Georgia Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Georgia.

- Sean Canonica

- Updated March 20, 2024

Georgia, the Peach State, is known for its warm climate and agriculture. The state is the eighth-largest in the US by population with about 6.9 million licensed drivers. Many of them live in large metropolitan centers like Atlanta and Augusta.

With all the drivers on the road, it’s necessary to protect yourself. Georgia, like most other states, requires car insurance to drive. We break down everything you need to know about Georgia requirements, including an in-depth look at the cost of resident premiums. We’ll also teach you about state laws relating to auto coverage and driving.

Table of contents

Georgia Average Auto Insurance Rates

It’s a smart choice to look at average premiums in your state. Doing so can help you find out how much drivers typically pay. This will let you know if you’re paying too much (or getting a discount already) for auto insurance. Ultimately, how much you pay depends on several details about you, such as your:

- Age

- Driving record

- Area of residence

- Driving experience

- Car’s make and model

The table below shows the average car insurance rates for Georgia and the US as a whole. On average, residents here seem to pay much more than the rest of the country. The average price per month is $104.95. That’s $15.75 higher than the national average.

| Coverage | Georgia Average | US Average |

|---|---|---|

| Liability | $829.86 | $650.35 |

| Collision | $420.60 | $381.43 |

| Comprehensive | $180.37 | $171.87 |

| Full Coverage | $1,259.49 | $1,070.47 |

| Price Per Month | $104.95 | $89.20 |

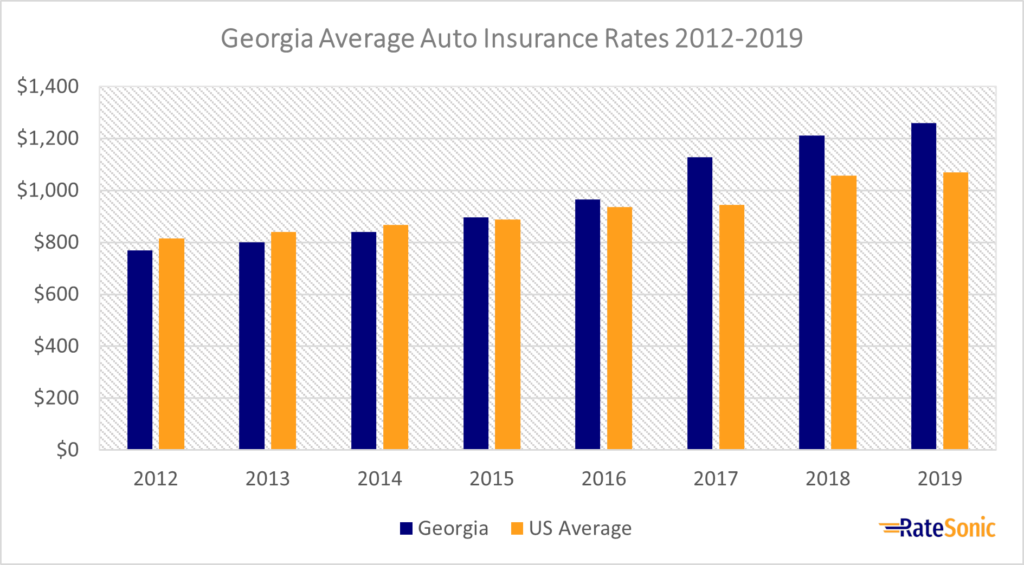

Average Full Coverage Rates

The graph below shows the change in average Georgia full coverage insurance premiums from 2012 to 2019. Rates rose from $768 in 2012 to $1,259 in 2019. This was an increase of $491, or nearly 64%.

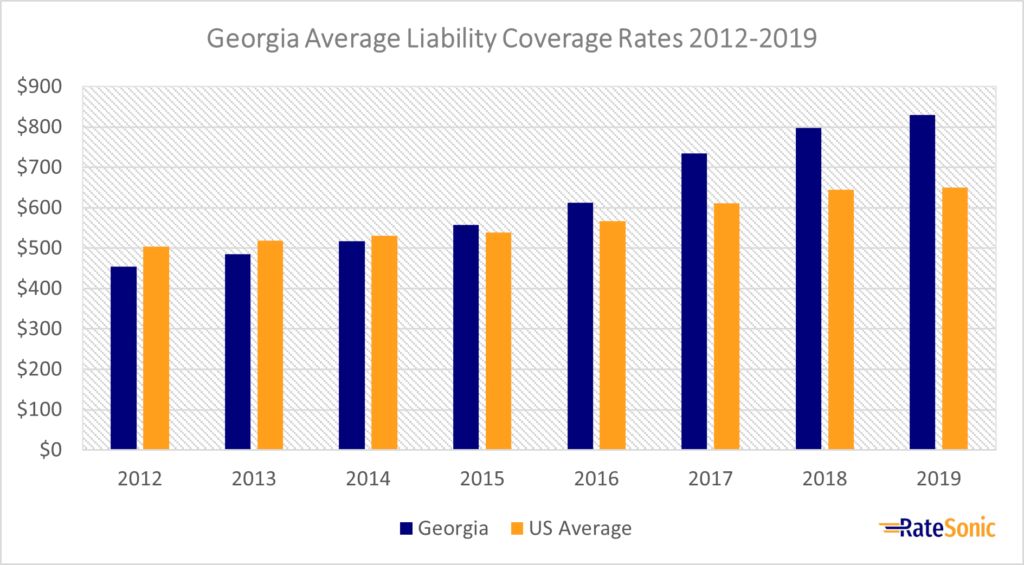

Average Liability Rates

The graph below shows Georgia’s average liability insurance rates between 2012 and 2019. Prices rose from $454 in 2012 to $829 in 2019. That’s an increase of $375, or an incredible 82%. In just seven years, premiums here went from slightly below the national mean to well above it.

How could this huge increase happen? This could be due to Georgia’s at-fault accident rate being 16% higher than the national average. This results in more liability insurance coverage claims and higher rates for all drivers.

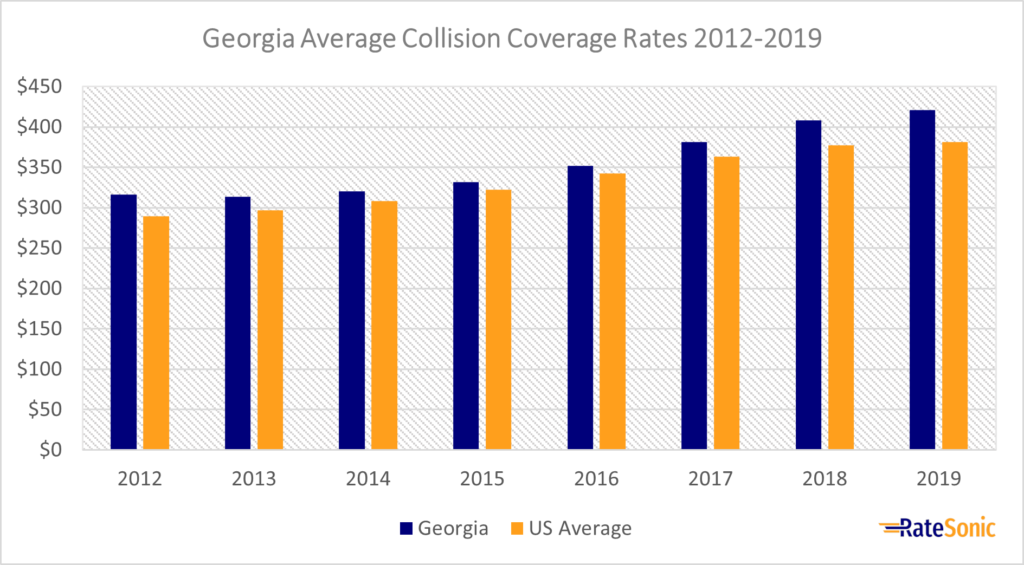

Average Collision Rates

Below is a graph that displays Georgia’s average collision insurance costs from 2012 to 2019. These rates started lower than the national mean in 2012. Now, the state’s premiums are much higher. Prices rose from $316 in 2012 to $420 in 2019. This was an increase of $104, or 33%.

Average collision rates may be higher here because of the cost to repair a car in the state. Per a study by CarMD done in 2019, Georgia ranks third in the country for expenses related to fixing vehicles. This makes claims more expensive for insurance companies to settle, resulting in higher rates for all.

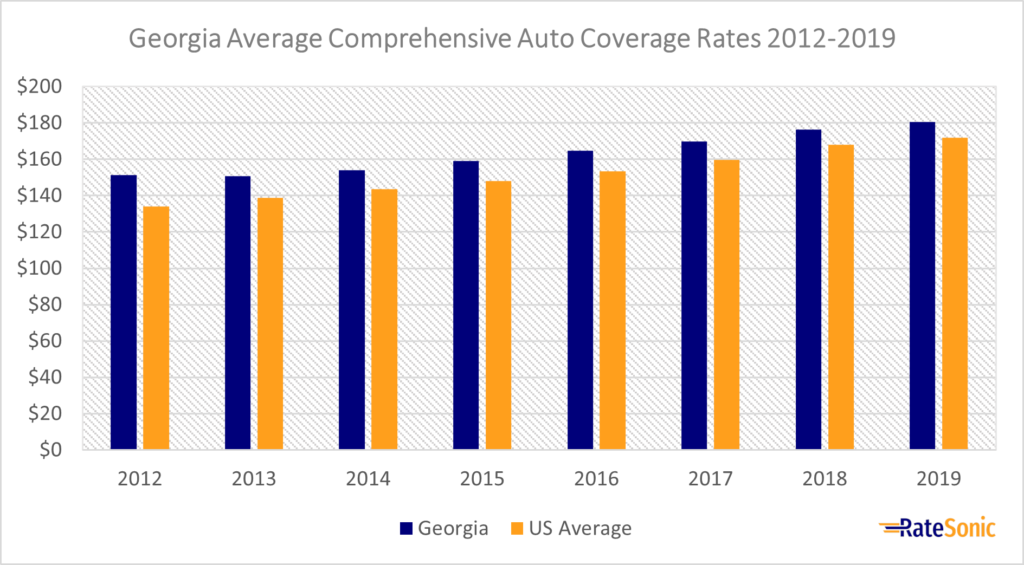

Average Comprehensive Rates

In the graph below, you can see how Georgia’s average comprehensive insurance rates have changed from 2012 to 2019. Throughout the eight years, this state has remained pricier than the national mean. Prices rose 19% from 2012 to 2019., increasing from $151 in 2012 to about $180 in 2019.

Minimum Auto Insurance Requirements

Just about every state requires auto coverage to drive. Only New Hampshire and Virginia allow you to drive without a standard auto insurance policy. Each state sets its own minimum requirements for drivers to follow.

State minimum requirements include:

- What type of car insurance you need i.e., coverage types

- How much of each coverage you need on your policy

Liability Insurance

Georgia drivers must have liability auto insurance to legally operate a motor vehicle on state roads. It’s the only type of coverage that the state requires. It protects you from having to pay out of pocket for damages or injuries you cause in an accident. You’ll need to maintain minimum policy limits of at least:

- $25,000 of bodily injury liability (BIL) for the injury or death of one person in a car accident caused by the driver of the insured vehicle

- $50,000 of BIL for the injury or death of more than one person in a car accident caused by the driver of the insured vehicle

- $25,000 of property damage liability (PDL) for each accident caused by the driver of the insured vehicle

Uninsured and Underinsured Motorist (UM and UIM)

While insurance is a state requirement, some people disregard this and get behind the wheel anyway. UM and UIM coverage protects you from expenses that an uninsured or underinsured driver cause in an accident.

Unlike some states, Georgia doesn’t require you to carry UM and UIM on your policy. Despite this, it’s still a good idea to buy it. Per the III, about 12.4% of drivers were uninsured in 2019. Getting into an accident with an uninsured driver could be a disaster. UM and UIM would help you avoid out of pocket costs.

Valid Proof of Insurance

You must keep valid proof of coverage on you at all times if you’re planning on driving in the Peach State. Valid proof can take on many forms. Here’s what counts as valid proof:

- Proof of insurance in the Department of Revenue’s database. Your insurer files this.

- Fleet insurance policy card. You must keep this in your vehicle whenever you’re driving.

- Bill of sale for a car that you bought in the last 30 days as well as the first page of your policy.

- A state-issued self-insurance card and certificate

- A rental agreement if you’re renting a car

Self-Insurance

You can self-insure your car(s). To do so, you’ll need to obtain a certificate of self-insurance from the Georgia Insurance and Safety Commissioner’s Office (ICO). You can get the certificate by sending an application to the ICO. The application should include:

- A list of all vehicles that you intend to insure. The list should include key details, such as car make and model, VIN, license plate number, and proof of ownership

- An audited financial statement that displays your assets, liabilities, and current net worth. This will give the state a good idea of your financial situation

- A blank self-insurance ID card

There are certain financial conditions you need to meet before self-insuring. These conditions depend on how many vehicles you’re trying to cover. Below is a table indicating what you’ll need to do based on how many cars you’re insuring:

| Number of Cars | Minimum Net Worth | Minimum Cash Deposit |

|---|---|---|

| 1-50 | $100,000 | $50,000 |

| 51-100 | $150,000 | $50,000 |

| 100-150 | $200,000 | $100,000 |

| 151-200 | $250,000 | $100,000 |

| 201-250 | $300,000 | $100,000 |

| 251-350 | $400,000 | $100,000 |

| 351+ | $500,000 | $100,000 |

Penalty for Driving Without Insurance

In Georgia, you need to maintain insurance at all times for any registered cars. It’s illegal to drive your car without coverage. Getting into an accident or being pulled over by the police without proof can result in several penalties, some of them are quote severe.

Here’s happens the first time you’re caught driving without a policy:

- Misdemeanor

- 60-to-90-day driver’s license suspension

- Possible jail time of up to one year

- Vehicle impoundment

- Fine of $200 to $1,000

- Required court appearance

- You may be restricted from buying license plates or registering your car

Best Car Insurance Companies in Georgia

When you’re looking to buy car insurance in Georgia, you’ll have many options to choose from. But how can you be sure which one is the best? It’s wise to compare each company by their overall quality. The best auto insurers have the following features:

- Excellent customer service

- Competitive rates

- Lots of benefits (discounts and customer loyalty programs)

For a full breakdown on the best of the leading insurers, we suggest reading our article on the top car insurance companies in the nation.

Top Companies by Market Share

One way to find the best insurance company is by looking at who owns the most market share in your state. This will help you find the biggest carriers in the area. Keep in mind that the biggest insurers aren’t always the best. But they are the most popular among other drivers, so it’s a good place to start.

Below is a table showing the top insurance companies in Georgia by market share:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | State Farm | $2,034,291 | 21.6% |

| 2 | Progressive | $1,231,733 | 13.1% |

| 3 | GEICO | $1,222,221 | 13% |

| 4 | Allstate | $878,649 | 9.3% |

| 5 | USAA | $807,797 | 8.6% |

| 6 | Liberty Mutual | $341,971 | 3.6% |

| 7 | Travelers | $304,654 | 3.2% |

| 8 | Auto-Owners | $296,490 | 3.2% |

| 9 | Georgia Farm | $262,559 | 2.8% |

| 10 | Nationwide | $221,170 | 2.4% |

Top Companies by J.D. Power Rating

J.D. Power conducts an annual study of auto insurance providers and ranks them by their customer satisfaction scores. This rating helps consumers identify which Georgia insurers deliver the best customer service experience, and which providers lag behind.

The table below lists the top companies in the Southeast US region (this includes states such as Georgia, Alabama, and Kentucky) by J.D. Power rating:

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | Farm Bureau- Tennessee | 883 |

| 2 | Erie | 874 |

| 3 | Kentucky Farm Bureau | 866 |

| 4 | State Farm | 859 |

| 5 | Auto-Owners | 849 |

| 6 | GEICO | 843 |

| 7 | Allstate | 838 |

| 8 | Alfa | 837 |

| 9 | North Carolina Farm Bureau | 836 |

| 10 | Liberty Mutual | 831 |

Georgia Auto Insurance Laws

No-Fault or Fault?

A no-fault state requires drivers to buy coverage such as personal injury protection (PIP) to cover their medical expenses. PIP covers the driver’s expenses regardless of who caused the accident.

Georgia isn’t a no-fault state. It’s a fault state, where drivers that cause an accident are responsible for covering the costs of all parties. This is why you need liability coverage to drive. Otherwise, you would be on the hook for potentially thousands in damages.

Totaled Cars

Your insurer will declare your vehicle a total loss if the damages cost more than your car’s actual cash value (ACV). Every state has its own rules for how and when a car becomes a total loss.

Georgia uses the total loss formula (TLF) to decide if a car is totaled. With the TLF, a car is a total loss if the damages plus the salvage value are more than the ACV. If your car isn’t a total loss, your insurer will return it to you so that you may repair it.

Salvage and Rebuilt Titles

Once a car becomes a total loss, it will receive a salvage title. Salvage title cars typically have lots of damage and aren’t drivable. It’s illegal to drive a salvage car. To drive it, you must repair it to a roadworthy condition and then get a rebuilt title.

How to Get a Rebuilt Salvage Title

To get a rebuilt title, you have to go through an application process. This process is different in every state. In Georgia, this is how you can get a rebuilt title for your salvage car:

- Get a rebuilder license (you can’t get a rebuilt title without this)

- Pass a vehicle inspection

- Submit these documents to the Department of Revenue:

- The car’s salvage title in your name

- Receipts for all parts used to rebuild the car to a roadworthy condition

- At least one photo of the car in its salvaged form

- Rebuilder’s license copy

- $100 inspection fee

Insuring Cars with Rebuilt Titles

Once you have a Georgia-issued rebuilt title for your car, you’ll need to insure it. Don’t worry, you should have no trouble getting insurance coverage for a rebuilt title. However, you may have to settle for a liability-only policy. Full coverage might not be an option because of the car’s accident history.

In general, cars with rebuilt titles cost much more to insure than regular vehicles. This is because, although they’ve been restored, they may not be as safe as standard cars. And a vehicle’s claim history never goes away and factors into how much you pay. With this in mind, it’s important to try to find the lowest rates. Shop around for rebuilt title coverage from multiple companies to find the best deal.

Full Windshield Replacement

Some states, such as Florida and Kentucky, require insurers to replace your windshield with no deductible. In Georgia, insurers don’t have to repair your windshield damage for free. This means you’ll have to pay a comprehensive coverage deductible if you file a claim.

Providers can, however, offer full glass coverage at an additional cost. This coverage will replace your windshield for free, but it will add to your monthly rates.

SR-22 Forms

Following a serious driving offense conviction, you may be required to file an SR-22 form with the state. An SR-22 form certifies that you maintain minimum liability coverage on your policy. You’ll only have to file one if the state orders you to after a severe moving violation, such as a DUI or reckless driving. States often require this form because premiums increases significantly once the driver’s license points appear on your driving record.

Filing Claims

You’ll likely need to file a claim with your insurer if you get into a car accident. No matter who caused the accident, it’s always a good idea to tell them about it. If the other driver caused the accident, you’ll need to file a claim with their provider. On the other hand, if you were at fault, you may have to file collision, MedPay, or other types of claims with your insurer.

How long do insurers have to settle a claim?

After you file a claim, insurers have 40 days to settle your it. This breaks down as:

- 15 days to send you proof of loss forms

- 15 days to accept or deny your claim

- 10 days to pay you and settle the claim

How long do you have to file a claim?

While insurers have to follow deadlines to settle your claim, you also have to file in a certain amount of time. The exact amount of time depends on your provider. But you should try to file claim ASAP after the accident. Be sure to check with your carrier about how long they give you to file a claim.

Also, keep in mind that if the accident wasn’t your fault, you’ll have to file a claim with the other person’s insurer. This means you must follow that company’s deadlines. So, make sure to check their deadlines as well so that you don’t miss the date.

Credit History

Some states, like California and Hawaii, don’t allow insurers access to credit scores to set rates. However, Georgia doesn’t have any rule prohibiting this practice. This means that your credit history is a factor in determining how high or low your rates are. They can also use it as a means to deny you a policy.

Policy Cancellation

Insurers may cancel your policy without any notice if they have a good reason to do so. These reasons include:

- Fraud or misrepresentation to get the policy

- Violation of the policy’s terms and conditions

- Failure to disclose driving record for the 36 months leading up to obtaining the policy

- False claims

- Driver’s license suspension

When you lose coverage due to a missed payment, it’s still possible to reinstate your policy. To do so, you’ll need to pay everything you owe as soon as you can. If you don’t pay within your insurer’s grace period, your coverage lapses. After a lapse, it becomes very hard to reinstate your policy.

Drunk Driving Laws

Drunk driving is one of the worst decisions you can make. It puts everybody around you (including yourself) at risk and can result in tons of legal trouble. In Georgia, there are two types of DUI convictions:

- DUI. A police officer assesses that you’re driving under the influence of drugs and/or alcohol. The District Attorney must be able to prove, either through driving or sobriety tests, that you were driving under the influence.

- DUI “Per Se.” The police find that your BAC is 0.08 or higher.

If you receive a DUI conviction, severe penalties can follow. Even first offenses carry heavy consequences. However, DUI penalties can vary on a case-by-case basis. Here are common DUI penalties based on how many offenses you have:

First offense:

- $1,000 fine

- License suspension for up to one year

- Up to one year of jail time

- Mandatory DUI education course

- Probation

- 40 hours of community service.

Second offense:

- $1,000 fine

- License suspension for up to three years

- Up to one year of jail time

- Mandatory DUI education course or substance abuse treatment

- Probation

- 40 hours of community service.

- Ignition interlock device (IID)

Third offense:

- $1,000 to $5,000 fine

- License suspension for up to five years

- Up to one year of jail time

- Mandatory DUI education course

- Probation

- 40 hours of community service.

- IID

Fourth offense:

- $5,000 fine

- Felony and one to five years of prison

Keep in mind that the true cost of a DUI goes far beyond fines and license suspensions. Your insurance rates will go way up after a conviction. You could even lose your policy altogether because you’ll now be a high-risk driver.

Driver’s License Points System

Georgia uses a driver’s license points system to keep track of your moving violations. Points range from two to six, depending on how serious the violation is. Racking up 15 points in 24 months will result in a license suspension.

Point Reduction

It’s possible to reduce the number of points you have on your record. After five years, you can take off up to seven points. But there’s a catch. To reduce points, you have to complete the following steps:

- Attend and complete a certified defensive driving course. Completion of defensive driving training will often get you a discount.

- Mail the certificate of completion to the Georgia Department of Driver Services (DDS), P. O. Box 80447, Conyers, Georgia 30013

- You may also bring the certificate to a DDS building and request a point reduction there

Most Popular Cars

The most popular cars in each state can vary. Insurers pay attention to the most popular cars in each state. These cars may be a target for thieves because of how popular they are. These were Georgia’s most sold cars in 2021:

- Ford F-Series

- Chevrolet Silverado

- Ram 1500/2500/3500

- Toyota Camry

- Toyota RAV4

Most Stolen Cars

Like with the most popular cars in each state, providers also keep an eye on which are the most stolen. Owning a car that thieves frequently target may result in higher comprehensive coverage rates. In Georgia, these were 2021’s most stolen vehicles:

- 2006 Ford Pick-Up (Full Size)

- 2020 Chevrolet Pick-Up (Full Size)

- 2017 Nissan Altima

- 2007 Honda Accord

- 2020 Toyota Camry

- 2019 Dodge Charger

- 2020 Toyota Corolla

- 2019 Jeep Cherokee/Grand Cherokee

- 2020 Chevrolet Malibu

- 2013 Honda Civic