Illinois Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Illinois.

- Sean Canonica

- Updated March 20, 2024

Illinois is the sixth-largest state by population. It’s also home to Chicago, the third-largest city in the country by population. In 2021, there were approximately 7.23 million registered passenger vehicles in the state. Even with all the people and vehicles in the state, drivers here pay less on average for insurance coverage than the rest of the country.

In this article, you’ll learn about how auto insurance works in Illinois, including a breakdown of how rates stack up against the US average. We’ll also explain specific laws and policies.

Table of contents

Illinois Average Auto Insurance Rates

Your state’s average auto insurance rates are important to think about because they can help you get an idea of how much you can expect to pay. They can also paint a picture of how your state’s prices rank against the rest of the country. This info can help you know if you should switch companies to find a better deal or stay with the same provider.

In the table below, you can see how Illinois’ average insurance rates match up with the national mean. Drivers here pay less for every type of coverage. Their total price per month is also lower than the US average at $78.30.

| Coverage | Illinois Average | US Average |

|---|---|---|

| Liability | $521.11 | $650.35 |

| Collision | $351.27 | $381.43 |

| Comprehensive | $144.65 | $171.87 |

| Full Coverage | $939.64 | $1,070.47 |

| Price Per Month | $78.30 | $89.20 |

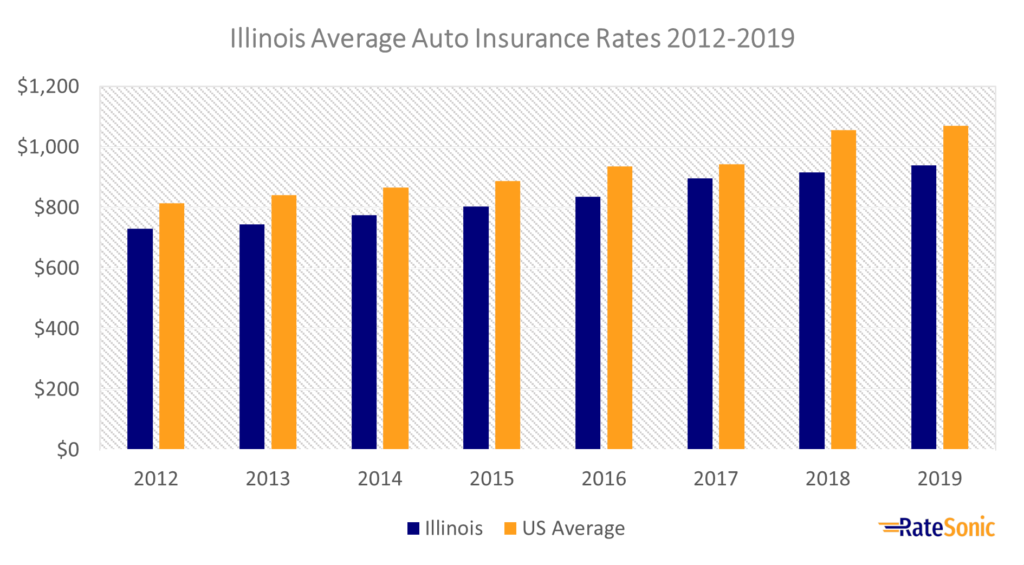

Average Full Coverage Rates

The graph below shows the change in average Illinois full coverage insurance costs from 2012 to 2019. Premiums rose from $731 in 2012 to $939 in 2019. This was an increase of $208, or 28%. Despite this rise, rates here remain below the US mean.

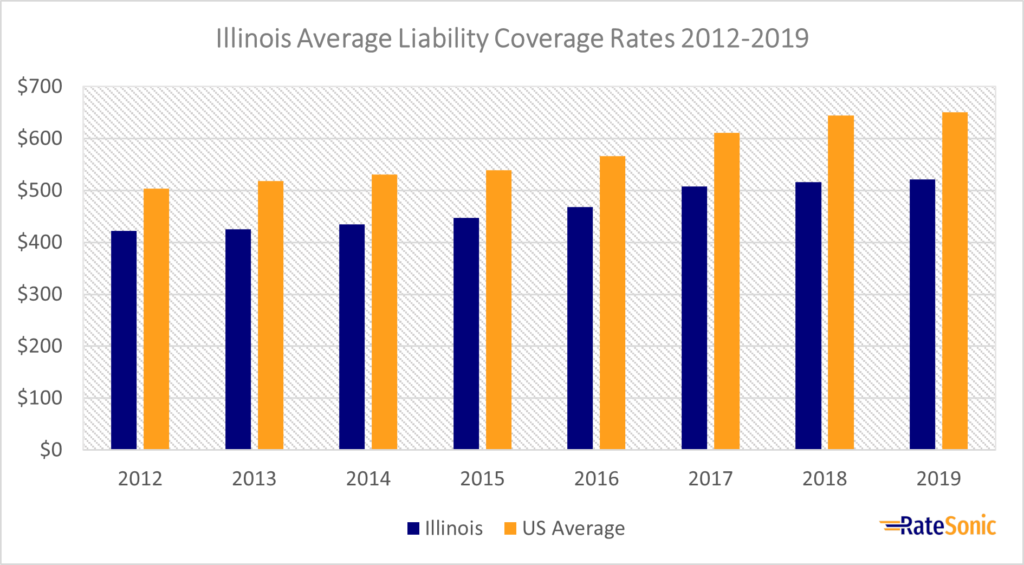

Average Liability Rates

Below is a graph that shows Illinois’ average liability insurance rates from 2012 to 2019. Each year, rates were lower than the national mean. But they have been slowly increasing through the eight years, going from about $410 in 2012 to around $510 in 2019. This is possibly due to the large number of accidents that occur in the state. In 2019, there were 312,988 crashes compared to 274,111 in 2012.

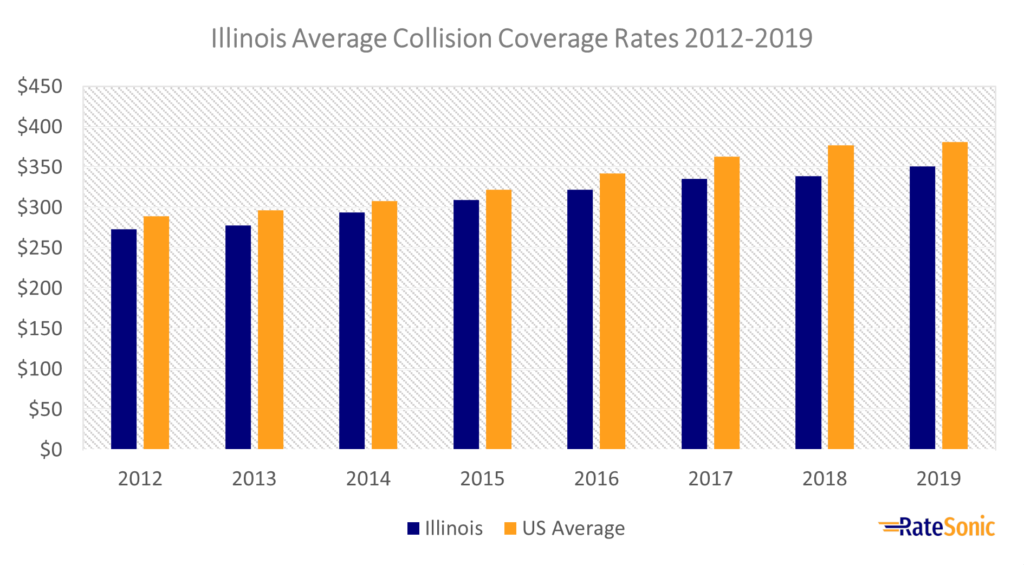

Average Collision Rates

The graph below shows Illinois’ average collision insurance rates from 2012 to 2019. Prices have consistently remained below the national mean but nevertheless increased incrementally each year, rising from about $275 in 2012 to $350 in 2019.

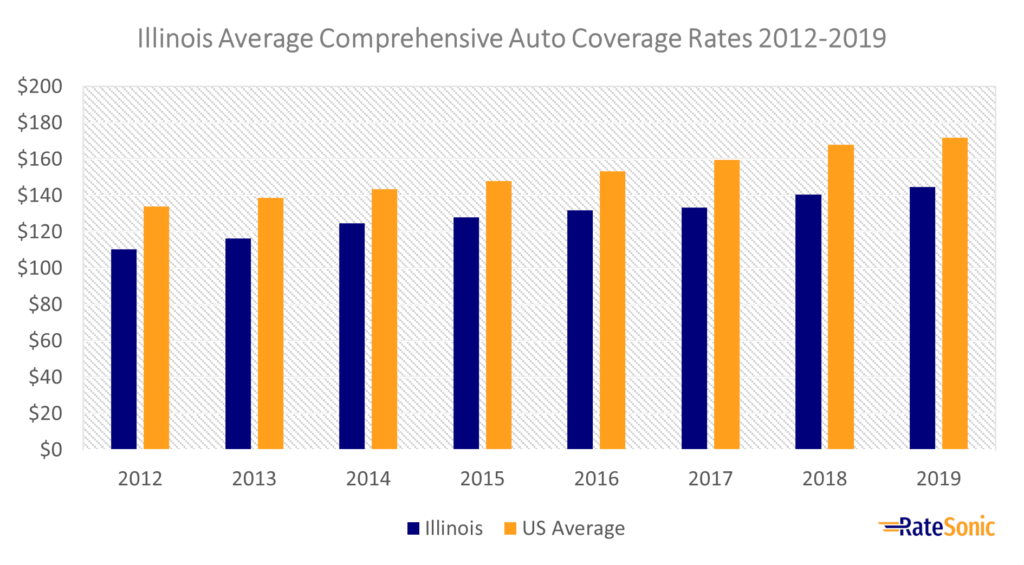

Average Comprehensive Rates

Below is a graph displaying the average comprehensive insurance costs in Illinois from 2012 to 2019. Similar to the other graphs above, rates here have been lower than the US mean throughout the eight years. Even still, prices have seen a steady rise, going from around $115 to about $145 from 2012 to 2019.

Illinois Minimum Auto Insurance Requirements

Almost all states require car insurance. Only New Hampshire and Virginia don’t require it to drive. Each state that does sets minimum requirements. This usually includes:

- What type of coverage you need to have on your policy

- How much of each coverage you need i.e., limits

Keep in mind that Illinois’ car insurance requirements are only the bare minimum. It’s always a good idea to add as much coverage as you can afford. If the costs of an accident go over your policy, you could end up paying out of pocket.

Liability

Illinois requires you to have liability insurance. This covers any damages or injuries that you cause to other parties in an accident. State law requires you to carry at least:

- $25,000 of bodily injury liability (BIL) for the injury or death of one person in an accident you caused

- $50,000 of BIL for all injuries or deaths in an accident you caused

- $20,000 per accident property damage liability (PDL)

Uninsured and Underinsured Motorist (UM and UIM)

Illinois also requires you to carry UM and UIM on your policy. This type of coverage protects you from having to pay out of pocket if you get into an accident with an uninsured or underinsured motorist.

Drivers must purchase uninsured motorist coverage (UM) with limits of at least:

- $25,000 per person

- $50,000 per accident

Remember that you’ll only need to buy underinsured motorist (UIM) if you buy higher limits of uninsured motorist bodily injury (UM) coverage.

Per the III, Illinois ranks 18th in the nation for uninsured motorists. This means that, while most drivers have the required liability coverage, 13.7% do not.

Valid Proof of Insurance

To drive in Illinois, you must carry valid proof of coverage in your vehicle or on you at all times. If the police pull you over or if you get into an accident, you’ll need to provide it on demand.

Valid proof of insurance coverage is an ID card that displays the following info:

- Vehicle information i.e., make, model, year, VIN

- Insured’s name

- Insurers name and code

- Policy number

- Policy start and expiration dates

Self-Insurance

In Illinois, you may only self-insure if you own 25 or more vehicles. You must also be able to meet the $95,000 minimum liability requirement. You’ll also need to obtain a certificate from the state. Because of the steep financial requirements, self-insurance is mainly for business owners or wealthy individuals.

Penalty for Driving Without Insurance

Driving without coverage can result in serious penalties. The only exception is if you’re able to prove after 30 days that you had minimum liability insurance for that vehicle. Otherwise, here’s what’ll happen if you’re caught:

- Fine of at least $500

- Registration suspension

- $100 reinstatement fee for vehicle registration

- Suspended license plates

Best Car Insurance Companies in Illinois

When you’re shopping for a policy, it’s important to find the best company. But how do you find out which one offers the best products and services? The best companies for car insurance are those that have excellent customer service, great benefits, and competitive rates. It’s smart to do some research before you select a company.

Top Companies by Market Share

Looking at who owns the most market share in your state is one way to find the best company. While the biggest companies aren’t always the best, they’re usually the most popular. Below is a list of the top car insurance companies in Illinois by market share:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm | $879,961 | 28.24% |

| 2 | COUNTRY | $181,996 | 5.84% |

| 3 | Allstate | $171,081 | 5.49% |

| 4 | American Family | $138,219 | 4.44% |

| 5 | Illinois Farmers | $125,555 | 4.03% |

| 6 | Progressive | $64,267 | 2.06% |

| 7 | Affirmative | $43,761 | 1.40% |

| 8 | GEICO | $39,722 | 1.27% |

| 9 | UAIC | $37,373 | 1.20% |

| 10 | Universal Casualty | $36,167 | 1.16% |

Top Companies by J.D. Power Rating

You can also find the best companies in your area by looking at J.D. Power rankings. J.D. Power scores insurance companies out of 1,000 based on their overall customer satisfaction. This can help you identify the companies with the best benefits, rates, and customer service.

Below is a list displaying the companies with the highest J.D. Power ranking in the North Central area (Illinois and several other states, such as Michigan, are part of this list):

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | Erie | 857 |

| 2 | State Farm | 851 |

| 3 | COUNTRY | 850 |

| 4 | MetLife | 849 |

| 5 | American Family | 844 |

| 6 | Auto-Owners | 842 |

| 7 | Progressive | 842 |

| 8 | GEICO | 837 |

| 9 | The Hanover | 836 |

| 10 | Liberty Mutual | 831 |

Illinois Auto Insurance Laws

No-Fault or Fault?

A no-fault state requires drivers to add personal injury protection (PIP) to their policies. PIP covers injuries regardless of fault. Illinois isn’t a no-fault insurance state. It’s a fault or tort state. This is where the driver who’s at fault is responsible for covering all expenses in an accident.

Totaled Car

Your insurer will declare your car a total loss if the cost of the damages outweighs the actual cash value (ACV). Every state has its own criteria to decide when a vehicle is a total loss. Some states use a percent threshold, where if the damages exceed a percentage of the car’s value, it’s a total loss.

Illinois, on the other hand, uses the total loss formula (TLF) to declare a car as a total loss. With the TLF, a car is a total loss if the damages plus the salvage value are more than its ACV.

Salvage and Rebuilt Titles

If your insurer declares a car to be a total loss, it’ll receive a salvage title. Salvage title cars are illegal to drive and are usually in poor condition. It’s common for people to buy a salvage car and then restore it to a drivable state. Then, it can receive a rebuilt title.

How to Get a Rebuilt Title

Getting a rebuilt title for your car isn’t as simple as repairing the car, though. You’ll need to go through a title application process with the Illinois Secretary of State (SOS). Here’s what you’ll need to submit when you apply for a rebuilt title:

- Salvage certificate or out-of-state title

- Bills of sale for every “essential” part used to rebuild the car

- A list of each car part that was replaced and the VIN of the car that it came from

- Photos of your rebuilt car in case the SOS requires it

- Certificate of Safety from the Illinois Department of Transportation (IDOT)

Keep in mind that your rebuilt car will also need to pass an inspection to get a new title if it’s eight years old or newer. You’ll need to make an appointment with the Illinois SOS police for an inspection. Before you can get an inspection, your vehicle will also need to receive a Certificate of Safety from the IDOT Safety Testing Lane.

Insuring Cars with Rebuilt Titles

Once your car passes inspections and receives a state-issued rebuilt title, you’ll need to insure it. Luckily, most insurance companies in Illinois cover rebuilt titles. So, you should have little trouble finding one willing to write you a policy. The catch is that full-coverage may not be an option, but you’ll still be able to get liability so that you meet state requirements.

Car insurance for rebuilt titles is also often expensive. This is because rebuilt cars were totaled at one point and aren’t as safe as normal vehicles. Its claim history is permanent and any insurer has instant access to it with a VIN.

Even though insuring your rebuilt car will be more expensive than normal, you can still find ways to pay less. Discounts are a great way to lower your monthly costs. You can also compare quotes from various companies to find the lowest rates.

SR-22 Forms

An SR-22 form is a document certifying that you have the minimum amount of financial responsibility, or liability coverage, in your state. Illinois requires drivers to file an SR-22 form if they have certain violations on their record. You’ll need to file an SR-22 form if:

- You have a safety responsibility suspension

- The state revoked your driver’s license, plates, or vehicle registration

- You have an unsatisfied judgment suspension

- You’re on mandatory insurance supervision

- You have at least three mandatory insurance violations on your record

Once you file the SR-22 form, it’ll be on your record for three years. If you fail to maintain insurance during this time, your provider will have to inform the SOS. They’ll then suspend your driving record until you’re able to regain coverage.

If you don’t want to file an SR-22 form and buy traditional insurance, you may also:

- Deposit $70,000 in cash or securities with the Illinois State Treasurer

- File a surety bond

- File a real estate bond

Full Windshield Replacement

In some states, insurers must offer you full glass insurance to repair your windshield with no deductible. However, Illinois doesn’t require this type of coverage. This means that you’ll need comprehensive to repair your windshield. Some providers may offer this as an extra benefit. But know that it will cost you extra to add to your policy.

Filing Claims

You’ll probably need to file a claim with your insurance carrier if you get into an accident. Even if you didn’t cause the collision, it’s always a good idea to let your insurer know. You might even file a claim with your own company, depending on what types of coverage you have.

What to Expect After Filing a Claim

After filing a claim with your insurer, it becomes a waiting game. Luckily, providers have to follow state laws. These laws protect you and set deadlines for companies to adhere to. Insurance providers must respond to your claim within 15 working days. They then have 30 days to settle the claim.

The state also sets laws for how long you have to conclude the claim. This is what many refer to as statutes of limitations. Here’s how long you have:

- Property damage claims. Five years from the accident date.

- Bodily injury claims. Two years from the accident date or two years after your 18th birthday if you were a minor in the accident

Credit History

Insurers often use your credit score as a way to determine how much you pay for coverage. But some states, such as Washington and California, don’t allow this. Illinois doesn’t have any laws to stop companies from using your credit score to set your rates. Carriers may also use your credit history as a means to deny or drop your policy.

Policy Cancellation

Illinois allows insurers to cancel your policy during the first 60 days for any reason. After that period, they must have a legit reason to cancel your policy. These reasons include:

- Missing payments

- Committing misrepresentation or fraud

- Violating the terms of the policy

- Fraudulent claims

- Driver’s license suspensions

- Your vehicle is unsafe to drive

- You’re using the car for illegal purposes

- You’re using the insured car for commercial or business purposes, such as for ridesharing services

- You committed a felony

Reinstating your policy is still possible if you missed a payment. Most insurers give you a grace period to pay your bill. After that, your policy will lapse, resulting in a whole host of issues. To reinstate your policy, pay your rates ASAP. If you avoid a lapse, your policy should continue as if nothing happened.

Drunk Driving Laws

Drunk driving comes with lots of consequences. It puts yourself and others in danger. You can also expect steep legal trouble to come your way. After each offense, penalties get worse. Here’s what’ll happen if you are convicted of a DUI:

First offense:

- Class A misdemeanor

- Suspension of driver’s license for at least one year (two years if under 21)

- Suspension of vehicle registration

Second offense:

- Class A misdemeanor

- Five days of jail time or 240 hours of community service

- Suspension of driver’s license for at least five years (two years if under 21)

- Suspension of vehicle registration

Third offense – Aggravated DUI:

- Class 2 felony

- Suspension of driver’s license for at least 10 years (two years if under 21)

- Suspension of vehicle registration

The total cost of a DUI is far more than initial fines and legal fees. You can also expect your rates to see a massive increase. It’s also likely that you’ll become a high-risk driver and may need to buy a non-standard insurance policy.

Driver’s License Points System

Illinois uses a driver’s license points system to keep track of violations on your record. Three or more offenses within a year will result in a driver’s license suspension. If you’re under 21 and commit two offenses in two years, you’ll lose your license. Here are the types of violations that result in points on your record:

- Negligent driving

- Disregarding a traffic light

- Hit-and-run

- Reckless driving

- Screeching tires

- Speeding

Most Popular Cars

The most popular cars vary based on the state that you’re in. Insurers pay close attention to which vehicles are the best sellers. These cars may see higher coverage costs because they’re a target for thieves. These were the most sold cars in 2021:

- Honda CR-V

- Ford F-Series

- Chevrolet Silverado

- Toyota RAV4

- Ram 1500/2500/3500

Most Stolen Cars

Insurers keep watch on which vehicles are the most stolen in each state. Your comprehensive rates might be higher if your car is often a target. Here are the most stolen cars in 2021:

- 2015 Jeep Cherokee/Grand Cherokee

- 2018 Chevrolet Malibu

- 2020 Nissan Altima

- 2008 Chevrolet Impala

- 2007 Toyota Camry

- 2005 Ford Pick-Up (Full Size)

- 2019 Dodge Charger

- 2000 Honda Civic

- 2019/2010 Honda Accord

- 2017 Ford Fusion