Arizona Car Insurance Guide

Discover auto insurance requirements, the best companies, and how to get the lowest rates in Arizona.

- Brandon Canonica

- Updated March 20, 2024

Home to the world-famous Grand Canyon and sprawling deserts, Arizona is the sixth-largest state by land area. It’s also one of the 15 most populous, bordering four states and Mexico to the south. The state’s capital city, Phoenix, boasted about 1.6 million residents in the 2020 Census.

According to the Federal Highway Administration, there were roughly 5.6 million registered drivers in the Copper State in 2020. On this page, we’ll explain everything you need to know about Arizona auto insurance. This includes average rates, important laws and requirements, and how to find the best companies.

Table of contents

Arizona Average Auto Insurance Rates

When you’re in the market for a new policy, it’s always a good first step to look at your state’s average auto insurance rates. This can help you figure out how much others pay, and what you should pay with your insurer—or with a new one.

However, remember that many factors and details about you can affect how much you pay for coverage. Typical examples are things like where you live, your claims history, and your driving record.

Below is a table that shows the average car insurance rates in Arizona versus the rest of the country. This includes average costs for common coverage options, as well as full coverage.

| Coverage | Arizona Average | US Average |

|---|---|---|

| Liability | $662.55 | $650.35 |

| Collision | $327.86 | $381.43 |

| Comprehensive | $208.38 | $171.87 |

| Full Coverage | $1,063.93 | $1,070.47 |

| Price Per Month | $88.66 | $89.20 |

Average Full Coverage Rates

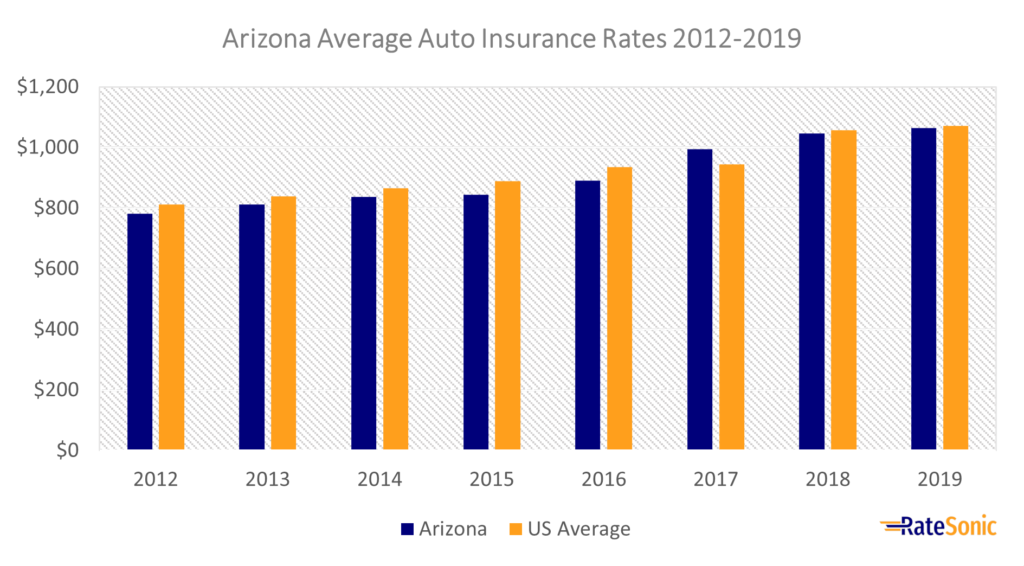

The graph below shows the change in average Arizona full insurance coverage rates from 2012 to 2019. Premiums rose from $781 in 2012 to $1,063 in 2019. This was an increase of $282, or 36%.

Arizonans paid less than average for car insurance for five years until 2017, when premiums reached nearly $1,000, compared to the US mean of almost $950. For the next couple of years, though, prices here dipped below the rest of the nation’s again. Despite this, coverage costs have still been on the rise. This could be due to recent inflation spike across the nation. Providers often raise rates to meet new market demands.

Average Liability Rates

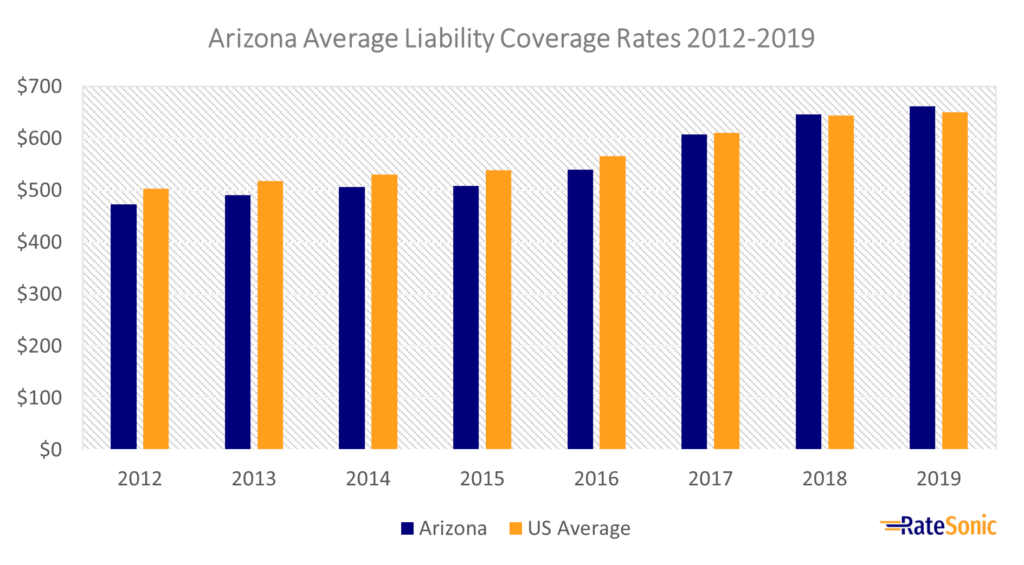

In the following graph, you can see Arizona’s average liability insurance rates from 2012 to 2019, which saw an increase of $189 or 40% during this period. Costs rose from $473 in 2012 to $662 in 2019.

For the most part, liability costs remained below the US average. It was only in 2018 that Arizona premiums rose above the national mean. One reason coverage prices remained affordable are the relatively low healthcare costs. Arizona ranked 50th for healthcare expenditure, per data from the Kaiser Family Foundation (KFF).

Average Collision Rates

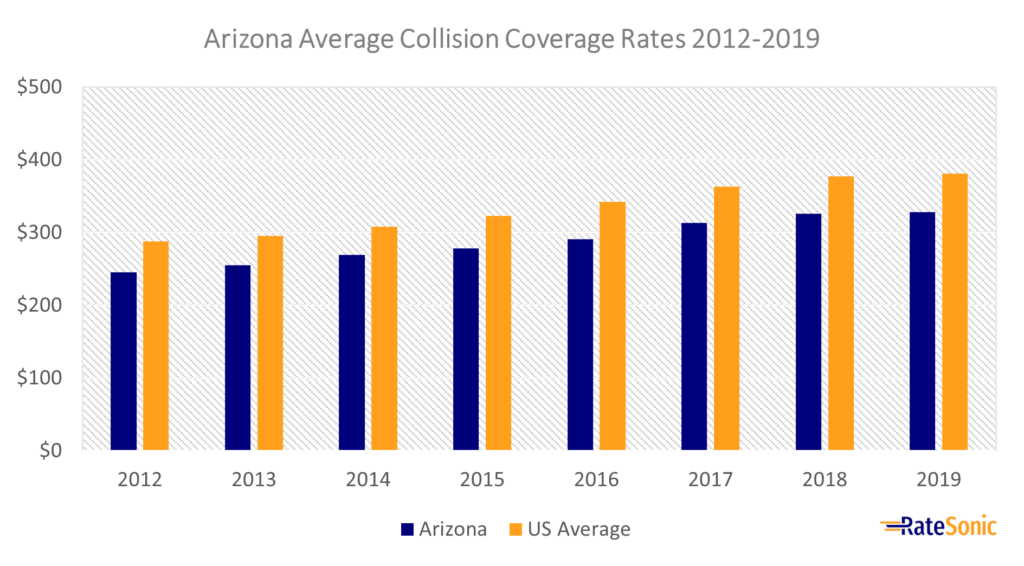

Below is a graph showing Arizona’s average collision insurance costs from 2012 to 2019. Rates rose from $245 in 2012 to $327 in 2019. This was an increase of $82, or 33%.

Over this eight-year-period, residents have paid less, on average, for collision coverage. A possible reason for this could be that it costs less to fix vehicles here. A 2019 study by CarMD ranked Arizona 27th for car repair expenses. If it takes less money to satisfy a claim, providers won’t feel the need to raise prices as much.

Average Comprehensive Rates

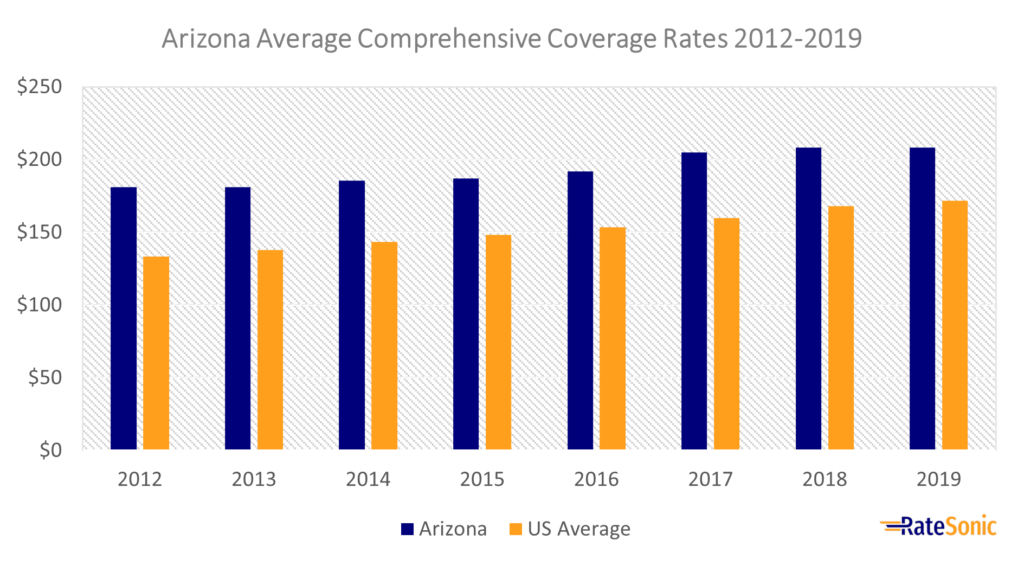

Finally, the next graph shows the difference in average Arizona comprehensive insurance costs from 2012 to 2019. Unlike the other coverage types above, costs in this state trend higher than most. To make matters worse, rates for this coverage rose 15% from $180 in 2012 to $208 in 2019.

One factor that may influence Arizona’s comprehensive rates is the above-average number of property crimes, including vehicle theft and car break-ins. In 2019 alone, the state saw over $8 million worth of motor vehicles stolen.

A 2022 article by AP News also reveals that catalytic converter thefts have been on the rise in Arizona, especially in urban areas. Since car parts like catalytic converters can be so expensive to replace (costing around $1,000 to $3,000), it’s no wonder carriers have increased comprehensive prices.

Minimum Auto Insurance Requirements

Nearly every state requires car insurance to drive. Each state sets minimum requirements to ensure sufficient coverage, including limits or required coverage types.

Liability Coverage

Liability is the only type of insurance drivers need to satisfy the law. You must maintain minimum coverage limits of at least:

- $25,000 of bodily injury liability (BIL) for the injury or death of one person in a car accident caused by the driver of the insured vehicle

- $50,000 of bodily injury liability (BIL) for the injury or death of more than one person in a car accident caused by the driver of the insured vehicle

- $15,000 of property damage liability (PDL) for each accident caused by the driver of the insured vehicle

It’s common to see your state’s minimum liability requirements written in a shorthand form. It looks like: “25/50/15.” This indicates the amount of coverage, in thousands, that you must have on your policy.

You’ll satisfy state law if you buy the minimum required coverage. But be aware that it may not be enough to cover an expensive or severe car accident. For that reason, it’s usually a good idea to buy as much protection as you can, either by upping your liability limits or adding extra coverage to your policy. The auto insurance industry generally recommends bodily injury limits of $100,000 per person and $300,000 per accident.

Uninsured and Underinsured Motorist

State law doesn’t require either uninsured (UM) or underinsured motorist (UIM) coverage. However, it’s typically a good idea if you can afford to add it to your policy

Data from the III ranks Arizona as the 24th in the nation for uninsured motorists. While most drivers have the required liability coverage, nearly 12% don’t. UM and UIM coverage can protect you if you get into an accident with someone who doesn’t have insurance or doesn’t have enough to cover the costs of the accident.

Valid Proof of Insurance

Before you can register a vehicle, you must show show proof of insurance. You may also see this as proof of financial responsibility (FR).

To prove FR in Arizona, you must have a valid insurance ID card. It should contain the following critical information:

- Your insurer’s name

- Policy number

- Policy effective date and expiration date

- Name and address of each insured driver

- Policy limits or a statement that the policy meets the required minimum amounts of liability

- Make, model, and VIN of each insured vehicle

Alternatives to Standard Auto Coverage

State law allows a few exceptions to the bare minimum coverage requirements. This is typically for people who don’t want to buy a policy from a standard company. It’s important to note that this isn’t usually a great idea for most people, as it can be expensive and can have some steep requirements.

For example, exceptions to car insurance are typically in the form of a surety bond, certificate of deposit, or cash of at least $40,000. This proves that you can sufficiently cover a car accident if one occurs.

You must own ten or more vehicles (registered in Arizona) if you prefer to self-insure. Then, you must fill out an application for a certificate of self-insurance.

Penalties for Driving Without Insurance

You must show your proof of coverage to authorities whenever asked. If you’re caught driving without insurance coverage, you could lose your license or have your vehicle’s registration suspended.

Be aware that Arizona’s Motor Vehicle Division (MVD) requires your insurer to tell them anytime either you or they cancel or non-renew your policy. In this case, you’d have to immediately prove that you’re covered by a policy, or you’d face steep penalties.

Below are the penalties for driving without coverage:

First offense:

- Fine of $500

- License and car registration suspended for three months

- SR-22 requirement for three years

Second offense:

- Fine of $750

- License and car registration suspended for six months

- SR-22 requirement for three years

Third offense:

- Fine of $1,000

- License and car registration suspended for one year

- SR-22 requirement for three years

Best Car Insurance Companies in Arizona

A useful way to find a new car insurance company is by looking at the best providers in Arizona. But what qualifies as the best? You’ll find that the top insurers typically give you the most value. This includes things like:

- Great rates

- Excellent customer service

- A quick and easy claims process

- A wide array of discounts

Comparing the best insurance companies side by side is a good strategy to get the best bang for your buck. You can do this in several ways. One way, for instance, is to check out our article on the best US auto insurers. Another smart idea is comparing quotes between well-known providers. You can also research specific info, such as market share or customer satisfaction, about the carriers you’re thinking of working with.

Top Companies by Market Share

Looking at a company’s market share can tell you how big it is in terms of customers served. The biggest companies aren’t necessarily always the best, but it can be a good sign if lots of people gravitate toward certain providers.

The following is a list of the top car insurance companies by market share in Arizona:

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | GEICO | $829,422 | 15.7% |

| 2 | State Farm | $817,363 | 15.5% |

| 3 | Progressive | $632,441 | 12% |

| 4 | USAA | $420,513 | 8.0% |

| 5 | Farmers | $410,379 | 7.8% |

| 6 | Allstate | $400,770 | 7.6% |

| 7 | American Family | $302,036 | 5.7% |

| 8 | Liberty Mutual | $290,719 | 5.5% |

| 9 | The Hartford | $107,264 | 2.0% |

Top Companies by J.D. Power Rating

Another good way to find the best insurers in your state is by looking at J.D. Power ratings. J.D. Power releases an annual list of the top providers in certain regions by customer satisfaction score. Arizona is in the “Southwest” region, which also includes neighboring states such as Nevada and New Mexico.

Below were the top car insurance companies in the Southwest in 2021 by J.D. Power rating (note: USAA didn’t fit the criteria of the study and isn’t on this list):

| Rank | Company | Customer Satisfaction Score (Out of 1,000) |

|---|---|---|

| 1 | American Family | 850 |

| 2 | State Farm | 847 |

| 3 | Liberty Mutual | 836 |

| 4 | Progressive | 835 |

| 5 | GEICO | 829 |

| 6 | The Hartford | 826 |

| 7 | Allstate | 822 |

| 8 | Safeco | 813 |

| 9 | Farmers | 802 |

| 10 | CSAA | 800 |

| 11 | Travelers | 792 |

Arizona Auto Insurance Laws

No-Fault or Fault?

Arizona is not a no-fault car insurance state. This means that it doesn’t require drivers to buy coverage that takes care of medical costs no matter who was at fault in an accident. This type of coverage is typically personal injury protection (PIP).

Rather, it’s a fault state. This means that you’re responsible for covering the costs of an accident you’re involved in. The most straightforward way to do this is by having enough coverage on your policy for any situation.

Totaled Cars

Your car becomes a total loss if it’s damaged to the point that it would cost more to repair than it’s worth. If your car gets totaled, you should receive a payout from your insurer that’s equal to your car’s actual cash value (ACV). A car’s ACV is also known as its market value, or what it was worth before the incident occurred.

Arizona requires providers to use the total loss formula (TLF) to decide if your car should be a total loss. With the TLF, your provider can total your car if its repairs plus its salvage value exceed its ACV. Your car’s salvage value is its worth after it’s taken damage.

Salvage and Restored Salvage Titles

A salvage title car is a vehicle that’s been declared a total loss by an insurance company. Salvage titles typically carry a brand that shows the reason for their damage.

In Arizona, salvage vehicles are illegal to drive on public roads and highways. You’ll also have a tough time trying to find a policy if you own one. Since they’re unsafe and illegal to take on the road, most insurers don’t cover salvage titles.

How to Get a Restored Salvage Title

To drive your salvage again, you’ll have to repair it and apply for a restored salvage title. This is how to get a restored salvage title:

- Fully rebuild or repair your car (be sure to keep all receipts or bills of sale for any parts used)

- Fill out a title application (Form 96-0236)

- Make an appointment and go through a Level III inspection (includes a $50 fee). You must bring the following:

- Proof of ownership (vehicle title, registration, or bill of sale)

- Driver’s license

- Receipts or bills of sale for all the parts you used to fix the car

- If needed, you must get an emissions compliance certificate

- Surrender your salvage title (includes a $4 fee, and possibly other registration fees)

Insuring Cars with Restored Salvage Titles

Unlike salvage titles, you can insure a restored salvage title car. However, your policy may not have the same benefits or coverage options as it would with a clean title car.

Many insurance companies only offer basic liability coverage to restored or rebuilt title owners. This is because, while safe to drive, a restored salvage car could cost more to repair or could be riskier. After all, it used to be a total loss. Therefore, extra options, like full coverage, aren’t typically an option if you own one.

Also, your rates will be higher if you have a restored salvage car. Despite this, you can still try to find the best deal by comparing quotes from several insurers. Some companies may offer better rates for restored salvages.

Full Windshield Replacement

Some states, like Florida, require providers to pay for repairs to your windshield without a deductible. Arizona has no laws that require insurers to do so. Luckily, your comprehensive coverage will pay for windshield damage. This includes a varying deductible amount, based on what you decided when you set up your policy.

Another option that some companies offer is windshield and glass replacement coverage. With this coverage, your insurer will repair your car’s front windscreen without a deductible. Keep in mind, though, that adding this to your policy could make your premium more expensive.

Filing Claims

Filing a claim is important after a car accident. Doing so ensures that you can get the coverage you need as soon as possible. If you wait too long to file a claim, you may not be able to remember all the critical details about the incident and may not be able to get help from your insurer.

Most carriers make filing a claim a quick and easy experience. You can do it on the phone or online with many providers. Be sure to check out your insurer’s website for more information on how to make a claim.

How Long Does It Take to Settle a Claim?

Insurers have 40 days to settle your claim. They must also notify you within ten business days that they’ve received your claim, and within 15 days on whether they’ll accept or deny it. If your company accepts your claim, they then have 15 days to give you your payment.

SR-22 Forms

You must maintain an SR-22 for three years after a severe violation that leads to a license suspension or revocation. The Arizona Department of Transportation (ADOT) refers to this as proof of future financial responsibility. Examples of violations that can lead to an SR-22 requirement include driving without insurance, a DUI, and reckless driving.

An SR-22 form is a certificate indicating that you have the state’s minimum required auto insurance. Your insurer will typically help you file an SR-22 with the state. Some carriers, however, don’t offer them.

Credit History

Drivers with a bad credit score can end up paying higher premiums. It’s not uncommon for providers to use your credit history, among other factors, when they determine your premiums. They do this because it can show how reliable or risky you are as a customer.

Policy Cancellation

According to state regulations, your provider can cancel or non-renew your policy for several reasons after 60 days. According to the Department of Insurance and Financial Institutions (DIFI), these reasons include:

- Not paying your rates

- Fraud or misrepresentation

- You’ve had your driver’s license revoked or suspended

- You or someone on your policy have had a serious conviction during the policy’s effective period

- You’ve been using your car for business reasons without telling your provider

If your insurer cancels your insurance due to a missed payment, you may be able to reinstate your policy. Be sure to contact your carrier right away. After your coverage lapses, it becomes very difficult to reinstate your policy.

Drunk Driving Laws

Driving under the influence of drugs and alcohol is always a bad choice. It can land you in some serious legal trouble and can end up costing you a ton of money. A single DUI can make coverage unaffordable. But more than anything, it can put yourself and others in danger.

In Arizona, you’ll get a DUI if you’re caught driving with a blood alcohol content (BAC) of 0.08. You could also get a DUI conviction if your BAC was below this threshold, but there was enough evidence for the authorities to believe you couldn’t safely operate a vehicle. Drivers under the age of 21 can also be convicted of a DUI if any alcohol is in their system, even if their BAC is under the legal threshold.

Here are the penalties for getting convicted for a DUI:

Standard DUI

First offense:

- License suspension for up to one year

- At least 10 consecutive days in jail

- A fine of at least $1,250

- Must go through an alcohol screening, education, and treatment program

- Must use an ignition interlock device (IID) before driving a vehicle for one year

- Community service

Second and subsequent offenses:

- License revoked for one year

- At least 90 days in jail

- A fine of at least $3,000

- Must go through an alcohol screening, education, and treatment program

- Must use an IID before driving a vehicle for one year

- Community service

Extreme DUI (BAC of 0.15 or higher)

First offense:

- License suspension for up to one year

- At least 30 days in jail

- A fine of at least $2,500

- Must go through an alcohol screening, education, and treatment program

- Must use an IID before driving a vehicle for one year

- Community service

Second and subsequent offenses:

- License revoked for one year

- At least 120 days in jail

- A fine of at least $3,250

- Must go through an alcohol screening, education, and treatment program

- Must use an IID before driving a vehicle for one year

- Community service

How a DUI Impacts Your Coverage

Not only will a DUI conviction cause you trouble with the law, but it’ll also hurt your car insurance. Your provider will label you a high-risk driver and is likely to cancel your policy. It may also be hard to find a new insurer after this since most don’t insure high-risk drivers with DUIs.

If you can’t find a provider, you may have to get a policy from a non-standard company or through a state run program for high-risk drivers. You can expect to pay a lot more for coverage from these sources and after a DUI in general.

State law requires that you have an SR-22 for three years after a DUI conviction. This proves to the state that you meet its bare minimum insurance requirements.

Driver’s License Points System

Arizona uses a driver’s license points system to keep track of traffic violations. When you get a ticket, you’ll get points on your driving record. If you get eight points in 12 months, however, you can have your license suspended or you’ll have to go to Traffic Survival School (TSS).

Below are the number of points you’ll receive for certain violations:

- Reckless or aggressive driving, DUI, or extreme DUI – 8 points

- Hit-and-run – 6 points

- Failure to stop at a stoplight, stop sign, or yield to others (resulting in death) – 6 points

- Failure to stop at a stoplight, stop sign, or yield to others (resulting in serious injury) – 4 points

- Speeding – 3 points

- Driving or stopping your car in a gore area – 3 points

- Any other type of violation – 2 points

Most Popular Cars

Every state has a unique group of the most popular cars. These are typically ones that have top-tier ratings and are the most desired by consumers. These were Arizona’s most-sold cars in 2021:

- Ram 1500/2500/3500

- Ford F-Series

- Chevrolet Silverado

- Toyota Tacoma

- Toyota RAV4

Most Stolen Cars

States also have a set of the most stolen cars. These are the ones most desired by criminals. If you own one, you could pay more for coverage because of the increased theft risk. These were the Copper State’s most-stolen vehicles in 2021:

- 2004 Chevrolet Pick-Up (Full Size)

- 2006 Ford Pick-Up (Full Size)

- 2000 Honda Civic

- 2001 Dodge Pick-Up (Full Size)

- 1997 Honda Accord

- 2015 Nissan Altima

- 2001 GMC Pick-Up (Full Size)

- 2020 Toyota Camry

- 2001 Chevrolet Tahoe

- 1996 Jeep Cherokee/Grand Cherokee