated March 20, 2024

Tennessee is the 16th-largest state in the country by population. It’s known for its beautiful terrain and being the birthplace of country music. It’s also home to Nashville, the state’s capital and largest city.

There are approximately 4.87 million drivers in Tennessee. With so many cars on the road at any given time, protection from disaster is a necessity and in the public interest. The state requires that all drivers purchase coverage before driving for this very reason. In this article, you’ll learn all about how car insurance works in The Volunteer State. This includes rate data, requirements, the best insurers, and laws.

Table of contents

Tennessee Average Auto Insurance Rates

Whether you’re looking for your first policy or need to renew it, it’s always a good idea to know your state’s average car insurance rates. This will help you know if you’re paying too much or too little for coverage. However, remember that your rates depend on many factors, such as:

- Your age

- Gender

- Driving history

- Your Zip code

- Car make and model

How much does insurance cost? The table below shows average Tennessee auto premiums, by coverage type, as well as how they stack up against the rest of the country:

| Coverage | Tennessee Average | US Average |

|---|---|---|

| Liability | $479.43 | $650.35 |

| Collision | $353.43 | $381.43 |

| Comprehensive | $168.07 | $171.87 |

| Full Coverage | $863.39 | $1,070.47 |

| Price Per Month | $71.95 | $89.20 |

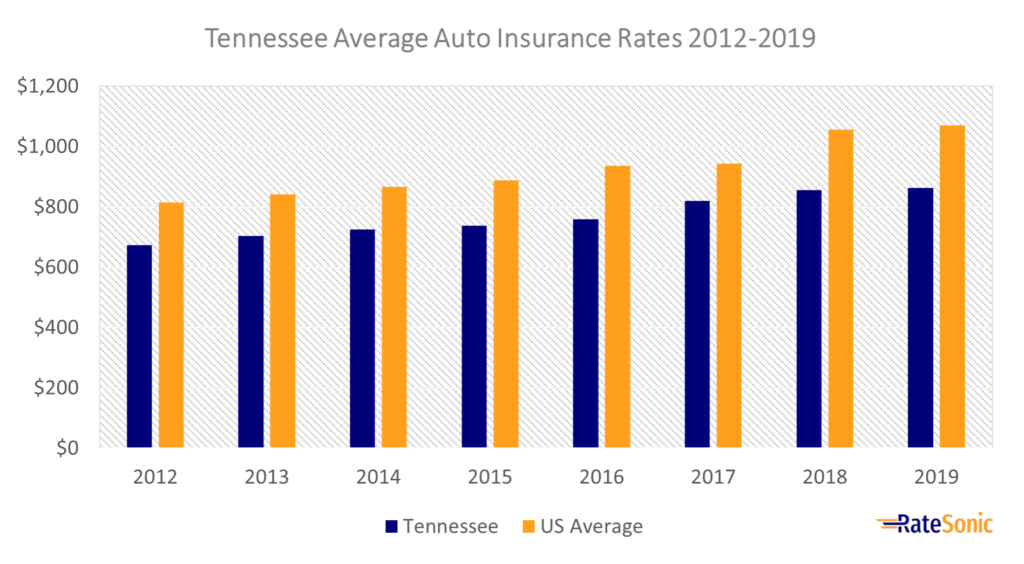

Average Full Coverage Rates

The graph below shows the change in average Tennessee insurance rates for full coverage from 2012 to 2019. premiums rose from $673 in 2012 to $863 in 2019. This was an increase of $190, or 28%.

Despite the increase, Tennessee’s full coverage rates remain below average. One reason is the state ranks 47th for healthcare spending per capita. This helps keep liability costs in check, even when collision and comprehensive keep pace with national pricing trends.

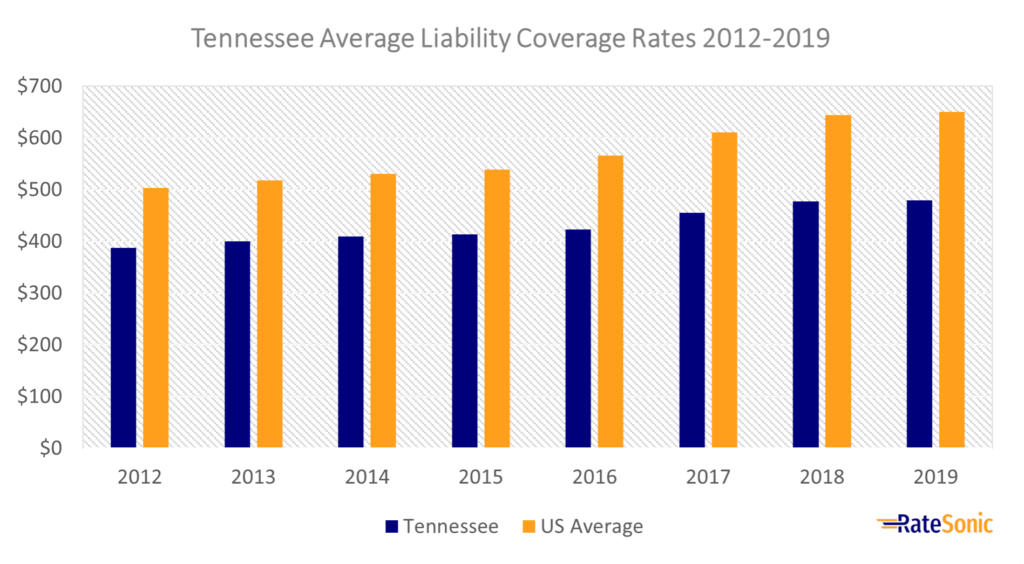

Average Liability Rates

Below is a graph displaying Tennessee’s average liability insurance rates from 2012 to 2019. During this time, coverage costs went from about $387 in 2012 to $479 in 2019, an increase of 23%.

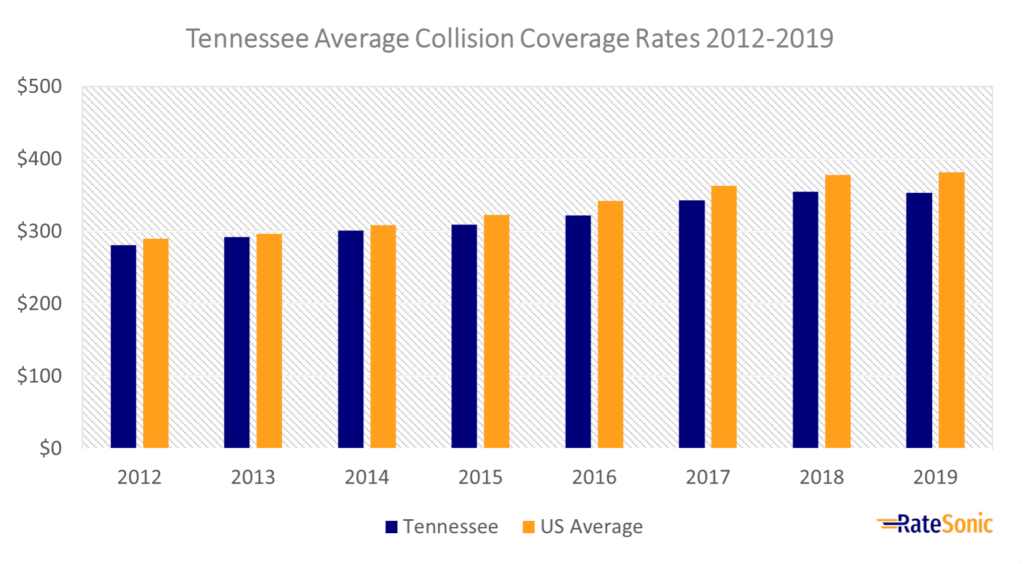

Average Collision Rates

In the graph below, you can see the change in average Tennessee collision insurance rates from 2012 to 2019. In the seven years, prices for this coverage went up by 36%, going from $280 in 2012 to $353 in 2019.

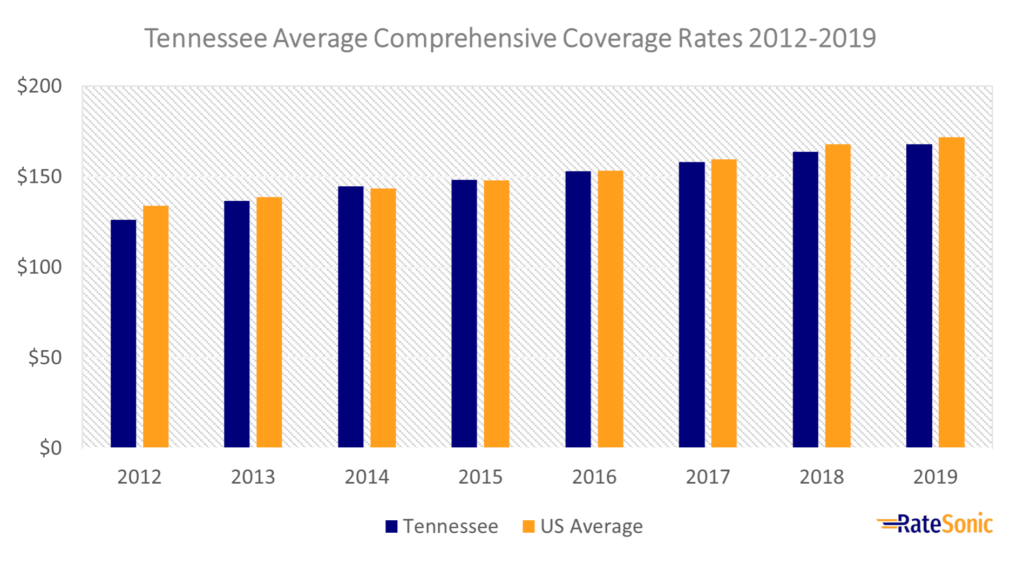

Average Comprehensive Coverage Rates

The graph below displays Tennessee’s comprehensive insurance rates from 2012 to 2019. Prices increased by 33% during this period, going from $126 in 2012 to $168 in 2019.

Tennessee might enjoy lower comprehensive costs had motor vehicle theft not exploded in recent years. Per the FBI’s Uniform Crime Data Crime Explorer, stolen car numbers have nearly doubled since 2013. This increases the number of claims in the state. As a result, insurers raise prices for everyone.

Why Do Rates Keep Increasing?

Did your rates go up for no reason? There are many reasons why this could happen. Premiums in Tennessee have continued to climb for the past ten years. Inflation is a major factor here. As the cost of auto repairs, medical bills, and other expenses go up, so do premiums. You’re also at the mercy of all of the other drivers around you. Your rates will go up if there are too many claims in your area.

Even though car insurance rates are going up, there are ways to curb this for yourself. It’s a good idea to compare quotes to be sure you’re getting the best deal. You can also search for more discounts to qualify for so you can get cheaper rates.

Minimum Auto Insurance Requirements

Nearly every state requires car insurance. You must meet the state’s minimum requirements before you can legally get behind the wheel. Below are the minimum requirements your policy must meet or exceed:

Liability Insurance

To drive in Tennessee, all you need on your policy is liability insurance. This helps cover any expenses you cause in an accident to another party. The state requires you to carry at least:

- $25,000 of bodily injury liability (BIL) for each injury or death per accident

- $50,000 of BIL for total injuries and death per accident

- $15,000 of property damage liability (PDL) per accident

When you look at your state’s requirements, you may see minimum requirements in a shorthand form: “25/50/15.” Each number indicates the amount of coverage, in thousands, that must appear on your policy.

Keep in mind that while only buying the minimum amount of auto insurance satisfies state law, it may not be enough to cover the costs of an accident. The general recommendation is to buy as much coverage as you can afford. A good rule of thumb is to buy bodily injury limits of $100,000 per person and $300,000 per accident.

Tennessee, however, doesn’t require any of the following coverages:

- Uninsured motorist (UM)

- Underinsured motorist (UIM)

- Comprehensive

- Collision

- Personal injury protection (PIP)

- Medical payments coverage (MedPay)

Even though the law doesn’t require UM and UIM, you should consider it. The III ranks Tennessee third for uninsured drivers with 23.7% driving without coverage. If an uninsured driver causes an accident, you may have to cover thousands for any damages and injuries. UM and UIM coverage can help you avoid this situation by covering the costs.

Valid Proof of Insurance

Drivers must keep their ID cards with them at all times. You must show valid proof of an existing policy to law enforcement after an accident, regardless of fault. The information on your card must show that your policy complies with the state’s requirements.

A certificate from the Department of Safety noting a cash deposit or bond in the required amounts will also prove financial responsibility.

Electronic Insurance Verification System

A new computer system is now in place that matches your vehicle registration with your policy from an insurer. Information updates regularly. So, if you don’t have coverage, you’ll get a notice from the Tennessee Department of Revenue.

If you get one of these notifications from the Department of Revenue requesting verification, go to the DriveInsured website and click “respond to your notice.” Follow the instructions to complete the form.

Personal Bond or Cash Deposit

The state’s financial responsibility law doesn’t require you to buy auto insurance. But you still need to prove your financial responsibility. You can do so by sending the following amounts to the Department of Revenue in one of two ways:

- Post a bond of $65,000

- Make a cash deposit of $65,000

Self-Insurance

You have the option of self-insuring if you own 25 or more cars. To do this, you must apply for a certificate and meet the state’s financial requirements.

Penalties for Driving Without Insurance

Driving without auto coverage is illegal just about everywhere. Tennessee is no exception. You must either have the minimum coverage or meet the state’s financial responsibility requirements. If you’re caught driving without coverage, these are the penalties you may incur:

- Class C misdemeanor

- A fine of not more than $300

- Possible towing fees

- Suspension of driver’s license

- Non-renewal of vehicle registration until proof of financial responsibility established

Best Car Insurance Companies in Tennessee

If you’re shopping for car insurance, it’s important that you find the best company. But how do you know which one is the best? Most people want cheap rates; however, to find the best company, it’s key to look at a company’s overall quality. The best providers typically have the following characteristics:

- Competitive rates

- Great customer service

- Lots of agents

- Good benefits and customer loyalty programs

If you need assistance narrowing your search, be sure to visit our article on the best car insurance companies in the country. We rank the top carriers in the nation by overall quality.

Top Companies in Tennessee by Market Share

A good way to find the best car insurance provider in your state is by looking at who owns the most market share. The insurers with the most market share are usually the biggest and most popular in the state. Now, the biggest isn’t always the best, but it’s a good place to start. These are the companies with the most market share in Tennessee:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm | $436,270,789 | 17.98% |

| 2 | Tennessee Farmers Mutual | $367,934,534 | 15.16% |

| 3 | Progressive | $136,590,061 | 5.63% |

| 4 | GEICO | $114,412,399 | 4.71% |

| 5 | Allstate | $97,683,946 | 4.03% |

| 6 | Erie | $73,136,731 | 3.01% |

| 7 | USAA | $50,657,328 | 2.09% |

| 8 | Direct Auto | $45,287,033 | 1.87% |

| 9 | Trexis | $44,988,980 | 1.85% |

| 10 | Safeco | $42,537,358 | 1.75% |

Top Companies in Tennessee by J.D. Power Rating

Another way to find the best company is by looking at its J.D. Power rating. J.D. Power ranks insurers based on overall customer satisfaction scores. Companies that top these rankings have superior customer service and generally happy customers. Below are the top companies by J.D. Power rating in the Southeast Region (includes Tennessee) in 2022:

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | Farm Bureau | 876 |

| 2 | Auto-Owners | 871 |

| 3 | Erie | 868 |

| 4 | Alfa | 862 |

| 5 | Kentucky Farm Bureau | 860 |

| 6 | State Farm | 855 |

| 7 | Nationwide | 850 |

| 8 | Safeco | 847 |

| 9 | North Carolina Farm Bureau | 844 |

| 10 | GEICO | 843 |

Best Companies Based in Tennessee

It may also be a good idea to buy auto insurance from a company based in the state. Regional companies tend to offer benefits to people in the state. Plus, it’s a great way to support local businesses. Here are some of the best companies based in Tennessee:

- Tennessee Farmers Mutual Insurance Company

- Trexis

- Direct Auto

Tennessee Auto Insurance Laws

No-Fault or Fault?

Some states are what many refer to as “no-fault.” This is where a state requires you to carry PIP or MedPay on your policy. These types of coverage protect you and your passengers from injury costs, regardless of fault.

Tennessee is a fault, or tort, state. This means that the at-fault driver in an accident is responsible for all the expenses they cause. The only car insurance coverage required in this state is liability.

Totaled Cars

Insurers typically label your car as a total loss if the cost of the damages is more than the actual cash value (ACV). However, in some states, your car is a total loss if the damages go over a certain percentage of the car’s value. In Tennessee, your car is a total loss if the damages exceed 75% of the car’s total cash value. If the damages are less than this, you’ll receive your vehicle and be able to repair it.

Salvage and Rebuilt Titles

After an insurer declares your car to be a total loss, you may apply for a salvage title if it’s less than ten years old. Vehicles with salvage titles are illegal to drive. This also means you won’t be able to insure a salvaged car. The only way to insure one is to restore it to a safe condition and obtain a rebuilt title.

How to Get a Rebuilt Title

You’ll need to restore your salvage car to a roadworthy condition to get a rebuilt title for it. Then, you can apply for a rebuilt title with the Department of Revenue. Here are the steps to get a rebuilt title in Tennessee:

- Repair the car to a drivable and safe condition

- Have the following on hand for your application:

- Salvage certificate

- Receipts for parts

- Color photos of the car before and after repairs

- The application (see below)

- Payment for fees

- Complete the Application for Motor Vehicle Identification Certification for Rebuilt Vehicles (Form RV-F1315401)

- Pay the $75 fee for converting a salvage document to a rebuilt title

Insuring Cars with Rebuilt Titles

You can insure vehicles with rebuilt titles. However, most insurance companies will only sell you a liability-only policy because the car was once a total loss.

Be aware that insuring a rebuilt car is usually more expensive than normal. Rebuilt cars, while passing inspections, aren’t as safe as normal ones. Be sure to shop around and find the best deal by comparing quotes before you settle on an insurance provider.

Full Windshield Replacement

In some states, like Florida, the law requires insurers to repair your windshield for free. Tennessee doesn’t have any of these laws. This means that you must pay a deductible if you file a comprehensive claim for your windshield.

You can also choose to buy full glass coverage. This will replace your windshield without a deductible, but it costs extra to add to your policy.

Filing Claims

If you end up in a car accident, chances are you’re going to be filing a claim with your insurer. It’s important to file a claim as soon as possible. This helps ensure you get coverage right away.

Insurers strive to make the claims process as easy as possible. You can usually do so either over the phone or online. It’s also common for a carrier to assign a representative to your claim.

What to Expect After Filing a Claim

After you file a claim, you can expect your insurer to settle the claim promptly. However, Tennessee doesn’t list an exact time limit for insurance companies to follow. In general, you should prepare for your the claim investigation process to take up to 30 days.

SR-22 Forms

An SR-22 form certifies that you have the state’s minimum amount of insurance. You may be required to file an SR-22 form if you receive a license or registration suspension. This is typically after a severe offense, such as a DUI or reckless driving. The state can legally require you to keep the form on file for up to five years.

Credit History

A driver’s credit history is a major rate factor. Insurers say that drivers with bad credit file more claims. So, insurers look at your credit score when they’re setting your rates. This means that if your credit rating is poor, you could end up paying extra for coverage in The Volunteer State.

Policy Cancellation

You or the insurer may cancel your policy if it’s been in force for less than 60 days. After 60 days, it can’t cancel your policy unless it has at least one of the following reasons:

- Missed payments

- Misrepresentation or fraud

- Violating the terms of the policy

- The insured has a felony, license suspension, or other valid offense

- The insured vehicle is unsafe or used in a matter that violates the policy terms (commercial or emergency services)

When you miss a payment, you may still be able to reinstate your policy. If you call your insurer right away, you could get an extension or be able to pay within a grace period. Not paying within the grace period could result in a lapse. After a lapse, reinstatement is very difficult or even impossible.

Drunk Driving Laws

It’s against the law to drive while under the influence of drugs and alcohol. If the police catch you with a blood alcohol content (BAC) of 0.08 or higher, you can receive a DUI conviction.

The penalties for a DUI in Tennessee are severe. And, after it’s all said and done, a drunk driving conviction will cost you tons of money. After each offense, the penalties get worse. Here’s what’ll happen after each DUI conviction:

First Offense:

- Up to 11 months in jail

- If BAC is 0.20 or over, offenders will receive a minimum of seven consecutive days in jail

- One-year license suspension

- Mandatory drug and alcohol treatment program

- Mandatory restitution to any victims

- $350 to $1,500 fine

- Ignition interlock device (IID) installation at your expense

Second Offense:

- Up to 11 months in jail

- $600 to $3,500 fine

- Two-year license suspension

- Potential vehicle-seizure

- Mandatory drug and alcohol treatment program

- Mandatory restitution to any victims

- IID installation at your expense

Third Offense:

- Up to 11 months in jail

- $1,100 to $10,000 fine

- Six-year license suspension

- Potential vehicle-seizure

- Mandatory drug and alcohol treatment program

- Mandatory restitution to any victims

- IID installation at your expense

Fourth and Future Offenses

- Class E Felony

- One year in jail

- $3,000 to $15,000 fine

- Eight-year license suspension

- Potential vehicle-seizure

- Mandatory drug and alcohol treatment program

- Mandatory restitution to any victims

- IID installation at your expense

How a DUI Affects Car Insurance

Getting a DUI doesn’t just cause legal trouble. It can also impact your auto insurance in a big way. Your rates are sure to skyrocket afterward. Insurers will also view you as a high-risk driver. This means that some providers may even deny you a policy. If this is the case, you may need to buy from non-standard companies or join a state-assigned risk pool.

Driver’s License Points System

Tennessee uses a driver’s license points system to keep track of moving violations on your record. If you rack up too many points, the state will suspend your license. For adults, you’ll lose your license for six months to a year if you get 12 points within 12 months. If you’re under 18 years old, all you need to lose your license is six points in 12 months.

You’ll receive points on your record for moving violations, such as speeding and running red lights. Depending on a violation’s severity, it can be worth more points than others. Below are examples of moving violations and how many points they’re worth:

- Speeding 1-5 mph over– 1 point

- Speeding 6-15 mph over – 3 points

- Improper passing – 4 points

- Reckless driving – 6 points

- Passing a school bus while it’s stopped – 8 points

Most Popular Cars

Each state has a different set of most popular cars. These are the cars that are most desired and, potentially, the most targeted by thieves. Here were Tennessee’s most-sold cars in 2021:

- Ford F-Series

- Chevrolet Silverado

- Ram 1500/2500/3500

- Honda CR-V

- Nissan Rogue

Most Stolen Cars

Insurers keep a close watch on which cars are targeted most by thieves. Owning a car that thieves often steal can result in higher rates. These were the state’s most stolen vehicles in 2021:

- 2006 Ford Pick-Up (Full Size)

- 2005 Chevrolet Pick-Up (Full Size)

- 2015 Nissan Altima

- 2003 Honda Accord

- 2000 Honda Civic

- 2018 Toyota Camry

- 2004 GMC Pick-Up (Full Size)

- 2020 Chevrolet Malibu

- 1998 Dodge Pick-Up (Full Size)

- 2008/2006 Chevrolet Impala