New Jersey Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in New Jersey.

- Brandon Canonica

- Updated March 20, 2024

New Jersey, otherwise known as the Garden State, is one of the biggest states in the Northeast. Close in proximity to the New York metropolitan area, the population is dense and growing. This is especially true in cities such as Newark and Jersey City.

More people also means more drivers on state roads. There are roughly 6 million registered drivers, which makes up over half of the state’s population. In both big cities and the suburbs, it’s important to have protection from accidents and damage. Because of this, the State of New Jersey requires all drivers to have car insurance coverage.

This article will break down car insurance in New Jersey. This includes basic state requirements, important laws, and the average cost of premiums. We’ll also help you find the best companies in the state.

Table of contents

New Jersey Average Auto Insurance Rates

A good starting point when you’re shopping for a new policy is looking at average rates in your state. This can give you a sense of what other residents pay, and, in turn, can help you get a ballpark of what you should end up paying.

Of course, many factors, such as age and zip code, go into each person’s premium costs. Therefore, keep in mind that you could end up paying less than the average or more in some cases.

The table below shows the average car insurance rates for New Jersey, relative to the average for the US. On average, New Jerseyans pay much more for their premiums than the rest of the nation.

| Coverage | New Jersey Average | US Average |

|---|---|---|

| Liability | $958.31 | $650.35 |

| Collision | $422.29 | $381.43 |

| Comprehensive | $129.97 | $171.87 |

| Full Coverage | $1,395.53 | $1,070.47 |

| Price Per Month | $116.29 | $89.20 |

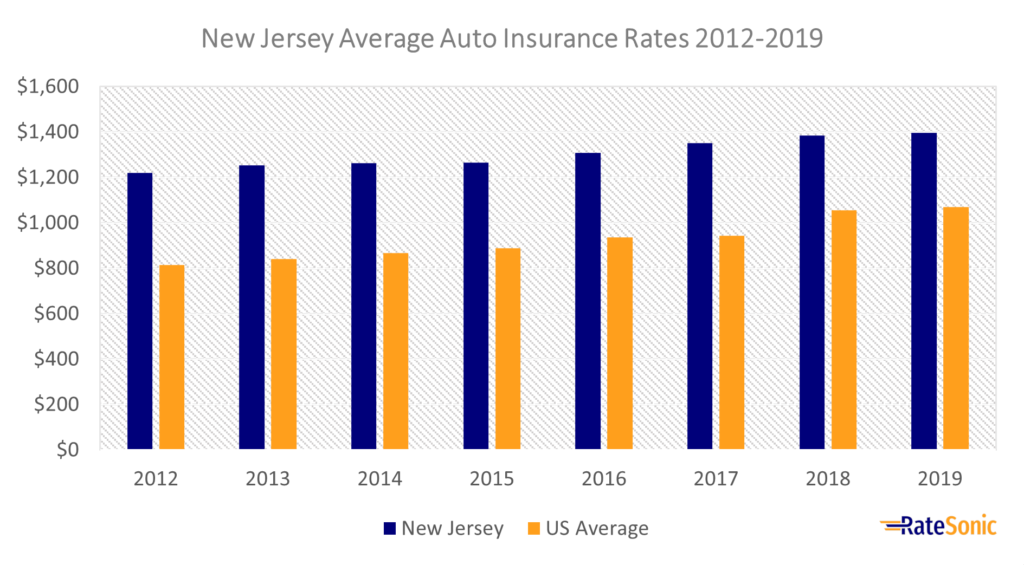

Average Full Coverage Rates

The graph below shows the change in average New Jersey full coverage rates from 2012 to 2019. Premiums here rose from $1,219 in 2012 to $1,395 in 2019. This was an increase of $166, or 14%. The good news is that, while auto insurance is still very expensive here, prices have risen slowly in recent years. So slowly, that residents can celebrate the fact that policies in the Garden State went from the most expensive in the nation to the sixth.

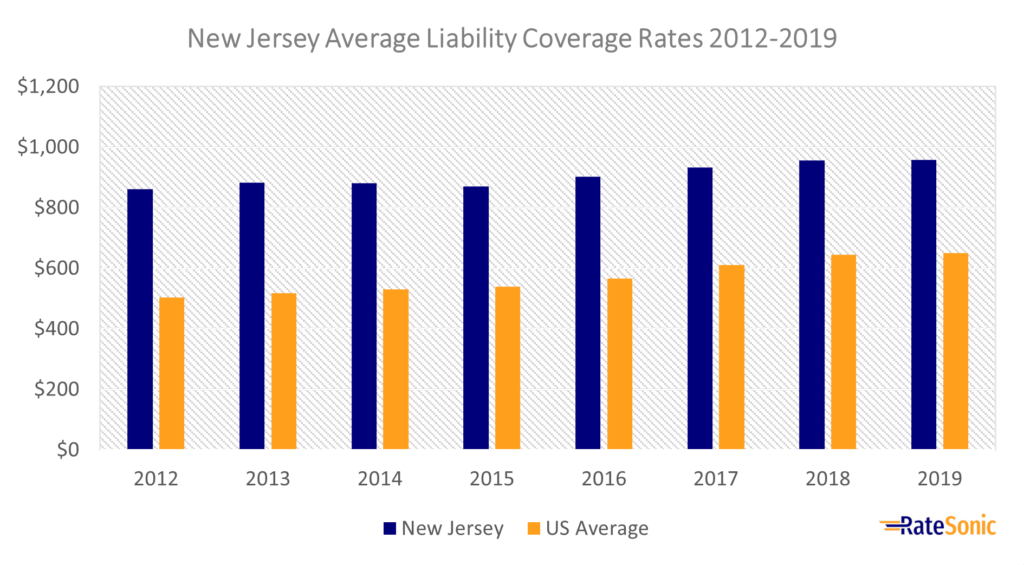

Average Liability Rates

The following graph shows the change in average New Jersey liability insurance rates from 2012 to 2019. Prices rose from $860 in 2012 to $958 in 2019. This was an increase of $98, or 11%. Each year, New Jersey has had the most expensive liability coverage the country.

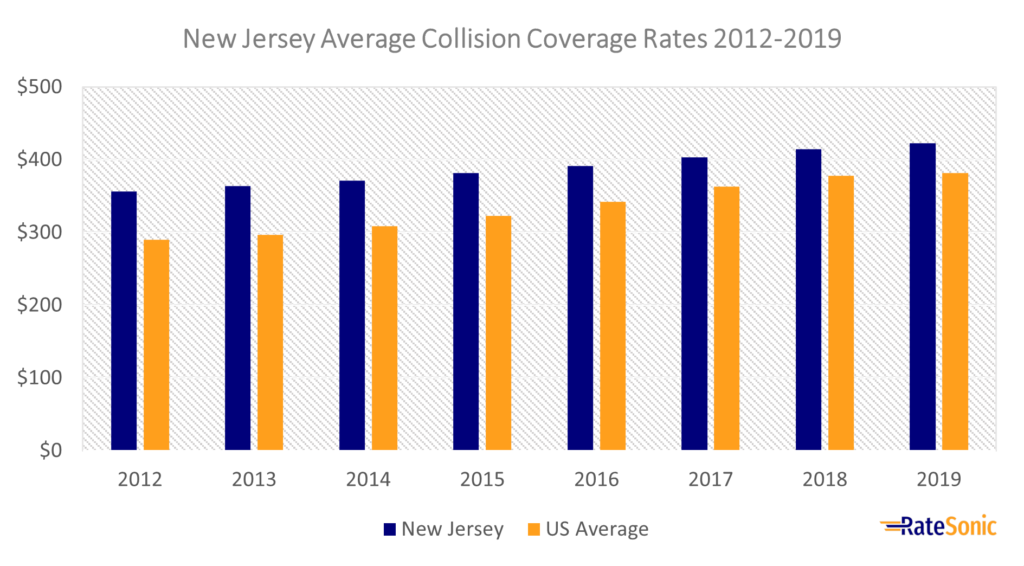

Average Collision Rates

The graph below shows the change in average New Jersey collision insurance rates from 2012 to 2019. Prices rose from $356 in 2012 to $422 in 2019. This was an increase of $66, or 18%.

You can see that New Jersey consistently sees higher collision rates than the US average. One explanation for this could be the state’s high average car repair costs. A 2019 CarMD study ranked this state fourth for most expensive vehicle repairs.

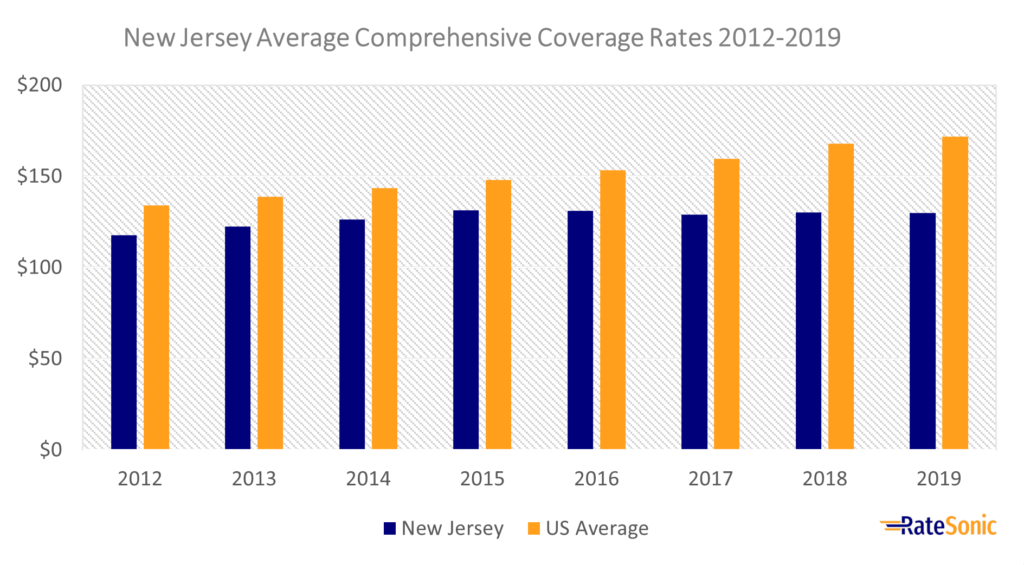

Average Comprehensive Rates

The graph below shows the change in average New Jersey comprehensive insurance rates from 2012 to 2019. Prices rose from $117 in 2012 to $129 in 2019. This was an increase of $12, or 10%. Unlike collision and liability, state residents pay below average for comprehensive coverage.

New Jersey Minimum Auto Insurance Requirements

New Jersey isn’t alone in requiring car insurance. Almost every state requires at least liability coverage, except New Hampshire and Virginia. Each state sets basic requirements. This includes:

- The types of coverage you need to have

- How much of each coverage is required

Liability Coverage

State law mandates liability insurance limits of at least “15/30/35,” or:

- $15,000 of bodily injury liability (BIL) for one person

- $30,000 of bodily injury liability (BIL) for two or more persons

- $35,000 of property damage liability (PDL) for any one accident

It’s always important to remember that your state’s minimum is just that, the minimum. Just meeting the most basic coverage limits is not the best idea for most people. Accidents can cost a large chunk of money and could set you back a lot of income if your policy can’t cover it. Most in the auto insurance industry recommend buying as much coverage as you can afford to ensure the most protection.

Personal Injury Protection (PIP)

State law also requires personal injury protection (PIP). This coverage takes care of medical-related costs for you or your passengers after a car accident. This includes anything from hospital bills, lost wages, and even funeral costs. It kicks in regardless of who was at fault. You may also hear PIP referred to as no-fault insurance.

Uninsured and Underinsured Motorist (UM and UIM)

Uninsured (UM) or underinsured (UIM) motorist coverage isn’t required. However, despite having the lowest percentage of uninsured drivers in the country at 3.1%, it’s generally a good idea to add it to your policy. It’s never good if you get into an accident with someone who either doesn’t have any insurance or doesn’t have enough of it. UM and UIM coverage can help protect you from these drivers.

Standard vs. Basic Policies

There are two types of policies available in New Jersey, standard and basic. A standard policy offers many options, along with the choice to add extra protection. On the other hand, a basic policy is more affordable but includes much less coverage.

Below is what you’ll find in a standard policy:

- Bodily injury liability (BIL) with minimum coverage limits of at least $15,000 per person and $30,000 per accident

- Property damage liability (PDL) with minimum coverage limits of at least $5,000 per accident

- Personal injury protection (PIP) with minimum coverage limits of at least $15,000 per person or accident

- Optional uninsured (UM) and underinsured (UIM) motorist coverage

- Optional collision and comprehensive coverages

Below is what you’ll find in a basic policy:

- Property damage liability (PDL) with coverage limits of $5,000 per accident

- Personal injury protection (PIP) with coverage limits of $15,000 per person or accident, and $250,000 for certain injuries

- Optional collision and comprehensive coverages

Valid Proof of Coverage

The law requires all drivers to carry proof of auto insurance with them while driving any vehicle. You must be able to provide this proof to the authorities if they ask you for it. The New Jersey Motor Vehicle Commission (MVC) warns that, if you can’t prove you have a policy, you can expect to pay a fine or even have your license suspended.

You can prove that you have coverage with a physical ID card or digitally on your smartphone or tablet. If you use a paper card, it must be between 3 inches by 5 inches and 5.5 inches by 8.5 inches. It also must be on white card stock paper that’s 20 pounds in weight.

Proof of insurance must include:

- The name and code of your company

- The address and name of the company or office that issued your ID card

- Policy number

- Policy effective and expiration date

- Name and address of each driver

- Policy limits or a statement that the policy meets the required minimum amounts of liability

- Make, model, and VIN of each vehicle

- A title that says “State of New Jersey Insurance Identification Card”

- The address your carrier gave for notification of the commencement of medical treatment

Self-Insurance

You can self-insure your cars. However, it can be rather expensive and has some lofty requirements. For starters, you’ll have to prove that you have enough money to cover an accident if one occurs. You must also have 25 or more vehicles registered in your name.

To self-insure, you need to:

- Send the state copies of your audited financial statements for the previous three years

- Send a $1,500 check to the “State Treasurer of New Jersey”

- Apply for a certificate of self-insurance with a $1,000 fee

Penalties for Driving Without Coverage

Driving without insurance can put you in serious legal trouble. The following are the penalties you’ll face if you’re caught driving without coverage:

- Fine of $300 to $1000

- Community service

- License suspension of up to one year

Note that more severe penalties will occur after a second or subsequent conviction.

Best Car Insurance Companies in New Jersey

It can be overwhelming to find the right auto insurance company. There are so many of them and, often, they all have unique pros and cons. One way you can narrow your search is by trying to find the best companies in your state. These are usually insurers that offer you the strongest combination of benefits, service, and great rates.

You can find the best insurers in your area by doing research and comparing details about the insurers you’re considering. As an example, it’s common to compare quotes among top providers. Another idea is to look at things like a company’s market share and customer satisfaction rating.

Top Insurers by Market Share

A good way to find the best insurers in New Jersey is by looking at the top ten by market share. This can show you which ones get the most business. The largest insurance companies may not always be the best, but it could be a good sign if they serve a lot of customers.

The following is a list of the top ten auto insurers by market share in New Jersey:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | GEICO | Not available | 21.8% |

| 2 | NJM | Not available | 13.1% |

| 3 | Progressive | $926,295 | 11.6% |

| 4 | Allstate | $836,903 | 10.5% |

| 5 | Plymouth Rock Assurance | $620,745 | 7.8% |

| 6 | State Farm | $612,198 | 7.7% |

| 7 | Liberty Mutual | $557,463 | 7.0% |

| 8 | USAA | $311,141 | 3.9% |

| 9 | Travelers | $289,711 | 3.6% |

| 10 | Farmers | $222,440 | 2.8% |

Top Insurers by J.D. Power Rating

Customer satisfaction is another good thing to look at when you’re trying to find the best auto insurer. J.D. Power releases a yearly ranking of the top insurance companies in each region by customer satisfaction score. New Jersey falls into the “Mid-Atlantic” region, which also includes nearby states such as Pennsylvania, Virginia, and Maryland.

Below were the top auto insurers in the Mid-Atlantic in 2022 by J.D. Power rating (note: USAA didn’t fit the criteria of the study and isn’t on this list):

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | Erie | 867 |

| 2 | Travelers | 860 |

| 3 | State Farm | 851 |

| 4 | NJM | 844 |

| 5 | GEICO | 834 |

| 6 | Allstate | 832 |

| 7 | CSAA (AAA) | 832 |

| 8 | Nationwide | 829 |

| 9 | Liberty Mutual | 827 |

| 10 | Progressive | 827 |

| 11 | The Hartford | 811 |

| 12 | Farmers | 790 |

| 13 | Plymouth Rock Assurance | 789 |

Best Companies Based in New Jersey

You could also try to find a local insurer to do business with. This could be a good idea if you value supporting local businesses. You may also get special benefits or better rates if you go with a regional or local provider. The most well-known provider headquartered in New Jersey is NJM Insurance.

Low-Income Drivers

Every driver in New Jersey must be covered to drive legally. But it can be expensive, and can seem almost impossible to afford if you don’t make much money. Fortunately, New Jersey offers a Special Auto Insurance Policy (SAIP) for residents who might have a hard time buying coverage.

According to the NJ Department of Banking and Insurance (DBI), a SAIP is for people who are eligible for Federal Medicaid with hospitalization. You can pay for a SAIP in one of two ways, either $360 all at once or $365 in two payments. Most insurers in New Jersey offer a SAIP to customers.

What Does SAIP Cover?

SAIP covers emergency medical costs immediately after a car accident. It also covers severe spinal cord or brain injuries up to $250,000 including $10,000 if death occurs. Note that a SAIP doesn’t cover property damage liability, comprehensive, or collision claims.

New Jersey Auto Insurance Laws

No-Fault or Fault?

New Jersey is a no-fault state. No-fault states require all drivers to purchase personal injury protection (PIP) coverage coverage, which takes care of medical expenses after an accident regardless of fault. All drivers must have PIP on their policy.

Totaled Cars

Your insurer will declare your car a total loss if it’s been damaged to the point where its repairs cost more than its actual cash value (ACV). If this happens to you, you can expect to receive a payout from your provider that’s equal to your car’s value immediately before the accident.

Some states allow insurers to total your car if its repair costs fall within a certain percentage of the vehicle’s value. However, other states, including New Jersey, use the total loss formula (TLF). With the TLF, your car becomes a total loss if its salvage value (value after depreciation) and repairs cost more than its ACV.

Salvage and Rebuilt Titles

A car receives a salvage title after an insurer declares it to be a total loss. Since salvaged cars are so badly damaged, they’re illegal to drive. Many insurance companies also won’t cover cars with salvage titles. You typically have a few options if you have a salvage title. You can:

- Sell it or its parts

- Use it for spare parts

- Repair it and apply for a rebuilt title

How to Get a Rebuilt Salvage Title

The only way you can legally drive a salvage vehicle again is if you repair it and get it a rebuilt or operable salvage title. To get a rebuilt salvage title in New Jersey, you must follow these steps:

- Apply for a salvage title:

- Must have your title assigned to an insurer with a New Jersey “sales tax-satisfied stamp”Pay a $60 title fee, and a $25 fee if you send your request ten days after the date of sale on the back of your title. Fill out an insurance listing sheet (Form BA-28) that shows how you got your vehicle

- Fill out a Salvage Title Application (Form OS/SS-61)

- Repair your salvage car completely and take before and after photos, using the Salvage Vehicle Information form as a guide (OS/SS-4)

- Fill out a Salvage Inspection Application (Form OS/SS-3) and send it to a nearby salvage title service location

- Pay a $200 inspection fee via check or money order and send it to a nearby salvage title service location

Note that you must bring all of the above documents to your vehicle inspection. This includes:

- Before and after photos of your car

- Your salvage title

- Any receipts or bills of sale for the parts used for repairs

For more information on getting a salvage title, contact the NJ MVC.

Insuring Cars with Rebuilt Salvage Titles

You should have no trouble finding insurance coverage for a rebuilt salvage title. However, most companies will only give you a liability-only policy. Full coverage is typically not available to cars with a rebuilt title brand. That’s because of the increased risk and high cost of repair.

You can also expect to pay more for a policy if your car has an operable or rebuilt salvage title. This is related to the overall risk of owning a salvage, even if it’s fully repaired. Even so, it might be a good idea to shop around and find a company that offers the best rates for rebuilt cars.

Full Windshield Replacement

In some states, auto insurance providers must replace your windshield with no deductible if it takes damage. New Jersey, however, has no laws requiring insurers to do so. Luckily, comprehensive pays for windshield damage. Keep in mind, though, that you’ll have to pay your deductible.

Filing Claims

Filing a claim is a crucial step after a car accident that caused damage or injury. It’s important to file as soon as possible after an accident to ensure that you remember all the details and can get the coverage you need. You can normally file your claim over the phone or online with most companies.

How Long Does It Take to Settle a Claim?

State regulations sets some rules for how companies deal with customer claims. Insurers must do the following when claims are filed:

- Notify you that they got your claim within ten days and then provide you with the appropriate forms and info you need to complete the claims process

- Start to investigate your claim within ten days of receiving it and should take no longer than 30 days

- Pay you once the investigation is over within ten days. If they don’t, they must tell you why within 45 days

Credit History

Insurers look at many factors when they decide your rates. This can include things like where you live, how much coverage you buy, and even your gender.

Another one of the most common rate factors providers use is your credit history. This helps them determine your reliability or risk as a customer. If your credit score is good, companies see you as more reliable and lower your premium.

Some states, such as Hawaii and Washington, don’t allow companies to use your credit or FICO score, though. But your credit history is fair game to providers. Insurers will take your credit into account when they calculate your premiums.

Policy Cancellation

Your provider can cancel your policy at any time, so long as they give you written notice. After five days, the cancellation will become effective. If your provider cancels your policy, they must reimburse you for the unearned portion of your premium.

These are some common reasons your insurer could cancel or non-renew your policy:

- A severe traffic violation, such as a DUI or reckless driving

- License suspension or revocation

- Fraud or misrepresentation of personal information on your policy

- You haven’t paid your rates

If you miss a payment, you’ll lose your coverage unless you contact your insurer for policy reinstatement. All you need to do is pay your premium before the grace period is up (how long this is varies by insurer). Your coverage will lapse if you don’t pay your rates by the end of the grace period. This makes it hard for you to get covered and can result in higher rates.

Drunk Driving Laws

Driving while under the influence of drugs or alcohol is illegal. It’s also one of the most severe moving violations you can get. New Jersey considers you legally intoxicated if you have a blood alcohol content (BAC) of 0.08 or more. Following a DUI conviction, you’ll face legal consequences such as steep fines, jail time, and a license suspension.

Below are the penalties for getting a DUI:

First offense:

- Fine of $250 to $400

- Up to 30 days in jail

- License suspension until you install an ignition interlock device (IID), which you need to have for three months

- At least six hours a day for two consecutive days at an Intoxicated Driver Resource Center (IDRC)

- An insurance surcharge of $1,000 per year for three years

Second offense:

- Fine of $500 to $1,000

- At least two days and up to 90 days in jail

- Minimum license suspension of one year and up to two years

- Must complete evaluation, referral, and program requirements of the IDRC

- Community service for 30 days

- Must install an IID for the entire span of license suspension, as well as two to four years after license restoration

- An insurance surcharge of $1,000 per year for three years

Third offense:

- Fine of $1,000

- 180 days in jail; however, the court can lower the period (not exceeding 90 days) for each day spent in a drug and alcohol rehabilitation program approved by the IDRC

- License suspension for eight years

- Must complete evaluation, referral, and program requirements of the IDRC

- Community service for 30 days

- Must install an IID for the entire span of license suspension, as well as two to four years after license restoration

- An insurance surcharge of $1,500 per year for three years

What a DUI Does to Auto Insurance

A DUI violation on your record will also affect your coverage. For example, your provider is likely to cancel or non-renew your policy and will label you a high-risk driver. You’ll also have a tough time trying to find an insurer willing to insure people with DUIs. If you do find a company willing to sell you a policy, you’ll pay higher rates. You might have to enroll in a state run program for high-risk drivers if you can’t find a standard company.

SR-22

You must file an SR-22 form with the state if you get a DUI conviction. An SR-22 is a form that certifies you meet the state’s minimum requirements. Your insurance company will usually help you file an SR-22 certificate with the state. But be aware that not all insurers offer SR-22s.

You must maintain an SR-22 for three years after a severe driving violation, like a DUI.

Driver’s License Point System

Many states use driver’s license point systems to keep track of violations on your driving record. You’ll get points on your record for any traffic ticket or violation you receive in New Jersey.

If you get too many points in a certain amount of time, you can expect to pay fines or even lose your license. For instance, the NJ MVC cautions that six points in three years will lead to “a surcharge of $150 plus points costs.” Once you get 12 points on your record, the MVC suspends your license.

There are things you can do to lower your points, however. You can pay $49.00 to take a defensive driving course, which can take two points off your record. This can also help lower your premium if the points on your record have increased your rates. Not only that, but drivers that complete a defensive driving course often qualify for discounts.

Most Popular Cars

Each state has a unique set of the most sold or sought-after cars. These were New Jersey’s most-sold cars in 2021:

- Honda CR-V

- Honda Civic

- Jeep Grand Cherokee

- Toyota RAV4

- Nissan Rogue

Most Stolen Cars

Insurance providers keep a watchful eye on the most stolen cars in each state. Insurers often raise your rates if you own one. These were New Jersey’s most stolen vehicles in 2021:

- 2017 Honda Accord

- 2000 Honda Civic

- 2004 Ford Pick-Up (Full Size)

- 2018 Jeep Cherokee/Grand Cherokee

- 2015 Nissan Altima

- 2018 Toyota Camry

- 1999 Honda CR-V

- 2011/2003 Ford Econoline E350

- 2020 Toyota Corolla

- 2006 Ford Econoline E250