Michigan Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Michigan.

- Sean Canonica

- Updated March 20, 2024

Michigan borders four of the five great lakes. The state is a hub for the motor vehicle industry and agriculture. It’s also the tenth-largest state in the country. There are about 7 million licensed drivers in the state. Many of these drivers are in the state’s largest cities, such as Detroit and Grand Rapids.

Like many other states, Michigan requires auto coverage to drive. This page will explain everything you need to know about car insurance in the Great Lakes State. This includes rate info, minimum requirements, the best companies, and other key details.

Table of contents

Michigan Average Car Insurance Rates

It’s always a good idea to look at your state’s average auto insurance prices. This can help you know if you’re paying too much and need to find a better deal. On the other hand, you might also find that you’re getting a good deal as is.

Below are Michigan’s average rates for full coverage insurance. Drivers in the Wolverine State pay much more for their coverage than most Americans. The price per month for coverage here is $35.46 higher than the US mean.

| Coverage | Michigan Average | US Average |

|---|---|---|

| Liability | $979.47 | $650.35 |

| Collision | $478.54 | $381.43 |

| Comprehensive | $162.01 | $171.87 |

| Full Coverage | $1,495.94 | $1,070.47 |

| Price Per Month | $124.66 | $89.20 |

Average Full Coverage Rates

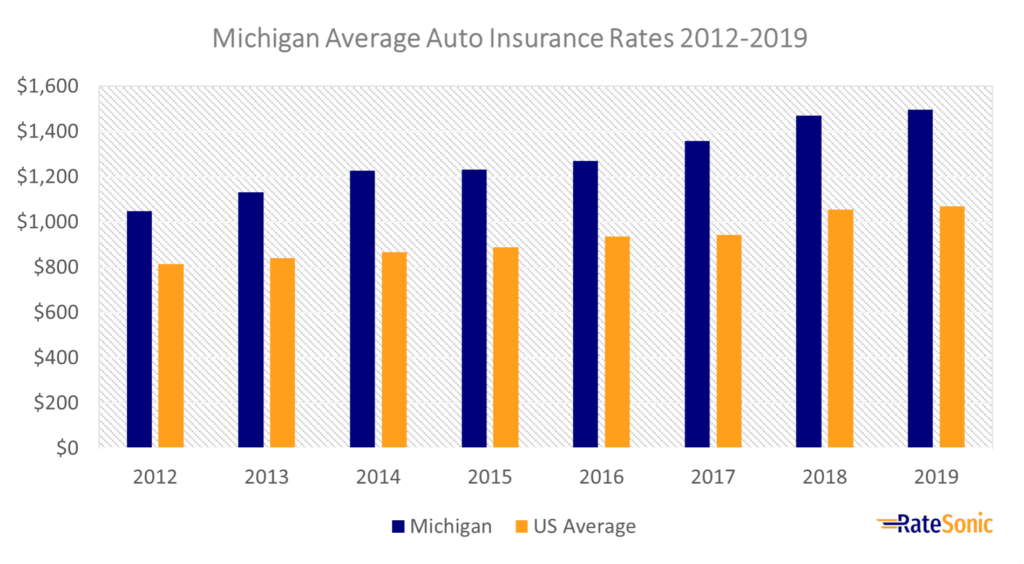

The graph below shows the change in average Michigan full coverage rates from 2012 to 2019. Premiums rose from $1,048 in 2012 to $1,495 in 2019. This was a big increase of $447, or 42%! This state went from the seventh to second most expensive in the nation for auto insurance in just seven years.

Rates are high in Michigan for a couple of reasons. First, it’s a no-fault state that requires you to buy unlimited personal injury protection (PIP) and $1 million worth of Property Protection Insurance (PPI). This can get expensive quickly. This state also is rife with fraud, which can cost providers money.

Average Liability Rates

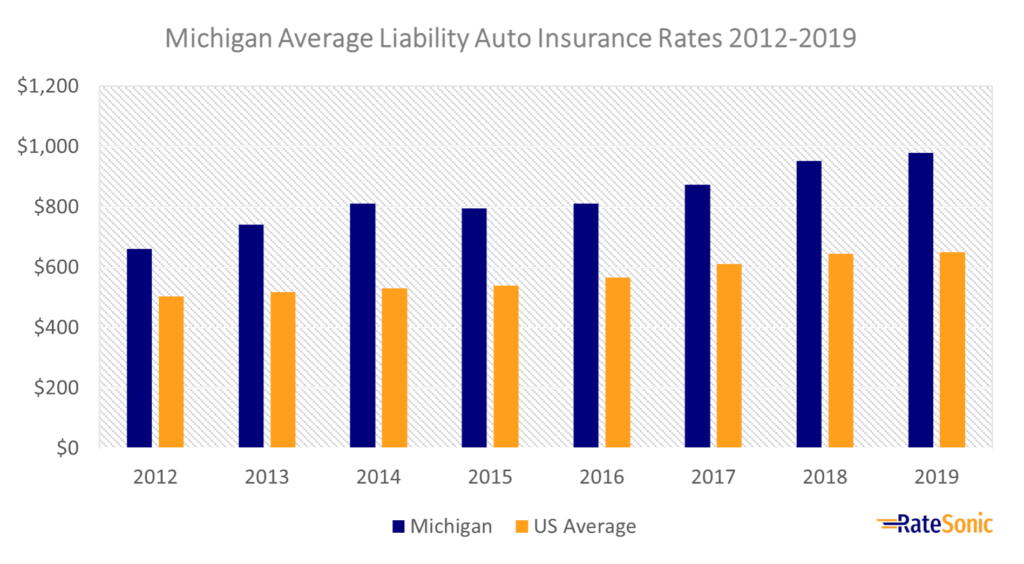

In the following graph, you can see Michigan’s average liability insurance rates from 2012 to 2019. Liability rates increased by $319 or 48% during this period. Rates went from $660 in 2012 to $979 in 2019.

This rise could be due to Michigan’s number of accidents per year. In 2019, there were 314,376 total crashes. This amounts to lots of claims for companies to pay out. As a result, rates are likely to be higher.

Average Collision Rates

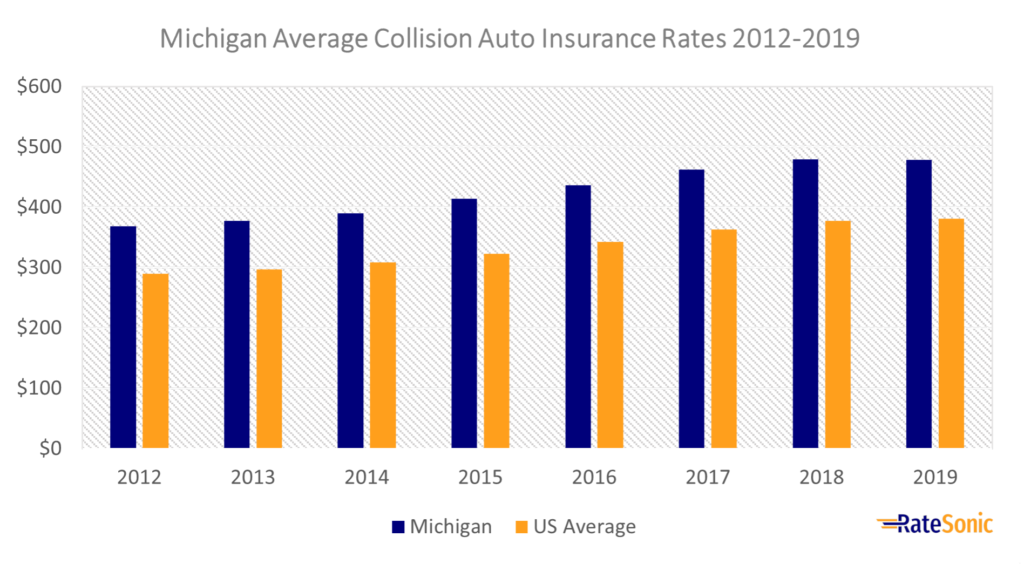

Below is a graph showing Michigan’s average collision insurance costs from 2012 to 2019. Collision rates increased from $368 in 2012 to $478 in 2019. This was an increase of $110, or 30%.

Also of note is that collision coverage cost far more than the US mean. This is surprising, considering that this is one of the most affordable states for fixing your car after an accident. A study by CarMD found that Michigan ranks 48th for vehicle repair costs in the country.

Average Comprehensive Rates

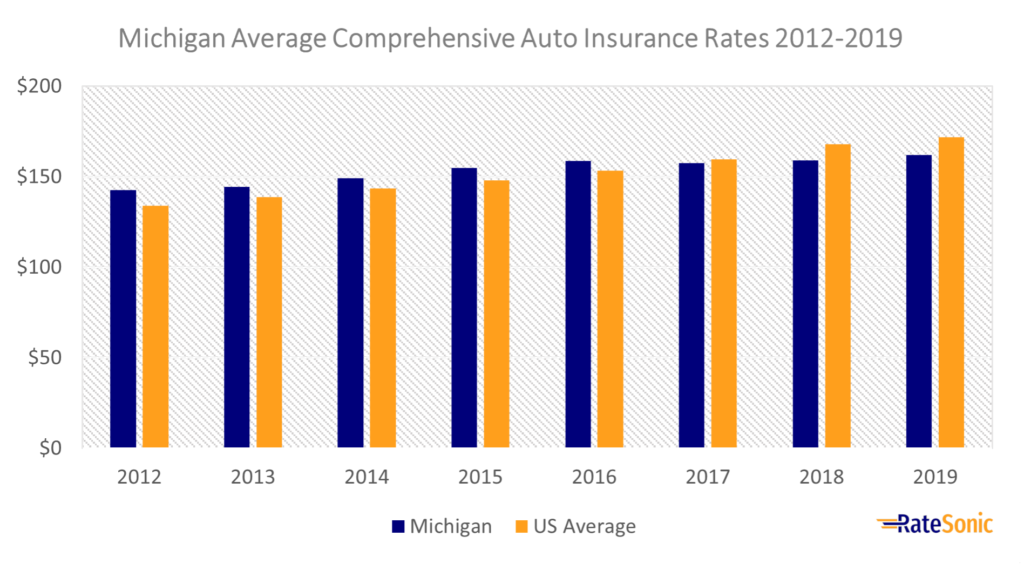

Finally, the graph below shows the difference in average Michigan comprehensive costs from 2012 to 2019. Unlike, the other insurance types above, rates for this one rank near or slightly above the US mean. Despite this, rates jumped 14% from $142 in 2012 to $162 in 2019.

Rates are likely to keep rising over time. As inflation increases, so will car insurance prices. The cost to repair cars rises with inflation, resulting in higher premiums for all drivers.

Minimum Auto Insurance Requirements

In the United States, car insurance is required almost everywhere, with the exception of New Hampshire and Virginia. But each state has unique coverage requirements that drivers must adhere to. These rules include what types you need to buy and how much of each. Any extra protection will be up to you to add to your policy.

Residual Liability Insurance

Michigan requires drivers to carry residual liability insurance on their policy. This protects you from any damages you cause in an accident, but it only kicks in at certain times. Here’s where a residual policy will cover you:

- When you get into an accident with a driver and car from another state

- When you get into a collision in another state

- When someone dies or suffers injuries in a crash

In all other cases, your other coverage will cover other expenses. Below are the liability coverage limits you must carry:

- $20,000 of bodily injury liability (BIL) for one person

- $40,000 of BIL for two or more persons

- $10,000 for property damage that occurs in another state

You may see insurers or state officials list minimum liability requirements in shorthand form: “20/40/10.” Each number indicates how much, in the thousands, you need to carry on your policy.

Keep in mind that state liability limits are the absolute minimum. It’s wise to buy as much as you can afford for max protection. Accident costs can often go way beyond your limits. Without coverage, you’d have to cover the costs out of pocket. The general auto insurance industry recommendation is to carry bodily injury limits of $100,000 per person and $300,000 per accident.

Personal Injury Protection (PIP)

In Michigan, you need to carry personal injury protection (PIP) on your policy. PIP covers you and your passengers’ medical bills no matter who caused the accident. Unlike liability coverage, there is no maximum or required limit for PIP in the Wolverine State. You’ll just need to add it to your policy.

PIP can get expensive, but you can lower your premium if you integrate it with your health plan. In this case, your health coverage would pay for your medical expenses first. PIP would only cover any extra costs that your health policy can’t cover.

Property Protection Insurance (PPI)

Property Protection Insurance (PPI) is a coverage unique to Michigan that drivers must add to their policies. This coverage affords you up to $1 million for any at-fault property damages that you cause.

Uninsured and Underinsured Motorist (UM and UIM)

Some states require drivers to carry UM and UIM coverage on their policies. This protects you if you get into an accident with a driver who has no insurance. State law doesn’t require UM and UIM on policies. But it’s a good idea to have it anyway. Per the III, 25.5% of drivers here are uninsured, which is second in the nation.

Valid Proof of Coverage

In Michigan, you must have a valid proof of coverage in your car at all times. At a traffic stop or after an accident, you need to be able to prove to the police that you have proper insurance. You must carry either a physical or digital certificate from your provider.

Self-Insurance

You may self-insure your vehicles. This is usually an option for high-net-worth individuals because you must be able to fulfill all of the state’s minimum coverage requirements on your own. Here’s what you’ll need:

- Fill out and submit a self-insurance application – Form FIS 2271

- Be able to fulfill the following requirements:

- Unlimited amount of PIP

- Up to $250,000 of BIL per person

- Up to $500,000 of BIL per accident

Penalties for Driving Without Insurance

Driving without car coverage is against the law. Doing so can result in serious legal consequences. This includes driving another person’s car without coverage or allowing someone else to drive your uninsured car. Here’s what’ll happen if you’re caught driving without insurance:

- $500 fine

- Jail time of up to one year

- No legal protection after an accident (you could be sued and lose everything)

- No protection from medical bills, lost wages, or any other accident costs

Best Car Insurance Companies in Michigan

When you’re shopping for a new policy, it’s smart to take your time and find the best insurer. But how do you do that? The easiest way is to compare each company, not just by rates, but by their overall quality. The best car insurance carriers have the following features:

- Superior customer service and satisfaction

- Competitive rates at a good value

- Lots of benefits and discounts

At the end of the day, you want a company that takes good care of you. This way, insurance can be a stress-free experience.

Top Companies by Market Share

A good way to find the best insurers in your state is by looking at who owns the market share. These companies will be the largest and most popular. This is always a good place to start, but these insurers may not always be the best. Below is a list of the top ten companies in Michigan by market share percentage:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm | $1,655,344 | 17.4% |

| 2 | Auto Club | $1,504,300 | 15.8% |

| 3 | Progressive | $1,499,226 | 15.8% |

| 4 | Auto-Owners | $979,009 | 10.3% |

| 5 | Nationwide | $751,790 | 7.9% |

| 6 | Hanover Financial | $593,032 | 6.2% |

| 7 | Michigan Farmer | $456,501 | 4.8% |

| 8 | Liberty Mutual | $372,014 | 3.9% |

| 9 | USAA | $290,278 | 3.1% |

| 10 | Frankenmuth | $169,397 | 1.8% |

Top Companies by J.D. Power Rating

The best companies are also those that have a reputation for good customer satisfaction. J.D. Power ranks companies based on their customer satisfaction score. Here are the top ten companies in the North Central region (including states like Michigan and Ohio):

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | Erie | 857 |

| 2 | State Farm | 851 |

| 3 | COUNTRY | 850 |

| 4 | MetLife | 849 |

| 5 | American Family | 844 |

| 6 | Auto-Owners | 842 |

| 7 | Progressive | 842 |

| 8 | GEICO | 837 |

| 9 | The Hanover | 836 |

| 10 | Liberty Mutual | 831 |

Best Companies Based in Michigan

You may also want to find an insurer that exclusively serves Michigan residents. There are several companies to choose from if you want to support local companies. Below are the major companies, in no particular order, based in the Great Lakes State:

- Auto-Owners

- Pioneer State Mutual

- Farm Bureau of Michigan

- Frankenmuth

- Fremont

- Michigan Insurance Company

Michigan Auto Insurance Laws

No-Fault or Fault?

Michigan is a no-fault state. These are states that require you to have PIP on your policy. PIP covers your injuries regardless of who caused the collision. You must carry PIP on your policy to drive.

Totaled Cars

Your car will generally become a total loss when the cost of damages is more than the actual cash value (ACV). Insurers must use the total loss formula (TLF) to determine whether or not your car is a total loss. Using the TLF, your car is totaled if the damages plus the salvage value cost more than the ACV.

Salvage and Rebuilt Titles

Your car will receive a salvage title after your insurance company declares it a total loss. Salvage title cars are illegal to drive on state roads. They typically have serious damage and aren’t safe to operate. For this reason, you can’t insure a salvage. People often restore these vehicles because they’re incredibly cheap. And for good reason. It takes a lot of time and effort to turn a salvaged wreck into a drivable car with a rebuilt title.

For some Michiganders, the effort and expense of rebuilding a salvage car makes sense. Cars with rebuilt titles look and drive just like any other vehicle. But no matter how much love you put into one of these vehicles, it cannot escape its sordid past. A vehicle’s claims history is permanent and that does affect insurance. But rebuilding salvage cars makes sense to a lot of people.

How to Get a Rebuilt Salvage Title

You can legally drive a salvage car if you restore it to a safe condition and obtain a rebuilt title. To get a rebuilt title, you’ll need to go through Michigan’s specific process. Here’s the process to get a rebuilt title:

- Repair your vehicle to a drivable condition

- Apply for a vehicle inspection with Form TR-13a (whoever repaired your car must fill out section four of this form)

- Pay the $100 inspection fee

- Complete Form TR-13b – Salvage Recertification

- Bring forms TR-13a, TR-13b, and your salvage title to a Secretary of State office

- Pay the $15 title application fee and await your rebuilt title

Insuring Cars with Rebuilt Titles

Once a salvaged car is repaired and granted a rebuilt title, it must be insured. Most insurance companies cover vehicles with rebuilt titles. However, providers may limit you to a liability-only policy. Full coverage may not be an option. You can also expect your rates to be a bit higher when insuring a rebuilt car. This is because rebuilt titles belong to cars that were once totaled. As a result, they carry a much higher safety risk than a normal vehicle would, even despite passing inspections.

Driving a rebuilt title car doesn’t mean you have to pay insane rates for a policy. You should always conduct a little research before choosing an insurer. It’s a smart practice to shop around and compare quotes to find the best deal.

SR-22 Forms

In Michigan, you may need to file an SR-22 form after a serious driving offense, such as a DUI. SR-22 forms certify that you have the minimum amount of car insurance in your state. They’re usually only for high-risk drivers to prove they have the proper coverage. If you have a severe driving violation, a court may order you to file one.

Full Windshield Replacement

In Florida, Kentucky, and South Carolina, insurers must repair your windshield without a deductible. However, Michigan doesn’t require carriers to do so. This means that when you file a comprehensive claim for your windshield damage, you must pay a deductible.

Alternatively, you can buy full glass coverage if your insurer offers it. This is where, for an extra cost in your monthly rates, your provider will repair your windshield without a deductible. Michigan commonly has large hailstorms that can damage windows, so full glass coverage may be a good idea here.

Filing Claims

You’ll likely need to file a claim if you get into a car accident. Luckily, this process should be very simple. Michigan’s Insurance Code requires companies to follow specific rules when they’re handling your claim. This includes how long they have to respond to and settle your claim.

How long do insurers have to settle a claim?

Insurers have 60 days to settle your claim after receipt of proof of loss. If they miss that deadline, they must pay your claim plus 12% interest.

If your claim is for injury, the insurer must pay “all reasonable and necessary expenses” within 30 days of receiving proof of loss. These costs include:

- Medical bills

- Lost wages

- Replacement services

How long do you have to file a claim?

Michigan doesn’t list a specific deadline for you to follow. But your insurer may set time limits for filing claims. It’s important to file a claim as soon as you can. Be sure to check with your provider about how long they give you to file a claim.

Credit History

Your credit score is a factor that insurers use to determine your rates. The state bans providers from using your credit history to set your rates. They also may not use it as a reason to deny you a policy.

Policy Cancellation and Denial

Insurers can cancel your policy for nonpayment of your premium. They must give you a 10 days notice in writing. In this case, it’s still possible to reinstate your policy without a lapse if you contact your them immediately to pay the bill. For any other reason, such as fraud or being a high-risk driver, they need to give you a 30-day written notice.

Insurers may also deny you a policy for several reasons including:

- License suspension

- Past insurance fraud convictions

- DUI, reckless driving, or other car-related convictions

- Your car is unsafe

- You have too many insurance eligibility points on your record

- An insurer canceled your auto policy in the last 2 years due to nonpayment of premium

Insurance Eligibility Points

Michigan lets insurance companies use eligibility points to keep track of your driving record. These points help providers know if they want to offer you a policy or not. If you have more than six eligibility points in three years, insurers can deny you a policy. You’ll receive points for various types of driving violations, including:

- Going 11-15 over the speed limit – three points

- Driving 15 over the speed limit – four points

- First at-fault accident where you’re over 50% at-fault – three points

- Future accidents where you’re over 50% at-fault – four points

Drunk Driving Laws

Driving while under the influence of drugs or alcohol is a crime. A DUI in Michigan is where you’re driving with a blood alcohol content (BAC) of 0.08 or higher for 21-year-olds and older. Any driver under 21 will get a DUI if their BAC is 0.02 or higher. A BAC of 0.17 or higher will result in even more severe penalties. Drivers showing impairment of any kind can be arrested for any BAC level.

Also note that other drugs, such as marijuana and cocaine, will result in the same consequences as a DUI. You don’t even need to be impaired to get a DUI. However, drivers with a marijuana card won’t receive a DUI unless they show signs of impairment.

Getting a DUI will result in several penalties. Below are common penalties for first-time DUI offenders:

First offense – BAC of under 0.17:

- Fines of up to $500

- Jail time of up to 93 days

- License suspension of up to 180 days

- Six driver’s license points

- Community service of up to 360 hours

First offense – BAC of 0.17 or over:

- Fines of up to $700

- Jail time of up to 180 days

- License suspension of up to one year

- Six driver’s license points

- Community service of up to 360 hours

- A mandatory alcohol treatment program

- Ignition interlock device (IID). You are responsible for paying for the device.

A DUI will carry more than just legal penalties. Your premium will skyrocket after a DUI conviction. It’ll also make you a high-risk driver, making it harder to get the coverage you need.

Driver’s License Points System

Michigan uses a driver’s license points system to keep track of your moving violations. After each conviction, you’ll receive points. The point amount depends on which type of violation you have.

Points stay on your record for up to two years. Having six one-point violations or 12 points in total will result in you having to retake a driver’s exam. Examples of violations include:

- 10 mph or fewer over the limit – two points

- Careless driving – three points

- Running a stop sign or red light – three points

- 11-15 over the speed limit – three points

- Drag racing – four points

- 16 mph or more over the limit – four points

- Manslaughter – six points

- DUI – six points

- Reckless driving – six points

Most Popular Cars

The most popular cars are different from state to state. Insurers keep a close watch each year on the most popular cars in each state. These cars are the most desired and are often a target for criminals. Below were Michigan’s most-sold cars in 2021:

- Chevrolet Silverado

- Ford F-Series

- Ram 1500/2500/3500

- Chevrolet Equinox

- Ford Escape

Most Stolen Cars

Insurers also pay close attention to the most stolen cars in each state. Owning a car that thieves target often will cause your comprehensive rates to be higher. These were Michigan’s most stolen vehicles in 2021:

- 2018 Dodge Charger

- 2019 Jeep Cherokee/Grand Cherokee

- 2020 Ford Pick-Up (Full Size)

- 2016 Chevrolet Malibu

- 2003 Chevrolet Pick-Up (Full Size)

- 2020 Ford Fusion

- 2008 Impala

- 2018 Chevrolet Equinox

- 2006 Chevrolet Trailblazer

- 2017 Ford Escape