Ohio Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Ohio.

- Sean Canonica

- Updated March 20, 2024

Ohio is the seventh-largest state in the country. It’s known by many for its Pro Football and Rock and Roll halls of fame. As of 2020, there were about 8.1 million drivers in the Buckeye State. But even with all these drivers on the road, residents enjoy cheaper than average car insurance rates.

In this article, we’ll break down everything you need to know about car insurance in Ohio. This includes taking a deep dive into how rates here stack up against the national average. We’ll also outline and thoroughly explain state coverage requirements and laws.

Table of contents

Ohio Average Car Insurance Rates

Your state’s average auto insurance rates are good to look at from time to time. They can help you find out if you’re paying too much each month for your policy. Then, you’ll know if you need to seek out a better deal or stick with your current company.

The table below shows average rates in Ohio for each type of car insurance. Premiums here are lower than they are nationally. Drivers here pay $22.31 less than in the rest of the country.

| Coverage | Ohio Average | US Average |

|---|---|---|

| Liability | $447.86 | $650.35 |

| Collision | $305.55 | $381.43 |

| Comprehensive | $131.37 | $171.87 |

| Full Coverage | $802.72 | $1,070.47 |

| Price Per Month | $66.89 | $89.20 |

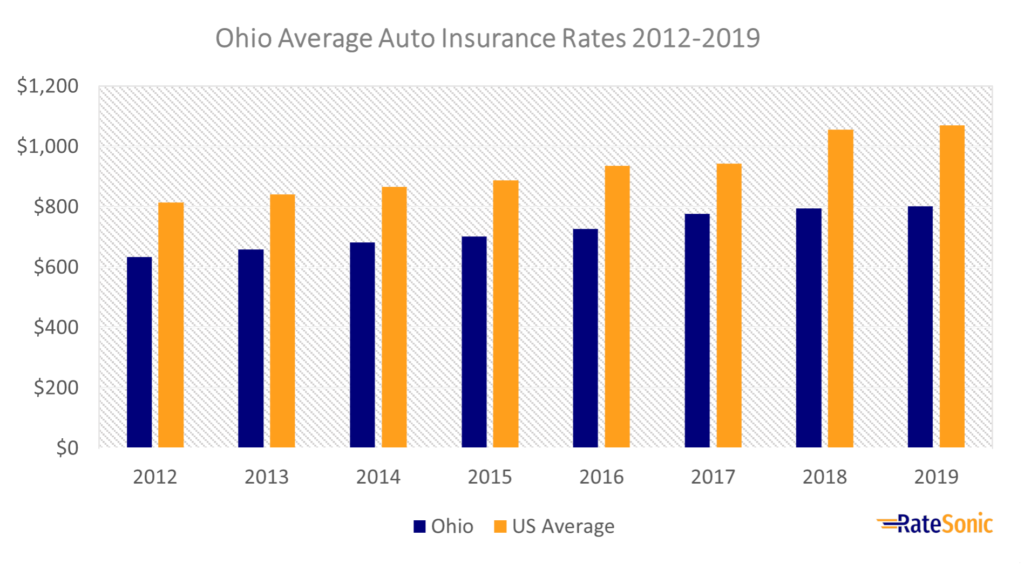

Average Full Coverage Rates

The graph below shows the change in average full auto coverage rates from 2012 to 2019. Premiums here rose from $634 in 2012 to $802 in 2019. This was an increase of $160, or 26%. This is surprising given that Ohio’s at-fault accident rate is 20% higher than the national mean.

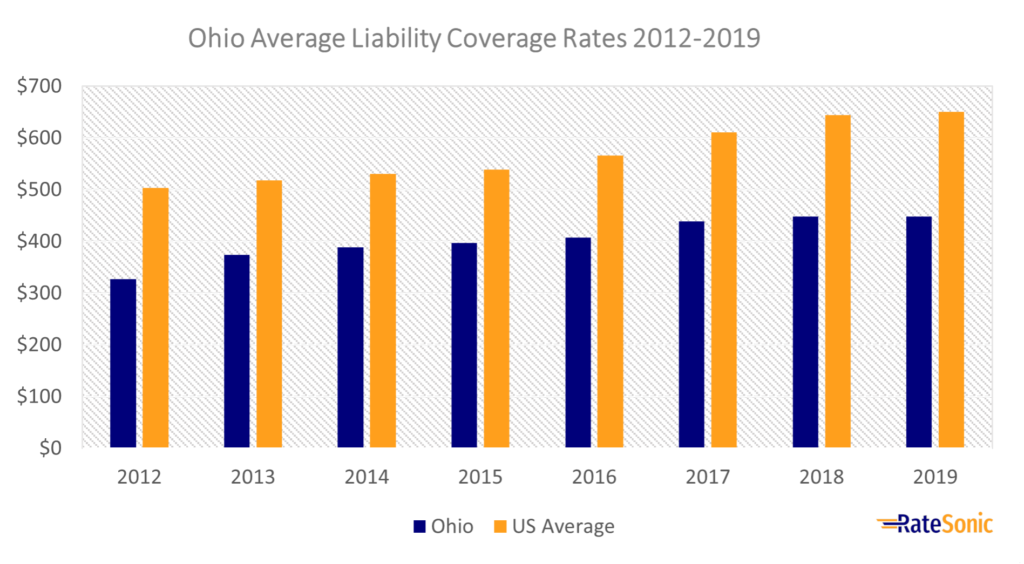

Average Liability Rates

The graph below displays Ohio’s average liability insurance costs from 2012 to 2019. Rates for this coverage here rose from $326 in 2012 to $447 in 2019. This was an increase of $121, or 37%.

Despite, this increase, liability rates have remained lower than the national average. This may be because Ohio’s auto repair costs are among the lowest in the country. A 2019 study by CarMD found that the state ranked 50th for fixing cars. This means that claims will, in general, cost less for insurers here because it’s cheaper to repair cars.

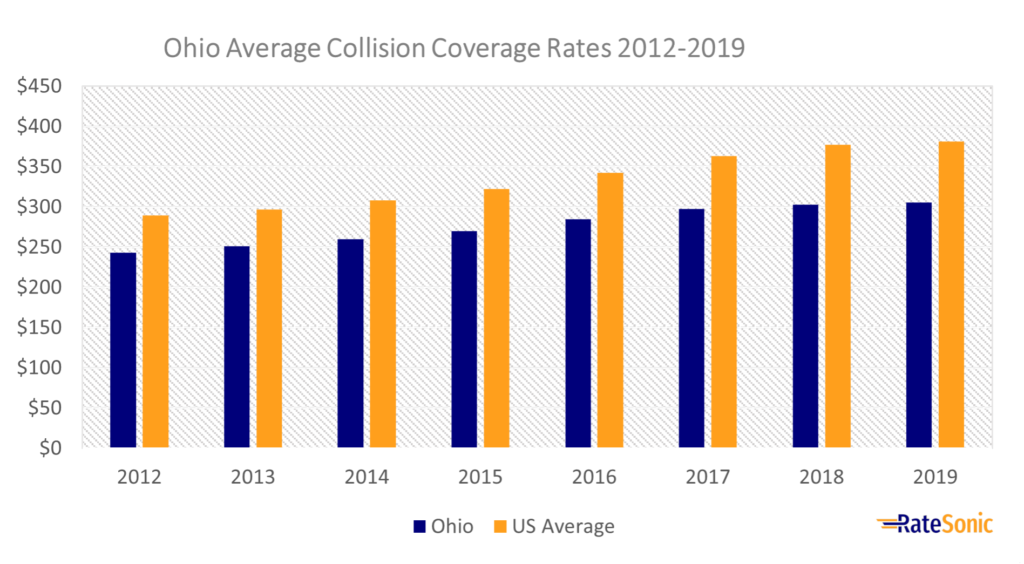

Average Collision Rates

Below is a graph that shows the average Ohio collision insurance rates from 2012 to 2019. Prices here rose from $243 in 2012 to $305 in 2019. This was an increase of $62, or 25%. However, the cost of this coverage stayed far below the national mean.

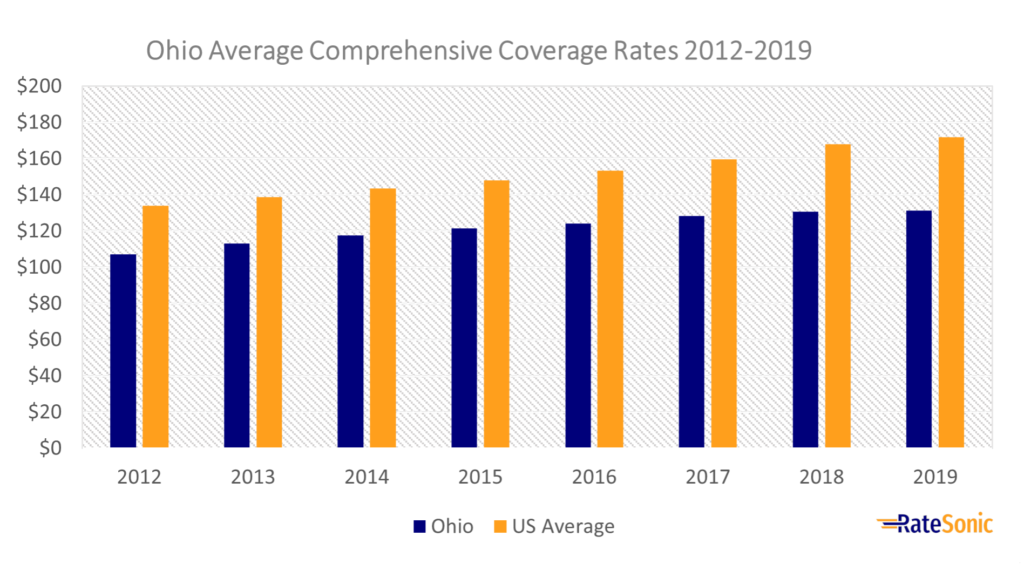

Average Comprehensive Rates

In the following graph, you can see the change in average Ohio comprehensive insurance costs from 2012 to 2019. Note that rates for this coverage increased $24 from 2012 to 2019. Prices went from $107 in 2012 to $131 in 2019.

Why Do Rates Keep Increasing?

Insurance rates in Ohio and every other state are likely to keep going up. This could be due to many reasons; however, inflation is the major culprit here. As inflation impacts the rest of the economy, prices are bound to rise.

Also, people are driving more and getting into more accidents. This results in more claims, which raises everybody’s premiums.

So, how do you get around constantly increasing prices? It’s important to shop around and compare quotes. That’s the best way to get the cheapest rates.

Minimum Auto Insurance Requirements

Car insurance is required in most states (the only exceptions are Virginia and New Hampshire). Every state has a unique set of minimum requirements that drivers must follow, including the types of coverage and how much of each you need on your policy.

Liability Insurance

The only coverage that Ohio requires is basic liability auto insurance. This covers any expenses that you cause in an accident. To legally drive, your minimum limits must be at least:

- $25,000 of bodily injury liability (BIL) for injury or death of one person

- $50,000 of BIL for injury or death of two or more people

- $25,000 of property damage liability (PDL) in an accident

You will sometimes see minimum liability requirements written in shorthand form: “25/50/25.” This indicates how much of each coverage, in the thousands, you need.

Keep in mind that state requirements are just the bare minimum amount you need to drive. But accident costs can often go far beyond the minimum limit requirements. The auto insurance industry generally recommends bodily injury limits of $100,000 per person and $300,000 per accident.

Uninsured and Underinsured Motorist (UM and UIM)

Uninsured motorist (UM) and and underinsured motorist (UIM) provide coverage when you’re involved in an accident with another driver that either has no insurance or not enough to pay for injuries and damages.

The State of Ohio has made UM and UIM optional. Even so, when getting a quote for a new policy, insurers may offer both to you. But, as UM and UIM are not required, you can refuse to add them to your policy.

Before refusing this insurance coverage when shopping for a new policy, consider that Ohio ranks 21st for uninsured drivers. Per the III, an estimated 13% of motorists drive without coverage. UM and UIM will protect you from having to cover any accident expenses out of pocket and it is relatively cheap to add to your policy.

Valid Proof of Insurance

Ohio requires that drivers carry proof of coverage with them at all times. Failing to show proof at a traffic stop or the scene of an accident results in severe penalties. One way to show proof is to keep your policy with you and show that when the police ask for it. But it’s more convenient to carry an ID card with you.

State law says that any insurer selling policies in the Buckeye State must provide you with an ID card that you can show to law enforcement. Insurance ID cards must include the following to be valid:

- Policyholder’s name as it appears on the policy

- The policy’s effective date and expiration date

- Name of issuing company and policy number

- The words “Financial Responsibility Identification Card” or “Insurance Identification card” or something similar

- Vehicle VIN, year, make, and model. If the policy covers more than five vehicles, use the word “Fleet” instead

State law allows logos and other information on ID cards. It’s fine if your card contains more information than needed. But the required information must appear on the card or it’s invalid.

Note that that law permits both plastic and paper ID cards. Digital copies on your mobile device are also valid. Be sure to check with your insurer about how to get an ID card on your phone. This is an easy way to avoid being caught without valid proof.

Keep in mind that drivers using a personal bond or self-insurance certificate must keep proof with them as well. Also, make sure your proof is with you in court in case you need to present it.

Personal Bonds and Certificates

Many drivers don’t want to use a standard insurance company for financial responsibility (FR). Ohio gives you two ways to comply with the law without a policy:

Surety Bonds

You may use a surety bond as a means for FR. You have two options for depositing bonds with the Ohio BMV for FR:

- $30,000 surety bond issued by an authorized surety or insurer

- $60,000 BMV bond secured by real estate worth the same amount

BMV Certificates

Another way to carry enough Financial responsibility for your car is to receive a certificate from the BMV. This is where you deposit enough money to serve as FR for your car. You have two options for using certificates to prove FR:

- $30,000 BMV Certificate for money or government bonds on deposit with the Ohio Treasurer of State

- A BMV Certificate of self-insurance is available to drivers or businesses owning at least twenty-six motor vehicles

Penalties for Driving Without Insurance

It’s against the law to drive without car coverage. Any driver who fails to show proof of financial responsibility (FR) when asked by law enforcement or a judge will face the following penalties:

First Offense

- Loss of driver’s license until you meet the state requirements

- You must surrender your driver’s license plates and registration

- $100 Reinstatement fee

- $50 penalty for any failure to surrender license, plates, or registration

- Maintain an SR-22 for high-risk coverage for three years

If the police catch you with your license suspended, your vehicle gets immobilized, and you will need to surrender your registration for 30 days.

Second Offense

- Loss of driver’s license for one year

- You must surrender your driver’s license plates and registration

- $300 Reinstatement fee

- $50 penalty for any failure to surrender license, plates, or registration

- Maintain an SR-22 for high-risk coverage for five years

If you’re caught driving with your license suspended, your vehicle gets immobilized, and you will need to surrender your registration for 30 days.

Third and Further Offenses

- Loss of driver’s license for two years

- You must surrender your driver’s license plates and registration

- $100 Reinstatement fee

- $50 penalty for any failure to surrender license, plates, or registration

- Maintain an SR-22 for high-risk coverage for five years

The penalties for driving without coverage become severe after the third conviction. First, the state confiscates your vehicle and auctions it off. Then you’ll lose the ability to register any vehicle within the state for five years.

Best Car Insurance Companies in Ohio

When you’re shopping for a new policy, it’s smart to weigh your options and find the best car insurance company overall. To find the one that suits your needs, it’s a good idea to compare companies head-to-head to get the overall picture. The best insurers are ones that put the customer first. This includes having features like:

- Great customer service

- Competitive rates

- Plenty of benefits, such as discounts and customer loyalty programs

Top Companies by Market Share

To find the best insurer, it’s a good idea to see who dominates the market share in the area. These companies are usually the most popular and biggest in the state. Their popularity doesn’t necessarily make them the best, but it’s a good place to start to find who people buy from. Here’s a list of the top auto insurers in Ohio by market share percentage in 2021:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | Progressive | $720,127,000 | 19.33% |

| 2 | State Farm | $591,119,000 | 15.87% |

| 3 | Allstate | $404,348,000 | 10.86% |

| 4 | GEICO | $347,206,000 | 9.32% |

| 5 | Nationwide | $215,425,000 | 5.78% |

| 6 | Liberty Mutual | $196,111,000 | 5.27% |

| 7 | Grange | $166,909,000 | 4.48% |

| 8 | Erie | $132,170,000 | 3.55% |

| 9 | American Family | $114,031,000 | 3.06% |

| 10 | USAA | $105,926,000 | 2.84% |

Top Companies by J.D. Power Rating

Another way you can find the best insurer in Ohio is by looking at the companies with the highest customer satisfaction. J.D. Power ranks carriers based on their customer satisfaction score. Below are the top companies in the North Central region (including Ohio) of the US by J.D. Power rating (USAA is not part of this data because it didn’t fit J.D. Power’s criteria):

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | Erie | 857 |

| 2 | State Farm | 851 |

| 3 | COUNTRY | 850 |

| 4 | MetLife | 849 |

| 5 | American Family | 844 |

| 6 | Auto-Owners | 842 |

| 7 | Progressive | 842 |

| 8 | GEICO | 837 |

| 9 | The Hanover | 836 |

| 10 | Liberty Mutual | 831 |

Best Companies Based in Ohio

Ohio has several insurance companies that are based locally. This would be a good option if you want to support local businesses. Also, local providers typically have benefits programs exclusive to residents in the area. Here are the top insurers based in-state (in no order):

- State Farm

- Progressive

- Nationwide

- Grange Mutual

- Cincinnati Financial

Ohio Auto Insurance Laws

No-Fault or Fault?

Many states are what the insurance world calls no-fault. These are states that require drivers to buy personal injury protection (PIP) to cover their injuries from an accident regardless of fault.

Ohio isn’t a no-fault state. It’s what many call a fault or tort state. This is where the at-fault driver in an accident is held responsible for all expenses. For this reason, state law requires drivers to carry a minimum amount of liability to protect drivers who weren’t at fault.

Totaled Cars

Your car becomes a total loss when its damages cost more than its actual cash value (ACV). However, each state sets criteria for when a car becomes a total loss. Some states declare a car a total loss if the damages reach a certain percentage of the car’s value. Ohio, on the other hand, uses the total loss formula to determine whether a car is totaled or not. With the TLF, a car is a total loss if its damages and salvage value cost more than the ACV.

Salvage and Rebuilt Titles

After your car becomes a total loss, it’ll receive a salvage title from the state. Salvage title cars have severe damage and are illegal to drive. For this reason, you can’t insure a salvage car. The only way to drive a vehicle with a salvage title is to restore it to a safe condition and then obtain a rebuilt salvage title from the Ohio BMV.

How to Get a Rebuilt Salvage Title

To get a rebuilt title for your restored salvage car, you need to follow a specific process. First, you’ll need to restore your car to a drivable condition making sure to keep receipts for all parts you use. Then you can schedule an inspection with the Ohio Vehicle Inspection Gateway. Here’s what you’ll need for the inspection:

- Ohio BMV issued prepaid inspection receipt

- A State-issued ID, such as a driver’s license or passport

- Salvage title with the car owner’s name on it

- Original receipts for all car parts used in restoration (for used parts, you also need the Donor Vehicle’s VIN)

- Receipts for parts that came via a “casual sale by an individual or business”

After your restored car passes a state inspection, it should receive a rebuilt title. Keep in mind that you’ll need to pay all the fees associated with getting a new title for your car.

Insuring Cars with Rebuilt Salvage Titles

You should have no trouble finding insurance coverage for a rebuilt salvage title once the state rebrands your vehicle. Be aware that insurers may only sell you a liability-only policy. Full coverage is usually off the table. You can also expect to pay higher rates. That’s because your rebuilt salvage car may be street-legal, but its claims history will follow it forever. We recommend shopping around and comparing quotes for the best deal possible.

Full Windshield Replacement

In some states, insurers must repair your windshield damage without requiring a deductible. But Ohio has no such law. This means that if you file a comprehensive coverage claim for any windshield damage, you must pay a deductible.

Some insurers will let you add full glass coverage to your policy at an extra cost. By doing so, glass repairs will not have a deductible. But remember that it will add to your monthly rates, so it isn’t truly a free repair.

SR-22 Forms

Ohio requires drivers with severe violations, such as a DUI or driving without coverage, to file an SR-22 form. SR-22 forms certify that you have the minimum amount of coverage on your policy. You’ll only need to file an SR-22 form if a court or other state authority orders you to do so. Your insurer should be able to file the form for you. Be sure to speak with your provider about how to file an SR-22 form through them.

Filing Claims

After a car accident damages your car, you’ll need to file a claim. Even if you don’t, it’s always a good idea to let them know about the collision. Each state has rules for how you and your insurer should handle the claims process. This includes how long an insurance company has to settle your claim and the deadline for you to file one.

How Long Do Insurers Have to Settle a Claim?

Insurers need to settle your claim by a certain deadline. Providers have 46 days to settle claims. Here’s how the deadline breaks down:

- 15 days to acknowledge that they’ve received the claim

- 21 days to accept or deny the claim

- 10 days to pay you

How Long Do You Have to File a Claim?

Residents also have responsibilities to be aware of with claims. The state doesn’t set a specific time limit for filing claims. However, your insurance provider will more than likely have deadlines for you to follow. It’s always best to report an accident as soon as possible. Be sure to check with your insurer to see how long you have to file a claim.

Credit History

Insurers often use your credit score as a rate factor. Some states, such as California, don’t allow this practice. But Ohio isn’t one of those states. Insurance companies may use your credit score as a way to choose your rates. Providers can also use your credit score to decide whether they want to offer you a policy or not.

Policy Cancellation

An insurer may not cancel your policy after 90 days unless there’s a good reason to do so. Reasons for policy cancellation include:

- Not paying your premium

- Committing fraud or misrepresenting information

- Becoming a high-risk driver (offenses such as DUIs and at-fault accidents can cause this)

- Attempting to hide hazardous or immoral info about yourself

Reinstating your policy is still possible after a cancellation due to a missed payment. This’ll require you to call your provider ASAP and explain the situation. You’ll also need to pay what you owe. Most insurers give you a grace period to pay. But if you wait too long, your coverage will lapse, resulting in higher rates and difficulty getting insurance.

Price Optimization

It’s a common practice for insurance companies to use “price optimization” to set rates for consumers. This is where providers raise your prices just high enough before you go elsewhere for a better deal. Ohio bans insurers from using price optimization. More specifically, carriers may not use factors “unrelated to risk” to change your rates.

Drunk Driving Laws

Drunk driving is a dangerous decision. It can put yourself and others in harm’s way. You can also find yourself drowning in legal trouble after the fact. In Ohio, you’re guilty of a DUI or operating a vehicle under the influence (OVI) penalty when:

- Your blood alcohol content (BAC) is 0.08 or above

- You’re impaired

- You have cocaine, heroin, marijuana, methamphetamine, amphetamine, PCP, or other illegal substances in your body

Getting a DUI/OVI comes with serious consequences. After each offense, penalties get even more severe. Here’s what happens when you get a DUI/OVI:

First offense:

- Up to $1,075 in fines

- License suspension of up to three years

- Jail time of three to six days

Second offense:

- Up to $1,625 in fines

- License suspension of up to seven years

- Jail time of up to six months

Third offense:

- Up to $2,750 in fines

- License suspension of up to 12 years

- Jail time of up to one year

Keep in mind that getting a DUI/OVI won’t only cause you trouble with the law, but it can affect your coverage. Your rates are sure to go sky-high. Insurers may also label you as a high-risk driver, making it hard for you to get insurance coverage. If this happens, you may need to turn to state-assigned risk pools or non-standard policies.

Driver’s License Points System

Ohio uses a driver’s license points system to keep track of moving violations on your record. After you reach a total of 12 points in two years, the BMV will suspend your license for six months. But to reinstate your license, it’s not as simple as waiting out the suspension. Here’s how to get your license back:

- Attend and complete a remedial driving course

- File an SR-22 form

- Pay a fee to reinstate your license

- Take a new driver’s license test

Most Popular Cars

The most popular cars differ based on the state. Carriers keep a close watch on which cars are the most popular. This is because they’re the most desired cars, but they may also be a target for crooks. Below were the state’s most popular cars in 2021:

- Ram 1500/2500/3500

- Honda CR-V

- Chevrolet Silverado

- Ford F-Series

- Honda Civic

Most Stolen Cars

Insurers also pay attention to which cars were the most stolen in each state. These cars are often a target for thieves. As a result, owning one of these could cause your comprehensive rates to be higher than average. These were Ohio’s most stolen vehicles in 2021:

- 2004 Ford Pick-Up (Full Size)

- 2020 Chevrolet Pick-Up (Full Size)

- 2003 Honda Accord

- 2016 Honda Civic

- 2010 Chevrolet Malibu

- 2012 Ford Fusion

- 2008 Chevrolet Impala

- 2020 Toyota Camry

- 2019 Jeep Cherokee/Grand Cherokee

- 2020 Nissan Altima