Maryland Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Maryland.

- Sean Canonica

- Updated March 20, 2024

One of the original 13 colonies, Maryland is known for its rich American history, the Chesapeake Bay, and the founding of “The Star-Spangled Banner.” There are about 4.5 million drivers in the state. Many of which are based in large urban centers like Baltimore and Columbia.

Maryland requires auto insurance to drive. In this article, you’ll learn everything you need to know to comply with the law and what you need to drive safe. This includes info about rates, requirements, the best companies, and important laws.

Table of contents

Average Maryland Auto Insurance Rates

How much you pay for auto insurance coverage depends greatly on where you live. Looking at your state’s average rates will help you know how much you can expect to pay. It might also let you know if you’re getting a good deal or overpaying.

The table below shows Maryland’s average auto insurance rates and how they match up with the rest of the country:

| Coverage | Maryland Average | US Average |

|---|---|---|

| Liability | $749.18 | $650.35 |

| Collision | $430.21 | $381.43 |

| Comprehensive | $168.01 | $171.87 |

| Full Coverage | $1,236.61 | $1,070.47 |

| Price Per Month | $100.98 | $89.20 |

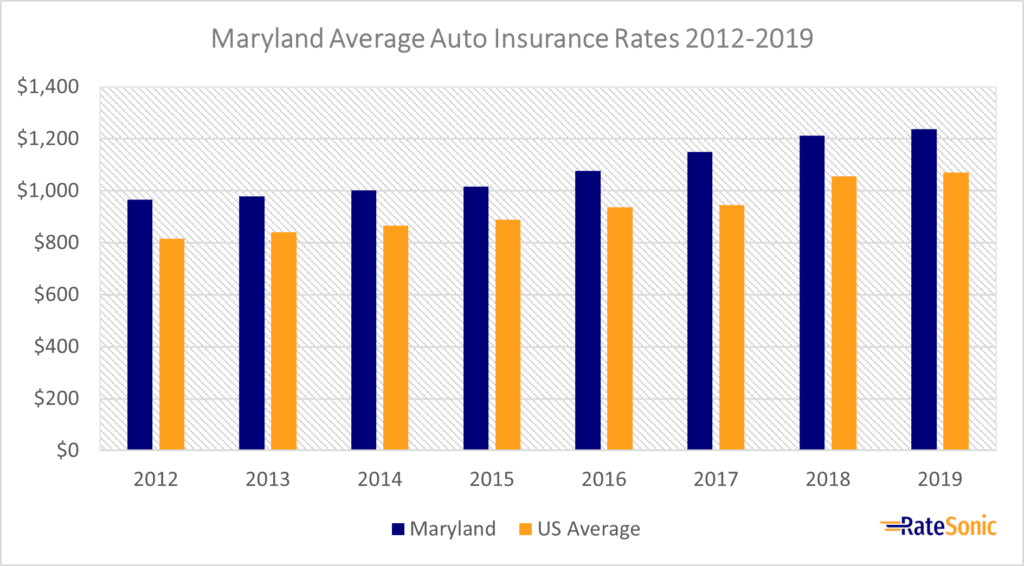

Average Full Coverage Rates

The graph below shows the change in average Maryland premiums from 2012 to 2019. Rates for full-coverage policies rose from $966 in 2012 to $1,236 in 2019. This was an increase of $270, or nearly 28%.

For eight years, Marylanders have paid more than the national mean. On top of that, rates have steadily increased each year. The same is also true for the rest of the US. Inflation is often to blame. It could also be due to providers raising prices to deal with a larger numbers of claims.

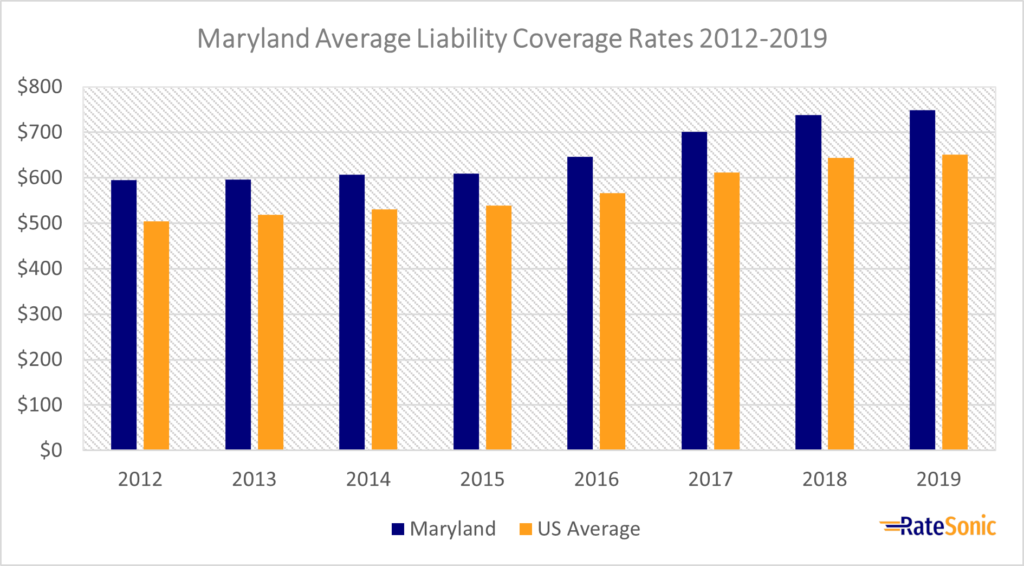

Average Liability Rates

The following graph displays average Maryland liability insurance rates from 2012 to 2019. The cost of liability rose from nearly $600 to about $750 in 2019. This was an increase of $150, or about 25%.

For the entire eight years, state residents have, on average, paid more for liability coverage than the rest of the nation. Rates have also increased each year, and have seen the most growth since 2015. One reason for this could be relatively high healthcare costs when compared to other states. According to a report by the Kaiser Family Foundation (KFF), Maryland ranks 18th for healthcare expenditure. More expensive medical bills typically mean pricier claims. Insurers raise prices to offset this.

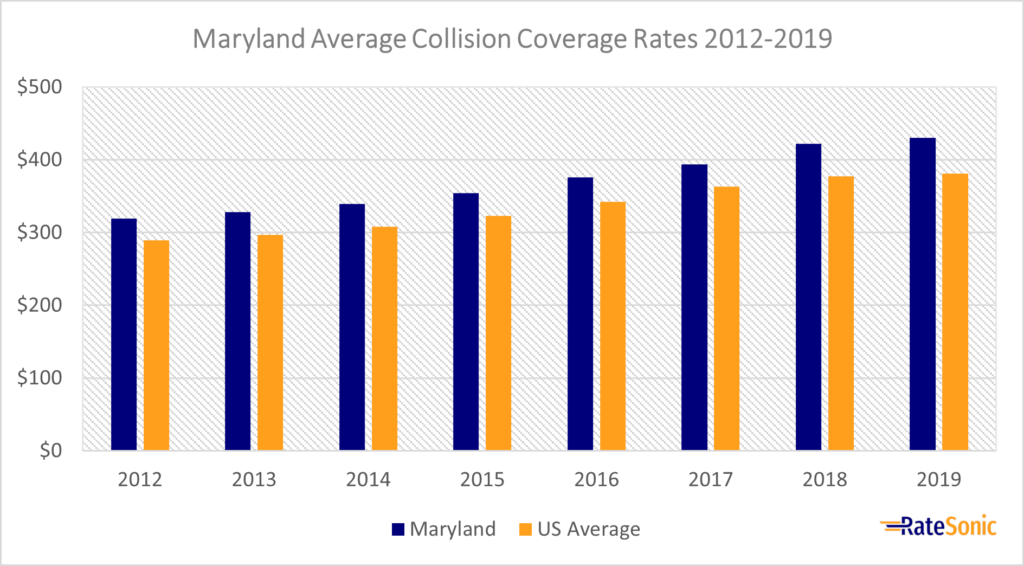

Average Collision Rates

The next graph shows average collision insurance prices in Maryland from 2012 to 2019. Rates rose from roughly $320 in 2012 to about $430 in 2019. This was an increase of $110, or about 34%.

As is the case with liability and full coverage, Marylanders pay more for collision than the rest of the country. Many things could cause this, especially the higher likelihood of car accidents in densely populated cities. However, another possible cause could be higher than average cost of fixing vehicles after crashes. 2019 data from CarMD places the “Free State” at number 11 for car repair billings. If cars are more expensive to fix in a certain place, insurance companies are likely to institute a price hike.

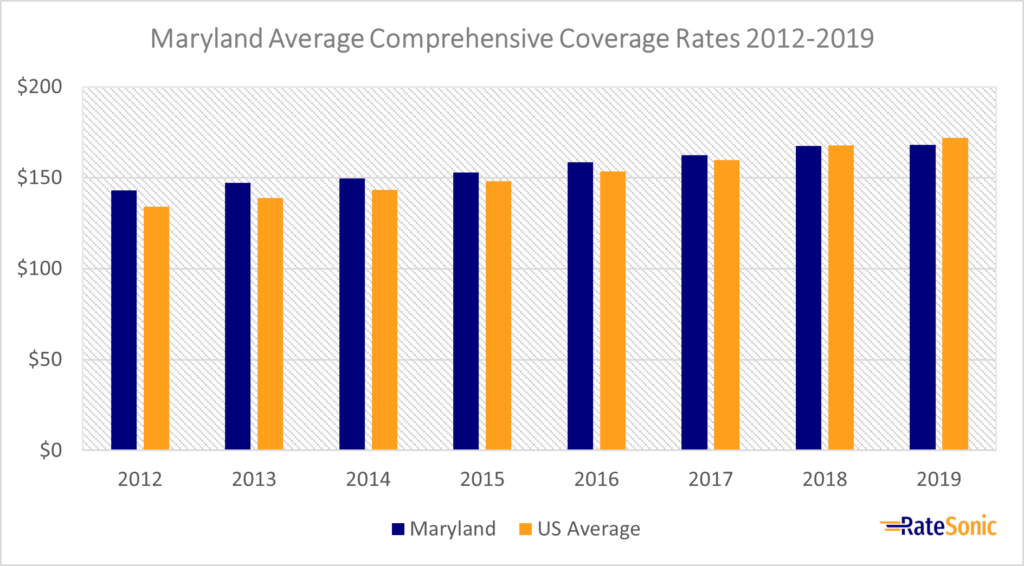

Average Comprehensive Rates

The graph below illustrates average Maryland comprehensive insurance rates from 2012 to 2019. Prices rose from around $140 in 2012 to nearly $168 in 2019, an increase of about $28, or 20%.

Between 2012 and 2017, residents paid more for this coverage than most Americans. In 2018, though, the tides began to turn, and by 2019 Maryland’s comprehensive costs were $3 less than the rest of the nation.

While rates rose each year, the recent slowing of comprehensive price hikes could be due to several factors. One likely explanation is that more natural disasters, such as hurricanes, have occurred in other states like Florida and have raised US premiums generally.

Why Do Rates Keep Increasing?

With car insurance premiums increasing each year in Maryland, you might be asking yourself: why? There are many reasons why this could be happening. The first is inflation. As the cost of auto repairs, medical supplies, and other expenses related to claims go up, so too will your rates. Prices may also be increasing because of a rise in claims in your city. If you live in an area with more claims, your costs will go up as a result.

We can’t mention claims without also talking about distracted driving, which accounts for up to 45% of all crashes in Maryland. These distracted driving accidents result in claims that lead to rate increases for everyone.

Even though Maryland insurance coverage costs are on the rise, you don’t have to pay more than you need to. To get the best deal, it’s a good idea to compare quotes from several insurers. You can also lower your premium by qualifying for discounts.

How to Get a Quote

Whether you’re switching insurance companies or are a first-time customer, you’ll need to get a quote, which is an estimate of your monthly rate based on many factors. You can get a quote directly from an insurer or right here at RateSonic.

Before you get a quote, you should be prepared to provide some info about yourself. Insurers use details about you to give you an accurate and personalized rate. Here’s what you may need to provide:

- First and last name

- Age

- Gender

- Address

- Phone number

- Email address

- Marital status

- Car make and model

- Education and occupation

- Desired coverages and limits

- Names of other drivers on your policy

If you get a quote online, the rate you receive may not be fully accurate. Be ready for an agent or another representative to reach out to you to finalize your quote.

Minimum Auto Insurance Requirements

Every state, except New Hampshire and Virginia, requires car insurance to drive. Each state sets various minimum requirements, including:

- Type(s) of coverage needed

- The minimum amount of each coverage, i.e., policy limits

Note: State law mandates that you have coverage before you can register your vehicle.

Liability Coverage

You must have liability insurance coverage on your policy to drive on Maryland roadways. This pays for any damages or injuries you cause to other parties in an accident. You’ll need to carry at least:

- $30,000 of bodily injury liability (BIL) for one person

- $60,000 of BIL for two or more persons

- $15,000 of property damage liability (PDL)

Keep in mind that these minimums may satisfy state requirements, but it may not be enough. Car accidents can often result in expenses costing tens of thousands of dollars. It’s always a good idea to buy as much coverage as you can. Otherwise, you could be paying out of pocket for hospital bills and repairs.

Uninsured and Underinsured Motorist (UM and UIM)

Drivers must also include UM and UIM coverage on policies. This protects you if you get into an accident with a driver with no or too little insurance. Here’s how much of this coverage Maryland requires:

- $30,000 of bodily injury per person

- $60,000 of bodily injury for two or more people

- $15,000 of property damage

Personal Injury Protection (PIP)

The third and final coverage Maryland requires is personal injury protection (PIP), which pays for injuries you or your passengers suffer in an accident, regardless of fault. You may also see insurers call this no-fault insurance.

You can opt for limited PIP instead. This is a more affordable option if full PIP is too much. Limited PIP doesn’t cover you and your family members who are 16 and over. It’s a good option if your health insurance can serve as an alternative.

Valid Proof of Coverage

All Maryland drivers must carry proof of coverage in their vehicles at all times. This can either be a paper card (issued by your insurer) or an electronic version. If you can’t provide a valid form of proof when asked by the authorities, you may receive a $50 fine.

Self-Insurance

Maryland state law allows you to self-insure if you own 26 or more vehicles. You’ll need to apply for a certificate and be able to show financial statements for the past three years. The minimum liability requirement is $105,000.

Penalties for Driving Without Coverage

Driving on Maryland state roads without coverage is illegal. If you’re caught operating a motor vehicle without insurance, you’ll be subject to several penalties. This includes:

- Loss of license plate and vehicle registration privileges

- A tag recovery agent will confiscate your license plates

- Uninsured motorist fee – $150 for the first 30 days

- Vehicle registration restoration fee – $25

- May not renew or register any future vehicles until you clear your violations

- Up to $1,000 fine and one year of imprisonment for misrepresentation

Best Car Insurance Companies in Maryland

Everyone wants to find a great company when they’re shopping for a new policy. But what separates average insurers from the best ones? We believe that the best auto insurance providers are the ones that give you the greatest value for the rates you pay. Good providers have characteristics like:

- Friendly and helpful customer service

- Competitive prices

- Lots of discounts

- Simple claims process

Top Companies by Market Share

A good place to start when you’re in the market for a new auto policy is looking at the top providers by market share in your state. While the biggest and most popular insurers might not always be the best, most of them get there for being pretty good.

Here are the top car insurance companies by market share in Maryland:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | GEICO | $1,289,470 | 24.4% |

| 2 | State Farm | $967,626 | 18.3% |

| 3 | Allstate | $611,327 | 11.6% |

| 4 | USAA | $471,969 | 8.9% |

| 5 | Erie | $416,530 | 7.9% |

| 6 | Progressive | $358,134 | 6.8% |

| 7 | Nationwide | $341,678 | 6.5% |

| 8 | Liberty Mutual | $173,446 | 3.3% |

| 9 | Travelers | $94,055 | 1.8% |

| 10 | Maryland Automobile Insurance Fund | $83,021 | 1.6% |

Top Companies by J.D. Power Rating

Another great way to find the best auto insurers in your state is by looking at customer service scores. J.D. Power comes out with an annual study on the best auto coverage providers in each region by customer satisfaction.

Below were the top companies in the Mid-Atlantic region (including Maryland) by J.D. Power in 2022:

| Rank | Company | Customer Satisfaction Score (Out of 1,0000 |

|---|---|---|

| 1 | Erie | 867 |

| 2 | Travelers | 860 |

| 3 | State Farm | 851 |

| 4 | NJM | 844 |

| 5 | GEICO | 834 |

| 6 | Allstate | 832 |

| 7 | CSAA Group (AAA) | 832 |

| 8 | Nationwide | 829 |

| 9 | Liberty Mutual | 827 |

| 10 | Progressive | 827 |

| 11 | The Hartford | 811 |

| 12 | Farmers | 790 |

| 13 | Plymouth Rock Assurance | 789 |

Best Companies Based in Maryland

You might want to work with a company based in Maryland. This could be a good idea for several reasons. For one, local or regional insurance companies may have better benefits or rates than larger national providers. You may also feel good about supporting local businesses.

In no order, the most well-known providers headquartered in-state are GEICO and the Maryland Automobile Insurance Fund (MAIF).

Maryland Auto Insurance Laws

No-Fault or Fault?

No-fault states require drivers to buy auto insurance that covers them and their passengers’ injuries in an accident, regardless of fault. The most commonly required type of coverage is personal injury protection (PIP).

Maryland is not a no-fault state. Instead, it’s an at-fault state. This means that you carry the responsibility for covering damages and/or injury costs of any accidents you cause.

Totaled Cars

A car is a total loss when it suffers damages so bad that it’d cost more to repair than it’s worth. The state considers your car a total loss if its damages reach 75% of its value.

If your car happens to get totaled, you should typically expect to receive a payout from your insurer that’s equal to the vehicle’s actual cash value (ACV). A car’s ACV is also known as its fair market value, which is its worth right before the accident occurred.

Salvage and Rebuilt Titles

Salvage title cars are vehicles that have been declared a total loss by an insurance company. It’s illegal to drive a car with a salvage title in Maryland. Since they’re so unsafe to drive, it’s also impossible to insure salvaged cars.

How to Get a Rebuilt Title

If you’d like to drive a salvage car again, you’ll need to get it a rebuilt title. This typically involves steps such as a thorough vehicle inspection and the payment of titling fees. To get a rebuilt title, you must do the following:

- Get your car the repairs it needs (be sure to keep all receipts and bills of sale for parts you used)

- Go through a salvaged vehicle inspection (includes a $25 fee)

- Apply for a title and registration. You’ll need these documents:

- Proof of ownership (certificate of salvage)

- Completed Application for Certificate of Title (Form VR-005)

- Proof of completed salvage inspection

- Maryland Safety Inspection Certificate

- Proof of purchase price only under certain conditions. Go to the Maryland Motor Vehicle Administration (MVA) website for more detailed information

- Odometer disclosure statement

- Lien info, if you’re financing the vehicle

- Pay necessary fees for titling and registration

You can apply for a rebuilt title and registration either in person at an MVA branch office or by mail to “MVA, Mail In Title Unit, 6601 Ritchie Highway, NE, Glen Burnie, MD 21062.”

Insuring Cars with Rebuilt Titles

You can insure cars with rebuilt titles in Maryland. But be aware that you typically can’t get full coverage. This is because the car used to be a total loss and, therefore, carries more risk. If you have a rebuilt title, you’ll likely only be able to get liability insurance.

Insuring rebuilt titles is more expensive than it is for clean titles. However, you can still try to get the best rates by comparing quotes between different insurance companies. You may find a company that’s more friendly towards rebuilt cars.

Full Windshield Replacement

Some states, such as Florida, have laws that require insurers to replace your windshield at no cost after an accident. Maryland has no such laws. If you need to replace your windshield, you’ll need comprehensive coverage to help you take care of the costs. With this, you’ll have to pay a varying car insurance deductible, depending on how you set up your auto policy.

You could also opt for a zero-deductible policy. For a little more money upfront on your rates, you can avoid paying a deductible each time you file a collision or comprehensive claim.

Filing Claims

You’ll need to file a claim if you get into a car wreck that causes injury or property damage. You must report a claim to your insurer as soon as possible after an accident to ensure you can remember everything. This can help you get the coverage you need.

Filing a claim is generally a simple process. Many carriers allow you to file online, over the phone, or on their mobile app.

How Long Does It Take to Settle a Claim?

It typically takes 30 business days to settle an auto claim. After you file a claim, you can expect to work with your company to assess the damages to your vehicle, as well as to find out who’s at fault (if applicable). Then, if accepted, you’ll receive reimbursement to take care of car repair costs or medical bills.

FR-19 Forms

Maryland law requires you to file an FR-19 form with the MVA after a severe violation such as a DUI or driving without coverage. This is like the SR-22 form that other states require after serious offenses.

An FR-19 form proves that you carry the minimum coverage required by the state. You can file the form with the MVA electronically (referred to as eFR-19). However, a licensed insurance agent is the only person allowed to submit the form. FR-19 forms are good for 30 days.

Credit History

It’s not uncommon for insurers to use your credit history when determining your rates. They use it because it can show how reliable you are as a customer and, potentially, as a driver.

A few states don’t allow insurers to use your credit score as a rate factor. Maryland allows providers to use your credit and FICO score to set your premiums. But the catch is that providers can’t deny you coverage simply because you have bad credit.

Policy Cancellation

Generally, your insurance company can cancel or choose not to renew your policy for any of the following reasons:

- Fraud or misrepresentation on your policy

- Not paying your rates

- A DUI conviction

- Getting ticketed for reckless driving

- Your driver’s license has been revoked or suspended

- You or someone on your policy have had a serious conviction during the policy’s effective period

- You’ve been using your car for business reasons without telling your provider

You should also expect your insurer to send you a written notice with an explanation of why it’s going to cancel, non-renew, or deny your insurance. This is a situation you want to avoid because a lapse in coverage will make the rates you pay in the future higher than they are now.

If you lose your policy because you missed a payment, you can still reinstate it. All you need to do is contact your insurer and pay your bill ASAP. In this case, you’ll avoid a lapse and pay the same rates as before.

Drunk Driving Laws

It’s illegal to drive under the influence of drugs or alcohol in every state including Maryland. If you’re convicted for a DUI, you’ll face severe legal consequences, and can expect to pay lots of money. You can certainly expect to spend at least one day in jail.

A DUI conviction will also strongly impact your car insurance. Many companies will cancel your policy immediately following a violation, and others likely won’t want to write you a policy. This makes you a high-risk driver and could force you to search for a more expensive non-standard insurer to do business with.

There are two types of convictions you can get for driving impaired. The first is a DUI (driving while under the influence) and the second is a DWI (driving while impaired). Both have steep penalties, but a DUI is more severe.

You can get a DUI when you get behind the wheel with a blood alcohol content (BAC) of 0.08. You can get a DWI if you drive with a BAC of 0.07. Here are the penalties for both violations, per the MVA:

Driving Under the Influence (DUI) Penalties

First Offense

- Fine of $1,000

- Up to one year in jail

- 12 license points on your record

- License revoked for up to six months

- May need to enroll in an alcohol abuse program

Second Offense

- Fine of $2,000

- Up to two years in jail

- 12 license points on your record

- License revoked for up to one year

- May need to enroll in an alcohol abuse program

On its website, the MVA says that two convictions within five years can get you an ignition interlock device (IID) requirement after your suspension ends. An IID is a tool that checks your BAC before you start up your car.

Driving While Impaired (DWI) Penalties

First Offense

- Fine of $500

- Up to two months in jail

- Eight license points on your record

- License suspended for up to six months

Second Offense

- Fine of $500

- Up to one year in jail

- Eight license points on your record

- License suspended for 9-12 months

Driver’s License Points System

Maryland uses a driver’s license points system to keep track of moving violations on your record. This means that, if you get a ticket, you can expect points to appear on your driving record.

The MVA keeps track of points you’ve accrued over two years; however, points are available for you and your insurance provider to see for three years. The points don’t typically ever fully go away, but they stop affecting your record after two years.

You’ll receive certain consequences for the number of points you have on your record. This is a breakdown of how the MVA responds to driver’s license points:

- 3 to 4 points – you’ll get a warning letter

- 5 to 7 points – you’ll be required to enroll in Driver Improvement Program (DIP) by the MVA

- 8 to 11 points – your license will be suspended

- 12 or more points – your license will be revoked

Most Popular Cars

Each state has a certain set of cars that are the most sought-after. These were the state of Maryland’s most-sold cars in 2021:

- Toyota RAV4

- Honda CR-V

- Ford F-Series

- Toyota Camry

- Toyota Highlander

Most Stolen Cars

These were Maryland’s most stolen vehicles in 2021. Owning one of these could result in a bump in your premium. This is because insurers know that criminals are more likely to target these cars:

- 2017 Honda Accord

- 2017 Toyota Camry

- 2015 Nissan Altima

- 2017/2016/2015 Honda Civic

- 2006 Ford Pick-Up

- 2020 Toyota Corolla

- 2013 Hyundai Sonata

- 2019 Nissan Sentra

- 2017 Hyundai Elantra

- 2015 Jeep Cherokee/Grand Cherokee