When shopping for a new auto policy, you may stumble upon the term full coverage. It confuses consumers because the phrase appears so much that many people believe it’s an actual product. In reality, it’s simply a term used a policy includes, at a minimum, the three pillars of auto insurance: liability, collision, and comprehensive.

In this article:

- Full coverage basics

- Commonly required coverages

- When full-coverage makes sense

- US Average Cost

- Frequently asked questions

Full-Coverage Basics

By definition, you have full-coverage when your policy includes three key auto insurance products: collision, comprehensive, and liability. Below are some quick explanations of each:

Liability

Liability pays for out of pocket expenses if you’re at fault in an accident. It can reduce worry after an accident and save you lots of money in the long run. Not only does it protect you, but it also ensures that the crash victim(s) don’t have to pay for anything.

Here’s a list of what liability covers if you’re in an accident:

- Damage to the other person’s car

- Property damage to other objects e.g., signs, light posts, buildings, etc.

- Bodily injury to other people in the accident

Most states require a minimum amount of liability to drive. So, what we’re really talking about are the two additional products necessary to have 360 degree coverage: collision and comprehensive.

Collision

Collision pays for repair costs if your car hits an object (or vice versa). This coverage also protects you if something damages your car while it’s parked. In addition, your insurer will renumerate you for out-of-pocket expenses when your vehicle hits another non-car object like a pole, tree, sign, or even your own house.

An accident doesn’t need to involve other objects for this coverage to protect it. So, if you run over a pothole or spin out due to snow or ice and cause damage, collision insurance can come to the rescue.

Comprehensive

Comprehensive pays for vehicle repairs if you fall victim to a random event that damages your car. Many providers refer to these events as an “act of God” because they come out of nowhere and are destructive. With this coverage added to your policy, you’ll get protection from disasters like:

- Natural disasters e.g., hurricanes, wildfires, tornadoes, hailstorms, and floods

- Vandalism

- Theft

- A collision with an animal

Comprehensive makes smart economic sense if you live in an area where you’re at risk from covered acts of God. It could mean places like hurricane hotspots, tornado alley, or rural areas with lots of deer running around on the roads.

Other Coverages Your State May Require

While these three primary coverages can protect you from many potential risks, you’re not bulletproof when you hit the road. To add extra protection, many providers offer additional types of insurance to ensure better financial security, including:

Medical Payments (MedPay)

Medical Payments (MedPay) pays for medical bills and funeral expenses regardless of who’s at fault. This coverage also extends to pedestrians injured in a crash. There are plenty of benefits to carrying MedPay on your policy, including:

- Ambulance and EMT fees

- Doctor and clinic visits

- Hospital visits

- Surgeries

- Medical exams e.g., x-rays and other tests

- Nursing

- Prosthetics

- Health insurance co-pays and deductibles

- Funeral expenses

Guaranteed Asset Protection (Gap)

Guaranteed Asset Protection or Gap insurance pays the difference between what you owe on a car and its actual cash value (ACV). It covers what you still owe on your loan if your car gets totaled or stolen before you make the final payment. Gap is for drivers who just bought a new car or only placed a small down payment. Your car lender or lessor may include it in your contract when you finance it.

Uninsured and Underinsured Motorist (UM and UIM)

UM and UIM are two very similar coverages that drivers have the option of adding to their policy. They pay for any damages or injuries you or your car sustain if you’re hit by a driver who doesn’t have any liability insurance. In addition, they cover an accident where the other driver doesn’t have enough insurance to pay for the expenses.

If you’re the victim of a hit-and-run, UM will cover it. Since the at-fault driver is nowhere to be found, insurers consider them to be uninsured.

When Full-Coverage Makes Sense

Here are some scenarios where full-coverage insurance is either required or a really good idea:

You Finance or Lease a Vehicle

If you’re financing or leasing a car, your lender will require collision and comprehensive. These are in addition to whatever your state requires, such as liability. Because of this, you technically must acquire full-coverage when you finance a car.

Also, note that your state may require more than just liability to drive. UM, UIM, and MedPay are mandatory in some states.

You Can’t Afford Out of Pocket Expenses

Accidents often result in expensive medical bills and property damages. Even a minor crash can empty your wallet if you have to pay for expenses out of pocket. Random events such as natural disasters and theft can happen at any moment. Full-coverage is a smart choice when you don’t have enough money to handle the often-large expenses of an accident.

You Live in a Risky Area

You may want to add collision coverage to your policy if you live in an area that puts you at risk for accidents. For instance, your state might have a higher incidence of accidents than the national average. According to the Insurance Institute for Highway Safety (IIHS), the three US states that experience the highest number of fatal crashes per year are:

- California – 3,316

- Texas – 3,294

- Florida – 2,950

Comprehensive might also be a good idea if you live in an area that’s notorious for tornadoes and hurricanes. The same goes if you live in a city that has a high rate of car thefts.

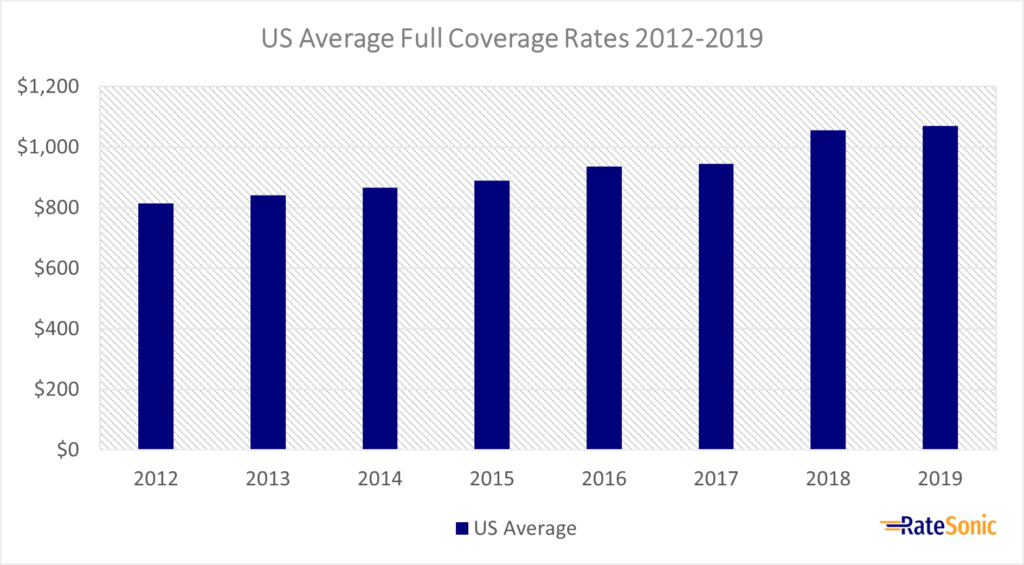

US Average Cost of Full-Coverage

The table below shows average rates for full-coverage policies in the United States from 2012 to 2019. This is the most recent period of pricing data we can access from the III.

| Year | US Average |

|---|---|

| 2012 | $814.99 |

| 2013 | $841.23 |

| 2014 | $866.31 |

| 2015 | $889.01 |

| 2016 | $935.80 |

| 2017 | $944.36 |

| 2018 | $1,056.55 |

| 2019 | $1,070.47 |

Below is a visual representation of the above data:

Average Price by State

Full-coverage rates tend to vary based on where you live. Many details about your area can impact average prices, including:

- Number of claims

- Car repair costs

- Health care costs

- Weather severity

The next table provides average rates to fully cover vehicles in all 50 states and the District of Columbia in 2019. The data is from the III and was originally collected by the National Association of Insurance Commissioners (NAIC). The national average we compared each state to was $1,070.47 in 2019.

| State | Average Cost | US AVG Difference |

|---|---|---|

| Alabama | $932.14 | -14.8% |

| Alaska | $991.09 | -8% |

| Arizona | $1,063.93 | -0.6% |

| Arkansas | $897.92 | -19.2% |

| California | $1,051.79 | -1.8% |

| Colorado | $1,174.87 | +8.9% |

| Connecticut | $1,237.55 | +13.5% |

| District of Columbia | $1,440.58 | +25.7% |

| Delaware | $1,289.93 | +17% |

| Florida | $1,414.17 | +24.3% |

| Georgia | $1,259.49 | +15% |

| Hawaii | $839.87 | -27.4% |

| Idaho | $738.10 | -45% |

| Illinois | $939.64 | -13.9% |

| Indiana | $777.05 | -37.8% |

| Iowa | $714.86 | -49.7% |

| Kansas | $818.99 | -30.7% |

| Kentucky | $935.61 | -14.4% |

| Louisiana | $1,557.22 | +31.2% |

| Maine | $696.37 | -53.7% |

| Maryland | $1,236.61 | +13.4% |

| Massachusetts | $1,182.69 | +9.5% |

| Michigan | $1,495.94 | +28.4% |

| Minnesota | $892.17 | -19.9% |

| Mississippi | $975.58 | -9.7% |

| Missouri | $929.91 | -15.1% |

| Montana | $834.86 | -28.2% |

| Nebraska | $807.30 | -32.5% |

| Nevada | $1,292.52 | +17.2% |

| New Hampshire | $864.35 | -23.8% |

| New Jersey | $1,395.53 | +23.3% |

| New Mexico | $932.67 | -14.8% |

| New York | $1,445.30 | +25.9% |

| North Carolina | $741.70 | -44.3% |

| North Dakota | $703.73 | -52.1% |

| Ohio | $802.72 | -33.3% |

| Oklahoma | $908.95 | -17.7% |

| Oregon | $990.00 | -8.1% |

| Pennsylvania | $992.33 | -7.9% |

| Rhode Island | $1,382.64 | +22.5% |

| South Carolina | $1,114.90 | +3.9% |

| South Dakota | $745.33 | -43.6% |

| Tennessee | $863.39 | -23.9% |

| Texas | $1,143.85 | +6.4% |

| Utah | $954.14 | -12.2% |

| Vermont | $785.37 | -36.3% |

| Virginia | $861.18 | -24.3% |

| Washington | $1,066.84 | -0.3% |

| West Virginia | $946.03 | -13.1% |

| Wisconsin | $767.42 | -39.5% |

| Wyoming | $776.22 | -37.9% |

Frequently Asked Questions

Is full coverage worth it?

Most people seem to think so. In fact, as many as 79% of US drivers opt for full-coverage. But, for others, it might not be. Ultimately, it depends on the risk you’re willing to take on. It’s probably worth it if you aren’t able to handle the out-of-pocket expense from an accident or live in a high-risk area for crashes or natural disasters.

Lenders may also require collision and comprehensive, in addition to standard liability, when you finance a car. Technically, it’s their car until you make the final payment. So, they’re just protecting their investment.

When should I drop collision or comprehensive?

Without a doubt, full-coverage is usually better. However, it doesn’t always make sense. You might think about dropping collision and comprehensive if:

- Your car is worth less than the price of your policy

- Your accident risk isn’t very high, or you believe you’re a very safe driver

- You don’t drive your car very far or hardly at all

- The car you drive has extremely high miles (at this point, it’s not worth too much)

What’s the difference between liability and full-coverage?

There are many differences between liability and full-coverage. The biggest one is that the latter isn’t a type of insurance. It means you have at least the three main types on your policy. These include collision, comprehensive, and liability.