Collision and comprehensive are two of the most common types of car insurance. They’re quite similar, sharing key components of any auto coverage. But any consumer should know the differences, too. That information is critical for anyone shopping for a new policy. It’s just as important for those updating their current policies. And if you’ve just financed a new car, you’ll learn that collision and comprehensive aren’t optional. Many lenders require these coverages to be part of your policy.

This article will help you learn the differences between collision and comprehensive auto insurance. This includes an explanation of what each does and doesn’t cover, as well as a comparison of the two side by side. We’ll also answer some frequently asked questions about both types of coverage.

Collision Insurance

Collision coverage pays for damages to your car if it’s in a crash with another vehicle or object. It covers both repairs and the cost to replace your car if it’s a total loss.

This coverage isn’t a requirement in any state. For that reason, it’s up to you to decide if you want to add it to your policy. But keep in mind that not having it can end up being very expensive.

You’ll have to pay for all repairs out of pocket if you get into an accident without collision insurance. This is the case whether you’re at fault or not. Accidents can happen when you least expect them. So, for most people, it might be a good idea to have that extra layer of protection.

What’s Covered

Collision takes care of incidents that are within your control as a driver. Here are some common examples of situations it covers:

- Collisions with other vehicles (hit-and-runs, rear-ends, head-on)

- Rollovers or other accidents only involving your car

- Collisions with trees, light poles, or other objects

- Pothole damage

Note that this collision insurance only covers the cost to repair damages to your vehicle. It doesn’t cover injuries to yourself or other drivers involved in an incident. Liability coverage or personal injury protection (PIP) will take care of any injuries from the accident.

What Isn’t Covered

Collision coverage doesn’t cover situations or incidents that happen without your control. Common examples may include theft, vandalism, or natural disasters. Comprehensive covers these types of incidents.

Comprehensive Insurance

Your life can change in an instant. A natural disaster could come through and cause lots of destruction. Or a vandal could randomly damage your car. Comprehensive insurance exists to help you in these unfortunate cases.

Since accidents can happen randomly and cost you lots of money, it makes sense to add comprehensive insurance to your policy. Without it, you’d be on the hook to pay out of pocket for any damages to your car.

Much like collision, no state requires comprehensive. The only case where you’d possibly be required to have it is if you’re financing a car. This is because most lenders require buyers to have comprehensive and collision insurance. They do this to protect their asset in case of disaster.

What It Covers

As previously mentioned, comprehensive covers events and accidents that are out of your control as a driver. Below are some common examples of what comprehensive insurance covers:

- Damage from natural disasters (e.g., volcanos, earthquakes, hurricanes, and tornadoes)

- Damage from a tree falling on your car

- Hitting a deer or other animal with your car (or if an animal damages your car while you’re not in it)

- Vehicle theft (doesn’t include the personal items inside your car)

- Vandalism

What It Doesn’t Cover

Comprehensive insurance doesn’t cover collisions you have with other vehicles and objects while driving. These types of incidents would only get coverage from collision coverage.

Overview of Collision and Comprehensive

While comprehensive and collision insurance both share the letter “C,” they’re very different from each other. The easiest way to remember the difference between them is that comprehensive handles events that are out of your control and collision handles events within your control.

Comprehensive – Covers accidents and incidents out of your control. This includes vandalism, theft, earthquakes, “acts of God,” and more.

Collision – Covers accidents and incidents within your control. This includes wrecks with cars and objects, potholes, and more.

They Both Have a Deductible

One important part of the collision and comprehensive is that they both have a deductible. The two have a one because they only apply in cases where your vehicle takes damage.

A deductible is an amount that you must pay toward the repair of your vehicle before your insurance pays the rest. When you add collision and comprehensive to your policy, you’ll have to agree to a deductible amount with your insurer. This will be the amount of money you’ll pay each time you file a claim.

Make sure repair costs exceed your deductible before filing any claim. It doesn’t make sense to file a claim for $400 in damages when you have a $1,000 deductible. You should pay for minor accidents and fender benders out of pocket. A side benefit of paying for any repairs is that you’ll have fewer claims on record, helping your rates remain low.

They Both Have Coverage Limits

Liability, collision, and comprehensive insurance each have their own limits. The only one with mandated limits is liability. But collision and comprehensive are optional and have no limit requirements. You get to decide how much of each you’d like even if that means you don’t want them at all.

Before you finalize your policy, give limits some thought, because they’re very important. If they’re lower, your premium may be cheaper and easier to afford. But, if you’re in a serious accident, costs may exceed your policy maximum payouts and you’ll pay for any other damages out of pocket.

Do I Need Both Comprehensive and Collision?

It’s not uncommon to hear collision and comprehensive mentioned in the same sentence as “full coverage.” Full coverage refers to a policy with the three primary coverages (liability, collision, and comprehensive) being all on one policy. If you have all three, insurers will say you’re fully covered.

There could be situations where you might need collision, but not comprehensive, or vice versa. This often depends on many risk factors about yourself. You can check the following about yourself to decide if you need both types of insurance:

- How often you drive. This can affect your likelihood to get into an accident. For example, you likely have a higher accident risk if you’re a daily commuter. Therefore, getting collision would be a good idea.

- Where you live. The city you live in adds a lot to your potential risk of an accident. For instance, if you live in a high-traffic area, you should get collision because of the higher risk of getting into an accident. Also, getting comprehensive would be smart if you live in an area with lots of natural disasters per year.

- Your car’s value. You may feel comfortable paying for the repairs yourself instead of the deductible if your car isn’t worth that much. But if your car is expensive, it’d be better to have collision or comprehensive to protect your bank account.

- How much you can pay out of pocket. You might be able to get by without collision or comprehensive if you have a sizable emergency fund.

As with everything else in the world of insurance, you should carefully consider every factor before buying. Doing your homework could save you money, either by not paying for repairs or not paying for coverage you don’t need.

How Much Do They Cost?

How much collision and comprehensive insurance costs depends on several factors. Usually, insurers look at unique details about you and how much of a risk you are to file a claim. Things like inflation, company losses, and price optimization may also play a role.

Here are some common factors auto insurance companies use to set prices:

US Average Collision and Comprehensive Rates

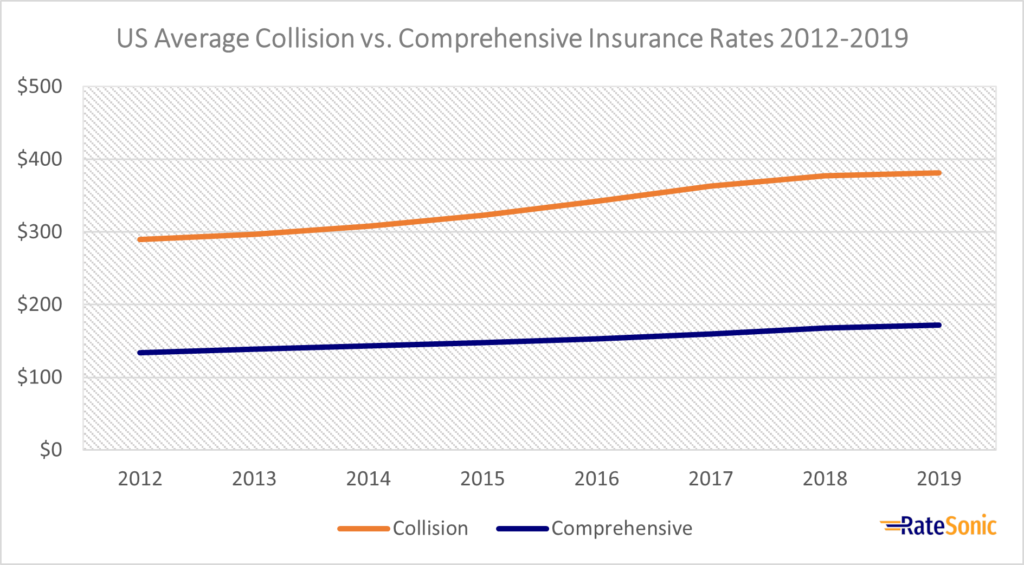

The following table shows average national collision and comprehensive rates side-by-side ranging from 2012 to 2019. It’s worth noting that this is the most recent actual cost data we can gather from the Insurance Information Institute (III).

| Year | Collision | Comprehensive |

|---|---|---|

| 2012 | $289.66 | $134.04 |

| 2013 | $296.99 | $138.82 |

| 2014 | $308.32 | $143.45 |

| 2015 | $322.61 | $148.04 |

| 2016 | $342.40 | $153.32 |

| 2017 | $363.08 | $159.72 |

| 2018 | $377.62 | $167.91 |

| 2019 | $381.43 | $171.87 |

Below is a visual representation of the above data:

On average, collision insurance costs far more than comprehensive. In 2019, consumers paid about $209 more for the former than the latter. Over the eight years, collision auto coverage rates increased by nearly $100. On the other hand, comprehensive rates stayed fairly level, only going up by about $37.

Average Collision and Comprehensive Rates by State

Your area of residence is one of the primary factors that dictate how much you pay for car insurance. Ultimately, this is because it reveals something to insurers about your risk factor to file a claim or cost them money. For instance, comprehensive rates are naturally higher in states that experience more natural disasters. Collision rates also often tend to be higher in places with more traffic and, consequently, the potential for accidents.

The table below displays average collision and comprehensive rates in each state, as well as the District of Columbia as of 2019. The costs below come from the III and were initially sourced by the National Association of Insurance Commissioners (NAIC). In 2019, the national average for collision was $381.43 while comprehensive averaged $171.87.

| State | Collision | Comprehensive |

|---|---|---|

| Alabama | $390.19 | $180.11 |

| Alaska | $401.87 | $155.11 |

| Arizona | $327.86 | $208.38 |

| Arkansas | $372.65 | $240.54 |

| California | $495.18 | $96.53 |

| Colorado | $332.26 | $298.01 |

| Connecticut | $412.78 | $134.01 |

| District of Columbia | $539.48 | $221.94 |

| Delaware | $354.76 | $136.31 |

| Florida | $355.69 | $153.00 |

| Georgia | $420.60 | $180.37 |

| Hawaii | $370.53 | $106.29 |

| Idaho | $270.36 | $142.89 |

| Illinois | $351.27 | $144.65 |

| Indiana | $288.97 | $138.86 |

| Iowa | $250.96 | $221.72 |

| Kansas | $285.92 | $286.48 |

| Kentucky | $307.91 | $168.11 |

| Louisiana | $485.01 | $252.34 |

| Maine | $297.60 | $115.26 |

| Maryland | $430.21 | $168.01 |

| Massachusetts | $447.05 | $149.86 |

| Michigan | $478.54 | $162.01 |

| Minnesota | $274.20 | $214.55 |

| Mississippi | $364.63 | $238.95 |

| Missouri | $318.44 | $223.94 |

| Montana | $286.02 | $313.27 |

| Nebraska | $272.97 | $269.19 |

| Nevada | $374.59 | $119.19 |

| New Hampshire | $334.15 | $120.48 |

| New Jersey | $422.29 | $129.97 |

| New Mexico | $315.88 | $222.43 |

| New York | $469.82 | $172.85 |

| North Carolina | $344.07 | $138.40 |

| North Dakota | $284.09 | $264.98 |

| Ohio | $305.55 | $131.37 |

| Oklahoma | $338.87 | $270.19 |

| Oregon | $281.69 | $109.76 |

| Pennsylvania | $383.01 | $171.18 |

| Rhode Island | $491.19 | $141.03 |

| South Carolina | $317.95 | $211.29 |

| South Dakota | $248.09 | $347.61 |

| Tennessee | $353.43 | $168.07 |

| Texas | $434.46 | $285.56 |

| Utah | $308.40 | $127.15 |

| Vermont | $333.38 | $148.88 |

| Virginia | $323.76 | $149.42 |

| Washington | $325.38 | $121.13 |

| West Virginia | $352.97 | $225.50 |

| Wisconsin | $250.73 | $168.52 |

| Wyoming | $292.37 | $335.04 |

Frequently Asked Questions

Are collision and comprehensive required in my state?

No state requires collision or comprehensive insurance coverage on driver policies. Adding both to your auto policy is completely up to you.

Do you need to have both comprehensive and collision on a financed car?

In almost all cases, the answer is yes. Most lenders require their customers to have comprehensive and collision when financing a new or used car. This is the case if you lease or if you purchase with a loan.

What is full coverage? How are collision and comprehensive related?

Collision and comprehensive often show up in the mix when people talk about full coverage. This is because they’re two of the main types of auto insurance. Full coverage refers to the three main types of insurance all in one policy:

- Liability

- Collision

- Comprehensive